Form 8990 For 2022

Form 8990 For 2022 - Web august 4, 2022 draft as of form 8990 (rev. Web if this election is made, complete line 22, adjusted taxable income, on form 8990 and leave lines 6 through 21 blank. Section i—business interest expense section ii—adjusted taxable income section iii—business interest income section. Web note if 13k is zero you do not file form 8990. Web first, some background may be helpful. Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. Employer identification number, if any. The limitation is back to 30% of ati — and depreciation, amortization, and depletion are no. Web kelvin richards contents how to fill out form 8990? December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue.

Web if this election is made, complete line 22, adjusted taxable income, on form 8990 and leave lines 6 through 21 blank. Web 2022 990 forms and schedules form 8990: Employer identification number, if any. Web the business interest limitation returned with a vengeance in 2022: The limitation is back to 30% of ati — and depreciation, amortization, and depletion are no. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue. Web august 4, 2022 draft as of form 8990 (rev. Section i—business interest expense section ii—adjusted taxable income section iii—business interest income section. Save or instantly send your ready documents.

No formal statement is required to make this election. Web if this election is made, complete line 22, adjusted taxable income, on form 8990 and leave lines 6 through 21 blank. 163 (j) had rules in place intended to prevent multinational entities from using. Section i—business interest expense section ii—adjusted taxable income section iii—business interest income section. Web 2022 990 forms and schedules form 8990: Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. Limitation on business interest expense under section 163(j) form 8992: If the partnership reports excess business. Prior to the passage of the tcja, sec. Save or instantly send your ready documents.

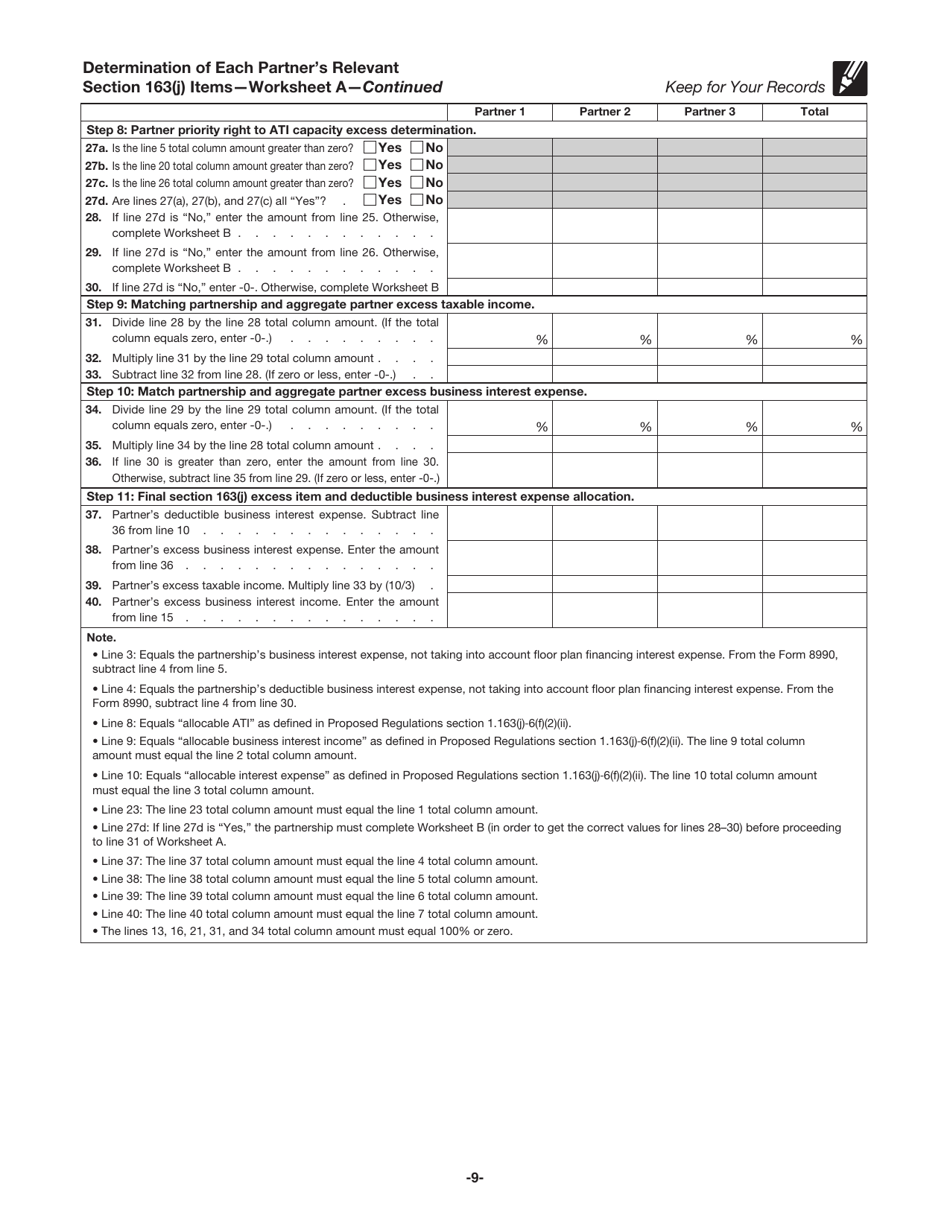

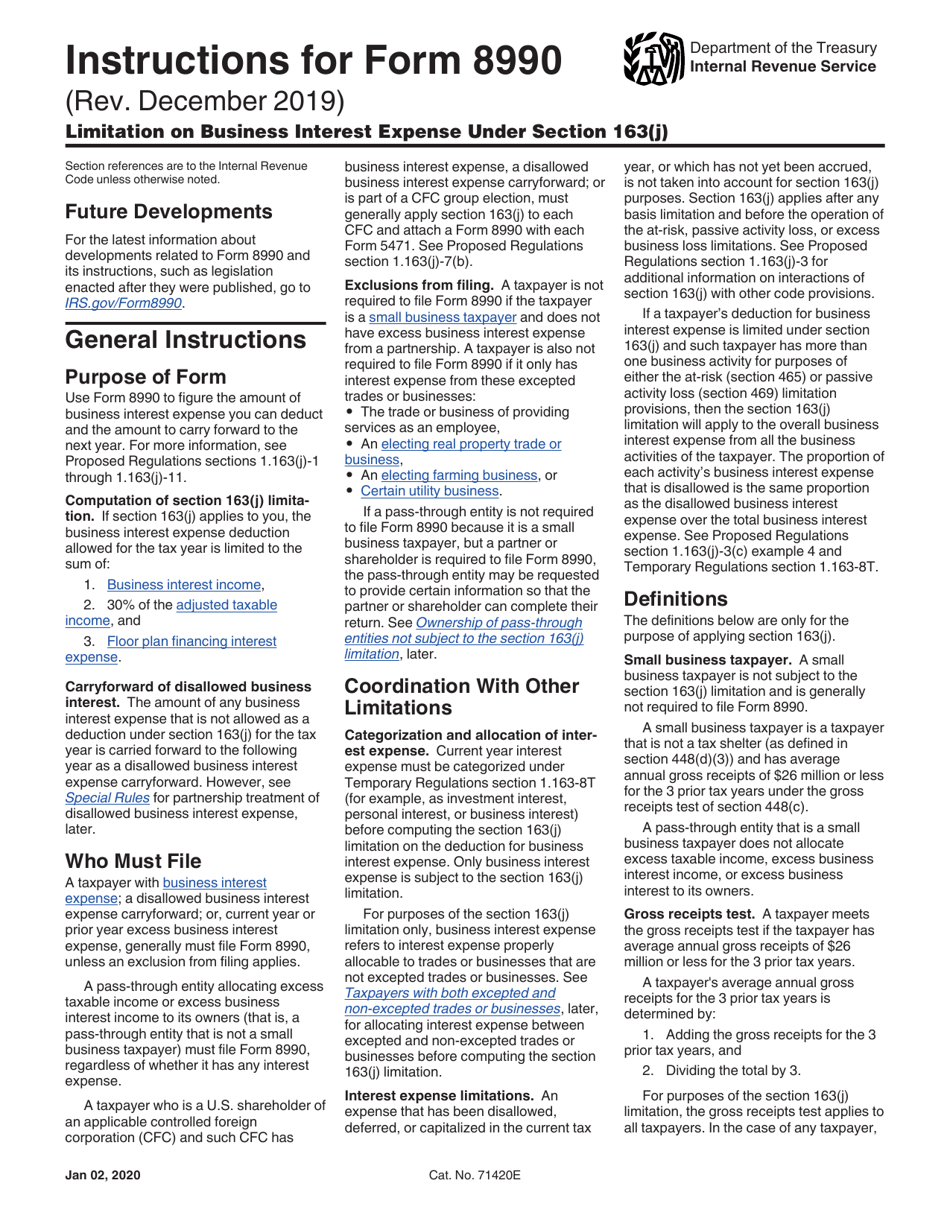

Download Instructions for IRS Form 8990 Limitation on Business Interest

2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. Us shareholder calculation of global intangible low. Employer identification number, if any. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Prior to the passage of the.

IRS Form 8990 walkthrough (Limitation on Business Interest Expenses

Web follow the simple instructions below: Prior to the passage of the tcja, sec. 2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. Web first, some background may be helpful. The limitation is back to 30% of ati — and depreciation, amortization, and depletion are no.

Irs Instructions 8990 Fill Out and Sign Printable PDF Template signNow

Prior to the passage of the tcja, sec. Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in. Web august 4, 2022 draft as of form 8990 (rev. Easily fill out pdf blank, edit, and sign them. Web form 8990 for dummies community discussions taxes get your.

Section 163j Photos Free & RoyaltyFree Stock Photos from Dreamstime

Prior to the passage of the tcja, sec. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below: Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from.

