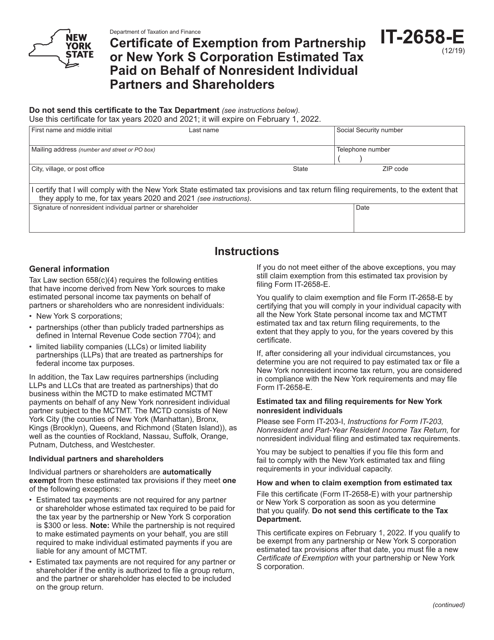

Form It-2658-E

Form It-2658-E - While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Or • the corporation will comply in its corporate capacity with all This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the new york government. The corporation may be subject to penalties if it files this form and fails to comply with the new york state estimated tax and Estimated tax and corporation tax filing requirements please see the appropriate new york state corporation tax form instructions for filing and estimated tax requirements.

Estimated tax and corporation tax filing requirements please see the appropriate new york state corporation tax form instructions for filing and estimated tax requirements. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the new york government. The corporation may be subject to penalties if it files this form and fails to comply with the new york state estimated tax and Or • the corporation will comply in its corporate capacity with all

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. This form is for income earned in tax year 2022, with tax returns due in april 2023. Estimated tax and corporation tax filing requirements please see the appropriate new york state corporation tax form instructions for filing and estimated tax requirements. Or • the corporation will comply in its corporate capacity with all The corporation may be subject to penalties if it files this form and fails to comply with the new york state estimated tax and We will update this page with a new version of the form for 2024 as soon as it is made available by the new york government.

Left Ventricular Diastolic Dysfunction in Ischemic Stroke Functional

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. The corporation may be subject to penalties if it files this form and fails to comply.

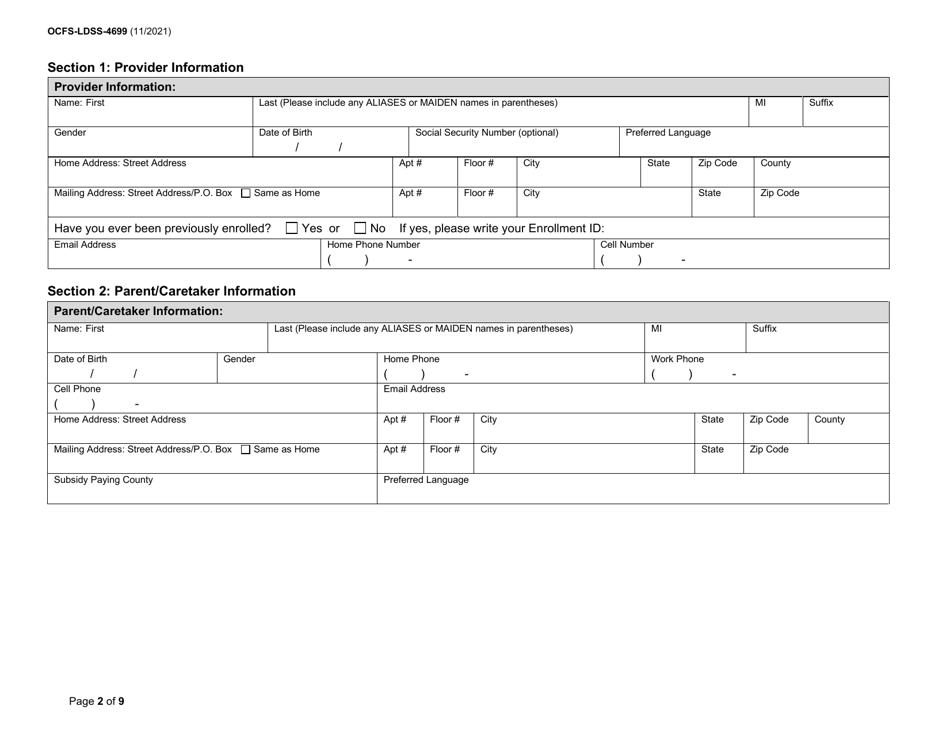

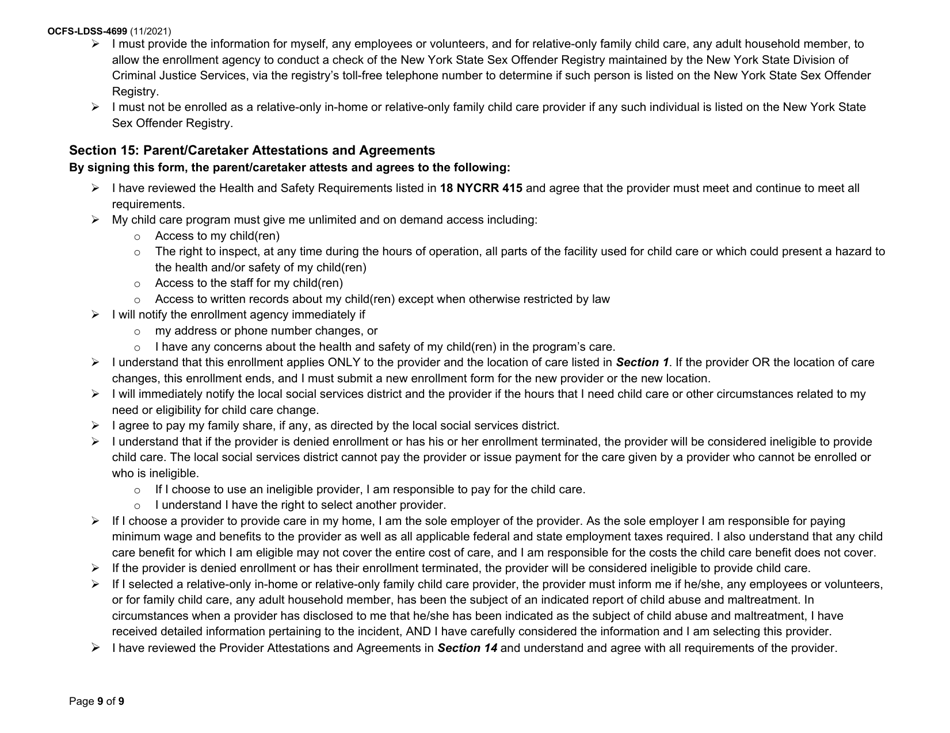

Form OCFSLDSS4699 Download Printable PDF or Fill Online Enrollment

This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the new york government. Or • the corporation will comply in its corporate capacity with all While most taxpayers have income.

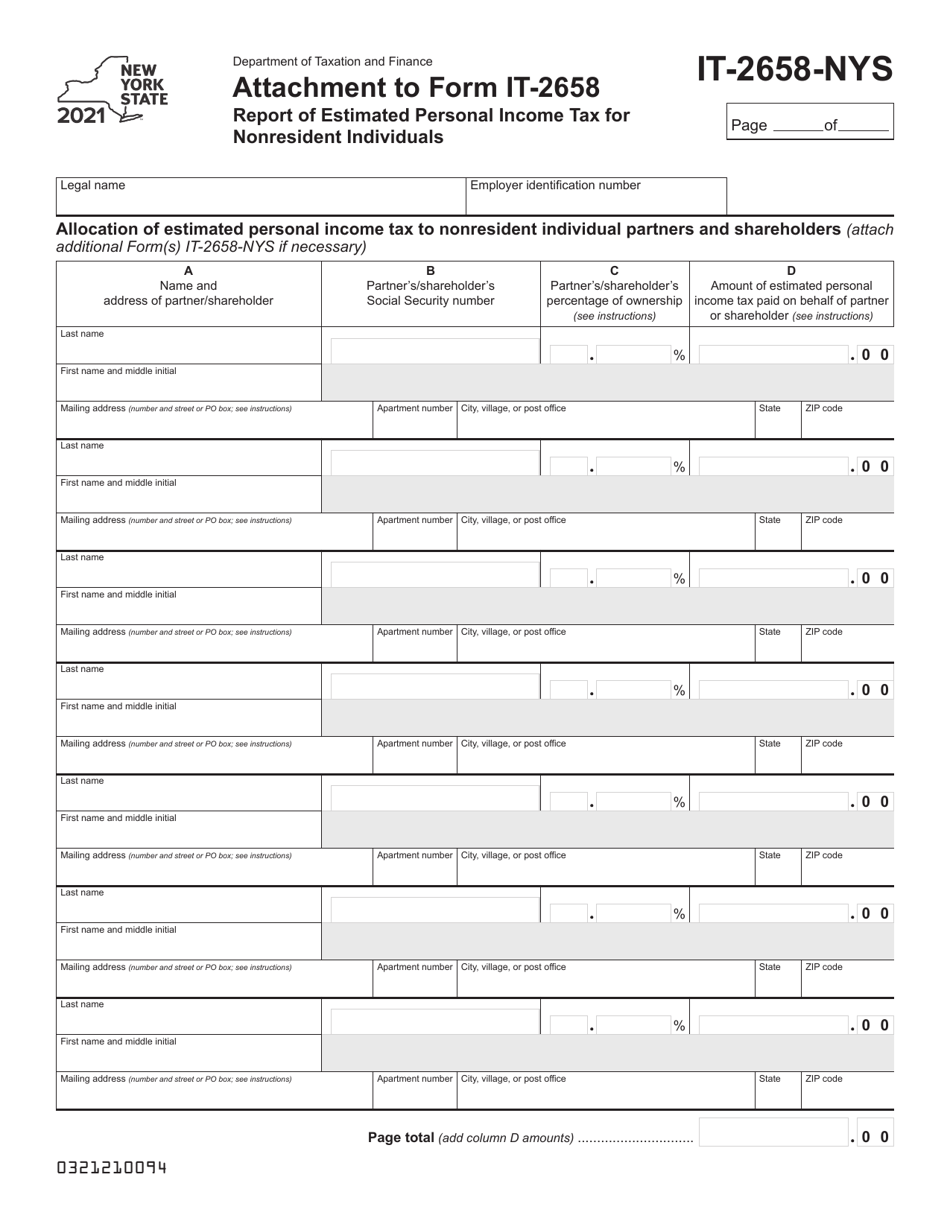

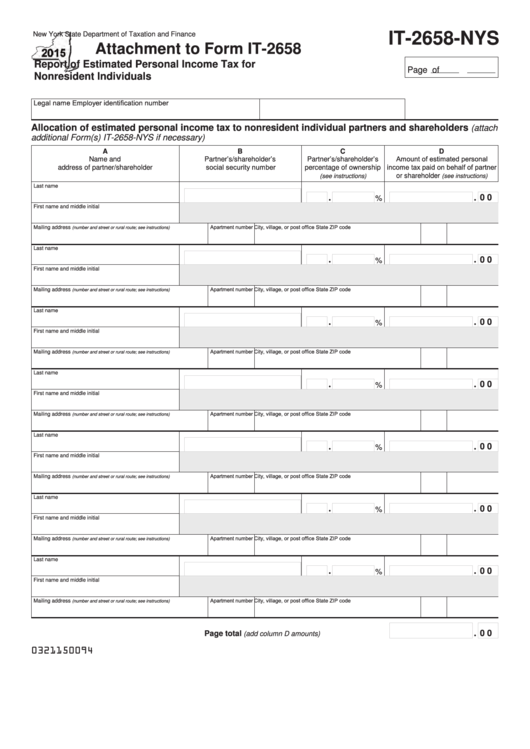

Form IT2658NYS Download Fillable PDF or Fill Online Report of

The corporation may be subject to penalties if it files this form and fails to comply with the new york state estimated tax and We will update this page with a new version of the form for 2024 as soon as it is made available by the new york government. This form is for income earned in tax year 2022,.

Form IT2658E Download Fillable PDF or Fill Online Certificate of

This form is for income earned in tax year 2022, with tax returns due in april 2023. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly.

Form It 2658 E ≡ Fill Out Printable PDF Forms Online

This form is for income earned in tax year 2022, with tax returns due in april 2023. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly.

Fillable Form It2658Nys Report Of Estimated Personal Tax For

We will update this page with a new version of the form for 2024 as soon as it is made available by the new york government. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often.

Form It 204 Ip ≡ Fill Out Printable PDF Forms Online

Estimated tax and corporation tax filing requirements please see the appropriate new york state corporation tax form instructions for filing and estimated tax requirements. The corporation may be subject to penalties if it files this form and fails to comply with the new york state estimated tax and Or • the corporation will comply in its corporate capacity with all.

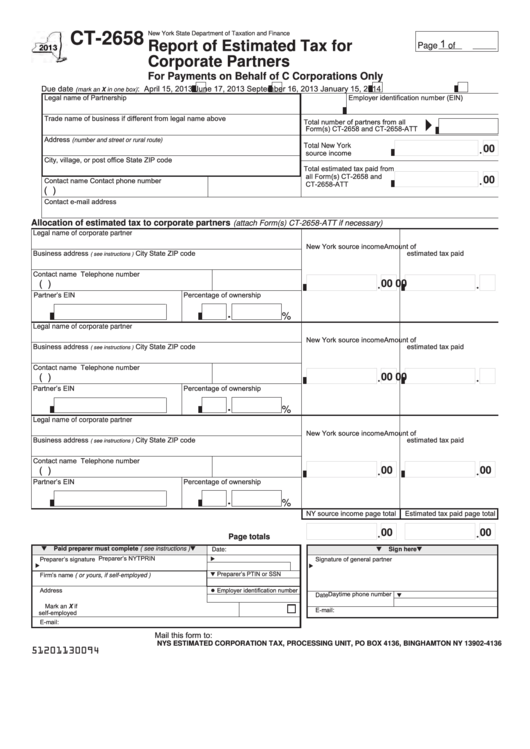

Fillable Form Ct2658 Report Of Estimated Tax For Corporate Partners

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Or • the corporation will comply in its corporate capacity with all We will update this.

Form OCFSLDSS4699 Download Printable PDF or Fill Online Enrollment

The corporation may be subject to penalties if it files this form and fails to comply with the new york state estimated tax and This form is for income earned in tax year 2022, with tax returns due in april 2023. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that.

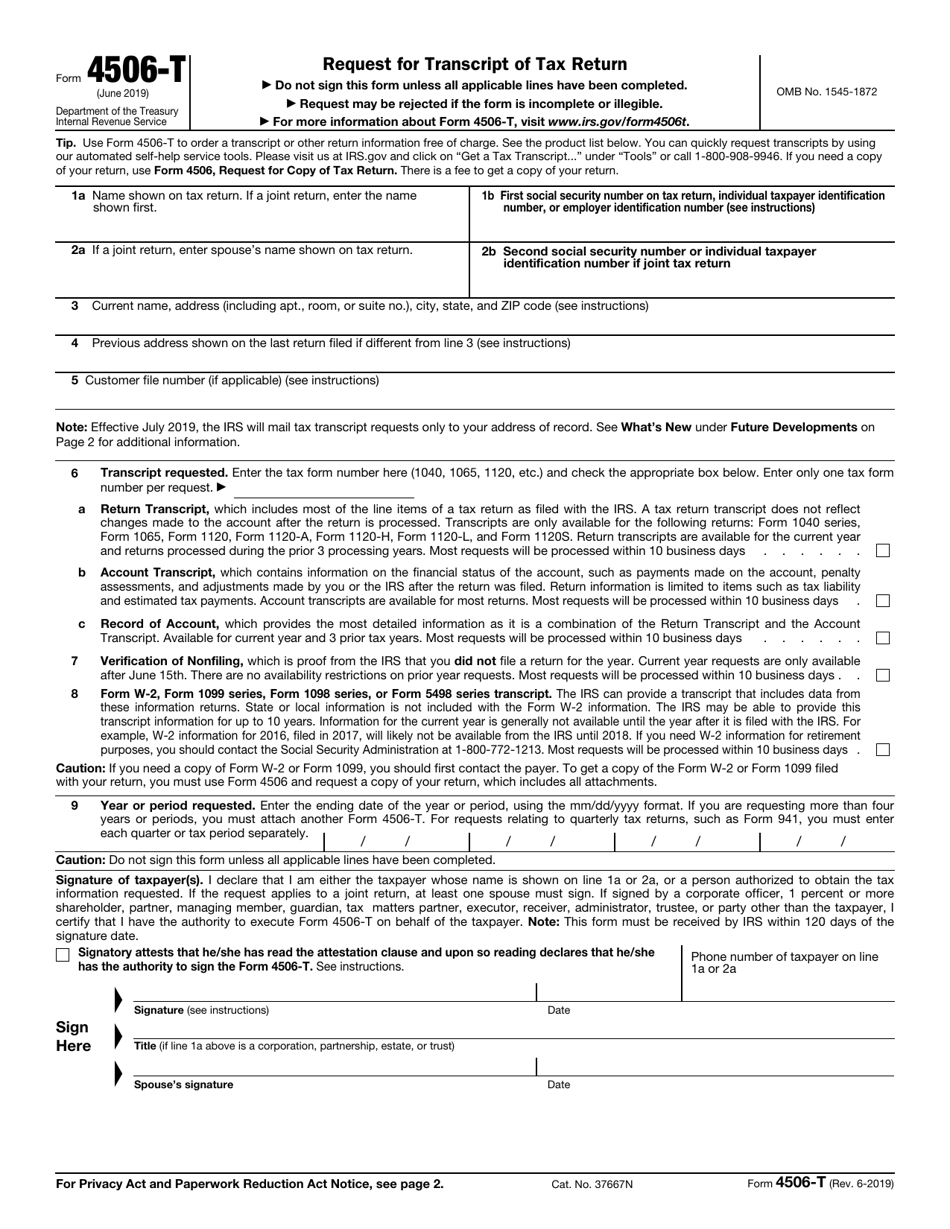

Irs Form W4s Download Fillable Pdf Or Fill Online Request For Federal A18

This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the new york government. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Estimated tax and corporation tax filing requirements please see the appropriate new york state corporation tax form instructions for filing and estimated tax requirements. Or • the corporation will comply in its corporate capacity with all We will update this page with a new version of the form for 2024 as soon as it is made available by the new york government. The corporation may be subject to penalties if it files this form and fails to comply with the new york state estimated tax and