Form 990 Schedule B Instructions

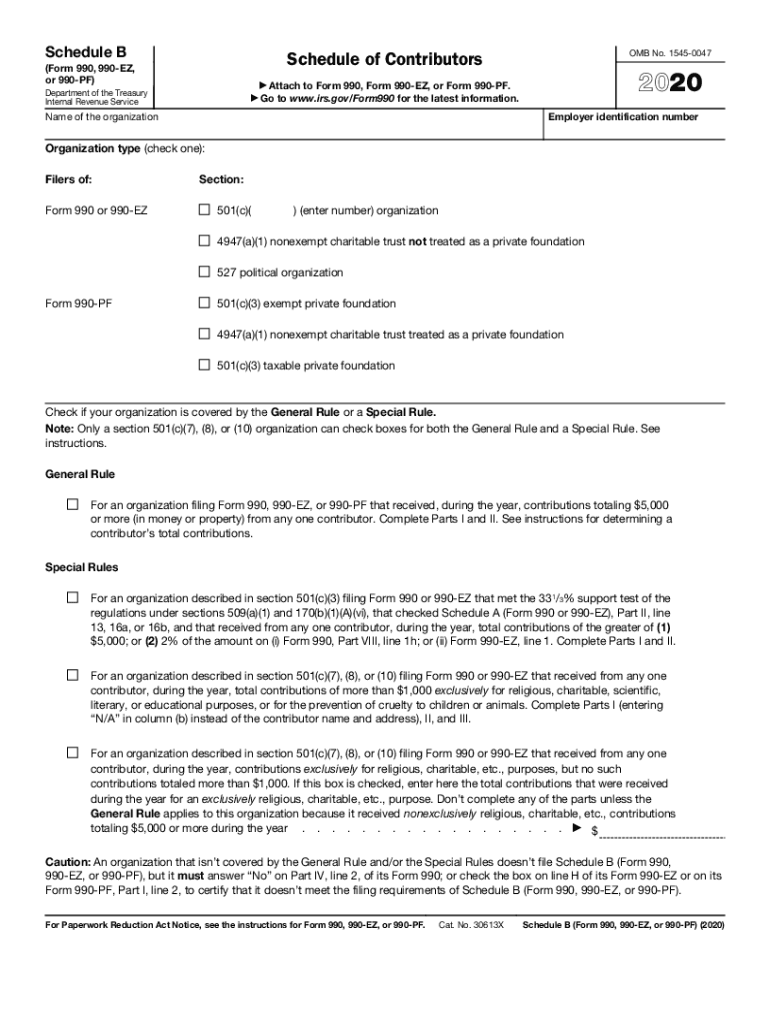

Form 990 Schedule B Instructions - Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. Web instructions for these schedules are combined with the schedules. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. Web irs releases final regulations regarding donor disclosure on form 990, schedule b. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor. There are special rules for certain 501 (c) (3) npos that.

Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. Form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Web irs releases final regulations regarding donor disclosure on form 990, schedule b. There are special rules for certain 501 (c) (3) npos that. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. Web instructions for these schedules are combined with the schedules. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor.

Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. Form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. There are special rules for certain 501 (c) (3) npos that. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Web instructions for these schedules are combined with the schedules. Web irs releases final regulations regarding donor disclosure on form 990, schedule b.

Form 990 Schedule A Instructions printable pdf download

Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. There are special rules for certain 501 (c) (3) npos that. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. Web generally, a npo must.

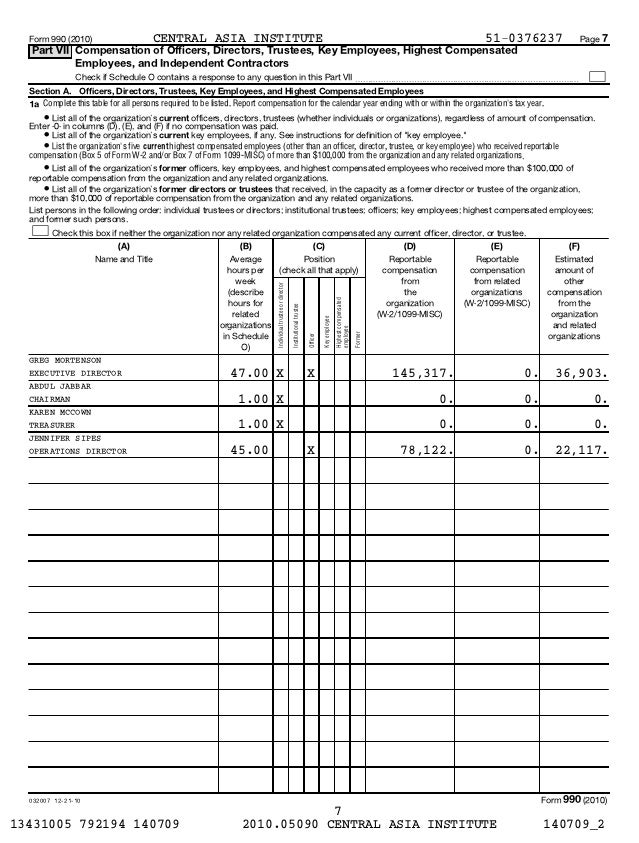

199N E Postcard Fill Out and Sign Printable PDF Template signNow

Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. Web generally, a npo must attach schedule b to its form 990 if it receives contributions.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations.

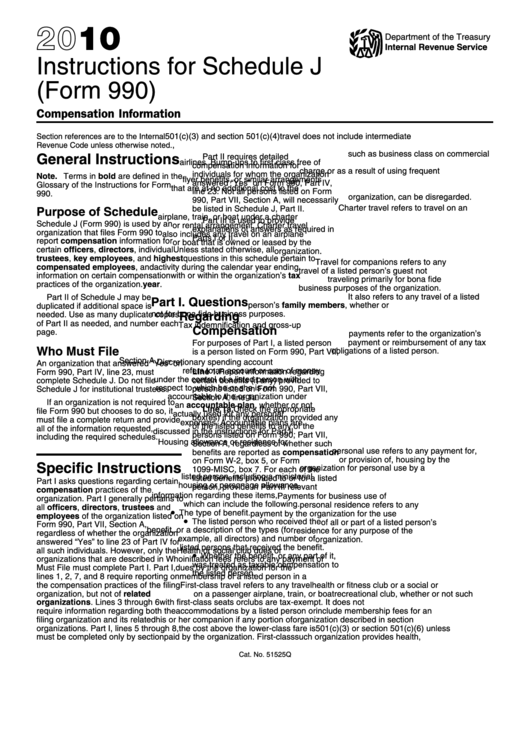

2010 Form 990 Schedule A Instructions

Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. Web irs releases final regulations regarding donor disclosure on form 990, schedule b. Form 990, return.

990 schedule b instructions Fill online, Printable, Fillable Blank

Form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Web irs releases final regulations regarding donor disclosure on form 990, schedule b. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. Web instructions for these schedules are combined with the schedules. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater.

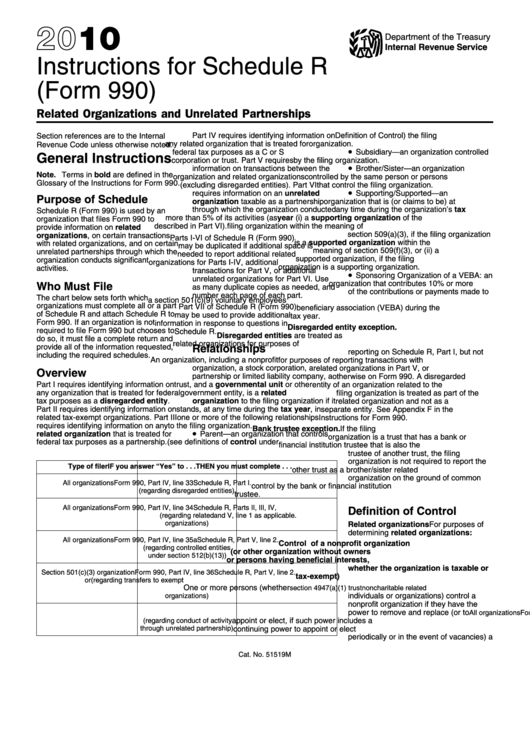

Form 990 Instructions For Schedule R 2010 printable pdf download

Web irs releases final regulations regarding donor disclosure on form 990, schedule b. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor. Web instructions for these schedules are combined with the schedules. Effective may 28, 2020, the internal.

Form 990 Instructions For Schedule J printable pdf download

There are special rules for certain 501 (c) (3) npos that. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor. Form 990 (schedule.

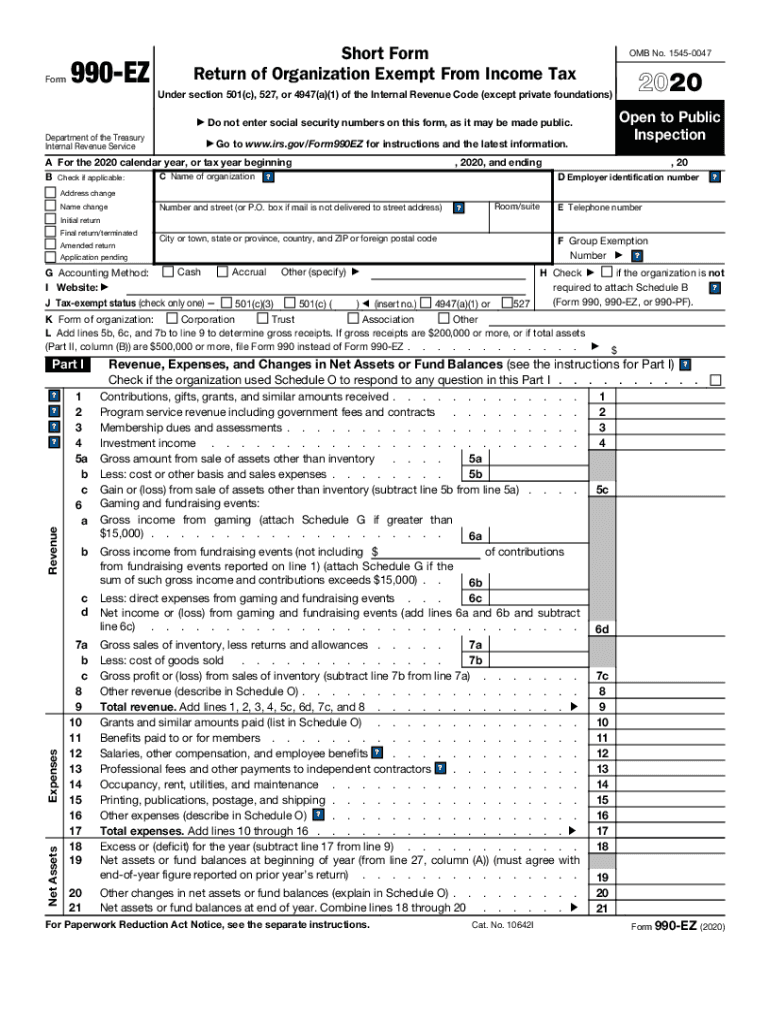

IRS 990EZ 2020 Fill out Tax Template Online US Legal Forms

Web instructions for these schedules are combined with the schedules. Web irs releases final regulations regarding donor disclosure on form 990, schedule b. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor. There are special rules for certain 501 (c) (3) npos that. Form 990, return of organization exempt from income tax, part viii,.

Editable IRS Form 990 Schedule G 2018 2019 Create A Digital

There are special rules for certain 501 (c) (3) npos that. Form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor..

Effective May 28, 2020, The Internal Revenue Service (Irs) Issued Final Treasury Regulations Addressing Donor.

Web instructions for these schedules are combined with the schedules. Web schedule b requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. Web irs releases final regulations regarding donor disclosure on form 990, schedule b. Form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf.

Form 990, Return Of Organization Exempt From Income Tax, Part Viii, Statement Of Revenue, Line 1;

There are special rules for certain 501 (c) (3) npos that. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor.