Form 990Ez Schedule A

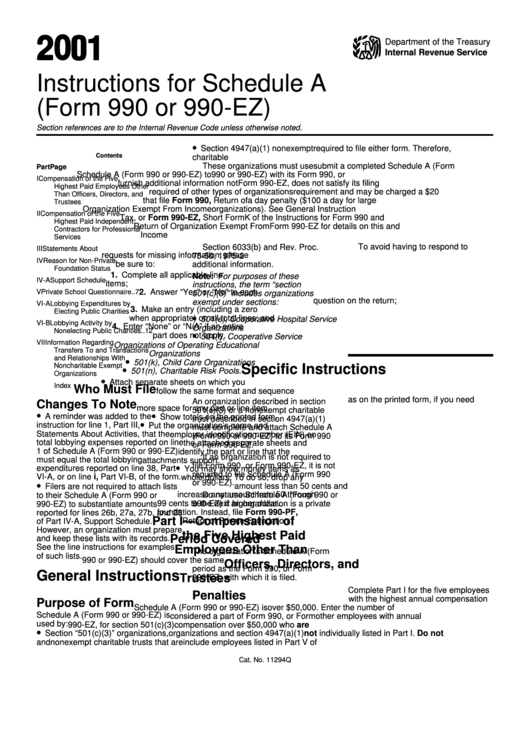

Form 990Ez Schedule A - Web schedule o (form 990) 2022 omb no. On this page you may download the 990 series filings on record for 2021. Optional for others.) balance sheets(see the instructions for part ii) check if the organization used schedule o to respond to any question in this part ii Complete, edit or print tax forms instantly. This form is used for tax filing purposes, and it will be sent to the united states internal revenue service. If the organization fails to qualify under the tests listed below, please complete part iii.) 13 first five years. Attach to form 990 or. Schedule a (public support and. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church. You must use the appropriate schedule a for.

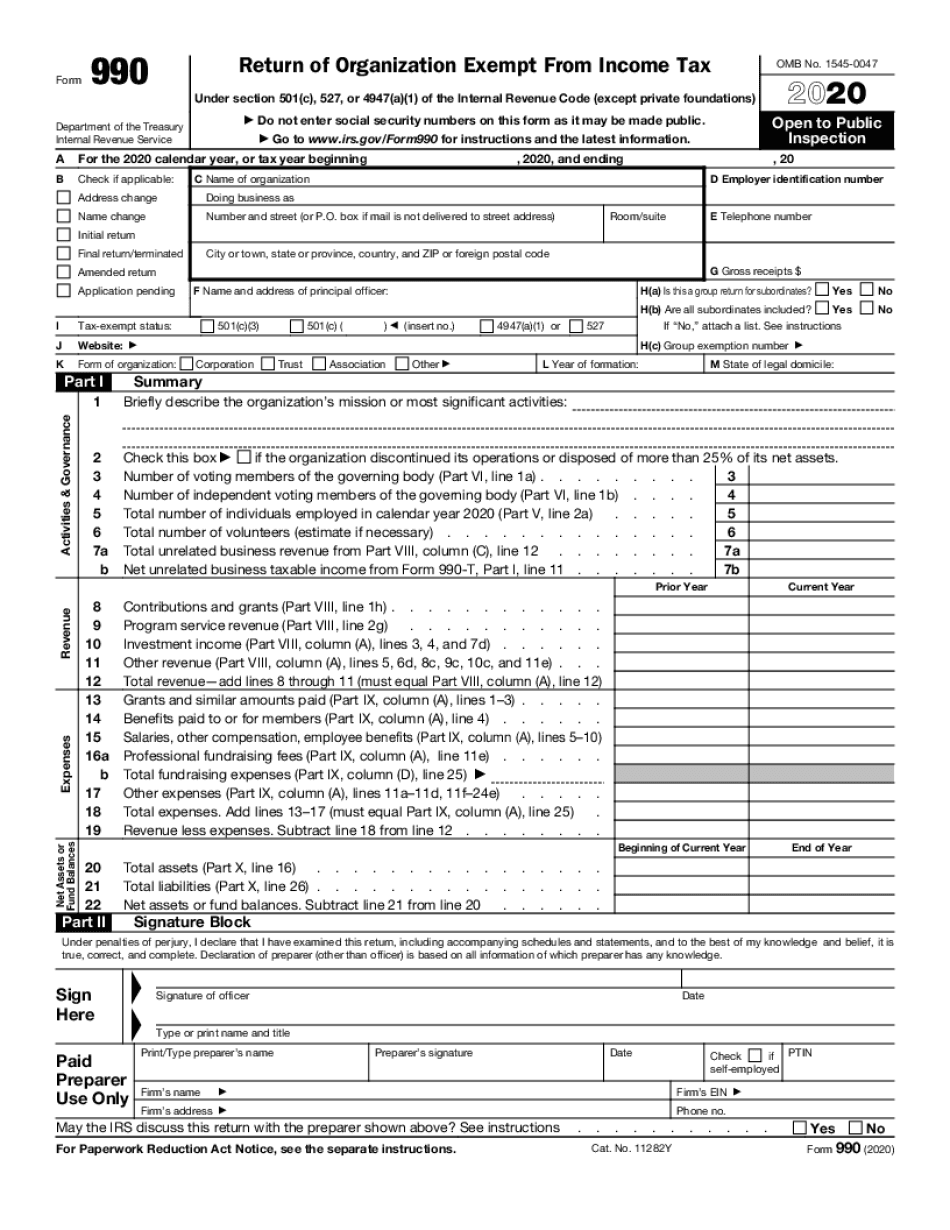

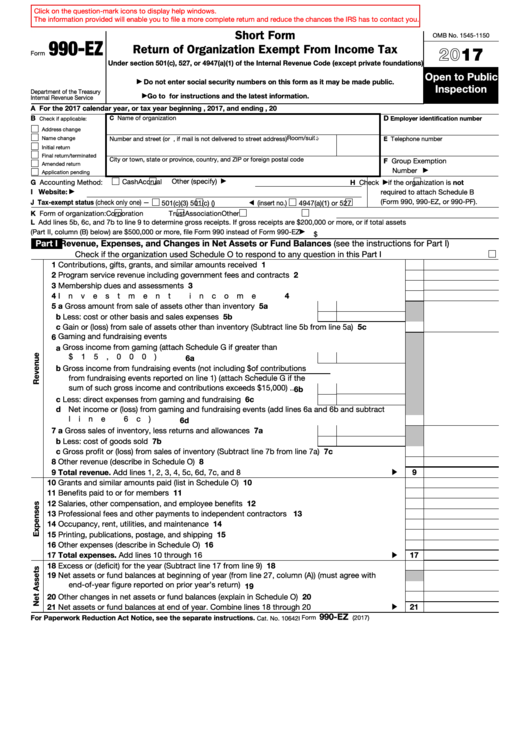

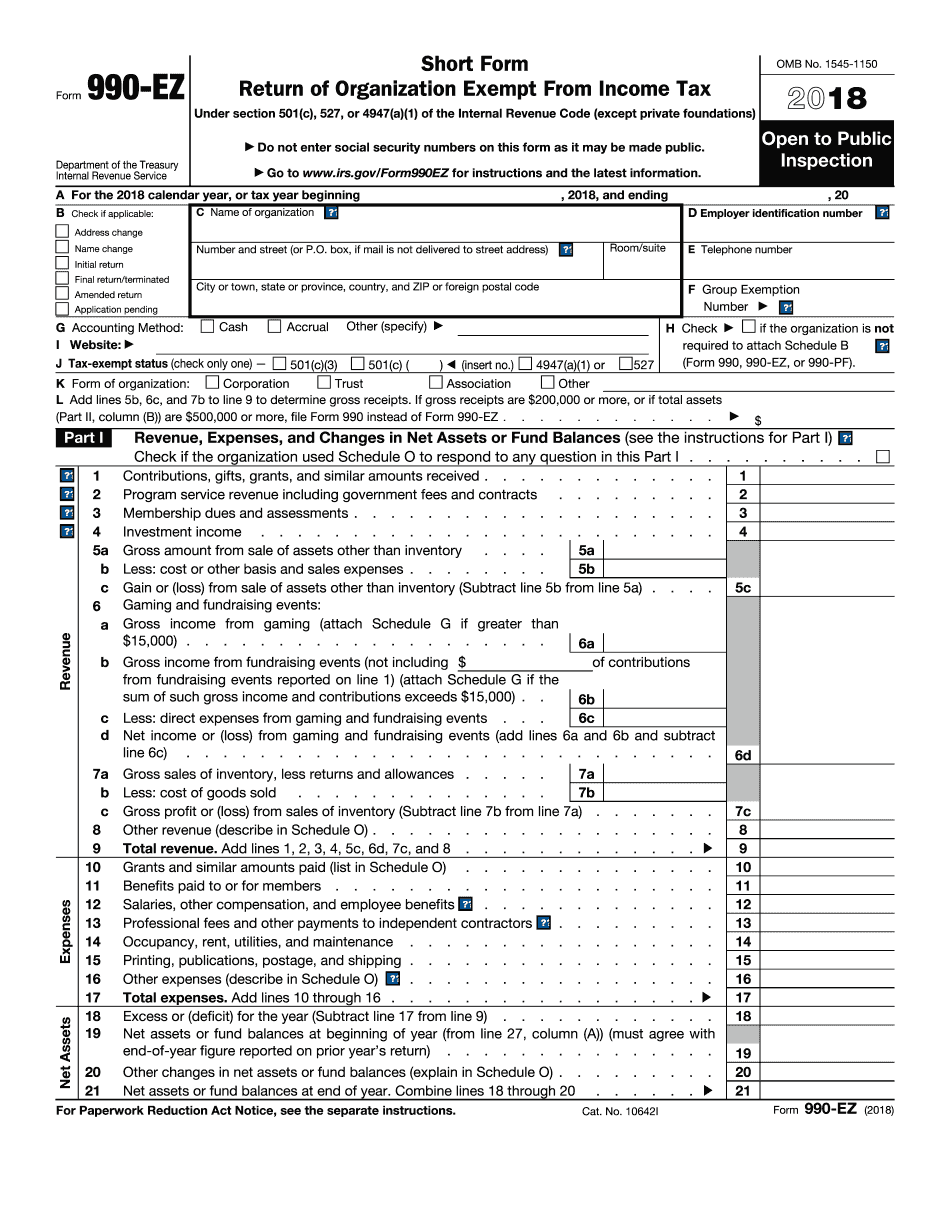

On this page you may download the 990 series filings on record for 2021. Instructions for these schedules are combined with the schedules. Complete, edit or print tax forms instantly. Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt from income taxpdf. Web short form return of organization exempt from income tax. This form is used for tax filing purposes, and it will be sent to the united states internal revenue service. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Complete, edit or print tax forms instantly. Web schedule o (form 990) 2022 omb no. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church.

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church. You must use the appropriate schedule a for. Attach to form 990 or. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. This form is used for tax filing purposes, and it will be sent to the united states internal revenue service. Instructions for these schedules are combined with the schedules.

IRS 990 Schedule O 2017 Fill and Sign Printable Template Online

Get ready for tax season deadlines by completing any required tax forms today. Schedule a (public support and. Optional for others.) balance sheets(see the instructions for part ii) check if the organization used schedule o to respond to any question in this part ii Ad access irs tax forms. Web schedule o (form 990) 2022 omb no.

990 ez form Fill Online, Printable, Fillable Blank

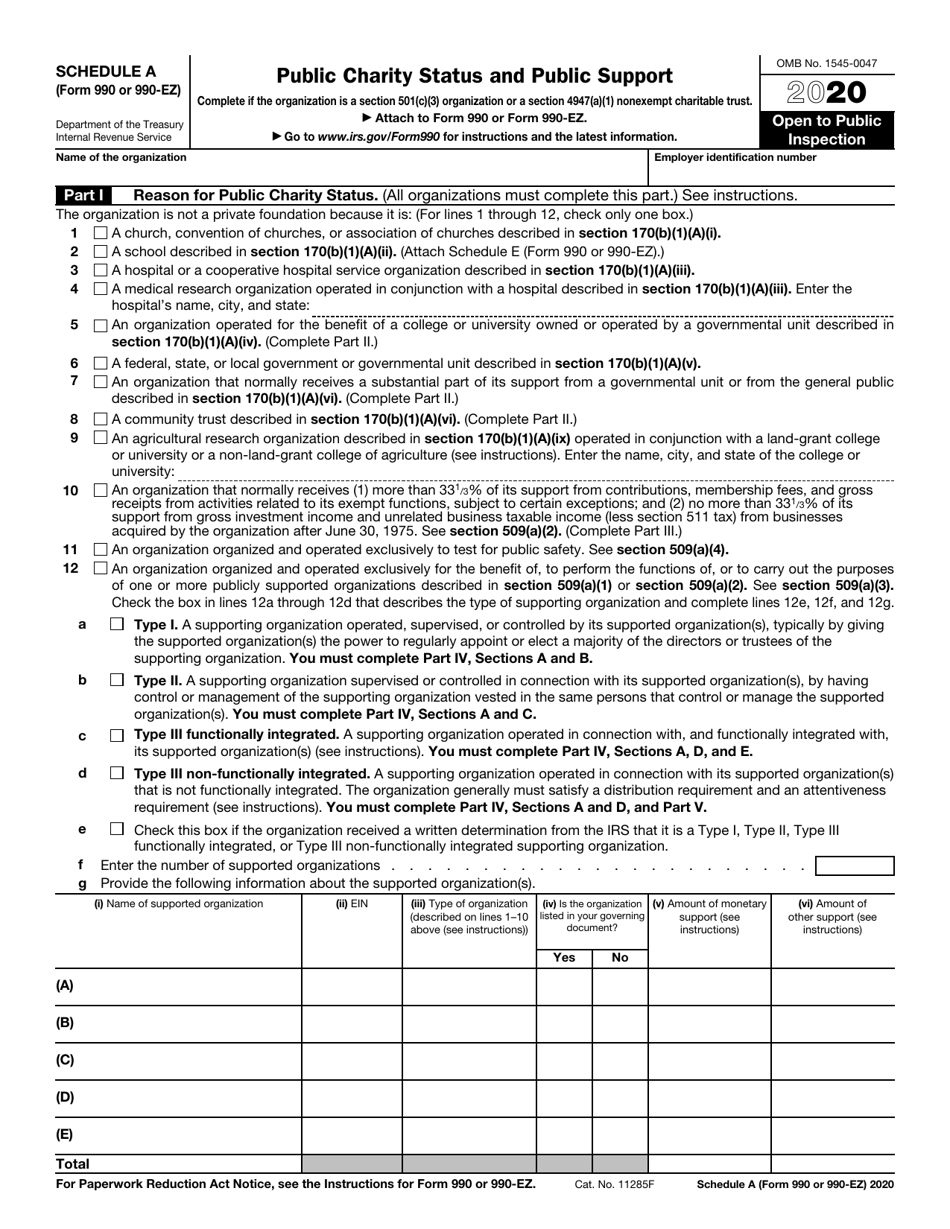

Get ready for tax season deadlines by completing any required tax forms today. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Complete, edit or print tax forms instantly. On this page you may download.

Form 990 (Schedule I) Grants and Other Assistance to Organizations

Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church. If the organization fails to qualify under the tests listed below, please complete part iii.) 13 first five years. Get ready for tax season deadlines by completing any required tax forms today. Web schedule o (form 990) 2022 omb no. Attach.

Instructions For Schedule A (Form 990 Or 990Ez) 2001 printable pdf

Get ready for tax season deadlines by completing any required tax forms today. This form is used for tax filing purposes, and it will be sent to the united states internal revenue service. You must use the appropriate schedule a for. Schedule a (public support and. If the organization fails to qualify under the tests listed below, please complete part.

Top 18 Form 990 Ez Templates free to download in PDF format

Web short form return of organization exempt from income tax. Complete, edit or print tax forms instantly. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Instructions for these schedules are combined with the schedules. Web schedule o (form 990) 2022 omb no.

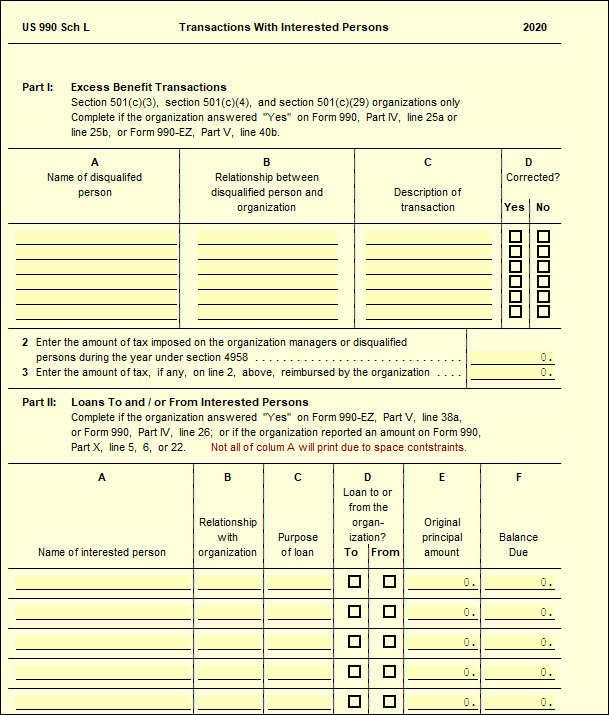

Schedule L (990/990EZ) Transactions with Interested Persons

Web short form return of organization exempt from income tax. If the organization fails to qualify under the tests listed below, please complete part iii.) 13 first five years. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Attach to form 990 or. Optional for others.) balance sheets(see the instructions.

Printable Form 990ez 2019 Printable Word Searches

Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church. You must use the appropriate schedule a for. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web short form return of organization exempt from income tax.

IRS Form 990 (990EZ) Schedule A Download Fillable PDF or Fill Online

On this page you may download the 990 series filings on record for 2021. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Schedule a (public support and. Complete, edit or print tax forms instantly. Web the irs has received a number of questions about how to report public support.

2009 form 990ez

Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Optional for others.) balance sheets(see the instructions for part ii) check if the organization used schedule o to respond to any question in this part ii.

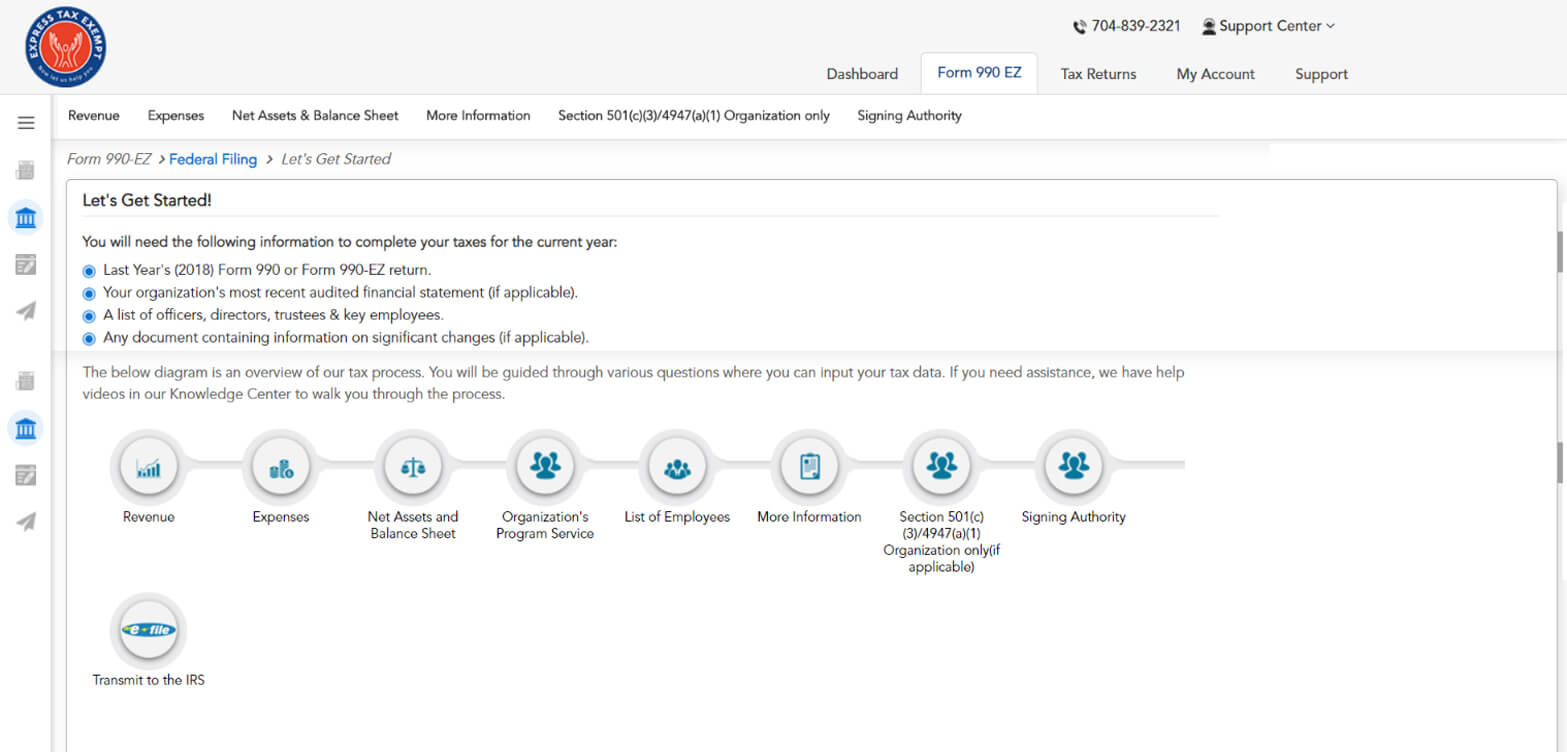

File 990EZ Online Efile 990 Short Form 990EZ Filing Deadline

If the organization fails to qualify under the tests listed below, please complete part iii.) 13 first five years. This form is used for tax filing purposes, and it will be sent to the united states internal revenue service. Attach to form 990 or. On this page you may download the 990 series filings on record for 2021. Under section.

If The Organization Fails To Qualify Under The Tests Listed Below, Please Complete Part Iii.) 13 First Five Years.

Schedule a (public support and. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

Web Short Form Return Of Organization Exempt From Income Tax.

This form is used for tax filing purposes, and it will be sent to the united states internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church. Web schedule o (form 990) 2022 omb no.

Web The Irs Has Received A Number Of Questions About How To Report Public Support And Public Charity Classification On Schedule A, Form 990, Return Of Organization Exempt From Income Taxpdf.

Attach to form 990 or. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Optional for others.) balance sheets(see the instructions for part ii) check if the organization used schedule o to respond to any question in this part ii You must use the appropriate schedule a for.

On This Page You May Download The 990 Series Filings On Record For 2021.

Attach to form 990 or. Complete, edit or print tax forms instantly. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Ad access irs tax forms.