Form 8990 Instructions 2020

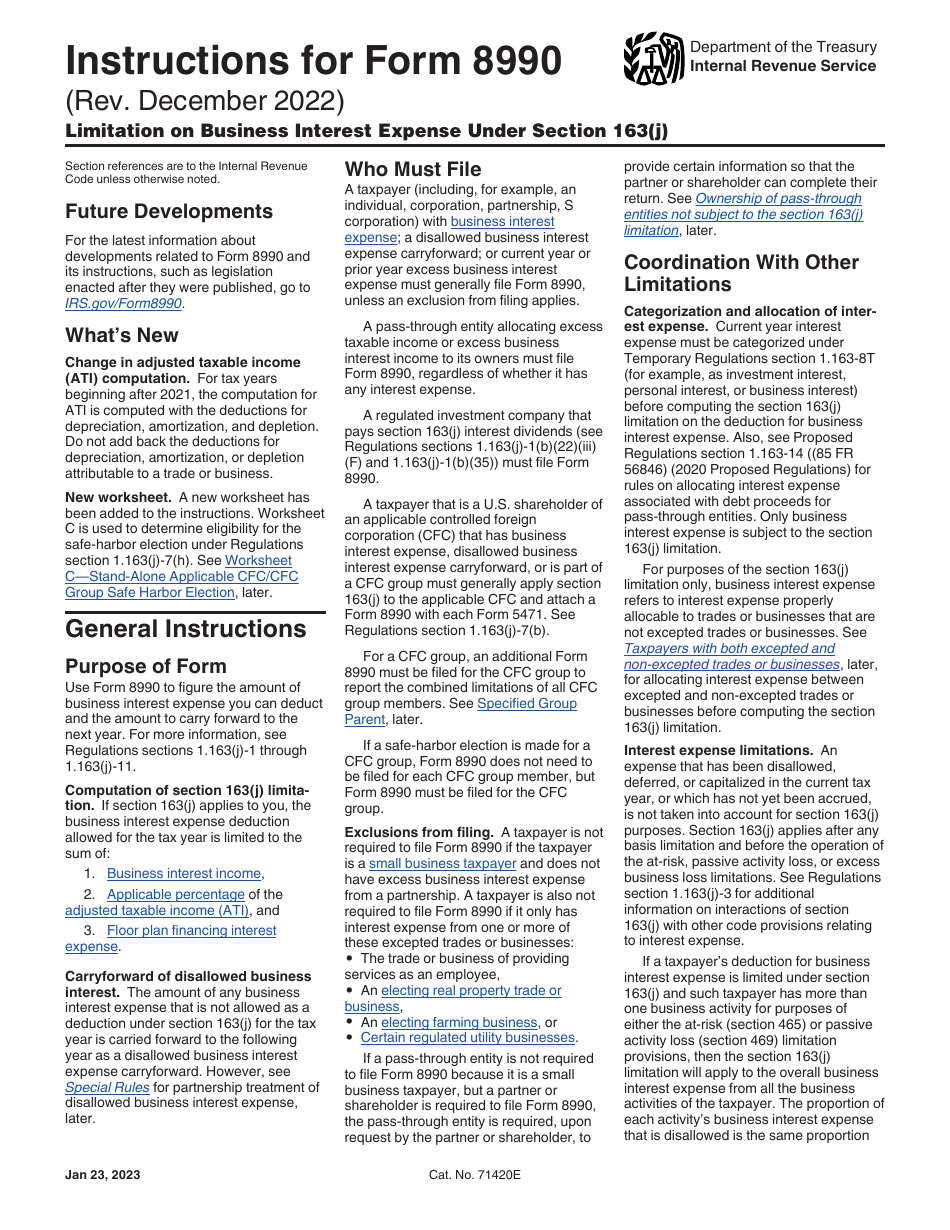

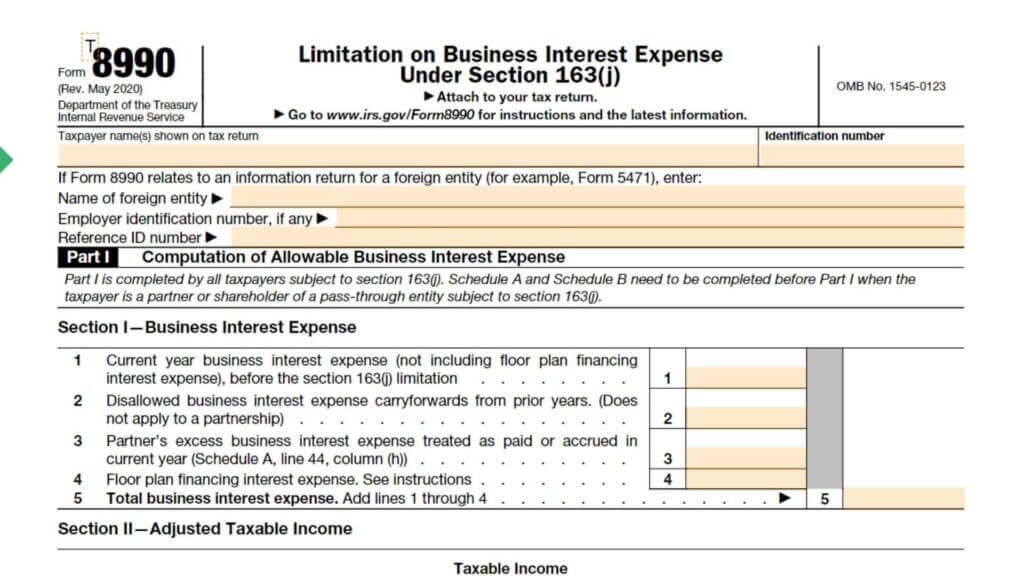

Form 8990 Instructions 2020 - Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. 2 section iv—section 163(j) limitation. How do i complete irs form 8990? For tax years beginning after 2017, the partner’s basis in its partnership interest at the end of the tax. Web see the instructions for form 8990 for additional information. There are 3 parts to this 3 page form, and two schedules. Web follow the simple instructions below: Web 2 years ago fed returns generally what is form 8990? Web for paperwork reduction act notice, see the instructions.

Web follow the simple instructions below: How do i complete irs form 8990? Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. 2 section iv—section 163(j) limitation. There are 3 parts to this 3 page form, and two schedules. Web 2 years ago fed returns generally what is form 8990? Web for paperwork reduction act notice, see the instructions. Web let’s start with step by step instructions on how to complete form 8990.

Web 2 years ago fed returns generally what is form 8990? Web follow the simple instructions below: Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest. 20 noting that the instructions should be. Note that passthrough entities not subject to the 163. Web let’s start with step by step instructions on how to complete form 8990. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web revised instructions for irs form 8990, limitation on business interest expense under section 163(j), released jan. Per the irs, form 8990 is used to calculate the amount of business interest expense that can be. There are 3 parts to this 3 page form, and two schedules.

Irs Instructions 8990 Fill Out and Sign Printable PDF Template signNow

Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. For tax years beginning after 2017, the partner’s basis in its partnership interest at the end of the tax. There are 3 parts to this 3 page form, and two schedules. Who must file form 8990? Web.

Instructions for Form 8990 (12/2021) Internal Revenue Service

For tax years beginning after 2017, the partner’s basis in its partnership interest at the end of the tax. How do i complete irs form 8990? Web revised instructions for irs form 8990, limitation on business interest expense under section 163(j), released jan. There are 3 parts to this 3 page form, and two schedules. Web let’s start with step.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web revised instructions for irs form 8990, limitation on business interest expense under section 163(j), released jan. Web follow the simple instructions below: Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. There are 3 parts to this 3.

K1 Excess Business Interest Expense ubisenss

Note that passthrough entities not subject to the 163. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Web overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business interest expense under section 163 (j). Per the irs, form 8990 is used to calculate the amount of business.

What Is Sale/gross Receipts Of Business In Itr 5 Tabitha Corral's

Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. Per the irs, form 8990 is used to calculate the amount of business interest expense that can be. 20 noting that the instructions should be. Web general instructions purpose of form use form 8990 to figure the.

IRS Form 8990 Instructions Business Interest Expense Limitation

Who must file form 8990? 2 section iv—section 163(j) limitation. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct.

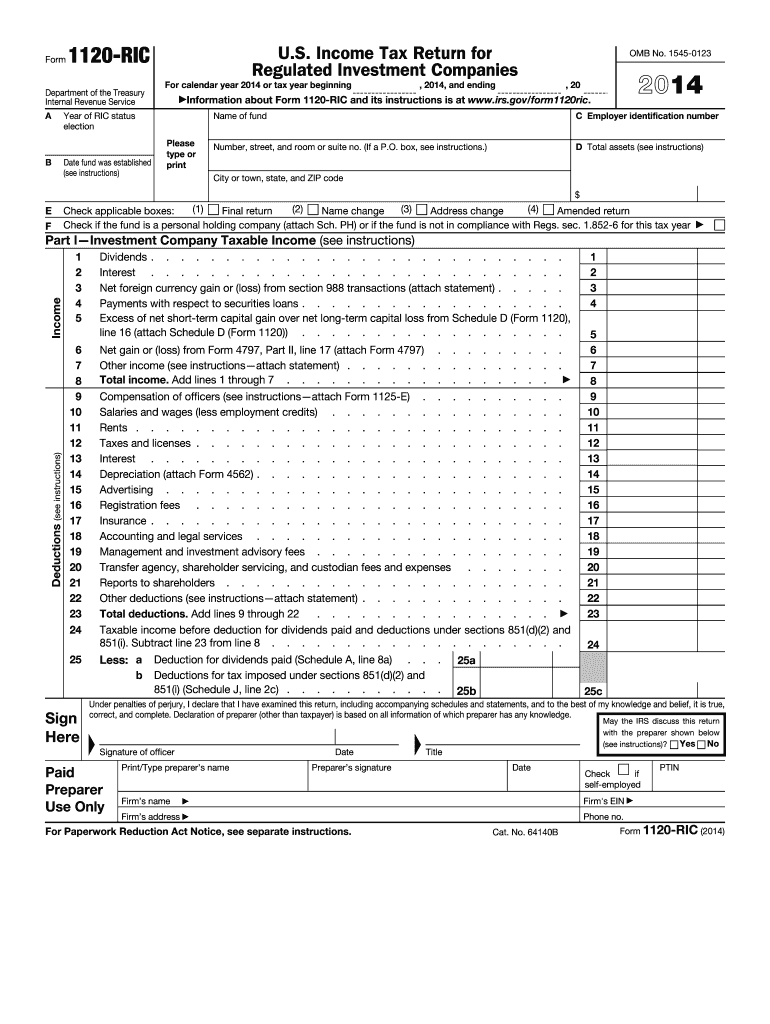

2014 Form IRS 1120RIC Fill Online, Printable, Fillable, Blank pdfFiller

Who must file form 8990? Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Choosing.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically. Web 2 years ago fed returns generally what is form 8990? How do i complete irs form 8990? Web revised instructions for irs form 8990, limitation on business interest expense under.

8990 Fill out & sign online DocHub

Web 2 years ago fed returns generally what is form 8990? There are 3 parts to this 3 page form, and two schedules. Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. How do i complete irs form 8990? Web how it works open the 2022.

Form 8990 Instructions 2023

Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Web for paperwork reduction act notice, see the instructions. Who must file form 8990? Web follow the simple instructions below: Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to.

Web Form 8990 Instructions For Details On The Gross Receipts Test And Other Exclusions For Excepted Businesses.

Web follow the simple instructions below: Web revised instructions for irs form 8990, limitation on business interest expense under section 163(j), released jan. 20 noting that the instructions should be. Web overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business interest expense under section 163 (j).

Choosing A Legal Expert, Creating An Appointment And Coming To The Business Office For A Personal Meeting Makes Completing A Irs 8990 From.

Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web see the instructions for form 8990 for additional information. Per the irs, form 8990 is used to calculate the amount of business interest expense that can be. Web for paperwork reduction act notice, see the instructions.

Web The 2020 Form 990 Instructions Contain Reminders That, Starting With Tax Years Beginning On Or After July 2, 2019, All Organizations Must File Form 990 Series Returns Electronically.

Web 2 years ago fed returns generally what is form 8990? Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web how it works open the 2022 instructions 8990 and follow the instructions easily sign the instructions 8990 form with your finger send filled & signed irs instructions 8990 or save. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest.

December 2022) Limitation On Business Interest Expense Under Section 163(J) Department Of The Treasury Internal Revenue Service Attach To Your Tax Return.

Who must file form 8990? Web let’s start with step by step instructions on how to complete form 8990. How do i complete irs form 8990? Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year.