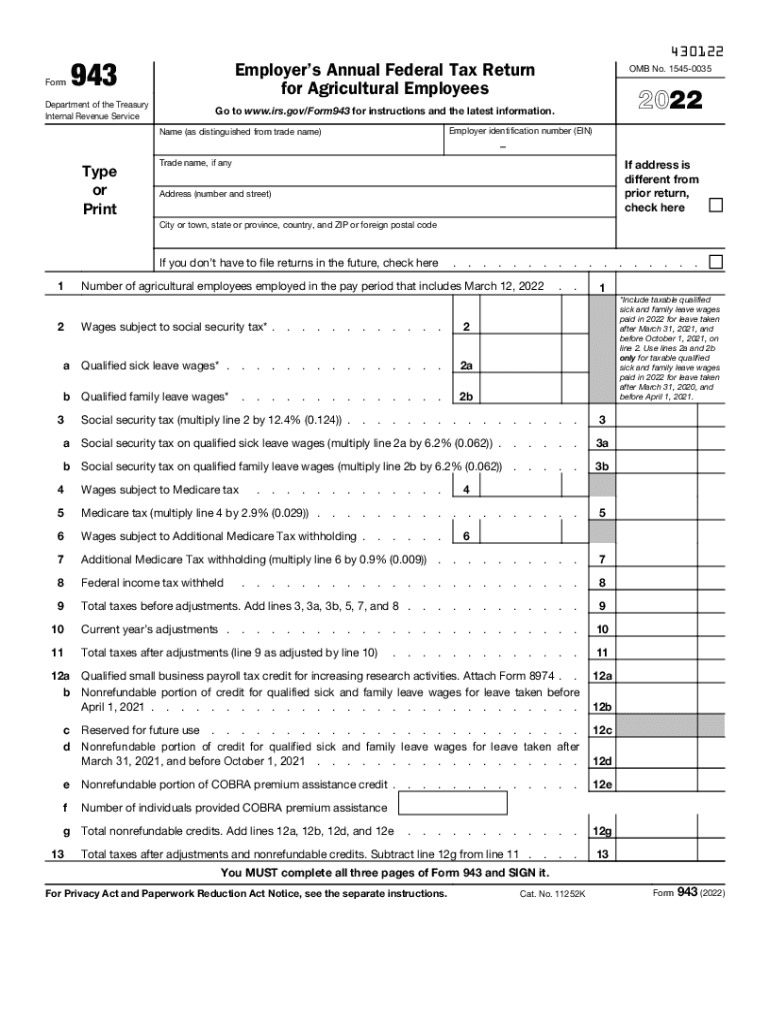

Form 943 2022

Form 943 2022 - File this form if you paid wages to one or more farmworkers and the wages were subject to social security and medicare taxes or federal income tax withholding. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Number of individuals provided cobra premium assistance* (form 943, line 12f) *line 15d can only be used if correcting. You pay an employee cash wages of $150 or more in a year for farmwork (count all wages paid on a time, piecework, or another basis). Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december 31, 2022. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your check or money order. Web complete this page and attach to form 943 if reason for request on page 1 is for a vendor no tax due or office of administration contract or bid greater than $1,000,000. Exception for exempt organizations, federal, state and local government entities and indian tribal government entities regardless of location. In other words, it is a tax form used to report federal income tax, social security and medicare withholdings. File form 943 only once for each calendar year.

Number of individuals provided cobra premium assistance* (form 943, line 12f) *line 15d can only be used if correcting. Download this form print this form Web for 2022, file form 943 by january 31, 2023. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to agricultural workers. Web complete this page and attach to form 943 if reason for request on page 1 is for a vendor no tax due or office of administration contract or bid greater than $1,000,000. Web (form 943, line 12d). In other words, it is a tax form used to report federal income tax, social security and medicare withholdings. The changes made under the ira will be discussed in the 2023 instructions for form 943 and in pub. Web form 943, is the employer’s annual federal tax return for agricultural employees. Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december 31, 2022.

