Form 941 For 2022 Schedule B

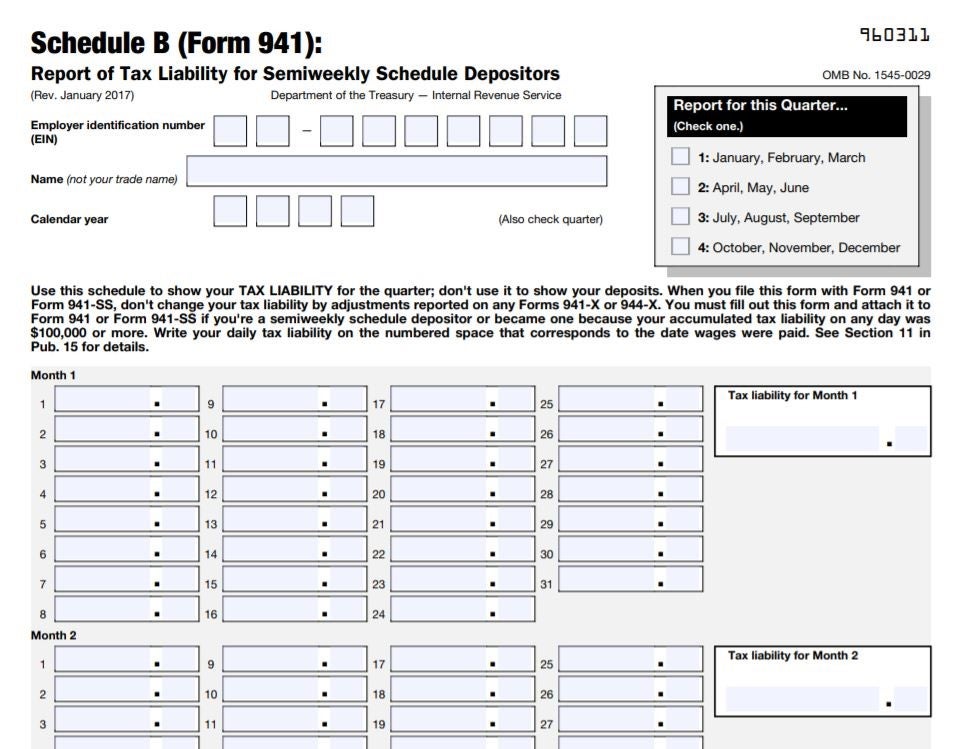

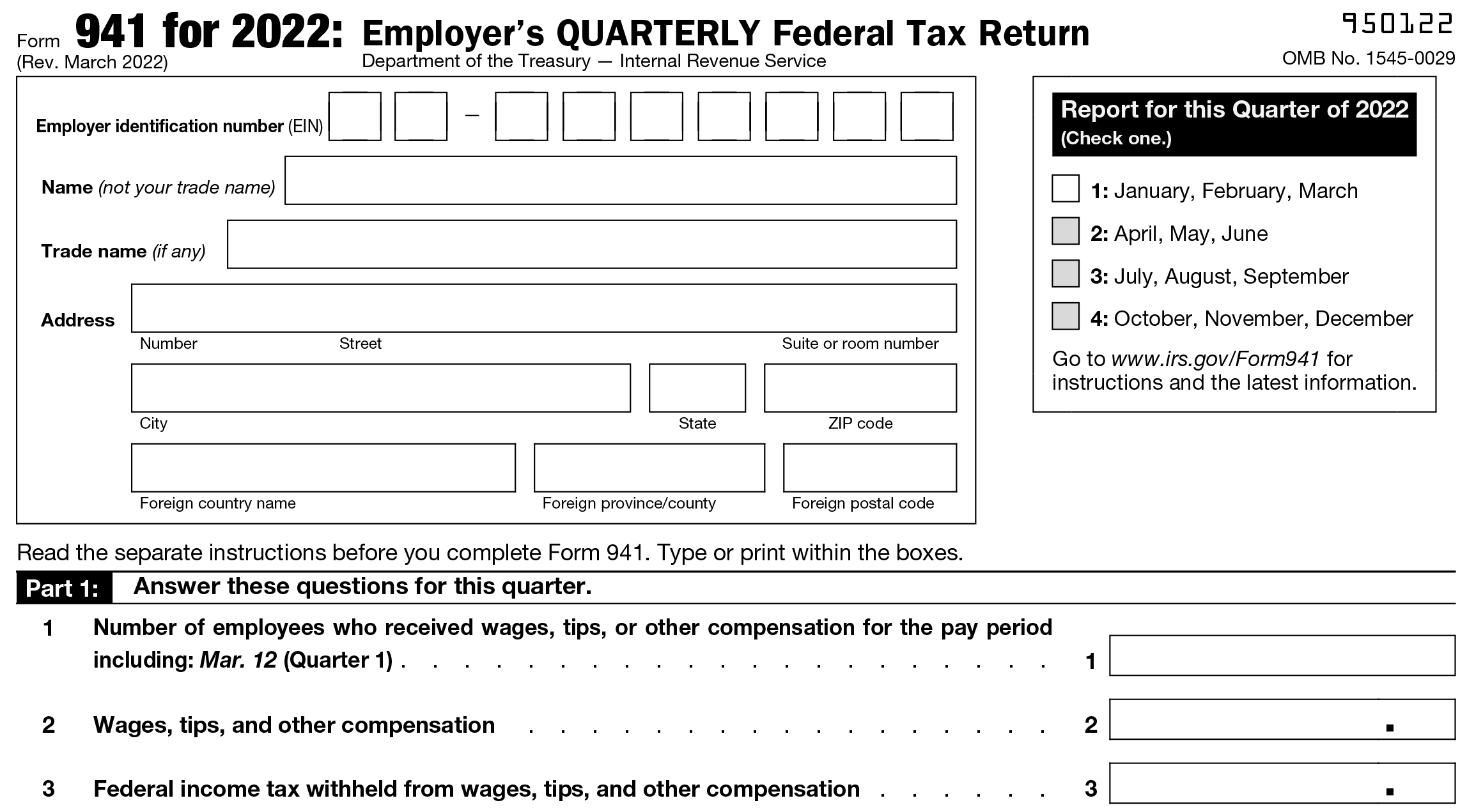

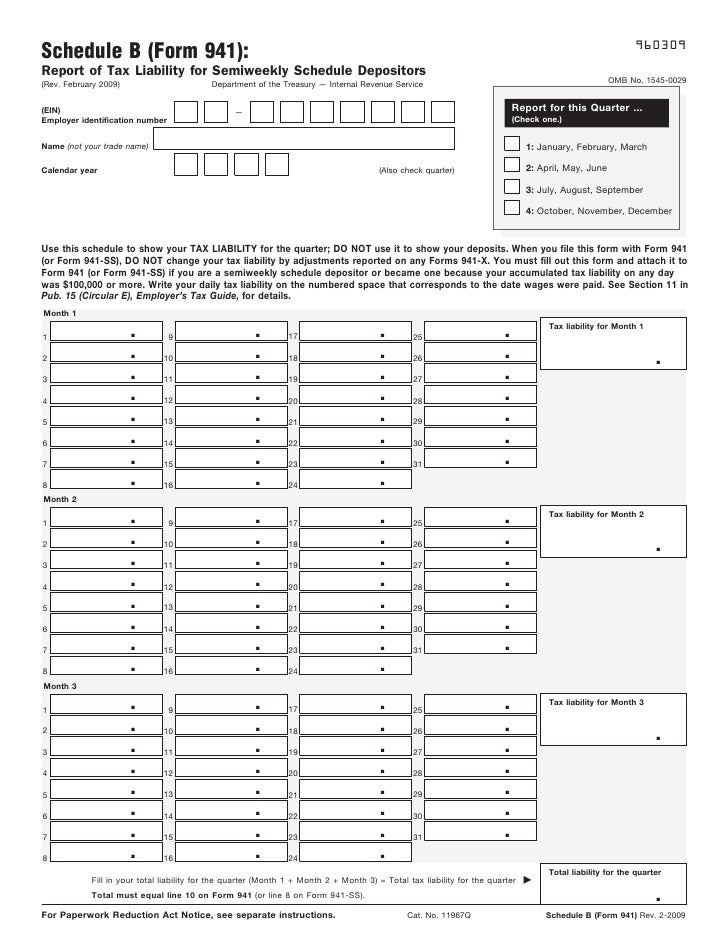

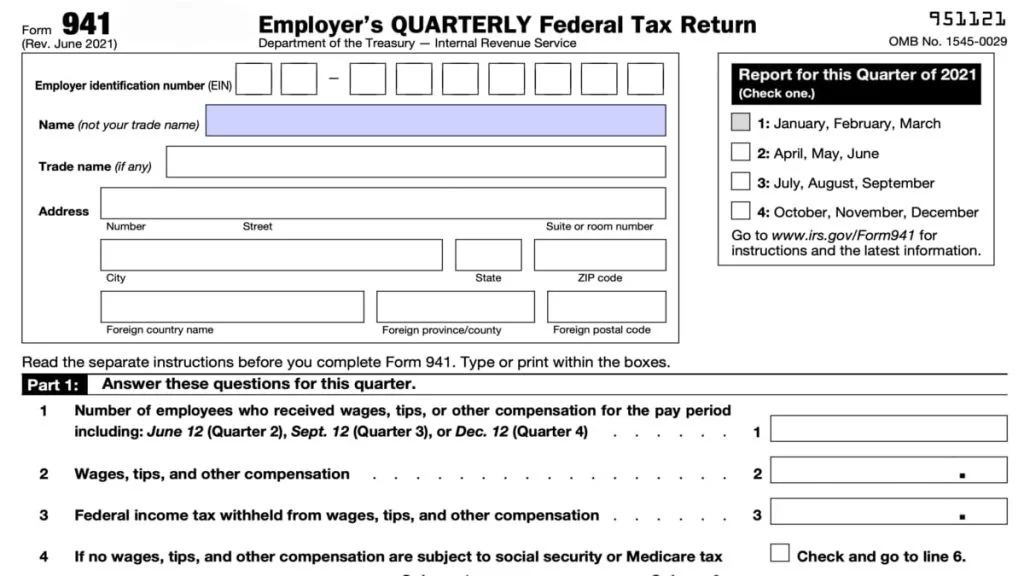

Form 941 For 2022 Schedule B - Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. In response to stakeholder input, the draft instructions provide a new filing exception as described on page 3 of the 2022. Schedule b (form 941) pdf instructions for. Web latest irs changes for filing form 941 and schedule b. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the Web 2022 941 (schedule b) form 941 (schedule b) (rev. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Reported more than $50,000 of employment taxes in the lookback period. Web in recent years several changes to the 941 form has made is difficult to understand. The credits for qualified paid sick and paid family leave wages may only be claimed for wages paid for. Web file schedule b (form 941) if you are a semiweekly schedule depositor. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web fillable forms such as 2022 941 form schedule b fillable can be utilized in a variety of methods, from gathering call info to collecting responses on services and products. Therefore, the due date of schedule b is the same as the due date for the applicable form 941.

