Form 941 Q1 2022

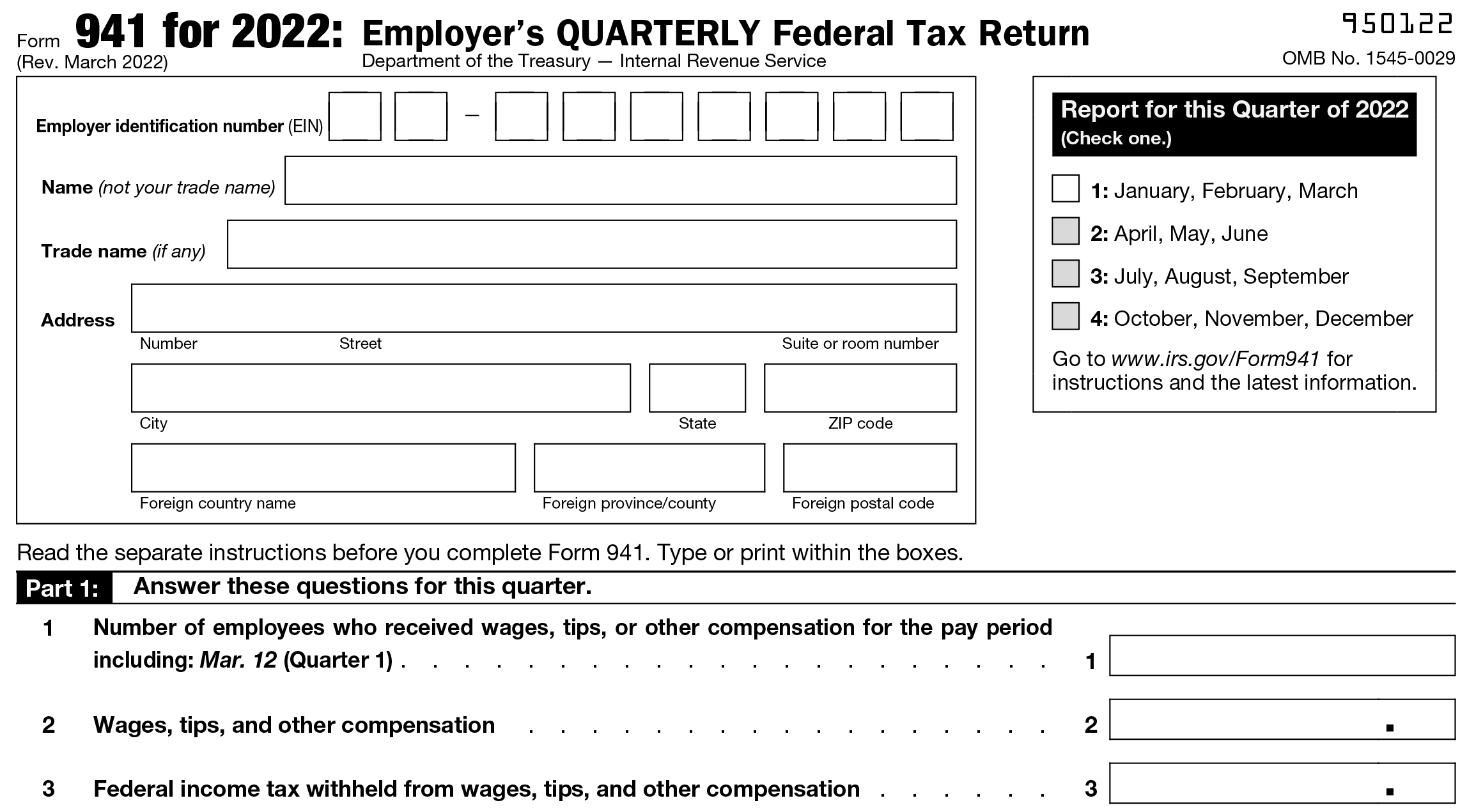

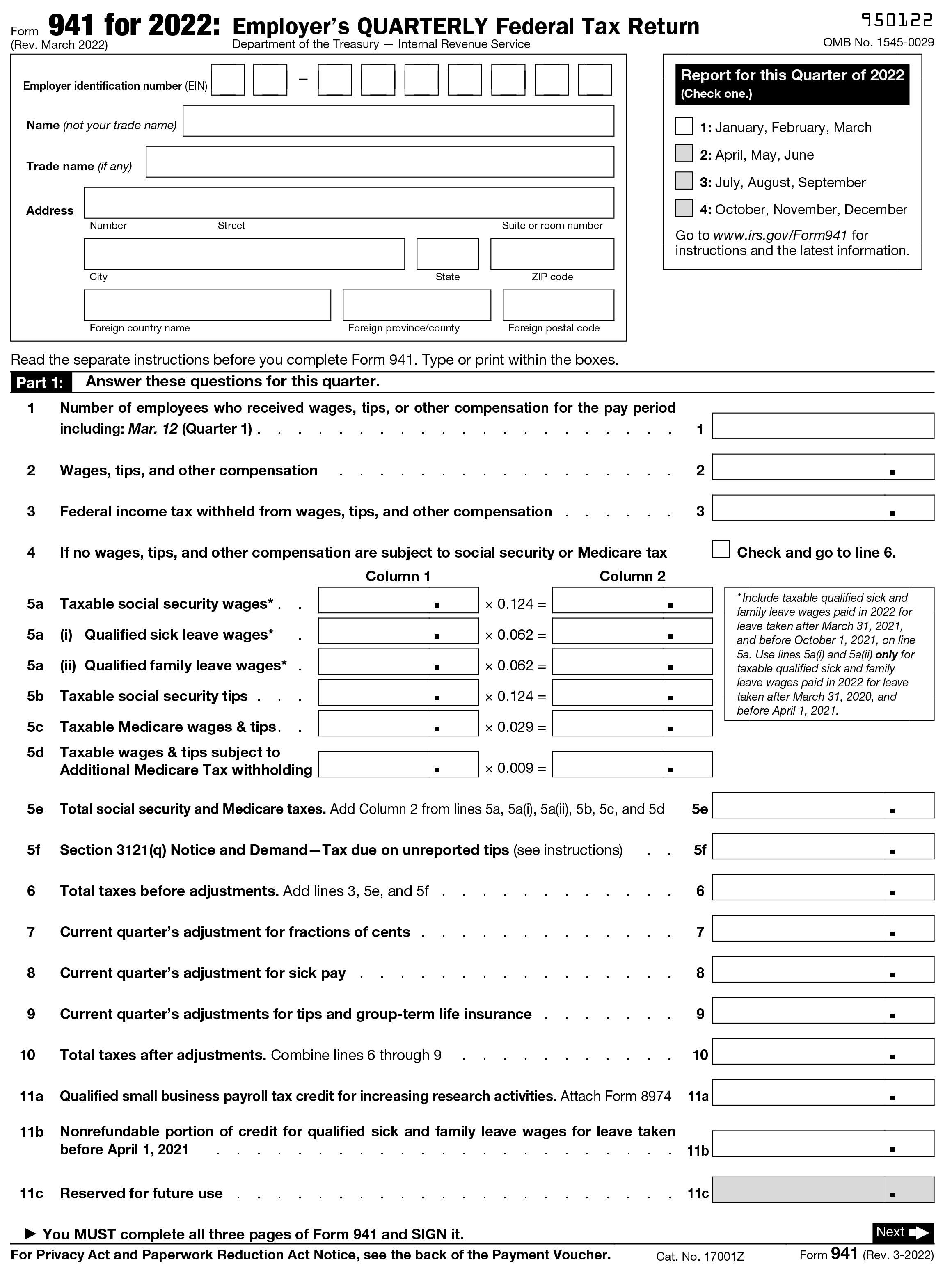

Form 941 Q1 2022 - Web employer’s quarterly federal tax return form 941 for 2023: Web mandatory filing deadlines for 2022 form 941 are: Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,. Web report for this quarter of 2022 (check one.) 1: 12 (quarter 1), june 12. They must have been too busy trying to. Form 941 reports federal income and fica taxes each. Number of employees who received wages, tips, or other compensation for the pay period including: To electronically file form 941, you’ll need to do it through a tax preparation.