Web for 2022, file form 943 by january 31, 2023. Download this form print this form Web (form 943, line 12d). File form 943 only once for each calendar year. Web federal employer's annual federal tax return for agricultural employees form 943 pdf form content report error it appears you don't have a pdf plugin for this browser. In other words, it is a tax form used to report federal income tax, social security and medicare withholdings. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to agricultural workers. Web address as shown on form 943. File this form if you paid wages to one or more farmworkers and the wages were subject to social security and medicare taxes or federal income tax withholding. Web about form 943, employer's annual federal tax return for agricultural employees.

IRS Form 943 Online Efile 943 for 4.95 Form 943 for 2020

Nonrefundable portion of cobra premium assistance credit* (form 943, line 12e) *line 15c can only be used if correcting a 2021 or 2022 form 943. Web complete this page and attach to form 943 if reason for request on page 1 is for a vendor no tax due or office of administration contract or bid greater than $1,000,000. Web (form.

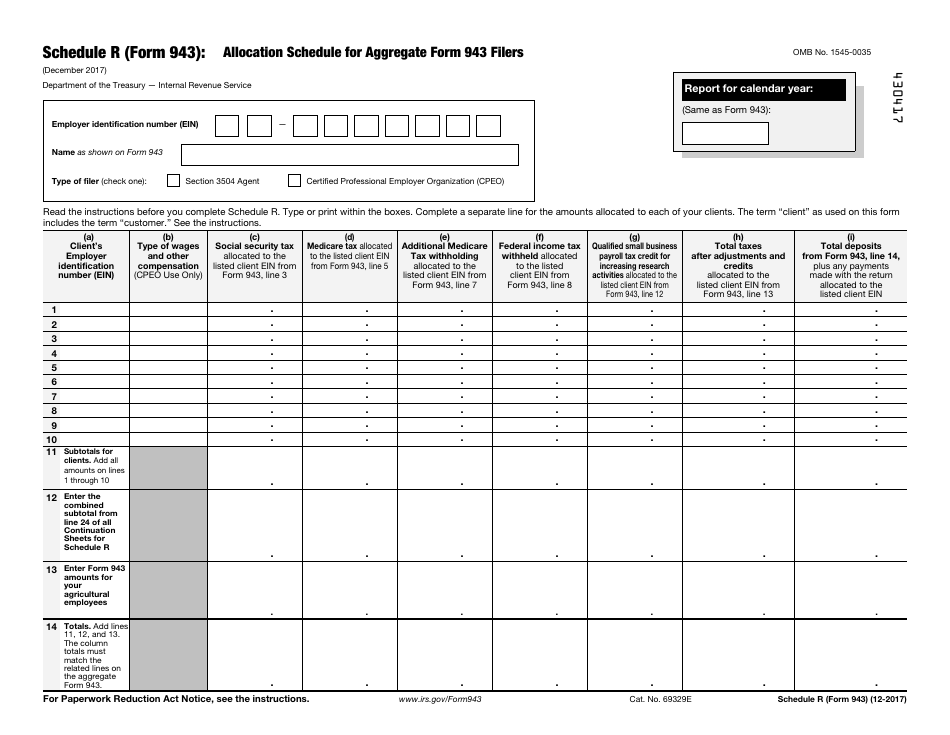

IRS Form 943 Schedule R Download Fillable PDF or Fill Online Allocation

Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december 31, 2022. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Web for 2022,.

2022 Form IRS 943 Fill Online, Printable, Fillable, Blank pdfFiller

All applicable identification numbers must be completed on page 1. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. In other words, it is a tax form used to report federal income tax, social security and medicare withholdings. Number of individuals provided cobra.

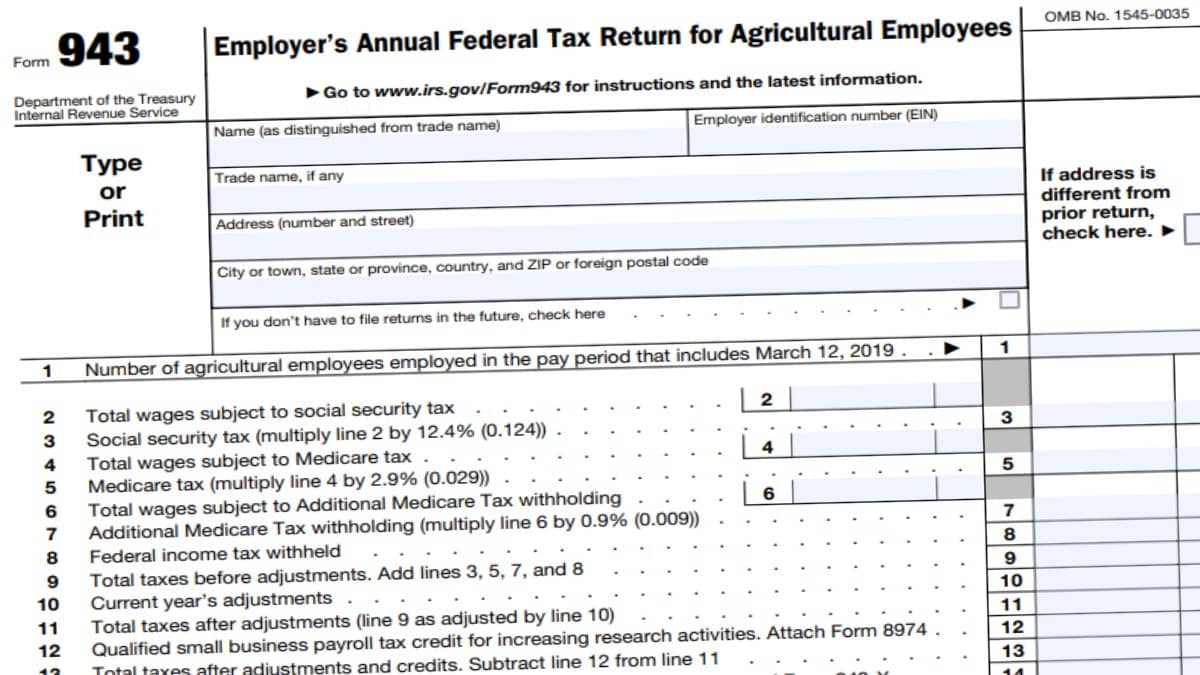

2018 form 943 fillable Fill out & sign online DocHub

All applicable identification numbers must be completed on page 1. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to agricultural workers. Web federal employer's annual federal tax return for agricultural employees form 943 pdf form content report error it appears you don't have a.

943 Form 2022 2023

Web (form 943, line 12d). Exception for exempt organizations, federal, state and local government entities and indian tribal government entities regardless of location. Web address as shown on form 943. Number of individuals provided cobra premium assistance* (form 943, line 12f) *line 15d can only be used if correcting. Web complete this page and attach to form 943 if reason.

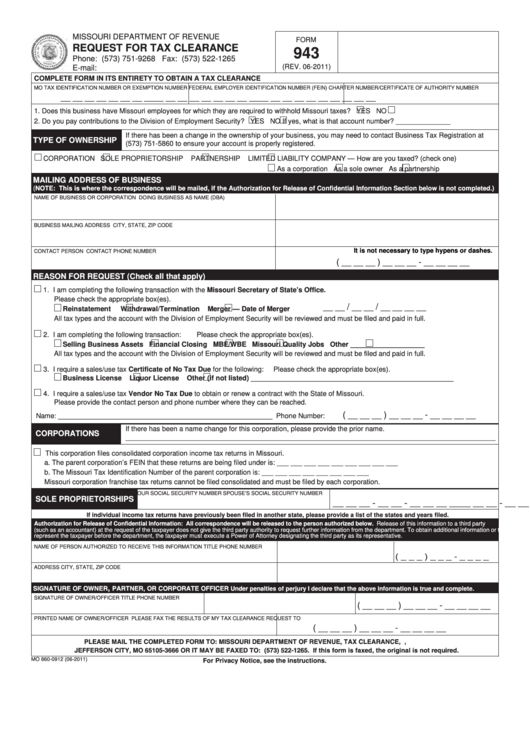

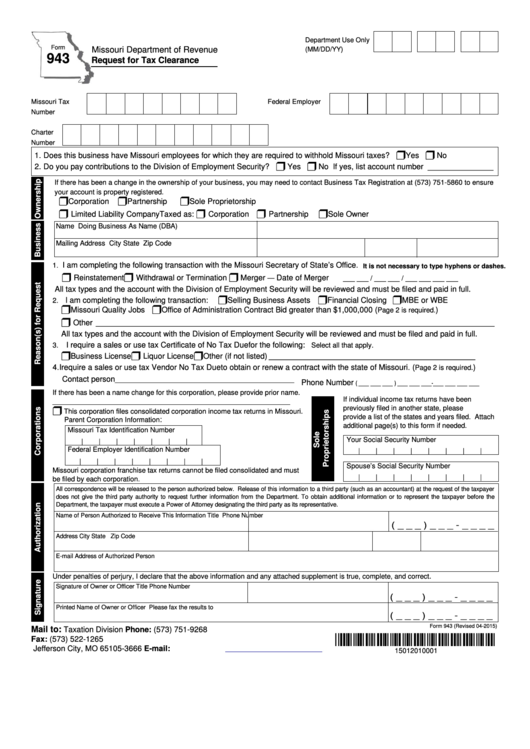

Fillable Form 943 Request For Tax Clearance printable pdf download

If you filed form 943 electronically, don't file a paper form 943. Web (form 943, line 12d). Web federal employer's annual federal tax return for agricultural employees form 943 pdf form content report error it appears you don't have a pdf plugin for this browser. All applicable identification numbers must be completed on page 1. Exception for exempt organizations, federal,.

20202022 Form IRS 943A Fill Online, Printable, Fillable, Blank

Web address as shown on form 943. The changes made under the ira will be discussed in the 2023 instructions for form 943 and in pub. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Web the inflation reduction act of 2022 (the.

IRS Form 943 Complete PDF Tenplate Online in PDF

Web about form 943, employer's annual federal tax return for agricultural employees. If you filed form 943 electronically, don't file a paper form 943. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your check or money order. Exception for exempt organizations, federal, state and.

Fillable Form 943 Request For Tax Clearance printable pdf download

File form 943 only once for each calendar year. In other words, it is a tax form used to report federal income tax, social security and medicare withholdings. The changes made under the ira will be discussed in the 2023 instructions for form 943 and in pub. If you filed form 943 electronically, don't file a paper form 943. •.

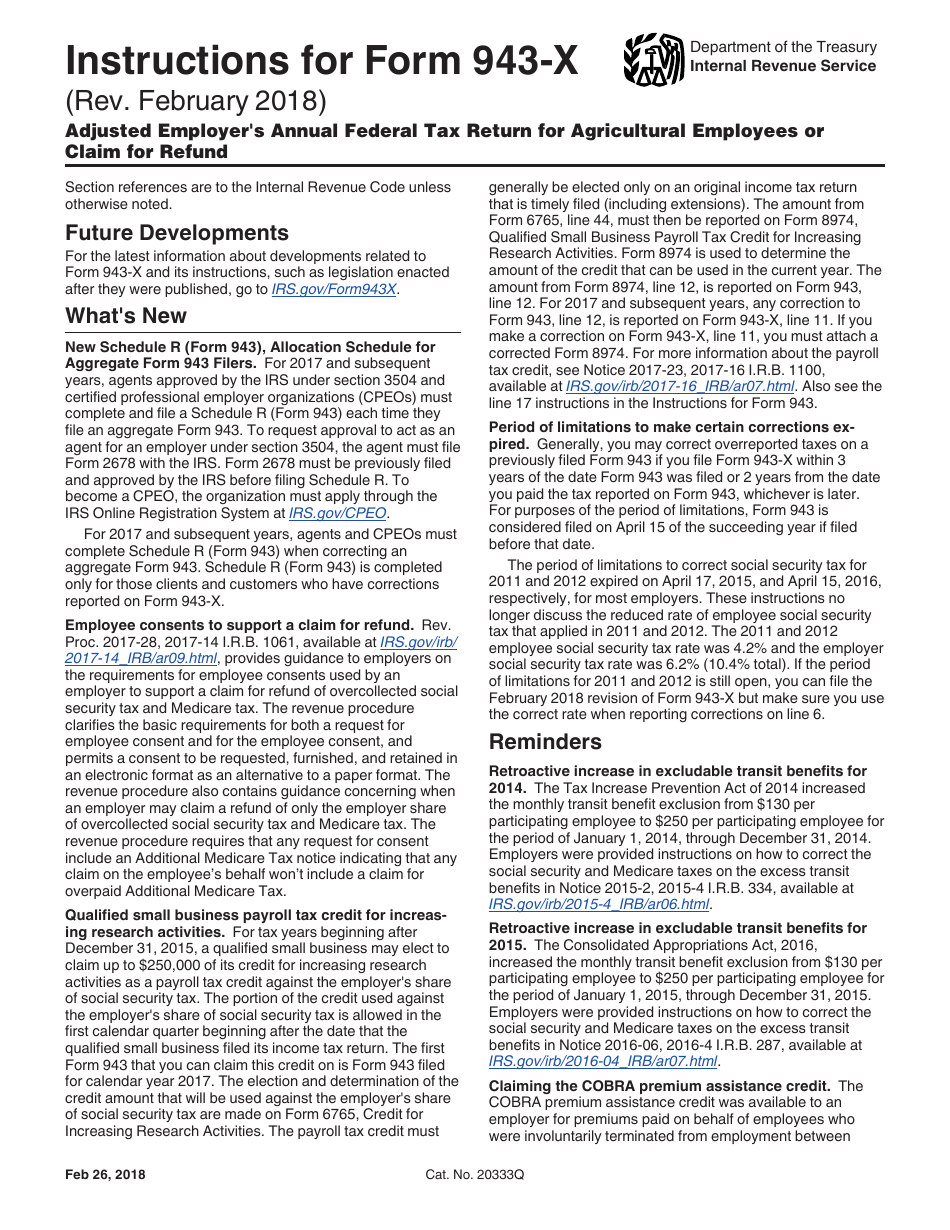

Download Instructions for IRS Form 943X Adjusted Employer's Annual

In other words, it is a tax form used to report federal income tax, social security and medicare withholdings. Web form 943, is the employer’s annual federal tax return for agricultural employees. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to agricultural workers. Web.

Web About Form 943, Employer's Annual Federal Tax Return For Agricultural Employees.

However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. The changes made under the ira will be discussed in the 2023 instructions for form 943 and in pub. If you filed form 943 electronically, don't file a paper form 943. You pay an employee cash wages of $150 or more in a year for farmwork (count all wages paid on a time, piecework, or another basis).

Web Federal Employer's Annual Federal Tax Return For Agricultural Employees Form 943 Pdf Form Content Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

Download this form print this form Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to agricultural workers. Exception for exempt organizations, federal, state and local government entities and indian tribal government entities regardless of location. File form 943 only once for each calendar year.

• Enclose Your Check Or Money Order Made Payable To “United States Treasury.” Be Sure To Enter Your Ein, “Form 943,” And “2022” On Your Check Or Money Order.

Web address as shown on form 943. Web complete this page and attach to form 943 if reason for request on page 1 is for a vendor no tax due or office of administration contract or bid greater than $1,000,000. In other words, it is a tax form used to report federal income tax, social security and medicare withholdings. File this form if you paid wages to one or more farmworkers and the wages were subject to social security and medicare taxes or federal income tax withholding.

Web Form 943, Is The Employer’s Annual Federal Tax Return For Agricultural Employees.

Number of individuals provided cobra premium assistance* (form 943, line 12f) *line 15d can only be used if correcting. Nonrefundable portion of cobra premium assistance credit* (form 943, line 12e) *line 15c can only be used if correcting a 2021 or 2022 form 943. All applicable identification numbers must be completed on page 1. Web (form 943, line 12d).