Form 990 Schedule J Instructions

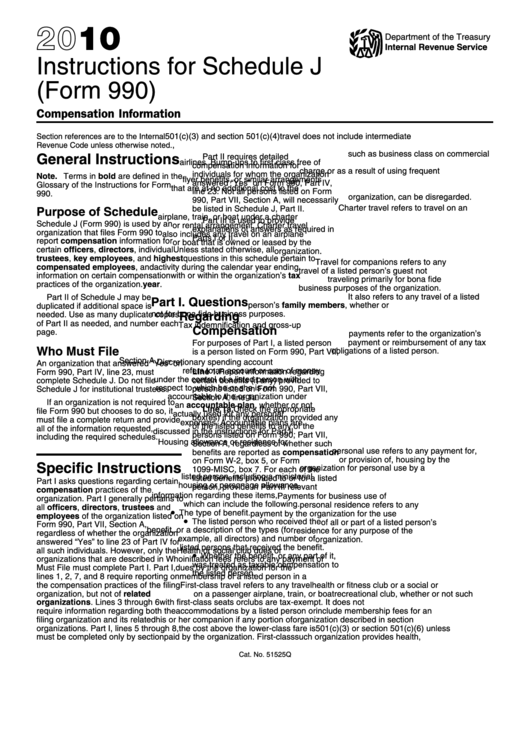

Form 990 Schedule J Instructions - For certain officers, directors, trustees, key employees, and highest compensated employees complete if the organization answered “yes” on form 990, part iv, line 23. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Transactions reported on schedule l (form 990) are relevant to determining independence of members of the governing body under form 990, part vi, line 1b. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Instructions for these schedules are combined with the schedules. (form 990) department of the treasury internal revenue service. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web a standard form 990 contains a wealth of information and could run over 100 pages in length, depending upon the financial standing of the entity. The area of most interest to those examining executive compensation is titled schedule j, where highly compensated leaders of the organization are reported.

The area of most interest to those examining executive compensation is titled schedule j, where highly compensated leaders of the organization are reported. (form 990) department of the treasury internal revenue service. Therefore, fiscal year organizations must keep dual sets of compensation data. Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization. Web a standard form 990 contains a wealth of information and could run over 100 pages in length, depending upon the financial standing of the entity. Transactions reported on schedule l (form 990) are relevant to determining independence of members of the governing body under form 990, part vi, line 1b. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Information relevant to paper filing. The amounts reported in part ix are based on the organization’s tax year. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year.

(form 990) department of the treasury internal revenue service. Transactions reported on schedule l (form 990) are relevant to determining independence of members of the governing body under form 990, part vi, line 1b. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization. The area of most interest to those examining executive compensation is titled schedule j, where highly compensated leaders of the organization are reported. Nonprofit organizations that file form 990 may also be required to include schedule j for reporting more details regarding their members’ compensation to the irs. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Therefore, fiscal year organizations must keep dual sets of compensation data. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web a standard form 990 contains a wealth of information and could run over 100 pages in length, depending upon the financial standing of the entity.

Fill Free fillable Compensation Information Schdul J Form 990 PDF form

Information relevant to paper filing. Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization. Complete part vi of form 990. Web see the instructions for schedule l (form 990), transactions with.

Form 990 (Schedule J1) Continuation Sheet for Schedule J (2009) Free

(form 990) department of the treasury internal revenue service. Instructions for these schedules are combined with the schedules. Nonprofit organizations that file form 990 may also be required to include schedule j for reporting more details regarding their members’ compensation to the irs. Web a standard form 990 contains a wealth of information and could run over 100 pages in.

Editable IRS Form 990 Schedule G 2018 2019 Create A Digital

Complete part vi of form 990. Therefore, fiscal year organizations must keep dual sets of compensation data. The amounts reported in part ix are based on the organization’s tax year. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web the compensation reported in part vii, section a and in.

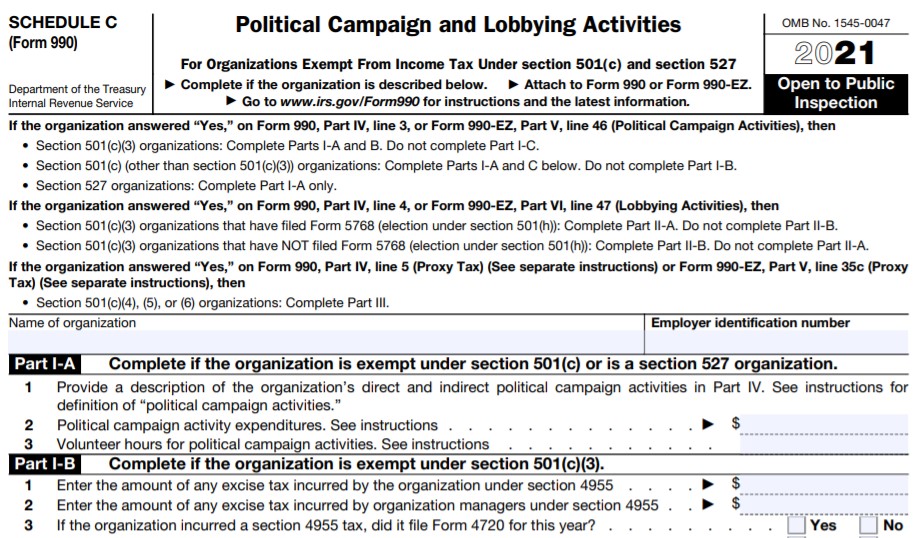

IRS Form 990/990EZ Schedule C Instructions Political Campaign and

Instructions for these schedules are combined with the schedules. For certain officers, directors, trustees, key employees, and highest compensated employees complete if the organization answered “yes” on form 990, part iv, line 23. Complete part vi of form 990. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Information relevant.

2023 Form 990 Schedule F Instructions Fill online, Printable

The area of most interest to those examining executive compensation is titled schedule j, where highly compensated leaders of the organization are reported. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Complete part vi of form 990. Web the following schedules to form 990, return of organization exempt from.

990 instructions 2023 Fill online, Printable, Fillable Blank

(form 990) department of the treasury internal revenue service. Transactions reported on schedule l (form 990) are relevant to determining independence of members of the governing body under form 990, part vi, line 1b. Instructions for these schedules are combined with the schedules. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following.

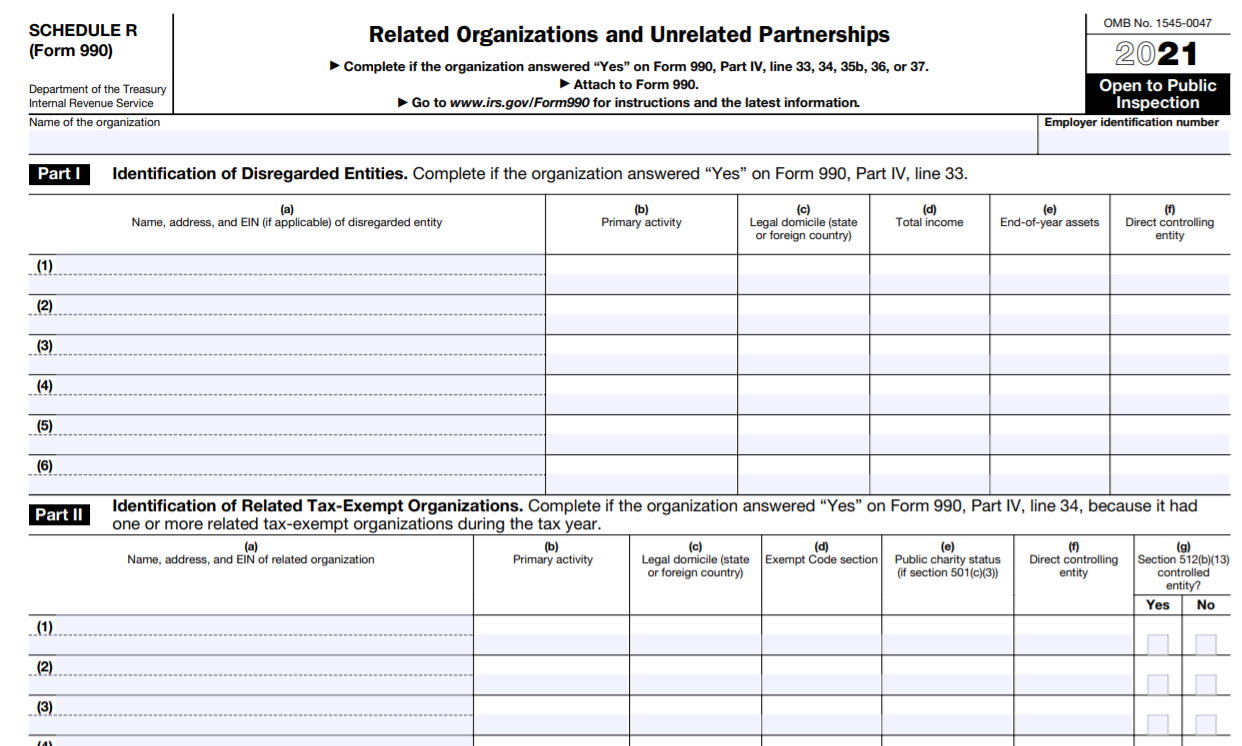

IRS Form 990 Schedule R Instructions Related Organizations and

Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). The area of most interest to those examining executive compensation is titled schedule j, where highly compensated leaders of the organization are reported. Web the compensation reported in part vii, section a and in schedule j should be for.

Form 990 Schedule J Instructions

(form 990) department of the treasury internal revenue service. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web the 2020 form 990,.

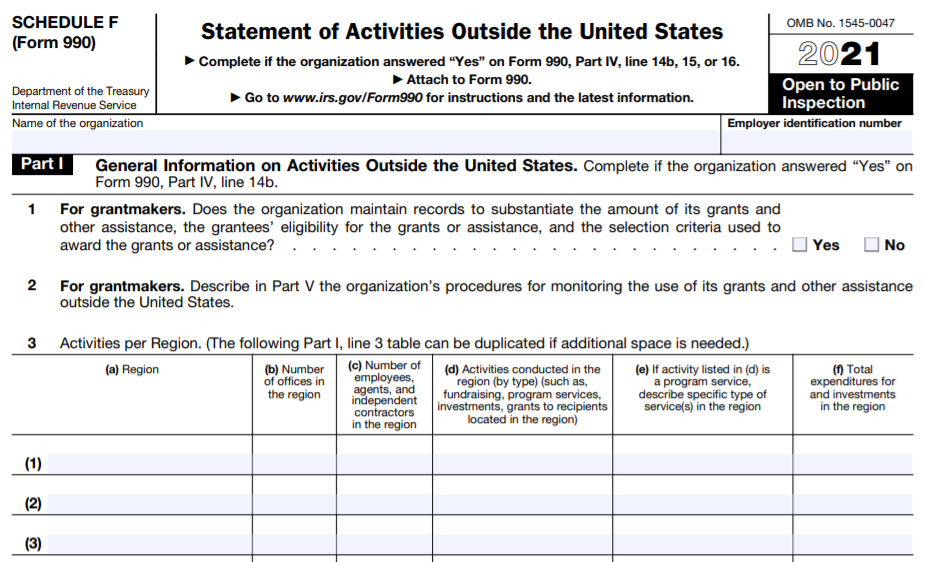

IRS Form 990 Schedule F Instructions Statement of Activities Outside

Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization. Web a standard form 990 contains a wealth of information and could run over 100 pages in length, depending upon the financial.

Form 990 Instructions For Schedule J printable pdf download

Nonprofit organizations that file form 990 may also be required to include schedule j for reporting more details regarding their members’ compensation to the irs. For certain officers, directors, trustees, key employees, and highest compensated employees complete if the organization answered “yes” on form 990, part iv, line 23. The area of most interest to those examining executive compensation is.

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Therefore, fiscal year organizations must keep dual sets of compensation data. (form 990) department of the treasury internal revenue service. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required).

The Area Of Most Interest To Those Examining Executive Compensation Is Titled Schedule J, Where Highly Compensated Leaders Of The Organization Are Reported.

Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization. For certain officers, directors, trustees, key employees, and highest compensated employees complete if the organization answered “yes” on form 990, part iv, line 23. Transactions reported on schedule l (form 990) are relevant to determining independence of members of the governing body under form 990, part vi, line 1b. Complete part vi of form 990.

The Amounts Reported In Part Ix Are Based On The Organization’s Tax Year.

Instructions for these schedules are combined with the schedules. Nonprofit organizations that file form 990 may also be required to include schedule j for reporting more details regarding their members’ compensation to the irs. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Information relevant to paper filing.