The irs also indicated there is going to be a. April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web mandatory filing deadlines for 2022 form 941 are: They must have been too busy trying to. Complete, edit or print tax forms instantly. Web irs form 941 is due to the irs quarterly. (check one.) employer identification number (ein) — 1: Once you’ve signed in to taxbandits, select “start new”. Upload, modify or create forms. Number of employees who received wages, tips, or other compensation for the pay period including:

Ad access irs tax forms. Ad get ready for tax season deadlines by completing any required tax forms today. 12 (quarter 1), june 12. To electronically file form 941, you’ll need to do it through a tax preparation. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web employer’s quarterly federal tax return form 941 for 2023: This version is no longer available in. In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,. Try it for free now! Are the 941 worksheets updated for q1, 2022?.

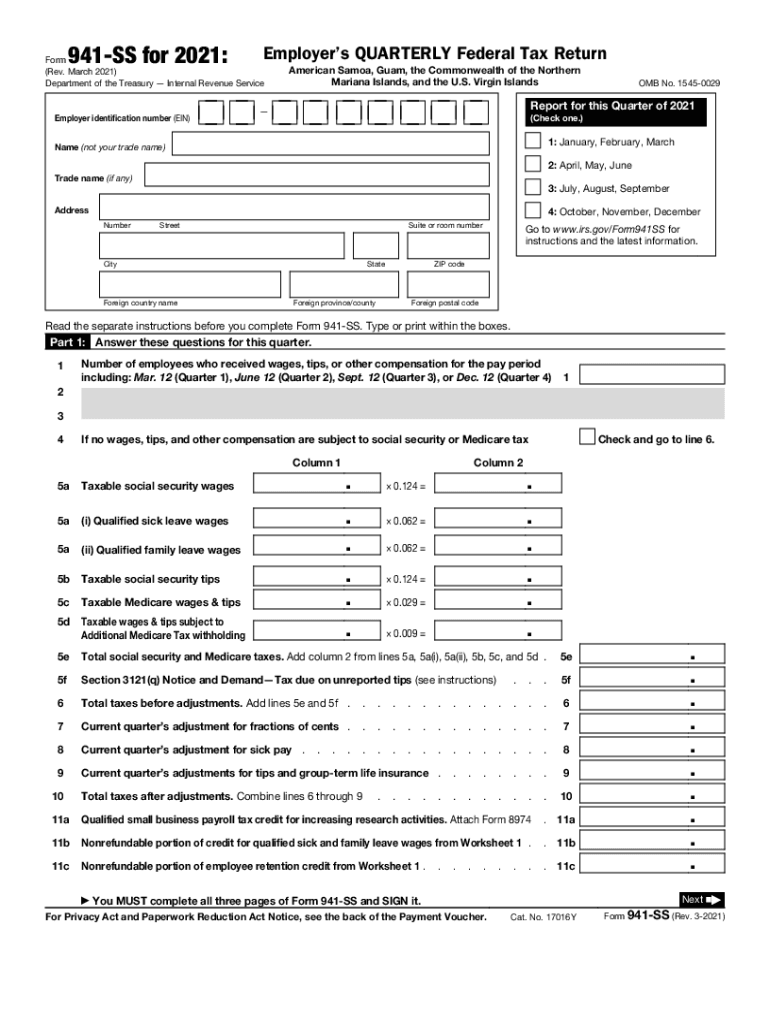

Form 941 Fill Out and Sign Printable PDF Template signNow

Try it for free now! March 2023) employer’s quarterly federal tax return department of the treasury — internal. Ad get ready for tax season deadlines by completing any required tax forms today. All you have to do is to. Ad access irs tax forms.