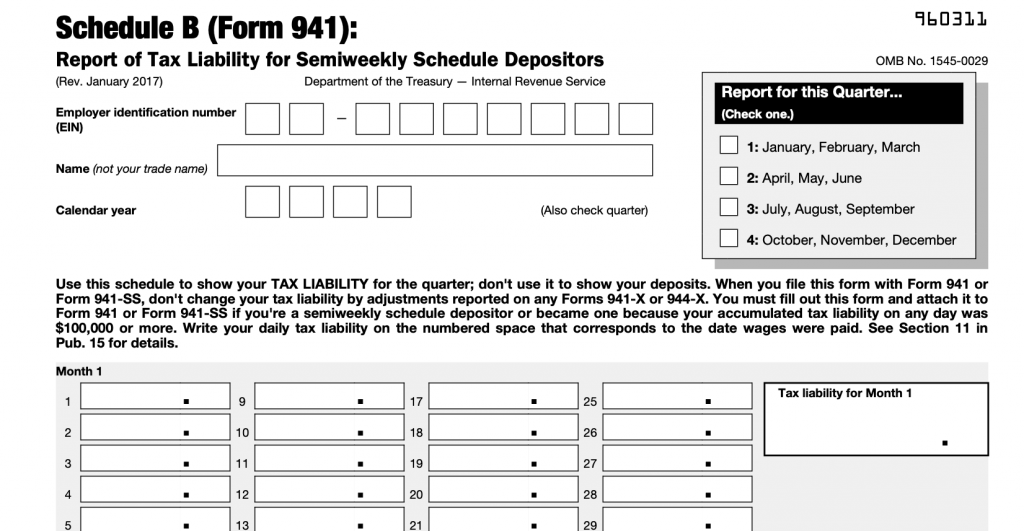

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Web schedule b is filed with form 941. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. File schedule b if you’re a semiweekly schedule depositor. January 2017) 2020 941 (schedule b) form 941 (schedule b) (rev. The credits for qualified paid sick and paid family leave wages may only be claimed for wages paid for. The instructions were updated with requirements for claiming the remaining credits in 2022. Web latest irs changes for filing form 941 and schedule b.

