Form 940 Worksheet

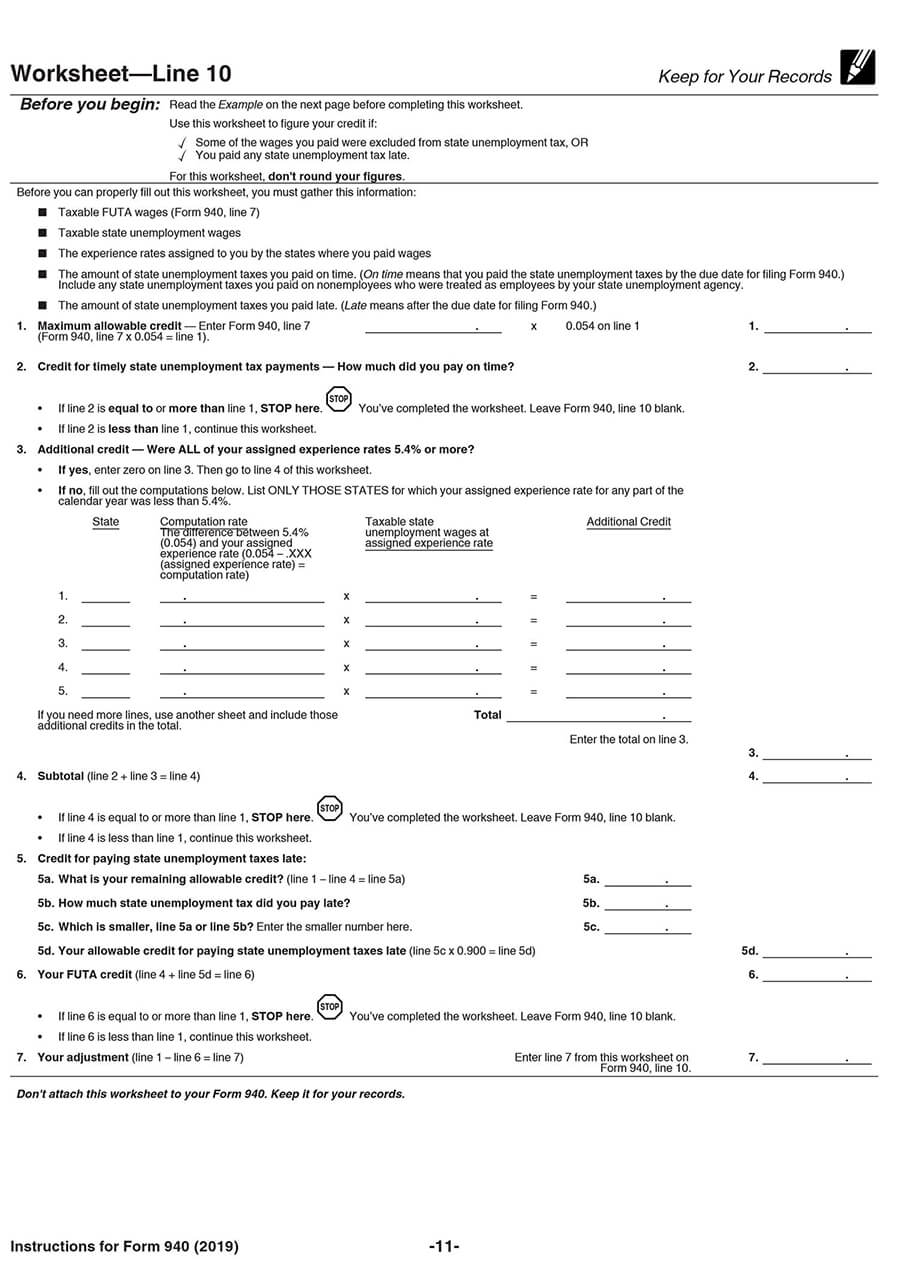

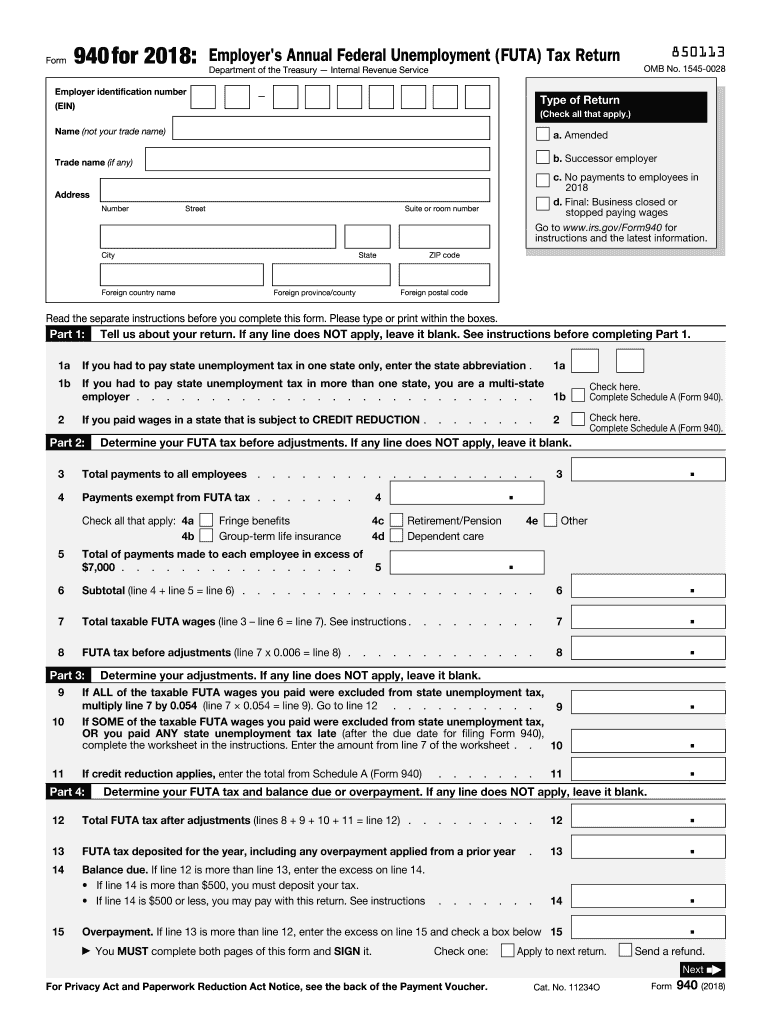

Form 940 Worksheet - You have completed the worksheet. Leave form 940, line 10, blank. Web form 940 shows the amount of federal unemployment taxes the employer owed the previous year, how much has already been paid, and the outstanding balance. If some of the taxable futa wages you paid were excluded from state unemployment tax, or you paid any state unemployment tax late (after the due date for filing form 940), complete the worksheet in the instructions. Gross pay wages subject to federal unemployment tax act (futa) and futa taxes. Many firms pay futa tax quarterly, so the worksheet also calculates the quarterly amount. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. Web what is form 940? The previous year's form 940 is.

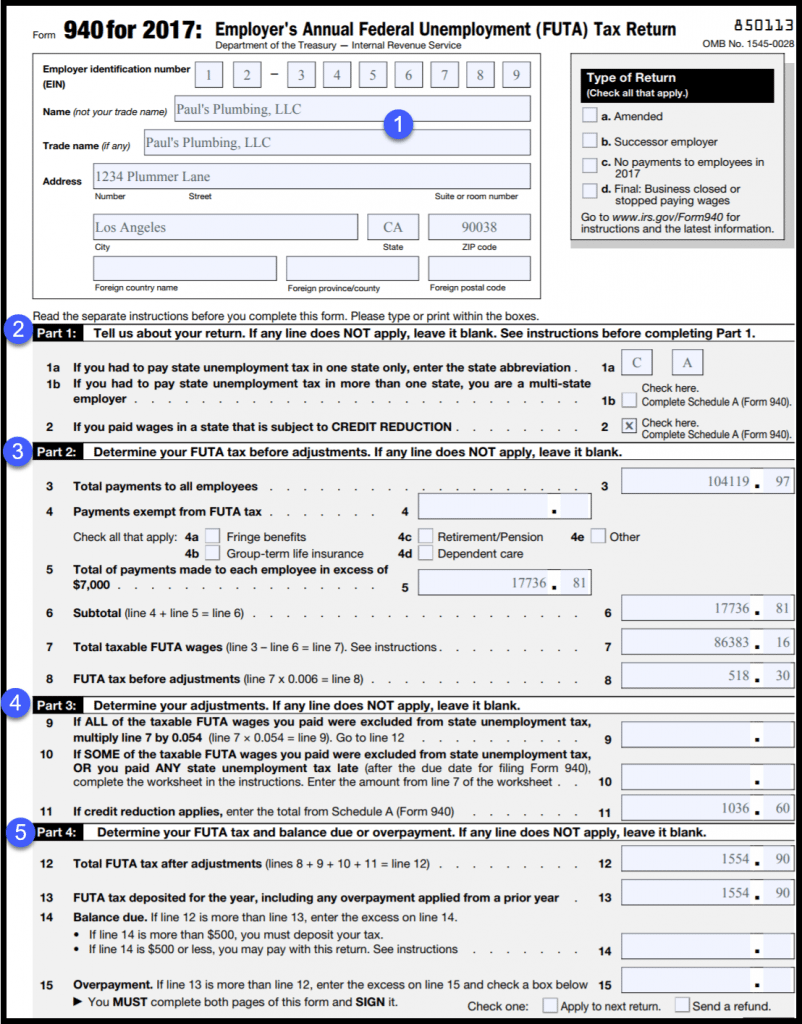

Web use schedule a (form 940) to figure the credit reduction. Web irs form 940 reports an employer’s unemployment tax payments and calculations to the irs. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. If credit reduction applies, enter the total from schedule a (form 940). If any line does not apply, leave it blank. The previous year's form 940 is. Credit for paying state unemployment taxes late: Web form 940 reports federal unemployment taxes to the irs at the beginning of each year. Web the instructions for line 10 on the 940 state: Determine your futa tax and balance due or overpayment.

Form 940 instructions frequently asked questions (faqs) if you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form. Enter the amount from line 7 of the worksheet. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. Pdf | pdf 2020 instructions for form 940 department of the treasury internal revenue service employer's annual federal unemployment (futa) tax return section references are to the internal revenue code unless otherwise noted. Most employers pay both a federal and a state unemployment tax. Web (after the due date for filing form 940), complete the worksheet in the instructions. Web irs form 940 reports an employer’s unemployment tax payments and calculations to the irs. The current tax rate is 6%, but most states receive a futa tax credit of 5.4%. What's new new filing addresses. Determine your futa tax before adjustments.

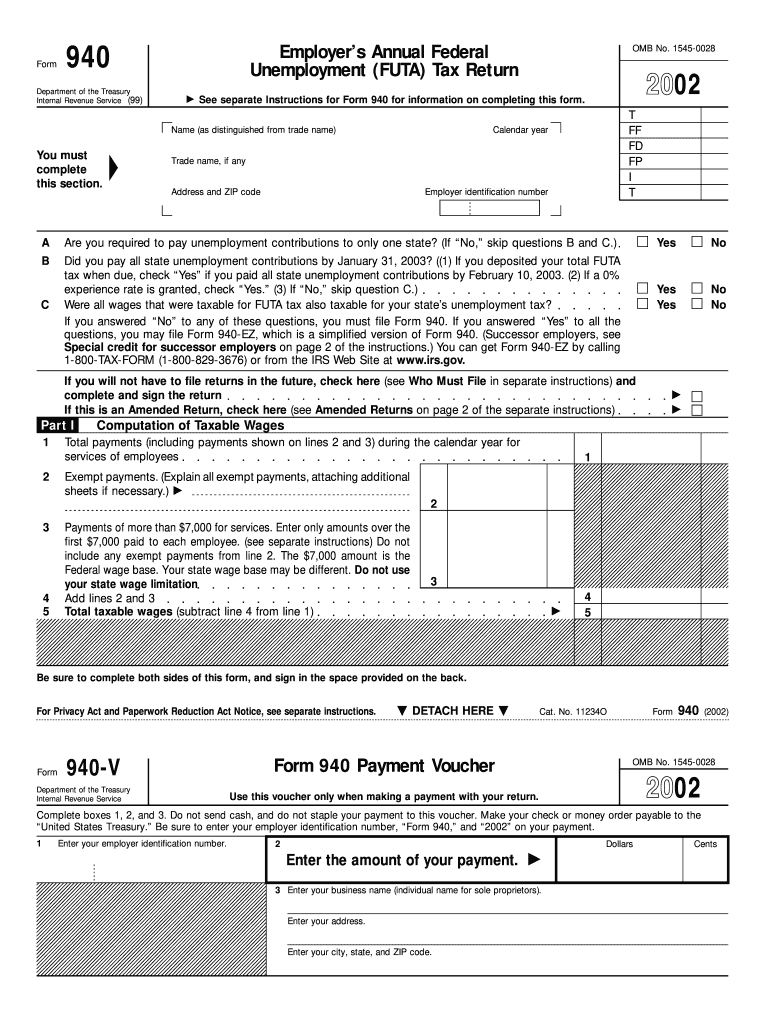

940 2002 Fill Out and Sign Printable PDF Template signNow

Credit for paying state unemployment taxes late: Web complete schedule a (form 940). • if line 4 is less than line 1, continue this worksheet. The previous year's form 940 is. Web use schedule a (form 940) to figure the credit reduction.

2018 FUTA Tax Rate & Form 940 Instructions

What is your remaining allowable credit? Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. Web irs form 940 reports an employer’s unemployment tax payments and calculations to the irs. X.054 on line 1 (form 940, line 7 x.054 = line 1). Complete schedule a (form 940).

Form 940 (Schedule R) Allocation Schedule for Aggregate Form 940

Web you’ve completed the worksheet. Web the tax form worksheet for form 940 for 2020 shows a difference (12,000)between total taxed wages (155,000)and total taxable futa wages (143,000). The current tax rate is 6%, but most states receive a futa tax credit of 5.4%. Web irs form 940 reports an employer’s unemployment tax payments and calculations to the irs. Web.

Form 940 Instructions StepbyStep Guide Fundera

If credit reduction applies, enter the total from schedule a (form 940). If some of the taxable futa wages you paid were excluded from state unemployment tax, or you paid any state unemployment tax late (after the due date for filing form 940), complete the worksheet in the instructions. Total payments to all employees. The current tax rate is 6%,.

How to calculate Line 10 on Form 940 (FUTA TAX RETURN)?

Web form 940 reports federal unemployment taxes to the irs at the beginning of each year. For more information, see the schedule a (form 940) instructions or visit irs.gov. Web future developments for the latest information about developments related to form 940 and its instructions, such as legislation enacted after they were published, go to irs.gov/form940. Web form 940 is.

SSA POMS RM 01103.044 Form 940, Employer's Annual Federal

Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. What is your remaining allowable credit? Gross pay wages subject to federal unemployment tax act (futa) and futa taxes. Web the form 940 worksheet displays data that you need to fill out the internal revenue service form 940,.

Payroll Tax Forms and Reports in ezPaycheck Software

Most employers pay both a federal and a state unemployment tax. It shows a positive amount showing that taxed wages was in excess of taxable futa wages by twice the amount of the national paid leave. Credit for paying state unemployment taxes late: The form is required if you paid wages of $1,500 or more to employees in a calendar.

Form 940 (Schedule R) Allocation Schedule for Aggregate Form 940

• if line 4 is less than line 1, continue this worksheet. Credit for timely state unemployment tax payments — how much did you pay on time? If any line does not apply, leave it blank. The worksheet takes you step by step through the process of figuring your credit under the following two conditions: What's new new filing addresses.

IRS Releases 2014 Form 940 ThePayrollAdvisor

Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. Web the worksheet of form 940 is required to calculate your credit for line 10 on the form. X.054 on line 1 (form 940, line 7 x.054 = line 1). Web the tax form worksheet for form 940.

Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

You must file form 940 with the irs annually with your payment of federal unemployment tax. What is your remaining allowable credit? Web irs 2020 form 940 instructions and worksheet document [pdf] download: Web form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course.

Total Payments To All Employees.

For more information, see the schedule a (form 940) instructions or visit irs.gov. If some of the taxable futa wages you paid were excluded from state unemployment tax, or you paid any state unemployment tax late (after the due date for filing form 940), complete the worksheet in the instructions. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax for states that have a credit reduction on wages that are subject to the unemployment compensation laws.

Web The Tax Form Worksheet For Form 940 For 2020 Shows A Difference (12,000)Between Total Taxed Wages (155,000)And Total Taxable Futa Wages (143,000).

Quarterly and annual payroll report look for or create a payroll report that contains the following information: Leave form 940, line 10, blank. Pdf | pdf 2020 instructions for form 940 department of the treasury internal revenue service employer's annual federal unemployment (futa) tax return section references are to the internal revenue code unless otherwise noted. The form is required if you paid wages of $1,500 or more to employees in a calendar quarter, or if you had one or more employees for part of a day in any 20 or more different weeks in the last two years.

Web Form 940 Shows The Amount Of Federal Unemployment Taxes The Employer Owed The Previous Year, How Much Has Already Been Paid, And The Outstanding Balance.

See where do you file, later, before filing your return. Credit for timely state unemployment tax payments — how much did you pay on time? Web use form 940 to report your annual federal unemployment tax act (futa) tax. If any line does not apply, leave it blank.

It Shows A Positive Amount Showing That Taxed Wages Was In Excess Of Taxable Futa Wages By Twice The Amount Of The National Paid Leave.

If any line does not apply, leave it blank. The filing addresses have changed for some employers. The worksheet takes you step by step through the process of figuring your credit under the following two conditions: X.054 on line 1 (form 940, line 7 x.054 = line 1).