Employers IRS Changes Payroll Tax Form 941 For Q1 of 2022

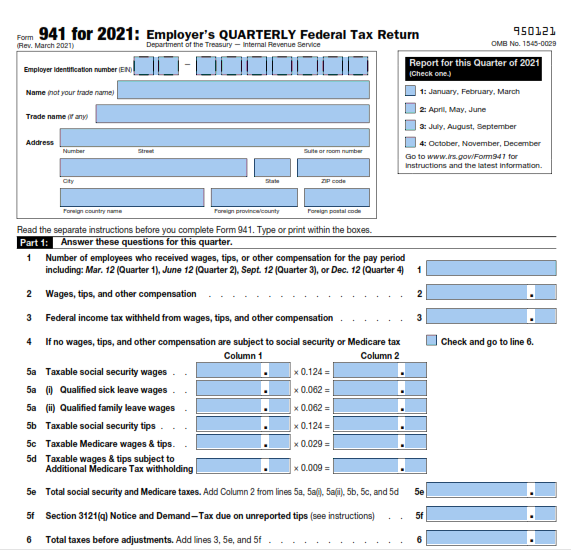

Web an overview of the new form 941 for q1, 2022 ; They must have been too busy trying to. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. These are the 941 due dates for the 2022 tax year: Ad get ready for tax season deadlines by.

2022 Q1 Form 941 Revisions 123PayStubs Blog

This version is no longer available in. Complete, edit or print tax forms instantly. 12 (quarter 1), june 12. These are the 941 due dates for the 2022 tax year: In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,.

Top 10 Us Tax Forms In 2022 Explained Pdf Co Gambaran

12 (quarter 1), june 12. Form 941 reports federal income and fica taxes each. Number of employees who received wages, tips, or other compensation for the pay period including: Web mandatory filing deadlines for 2022 form 941 are: Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs.

Fillable 941 Quarterly Form 2022 Printable Form, Templates and Letter

Form 941 reports federal income and fica taxes each. These are the 941 due dates for the 2022 tax year: Web january 10, 2022 02:29 pm. Web report for this quarter. (check one.) employer identification number (ein) — 1:

Print Irs Form 941 Fill and Sign Printable Template Online US Legal

Web the irs changed form 941 for the first quarter of 2022 and warns taxpayers not to use an earlier version of the form. (check one.) employer identification number (ein) — 1: In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,. They must have been too busy trying to. Web report for.

How to fill out IRS Form 941 2019 PDF Expert

How have the new form 941 fields been revised for q1 of 2022? Web we are breaking down step by step how to easily file form 941 for the first quarter of 2022 with taxbandits! Ad access irs tax forms. Web report for this quarter. 12 (quarter 1), june 12.

941 Form 2022 Printable PDF Template

They must have been too busy trying to. Number of employees who received wages, tips, or other compensation for the pay period including: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Once you’ve signed in to taxbandits, select “start new”. Web the irs changed form 941 for.

Update Form 941 Changes Regulatory Compliance

How have the new form 941 fields been revised for q1 of 2022? Web quickbooks team july 07, 2021 11:13 am good day, @landerson00. Web changes to irs form 941 for first quarter 2022 mar 08, 2022 form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022. Answer these questions.

2022 IRS Form 941 filing instructions and informations

Web march 21, 2022 at 11:50 am · 3 min read rock hill, sc / accesswire / march 21, 2022 / the first quarter of 2022 is almost complete, which means it's time for. Complete, edit or print tax forms instantly. Web report for this quarter of 2022 (check one.) 1: This version is no longer available in. Web irs.

They Must Have Been Too Busy Trying To.

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,. Once you’ve signed in to taxbandits, select “start new”. Upload, modify or create forms.

Web Mandatory Filing Deadlines For 2022 Form 941 Are:

March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web january 10, 2022 02:29 pm. Web report for this quarter of 2022 (check one.) 1: This version is no longer available in.

Form 941 Reports Federal Income And Fica Taxes Each.

Are the 941 worksheets updated for q1, 2022?. The irs also indicated there is going to be a. Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. Web q1 2023 form 941 not available it is now time to file the 2nd quarter and updates have been done on all our clients multiple times this year.

Web Employer’s Quarterly Federal Tax Return Form 941 For 2023:

How have the new form 941 fields been revised for q1 of 2022? To electronically file form 941, you’ll need to do it through a tax preparation. 12 (quarter 1), june 12. Web report for this quarter.