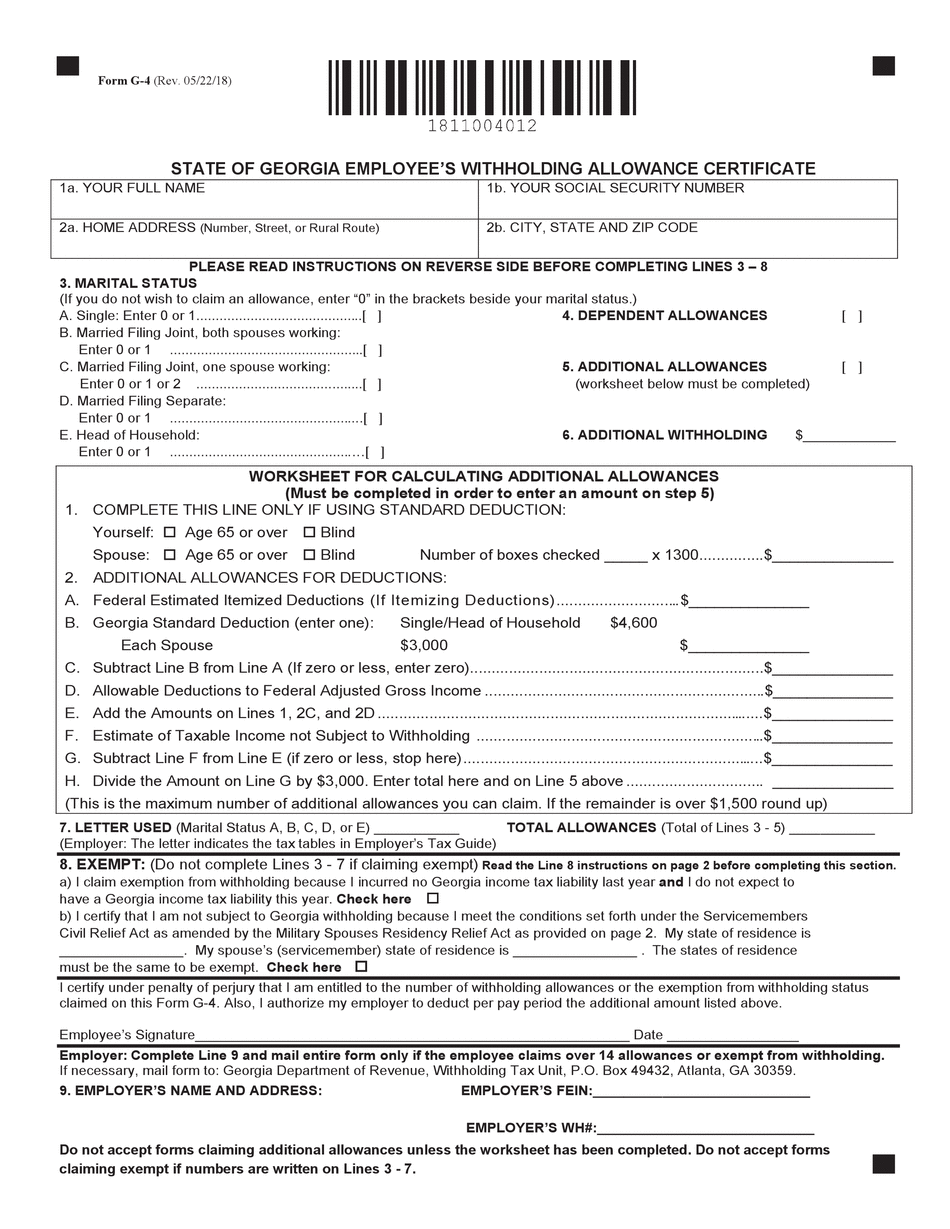

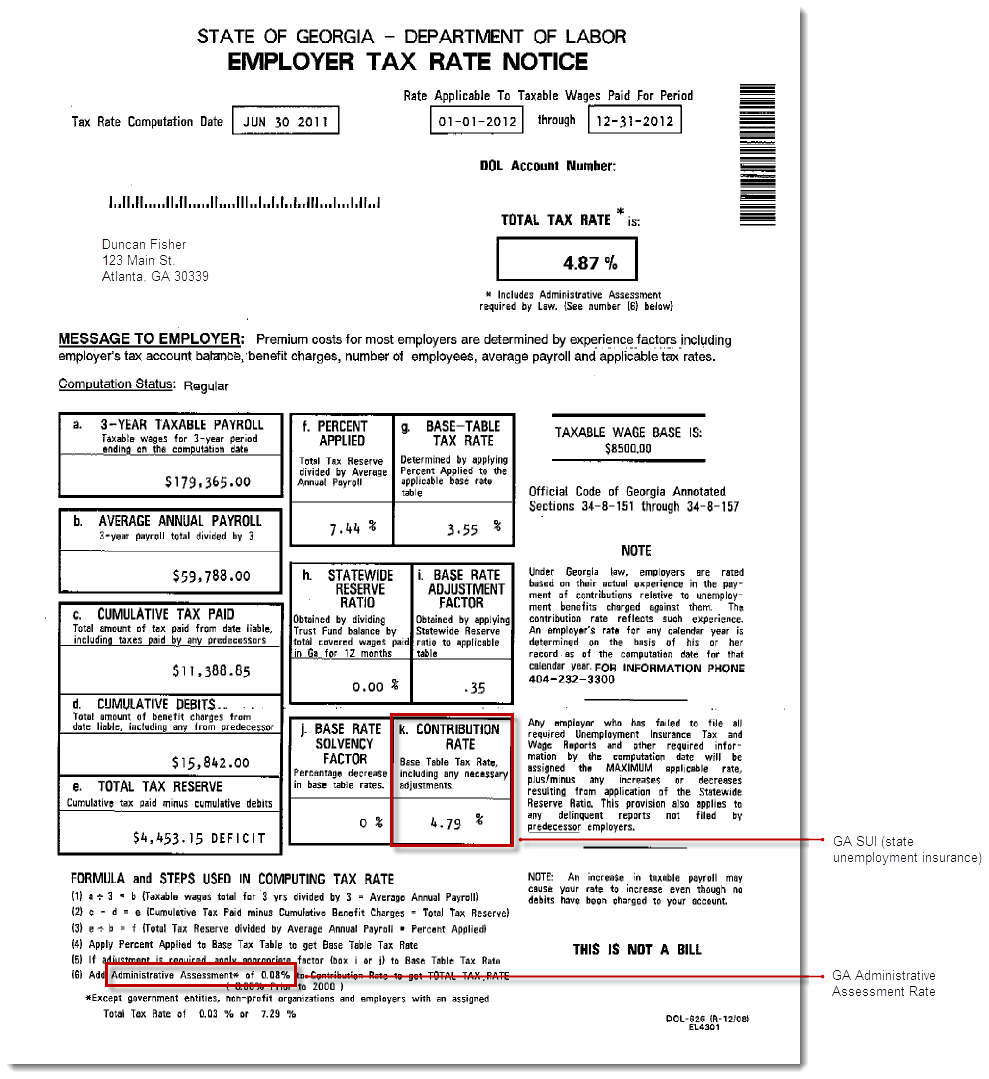

Ga Witholding Form

Ga Witholding Form - Name (corporate title) please give former name if applicable. Web effective may 31, 2012, sections 466(a)(1), (a)(8) and 466(b)(6) of the social security act (the act) require the use of the income withholding for support (iwo) form in all cases. Web up to 25% cash back have new employees complete withholding tax forms. $7.50 plus 2.0% of excess over $750. 12/09) state of georgia employee's withholding allowance certificate 1a. Web the amount of georgia tax withholding should be: Web georgia form 600 (rev. This includes tax withheld from: How third party/ bulk filers add. Over $750 but not over $2,250.

The pdf form must be printed, and then can be completed. 05/22/18 state of georgia employee s withholding allowance. Log into gtc, click on the withholding payroll number, select the return period. 12/09) state of georgia employee's withholding allowance certificate 1a. Any business that has employees as defined in o.c.g.a. Web withholding tax is the amount held from an employee’s wages and paid directly to the state by the employer. Web up to 25% cash back have new employees complete withholding tax forms. Ga withholding tax account number b. Over $0 but not over $750. Web register account and submit csv withholding return.

Name (corporate title) please give former name if applicable. Over $750 but not over $2,250. Web up to 25% cash back have new employees complete withholding tax forms. Web georgia form 600 (rev. Ga withholding tax account number b. This includes tax withheld from: Any business that has employees as defined in o.c.g.a. 12/09) state of georgia employee's withholding allowance certificate 1a. Web 7 hours agothe trial america needs. How third party/ bulk filers add.

Form G4 Printable Employee's Withholding Allowance Certificate

12/09) state of georgia employee's withholding allowance certificate 1a. The pdf form must be printed, and then can be completed. Web georgia form 600 (rev. Sections 466 (a) (1), (a) (8) and 466 (b) (6) of the social security act (the act) require the use of the income withholding for support (iwo) form. Any business that has employees as defined.

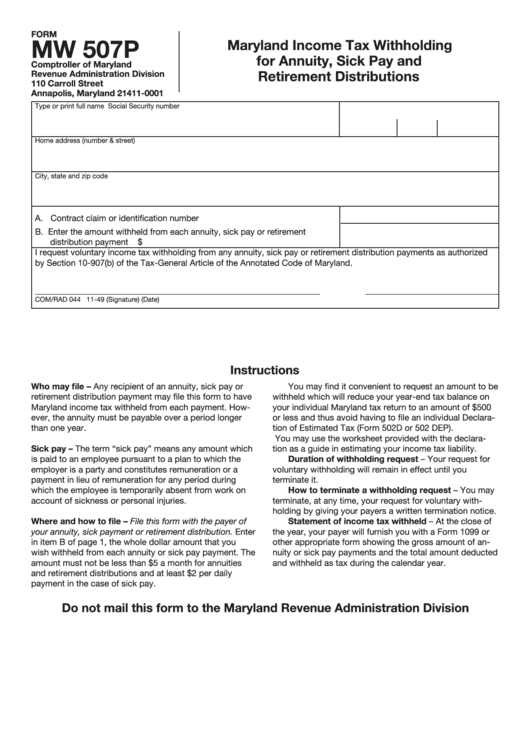

Fillable Form Mw 507p Maryland Tax Withholding For Annuity

Over $750 but not over $2,250. Web 7 hours agothe trial america needs. Ga withholding tax account number b. Web income withholding for support. $7.50 plus 2.0% of excess over $750.

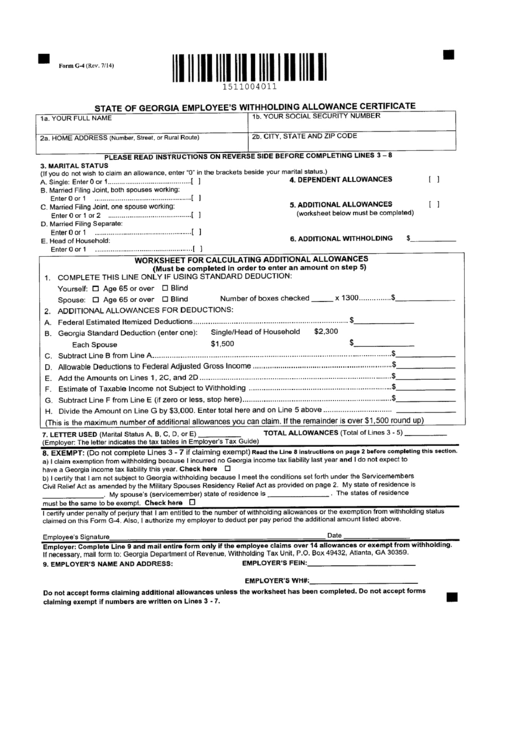

Form G4 State Of Employee'S Withholding Allowance

12/09) state of georgia employee's withholding allowance certificate 1a. Web income withholding for support. Web effective may 31, 2012, sections 466(a)(1), (a)(8) and 466(b)(6) of the social security act (the act) require the use of the income withholding for support (iwo) form in all cases. The federal criminal justice system is. Over $750 but not over $2,250.

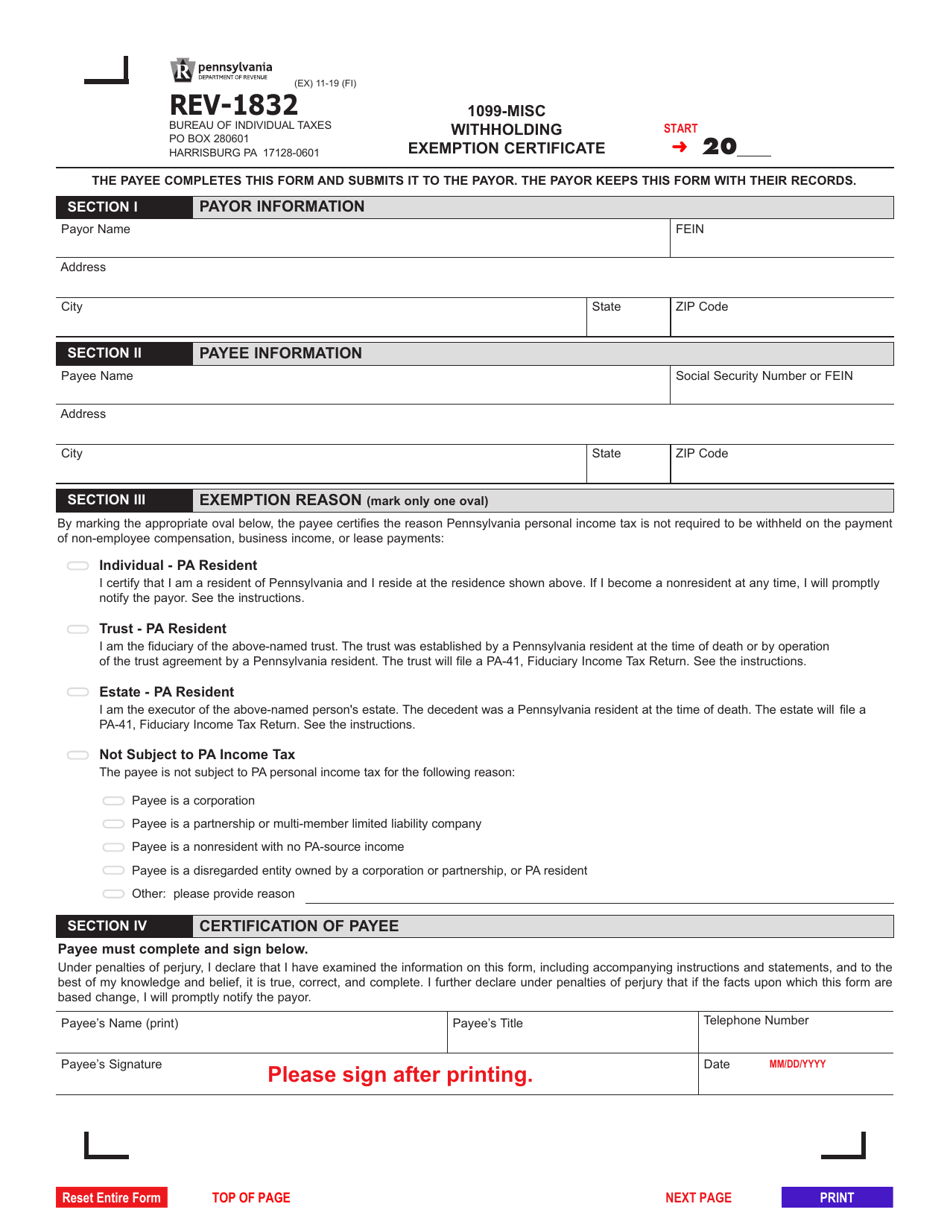

Form REV1832 Download Fillable PDF or Fill Online 1099misc

How third party/ bulk filers add. Over $0 but not over $750. Web income withholding for support. Web effective may 31, 2012, sections 466(a)(1), (a)(8) and 466(b)(6) of the social security act (the act) require the use of the income withholding for support (iwo) form in all cases. Web georgia form 600 (rev.

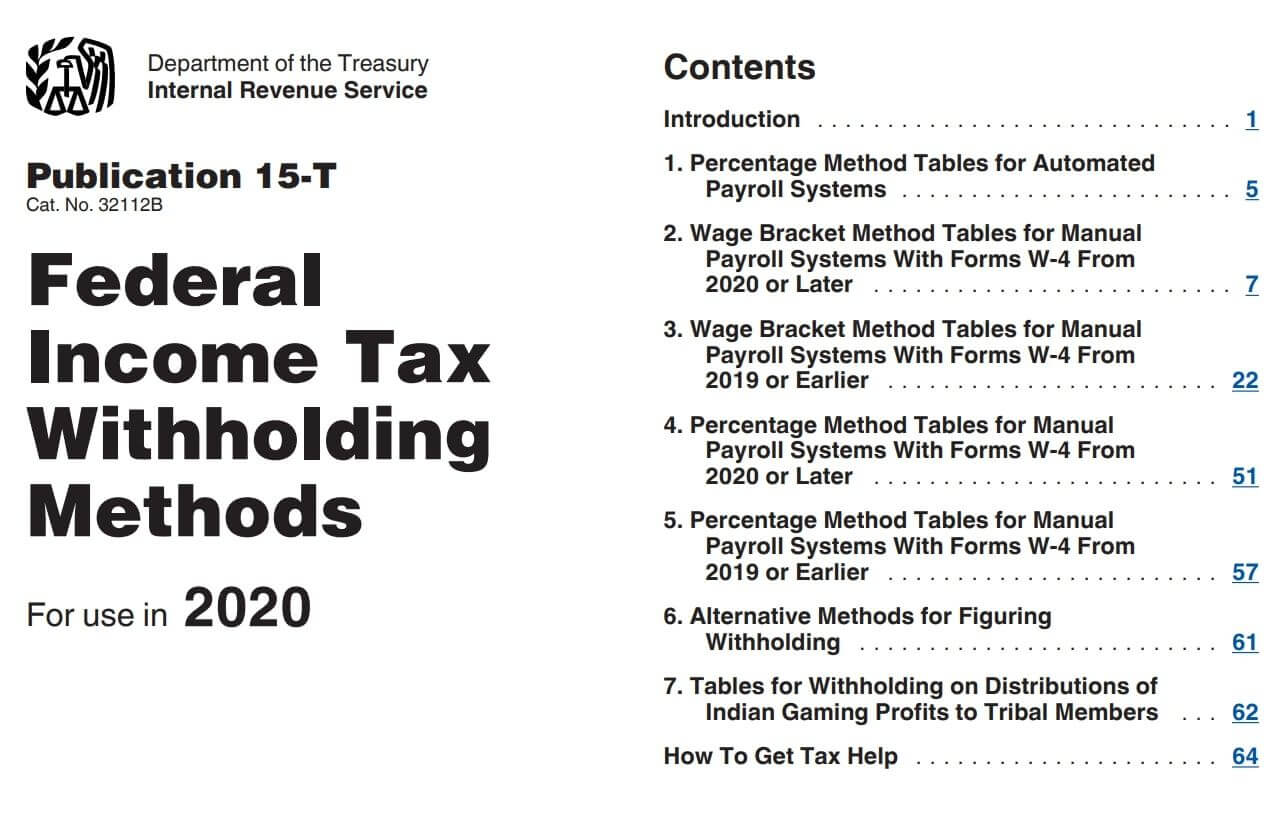

Payroll Federal Tax Withholding Chart 2023 IMAGESEE

Any business that has employees as defined in o.c.g.a. Sections 466 (a) (1), (a) (8) and 466 (b) (6) of the social security act (the act) require the use of the income withholding for support (iwo) form. $7.50 plus 2.0% of excess over $750. Over $0 but not over $750. This form may be only used by insurance companies licensed.

A New Form W4 for 2020 Alloy Silverstein

This includes tax withheld from: Over $0 but not over $750. $7.50 plus 2.0% of excess over $750. This registration does not require. Name (corporate title) please give former name if applicable.

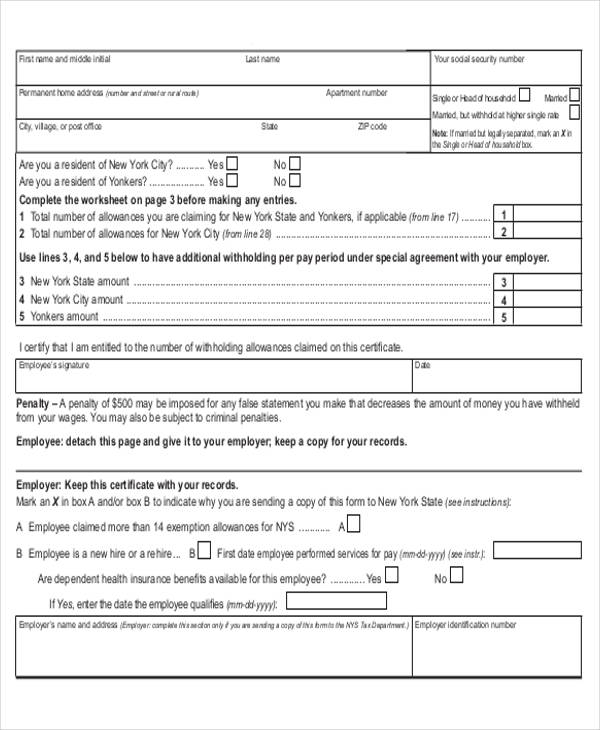

FREE 9+ Sample Employee Tax Forms in MS Word PDF

05/22/18 state of georgia employee s withholding allowance. How third party/ bulk filers add. Name (corporate title) please give former name if applicable. Web register account and submit csv withholding return. Web 7 hours agothe trial america needs.

2022 Ga Tax Withholding Form

Sections 466 (a) (1), (a) (8) and 466 (b) (6) of the social security act (the act) require the use of the income withholding for support (iwo) form. Web withholding tax is the amount held from an employee’s wages and paid directly to the state by the employer. This registration does not require. This includes tax withheld from: Home address.

2021 Form IRS W4(SP) Fill Online, Printable, Fillable, Blank pdfFiller

Name (corporate title) please give former name if applicable. Web income withholding for support. This form may be only used by insurance companies licensed to do business in georgia applying for replacement titles. Any business that has employees as defined in o.c.g.a. Over $750 but not over $2,250.

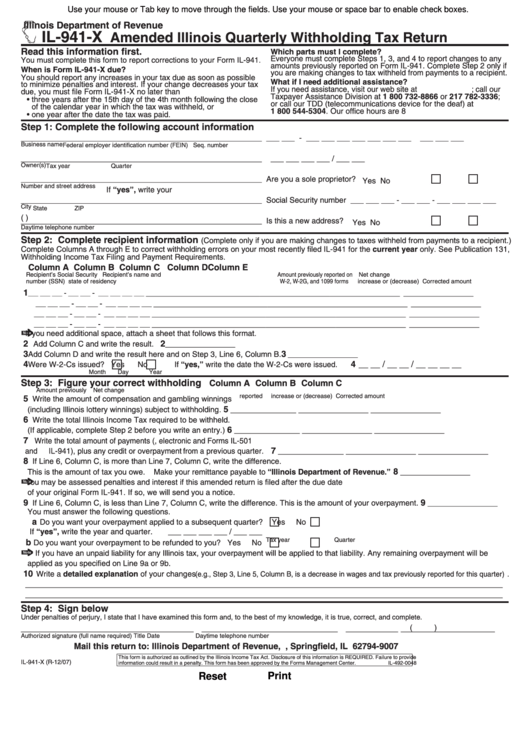

Fillable Form Il941X Amended Illinois Quarterly Withholding Tax

Web effective may 31, 2012, sections 466(a)(1), (a)(8) and 466(b)(6) of the social security act (the act) require the use of the income withholding for support (iwo) form in all cases. 05/22/18 state of georgia employee s withholding allowance. Web the amount of georgia tax withholding should be: Name (corporate title) please give former name if applicable. Ga withholding tax.

This Registration Does Not Require.

Sections 466 (a) (1), (a) (8) and 466 (b) (6) of the social security act (the act) require the use of the income withholding for support (iwo) form. How third party/ bulk filers add. Web effective may 31, 2012, sections 466(a)(1), (a)(8) and 466(b)(6) of the social security act (the act) require the use of the income withholding for support (iwo) form in all cases. Web the amount of georgia tax withholding should be:

Web 7 Hours Agothe Trial America Needs.

The federal criminal justice system is. Name (corporate title) please give former name if applicable. $7.50 plus 2.0% of excess over $750. Ga withholding tax account number b.

Over $0 But Not Over $750.

Web georgia form 600 (rev. Any business that has employees as defined in o.c.g.a. Web withholding tax is the amount held from an employee’s wages and paid directly to the state by the employer. Web up to 25% cash back have new employees complete withholding tax forms.

Over $750 But Not Over $2,250.

The pdf form must be printed, and then can be completed. Log into gtc, click on the withholding payroll number, select the return period. This form may be only used by insurance companies licensed to do business in georgia applying for replacement titles. Home address (number, street, or rural route) 1b.