8990 Fill out & sign online DocHub

163 (j) had rules in place intended to prevent multinational entities from using. 2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. Save or instantly send your ready documents. Limitation on business interest expense under section 163(j) form 8992: Us shareholder calculation of global intangible low.

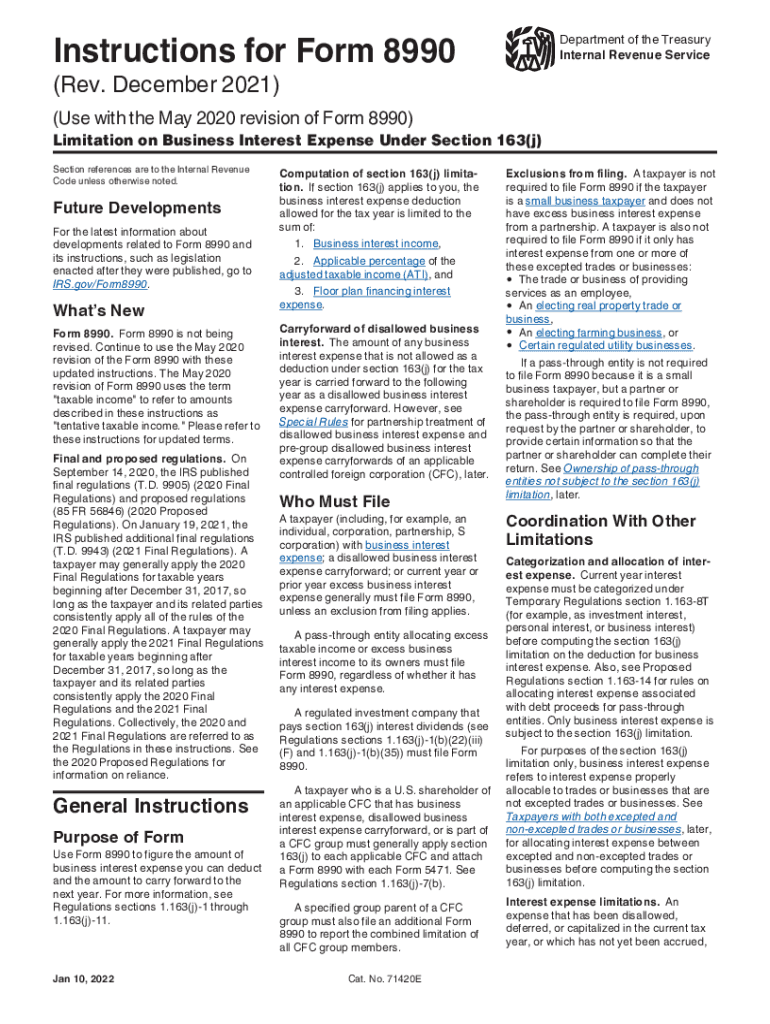

Instructions for Form 8990 (12/2021) Internal Revenue Service

2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. If the partnership reports excess business. Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information for form 8990 limitation on. Web if this election is made, complete line 22,.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Rental real estate income and expenses. If the partnership reports excess business. Web form 8990 for dummies community discussions taxes get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on.

調理器具収納/家電収納スペース/ストック収納/収納スペース/伸縮レンジボード...などのインテリア実例 20220914 1600

Us shareholder calculation of global intangible low. Rental real estate income and expenses. Web if this election is made, complete line 22, adjusted taxable income, on form 8990 and leave lines 6 through 21 blank. Web follow the simple instructions below: Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest.

what is form 8990 Fill Online, Printable, Fillable Blank form8453

Prior to the passage of the tcja, sec. 163 (j) had rules in place intended to prevent multinational entities from using. Web follow the simple instructions below: Employer identification number, if any. Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from.

1040NJ Data entry guidelines for a New Jersey partnership K1

Employer identification number, if any. Easily fill out pdf blank, edit, and sign them. Web form 8990 (draft rev. Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. If the partnership reports excess business.

Web Note If 13K Is Zero You Do Not File Form 8990.

Rental real estate income and expenses. If the partnership reports excess business. Web if this election is made, complete line 22, adjusted taxable income, on form 8990 and leave lines 6 through 21 blank. 163 (j) had rules in place intended to prevent multinational entities from using.

Choosing A Legal Expert, Creating An Appointment And Coming To The Business Office For A Personal Meeting Makes Completing A Irs 8990 From.

Section i—business interest expense section ii—adjusted taxable income section iii—business interest income section. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Limitation on business interest expense under section 163(j) form 8992:

Employer Identification Number, If Any.

Web august 4, 2022 draft as of form 8990 (rev. 2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. Web kelvin richards contents how to fill out form 8990? No formal statement is required to make this election.

Web Information About Form 8990, Limitation On Business Interest Expense Under Section 163(J), Including Recent Updates, Related Forms And Instructions On How To File.

Web follow the simple instructions below: Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in. The limitation is back to 30% of ati — and depreciation, amortization, and depletion are no. Web 2022 990 forms and schedules form 8990: