Form 990 Schedule M

Form 990 Schedule M - Web form 990, part iv, lines 29 or 30, must complete schedule m (form 990) and attach it to form 990. This means an organization that reported more than $25,000 of aggregate For instructions and the latest information. Form 990 (schedule m), noncash contributions pdf. Nonprofit organizations that file form 990 may be required to include schedule m to report additional information regarding the noncash contributions to the irs. The download files are organized by month. Form 990 schedule m is used to report certain information about the types of noncash contributions that an organization received during the year. Web overview of schedule m. On this page you may download the 990 series filings on record for 2021. Web about schedule m (form 990), noncash contributions organizations that file form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions.

The download files are organized by month. Also, the information regarding the quantity and the financial statements of the noncash. Complete, edit or print tax forms instantly. Web form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Web form 990, part iv, lines 29 or 30, must complete schedule m (form 990) and attach it to form 990. For instructions and the latest information. Some months may have more than one entry due to the size of the download. Form 990 (schedule m), noncash contributions pdf. Nonprofit organizations that file form 990 may be required to include schedule m to report additional information regarding the noncash contributions to the irs. Web overview of schedule m.

Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Also, the information regarding the quantity and the financial statements of the noncash. Nonprofit organizations that file form 990 may be required to include schedule m to report additional information regarding the noncash contributions to the irs. The download files are organized by month. Web about schedule m (form 990), noncash contributions organizations that file form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions. Some months may have more than one entry due to the size of the download. Web overview of schedule m. On this page you may download the 990 series filings on record for 2021. Complete, edit or print tax forms instantly. For instructions and the latest information.

2019 Form IRS 990 Schedule M Fill Online, Printable, Fillable, Blank

Form 990 schedule m is used to report certain information about the types of noncash contributions that an organization received during the year. Web about schedule m (form 990), noncash contributions organizations that file form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions. Ad get ready.

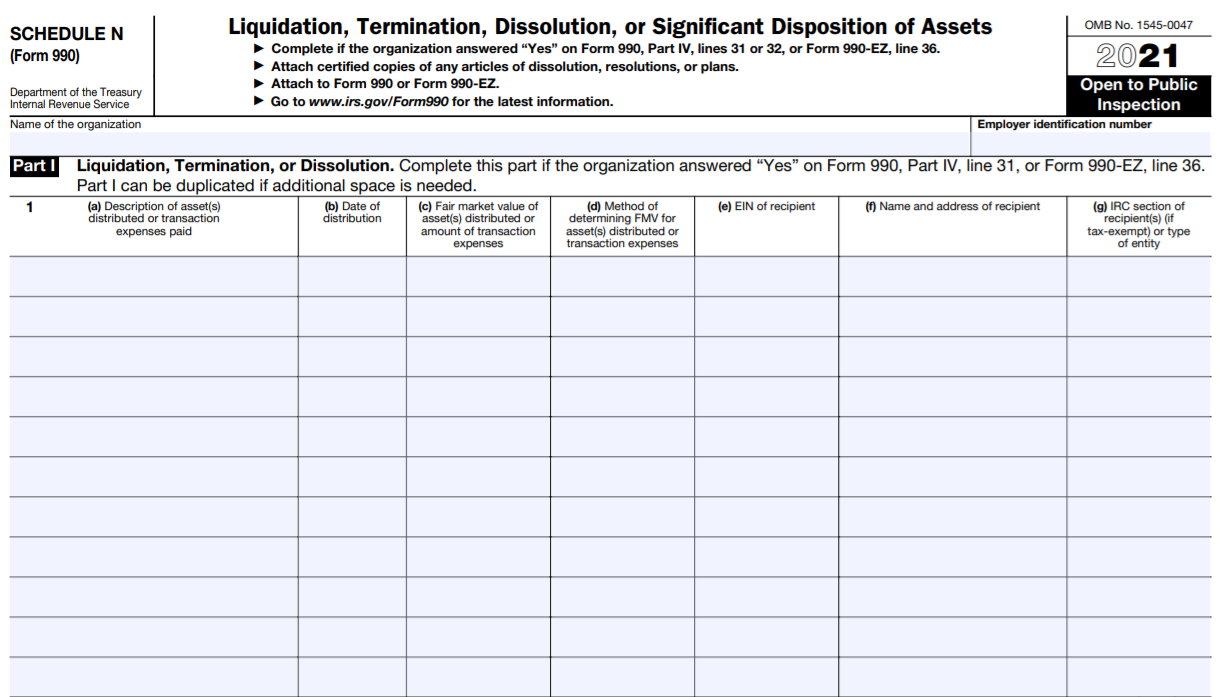

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Web form 990, part iv, lines 29 or 30, must complete schedule m (form 990) and attach it to form 990. The download files are organized by month. Also, the information regarding the quantity and the financial statements of the noncash. For instructions and the latest information. Web 2, to certify that it doesn t meet the filing requirements of.

2018 Form IRS 990 Schedule D Fill Online, Printable, Fillable, Blank

Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Ad get ready for tax season deadlines by completing any required tax forms today. On this page you may download the 990 series filings on record for 2021. Nonprofit organizations that file form 990 may be required to include schedule m to report.

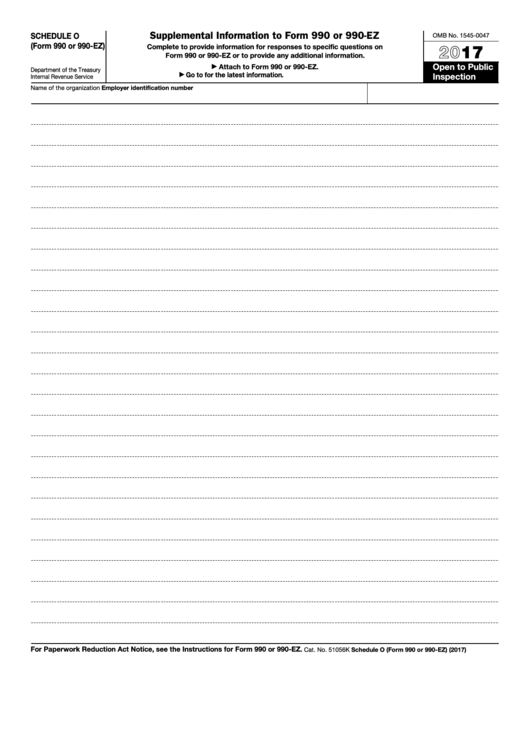

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Web overview of schedule m. Web about schedule m (form 990), noncash contributions organizations that file form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions. The download files are organized by month. Web form 990 (schedule i), grants and other assistance to organizations, governments, and individuals.

Instructions For Schedule A (form 990 Or 990 Ez) Public Charity Status

On this page you may download the 990 series filings on record for 2021. Some months may have more than one entry due to the size of the download. Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Complete, edit or print tax forms instantly. Nonprofit organizations that file form 990 may.

Form 990 (Schedule M) Noncash Contributions (2015) Free Download

Web about schedule m (form 990), noncash contributions organizations that file form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions. Complete, edit or print tax forms instantly. Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Web form.

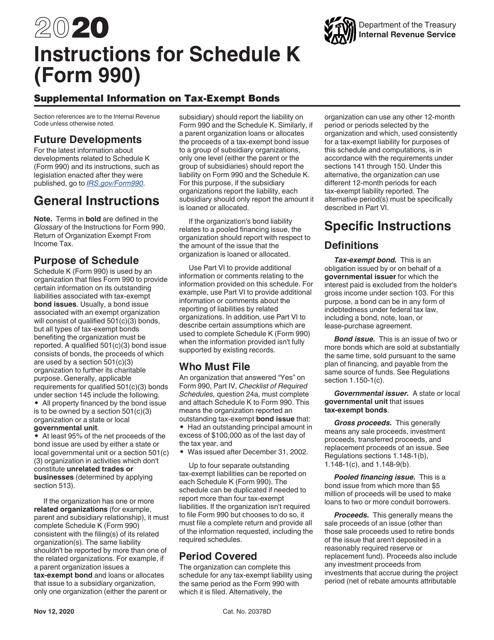

Download Instructions for IRS Form 990 Schedule K Supplemental

Web form 990, part iv, lines 29 or 30, must complete schedule m (form 990) and attach it to form 990. Ad get ready for tax season deadlines by completing any required tax forms today. On this page you may download the 990 series filings on record for 2021. This means an organization that reported more than $25,000 of aggregate.

form 990 schedule m Fill Online, Printable, Fillable Blank form990

On this page you may download the 990 series filings on record for 2021. Form 990 (schedule m), noncash contributions pdf. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 990, part iv, lines 29 or 30, must complete schedule m (form 990) and attach it to form 990. This means an organization.

Form 990 (Schedule M) Noncash Contributions (2015) Free Download

Web about schedule m (form 990), noncash contributions organizations that file form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions. The download files are organized by month. This means an organization that reported more than $25,000 of aggregate Ad get ready for tax season deadlines by.

Tax Brief Form 990, Schedule M Noncash Contributions Jones & Roth

Web overview of schedule m. Form 990 (schedule m), noncash contributions pdf. Nonprofit organizations that file form 990 may be required to include schedule m to report additional information regarding the noncash contributions to the irs. Web form 990, part iv, lines 29 or 30, must complete schedule m (form 990) and attach it to form 990. On this page.

Also, The Information Regarding The Quantity And The Financial Statements Of The Noncash.

Web form 990, part iv, lines 29 or 30, must complete schedule m (form 990) and attach it to form 990. For instructions and the latest information. Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Form 990 (schedule m), noncash contributions pdf.

Form 990 Schedule M Is Used To Report Certain Information About The Types Of Noncash Contributions That An Organization Received During The Year.

Web about schedule m (form 990), noncash contributions organizations that file form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions. Web overview of schedule m. Ad get ready for tax season deadlines by completing any required tax forms today. Nonprofit organizations that file form 990 may be required to include schedule m to report additional information regarding the noncash contributions to the irs.

Some Months May Have More Than One Entry Due To The Size Of The Download.

On this page you may download the 990 series filings on record for 2021. Complete, edit or print tax forms instantly. The download files are organized by month. This means an organization that reported more than $25,000 of aggregate