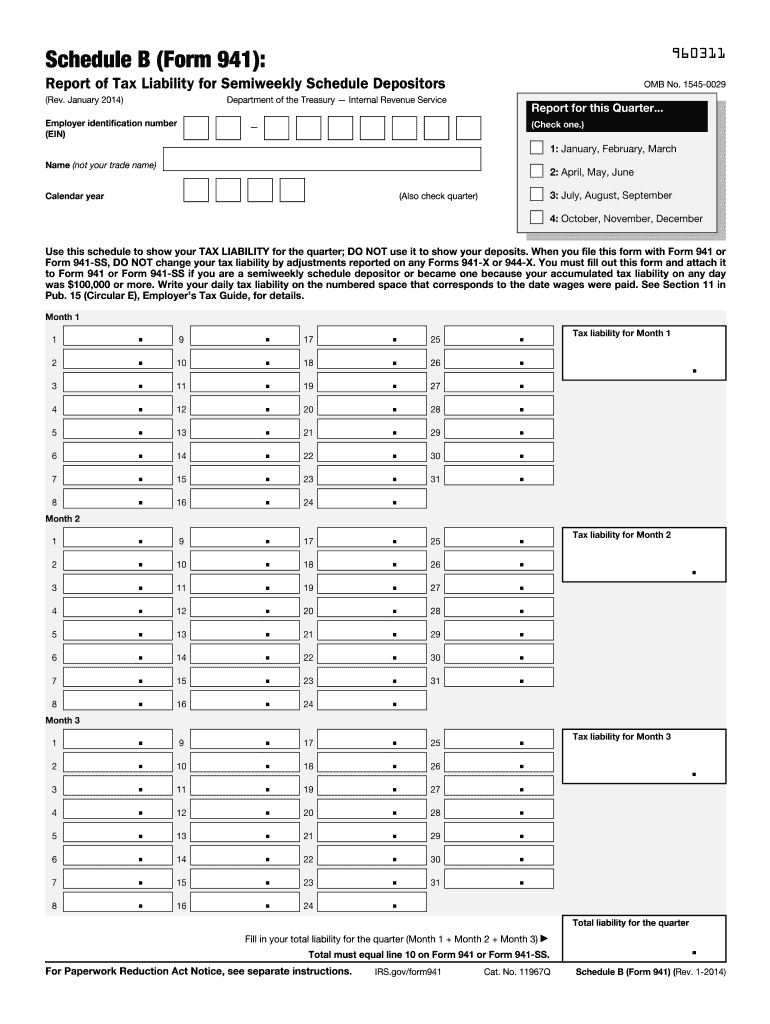

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. The credits for qualified paid sick and paid family leave wages may only be claimed for wages paid for. Web latest irs changes for filing form 941 and schedule b..

anexo b formulario 941 pr 2022 Fill Online, Printable, Fillable Blank

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. 15 or section 8 of pub. See deposit penalties in section 11 of pub. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. You have an accumulated tax liability of $100,000 or more on any.

941 Schedule B 2022

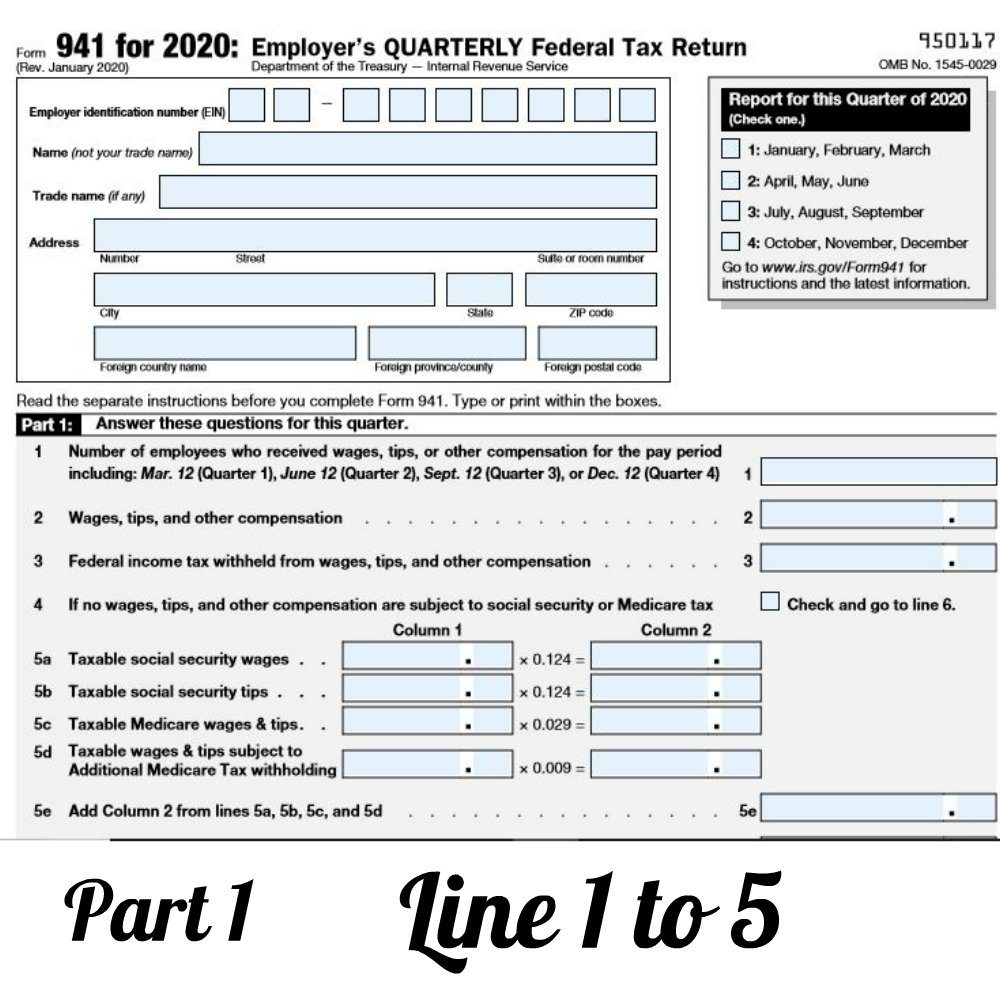

Reported more than $50,000 of employment taxes in the lookback period. Web form 941 schedule b 2022 focuses on documenting personal income tax, social security tax, and medicare tax withdrawn from an employee’s wages. Employers are classified into one of two deposit schedules: Schedule b (form 941) pdf instructions for. Therefore, the due date of schedule b is the same.

What is Form 941 Schedule B, Who Should Complete It? Blog TaxBandits

The instructions were updated with requirements for claiming the remaining credits in 2022. Taxbandits also offers great features like zero tax filing and 941 schedule b. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. The 941 form reports the total amount of tax withheld during each quarter. Fillable forms are variations of frequently.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

The employer is required to withhold federal income tax and payroll taxes from the employee’s paychecks. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web form 941 for 2023: The credits for qualified paid sick and paid family leave wages may only be claimed for wages paid for. Accumulated a tax liability of $100,000 or more.

941 Schedule B 2022

Make sure payroll has the updated info for filing employment tax returns for the first quarter of 2022. Schedule b (form 941) pdf instructions for. Web file schedule b (form 941) if you are a semiweekly schedule depositor. In response to stakeholder input, the draft instructions provide a new filing exception as described on page 3 of the 2022. File.

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

Federal law requires an employer to withhold taxes. Web schedule b is filed with form 941. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. As well as quarters 1 and 2 in 2022: Web in recent years several changes to the 941 form has made is difficult to understand.

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

You are a semiweekly depositor if you: January 2017) 2020 941 (schedule b) form 941 (schedule b) (rev. Web schedule b is filed with form 941. Web fillable forms such as 2022 941 form schedule b fillable can be utilized in a variety of methods, from gathering call info to collecting responses on services and products. In response to stakeholder.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

See deposit penalties in section 11 of pub. Web the lookback period directly impacts the deposit schedule for form 941. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Reported more than $50,000 of employment taxes in the lookback period. You’re a semiweekly schedule depositor if you reported more than.

941 Form 2023

Web the lookback period directly impacts the deposit schedule for form 941. Schedule b (form 941) pdf instructions for. The employer is required to withhold federal income tax and payroll taxes from the employee’s paychecks. January 2017) 2020 941 (schedule b) form 941 (schedule b) (rev. Rock hill, sc / accesswire / july 28, 2023 / the next business day,.

Web Schedule B Is Filed With Form 941.

Fillable forms are variations of frequently made use of and/or modified papers that are readily available in digital style for very easy editing and enhancing. 15 or section 8 of pub. Federal law requires an employer to withhold taxes. Web latest irs changes for filing form 941 and schedule b.

The Importance Of Reconciliation And Completed Of Not Only The Form 941 But Schedule B Is Becoming Increasingly Important For Employers To Avoid Costly Disputes With The Irs Resulting In Penalty And Interest.

Employers are classified into one of two deposit schedules: You report more than $50,000 employment taxes in the lookback period ; As well as quarters 1 and 2 in 2022: January 2017) 2020 941 (schedule b) form 941 (schedule b) (rev.

Accumulated A Tax Liability Of $100,000 Or More On Any Given Day In The Current Or Prior Calendar Year.

The instructions were updated with requirements for claiming the remaining credits in 2022. In response to stakeholder input, the draft instructions provide a new filing exception as described on page 3 of the 2022. Taxbandits also offers great features like zero tax filing and 941 schedule b. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

Reported More Than $50,000 Of Employment Taxes In The Lookback Period.

January 2017) 2019 941 (schedule b). Web fillable forms such as 2022 941 form schedule b fillable can be utilized in a variety of methods, from gathering call info to collecting responses on services and products. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty.