Form F 1120

Form F 1120 - Web facts and filing tips for small businesses. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Easily fill out pdf blank, edit, and sign them. Web for a foreign corporation with an office or place of business in the u.s., the filing deadline is by the 15th day of the 4th month after the end of its tax year. 01/22 page 4 of 6 schedule iii — apportionment of adjusted federal income within florida total everywhere a. Web form 1120 department of the treasury internal revenue service u.s. Complete, edit or print tax forms instantly. Florida corporate income/franchise tax return for 2022 tax year. Income tax liability of a foreign corporation. Income tax return of a foreign corporation department of the treasury internal revenue service section references are to the.

If form 2220 is completed, enter. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending , 20 go to www.irs.gov/form1120f for instructions and the. Web information about form 1120, u.s. Federal taxable income state income taxes deducted in computing federal. Web form 1120 department of the treasury internal revenue service u.s. 01/22 page 4 of 6 schedule iii — apportionment of adjusted federal income within florida total everywhere a. Income tax return of a foreign corporation department of the treasury internal revenue service section references are to the. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the.

Use this form to report the. It is an internal revenue service (irs) document that. Save or instantly send your ready documents. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending , 20 go to www.irs.gov/form1120f for instructions and the. Form 1120 is the u.s. Web for a foreign corporation with an office or place of business in the u.s., the filing deadline is by the 15th day of the 4th month after the end of its tax year. Web information about form 1120, u.s. 01/22 page 4 of 6 schedule iii — apportionment of adjusted federal income within florida total everywhere a. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to.

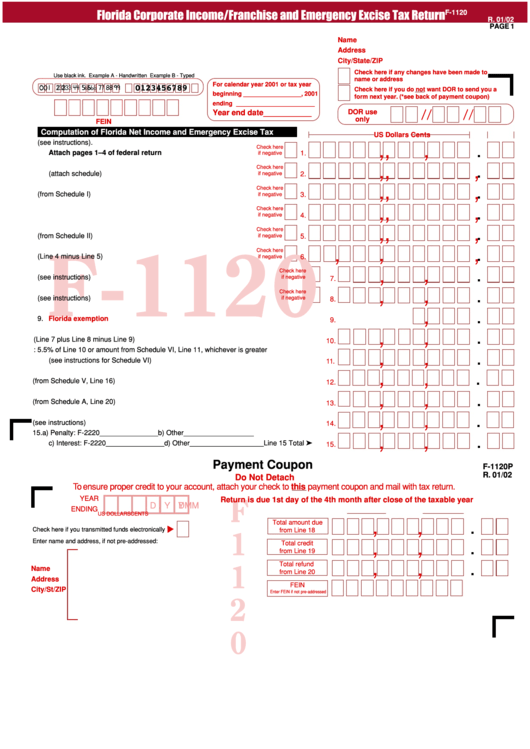

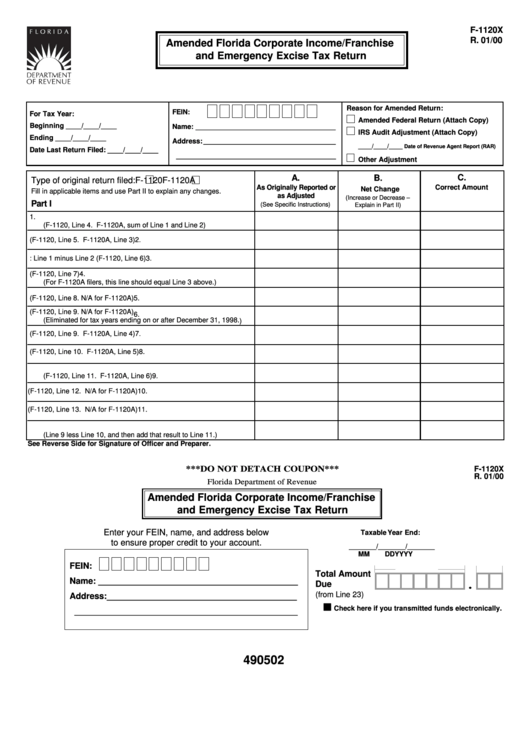

Form F1120 Florida Corporate And Emergency Excise

Federal taxable income state income taxes deducted in computing federal. It is an internal revenue service (irs) document that. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Save or instantly send your ready documents. Web form 1120 department of the treasury internal revenue service u.s.

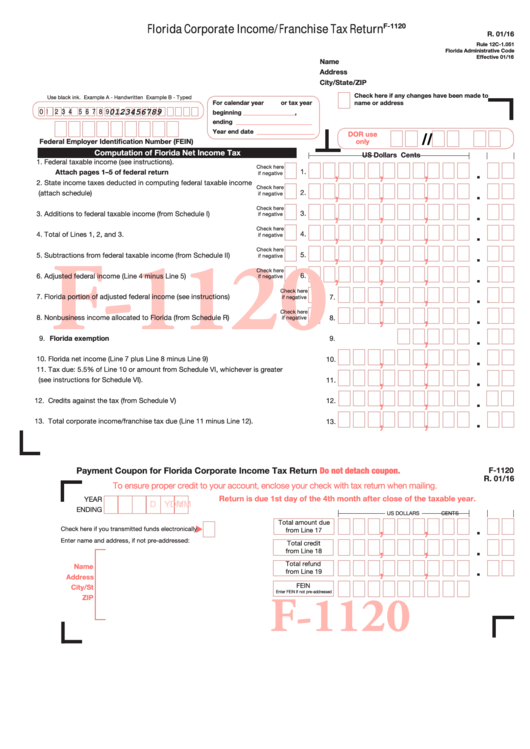

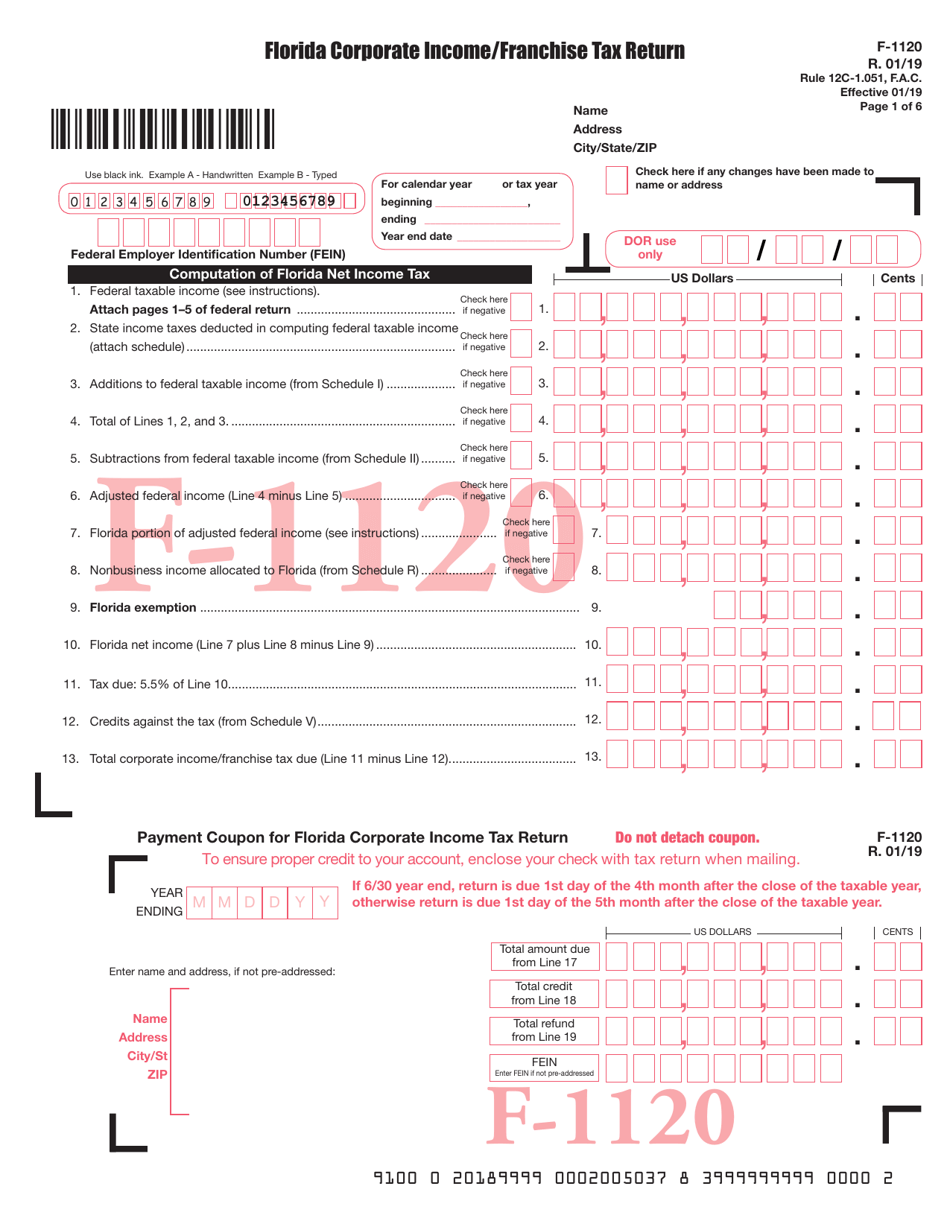

Fillable Form F1120 Florida Corporate Tax Return

Income tax return of a foreign corporation department of the treasury internal revenue service section references are to the. Complete, edit or print tax forms instantly. Save or instantly send your ready documents. Corporation income tax return, including recent updates, related forms and instructions on how to file. Form 1120 is the u.s.

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Florida corporate income/franchise tax return for 2022 tax year. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Income tax return of a foreign corporation department of the treasury internal revenue service section references are to the. Easily fill out pdf.

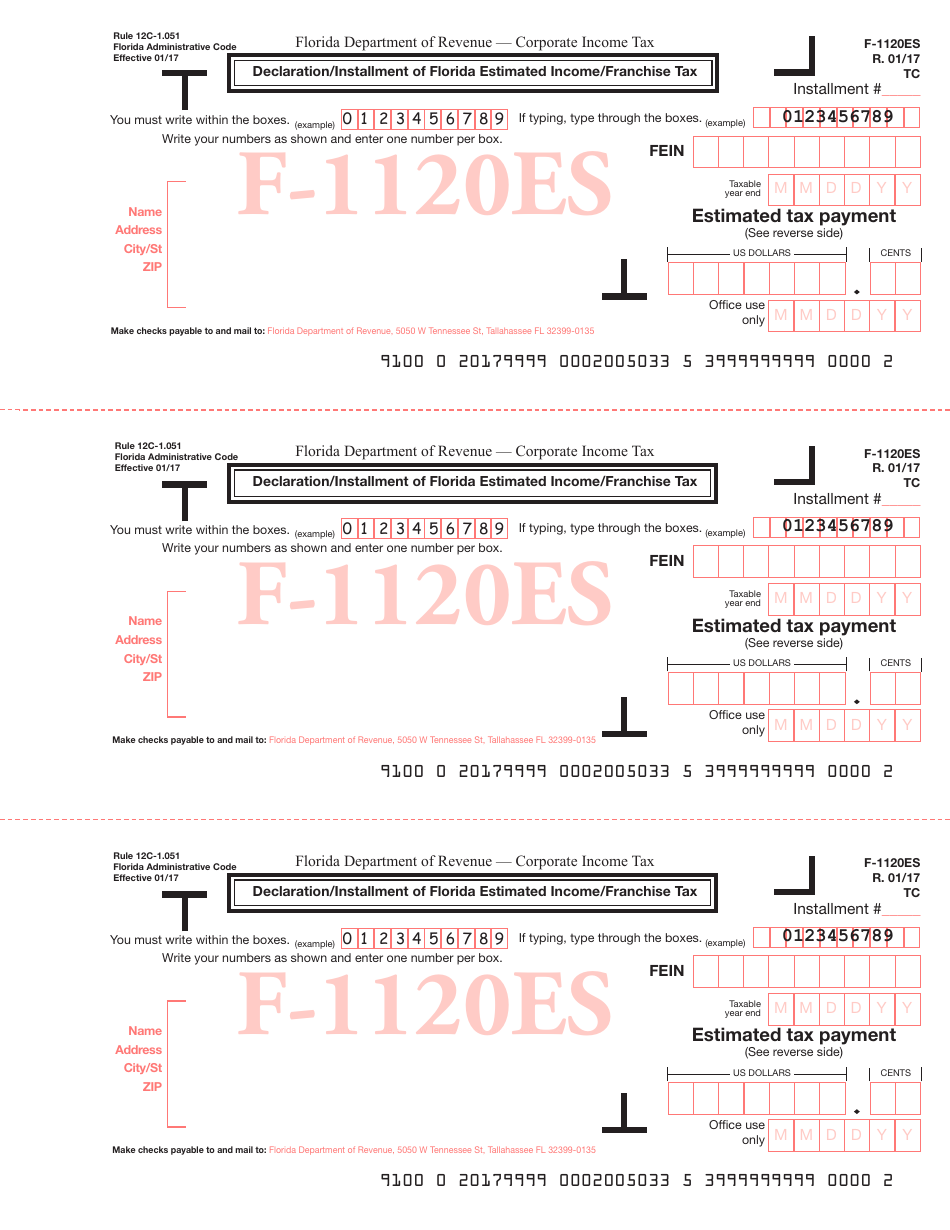

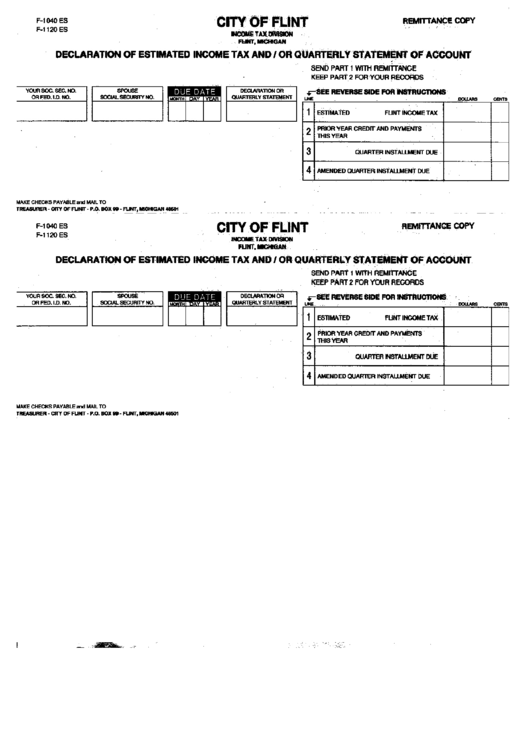

Form F1120ES Download Printable PDF or Fill Online Declaration

Florida corporate income/franchise tax return for 2022 tax year. Federal taxable income state income taxes deducted in computing federal. Web for a foreign corporation with an office or place of business in the u.s., the filing deadline is by the 15th day of the 4th month after the end of its tax year. Income tax return of a foreign corporation.

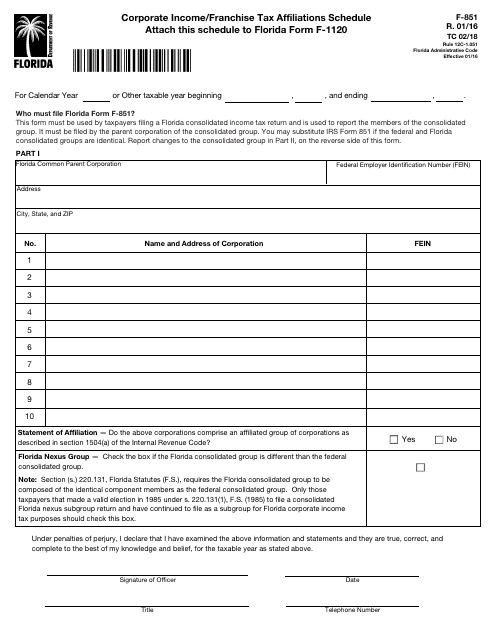

Form F1120 Schedule F851 Download Fillable PDF or Fill Online

Web information about form 1120, u.s. Corporation income tax return, including recent updates, related forms and instructions on how to file. Form 1120 is the u.s. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending , 20 go to www.irs.gov/form1120f for instructions and the. If form 2220 is completed, enter.

Form F1040es / F1120 Es Declaration Of Estimated Tax And

Save or instantly send your ready documents. Form 1120 is the u.s. Web facts and filing tips for small businesses. Federal taxable income state income taxes deducted in computing federal. Income tax liability of a foreign corporation.

Form F1120 Download Printable PDF or Fill Online Florida Corporate

Save or instantly send your ready documents. Use this form to report the. Web part i fill in applicable items and use part ii to explain as originally reported or as adjusted any changes. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web form 1120 department of the treasury internal revenue service u.s.

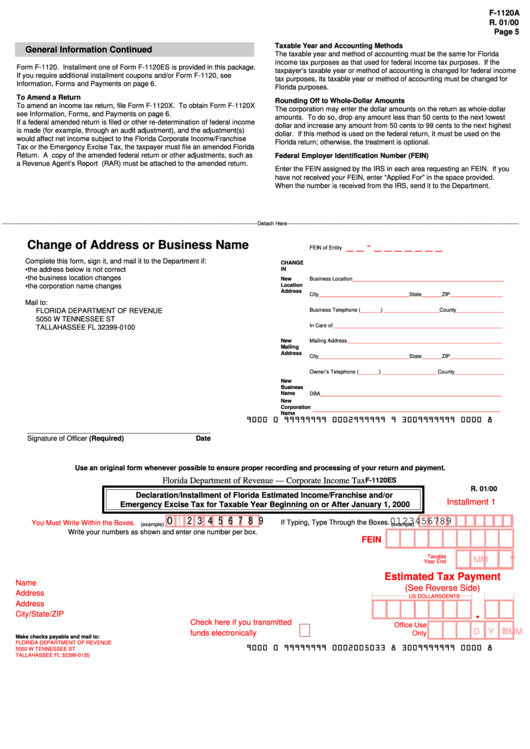

Form F1120es Change Of Address Or Business Name printable pdf download

If form 2220 is completed, enter. Web for a foreign corporation with an office or place of business in the u.s., the filing deadline is by the 15th day of the 4th month after the end of its tax year. 01/22 page 4 of 6 schedule iii — apportionment of adjusted federal income within florida total everywhere a. Web facts.

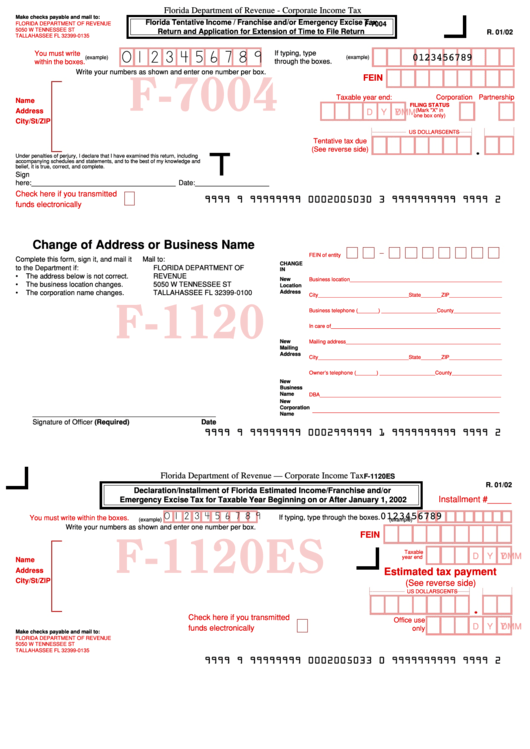

Form F7004 Corporate Tax, Form F1120 Change Of Address Or

Save or instantly send your ready documents. It is an internal revenue service (irs) document that. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Web part i fill in applicable items and use part ii to explain as originally reported or as adjusted any changes. Income tax return of a.

Form F1120x Amended Florida Corporate And Emergency

It is an internal revenue service (irs) document that. Income tax liability of a foreign corporation. Save or instantly send your ready documents. Web use form 2220, underpayment of estimated tax by corporations, to see if the corporation owes a penalty and to figure the amount of the penalty. Web facts and filing tips for small businesses.

Web Enter On Form 1120 The Totals For Each Item Of Income, Gain, Loss, Expense, Or Deduction, Net Of Eliminating Entries For Intercompany Transactions Between Corporations Within The.

Web information about form 1120, u.s. Federal taxable income state income taxes deducted in computing federal. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Florida corporate income/franchise tax return for 2022 tax year.

Complete, Edit Or Print Tax Forms Instantly.

Web use form 2220, underpayment of estimated tax by corporations, to see if the corporation owes a penalty and to figure the amount of the penalty. Web form 1120 department of the treasury internal revenue service u.s. 01/22 page 4 of 6 schedule iii — apportionment of adjusted federal income within florida total everywhere a. Income tax liability of a foreign corporation.

Income Tax Return Of A Foreign Corporation, Including Recent Updates, Related Forms And Instructions On How To File.

Form 1120 is the u.s. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and ending , 20 go to www.irs.gov/form1120f for instructions and the. Income tax return of a foreign corporation department of the treasury internal revenue service section references are to the. If form 2220 is completed, enter.

Web Part I Fill In Applicable Items And Use Part Ii To Explain As Originally Reported Or As Adjusted Any Changes.

Web for a foreign corporation with an office or place of business in the u.s., the filing deadline is by the 15th day of the 4th month after the end of its tax year. Save or instantly send your ready documents. Corporation income tax return, including recent updates, related forms and instructions on how to file. Use this form to report the.