Hawaii State Tax Extension Form

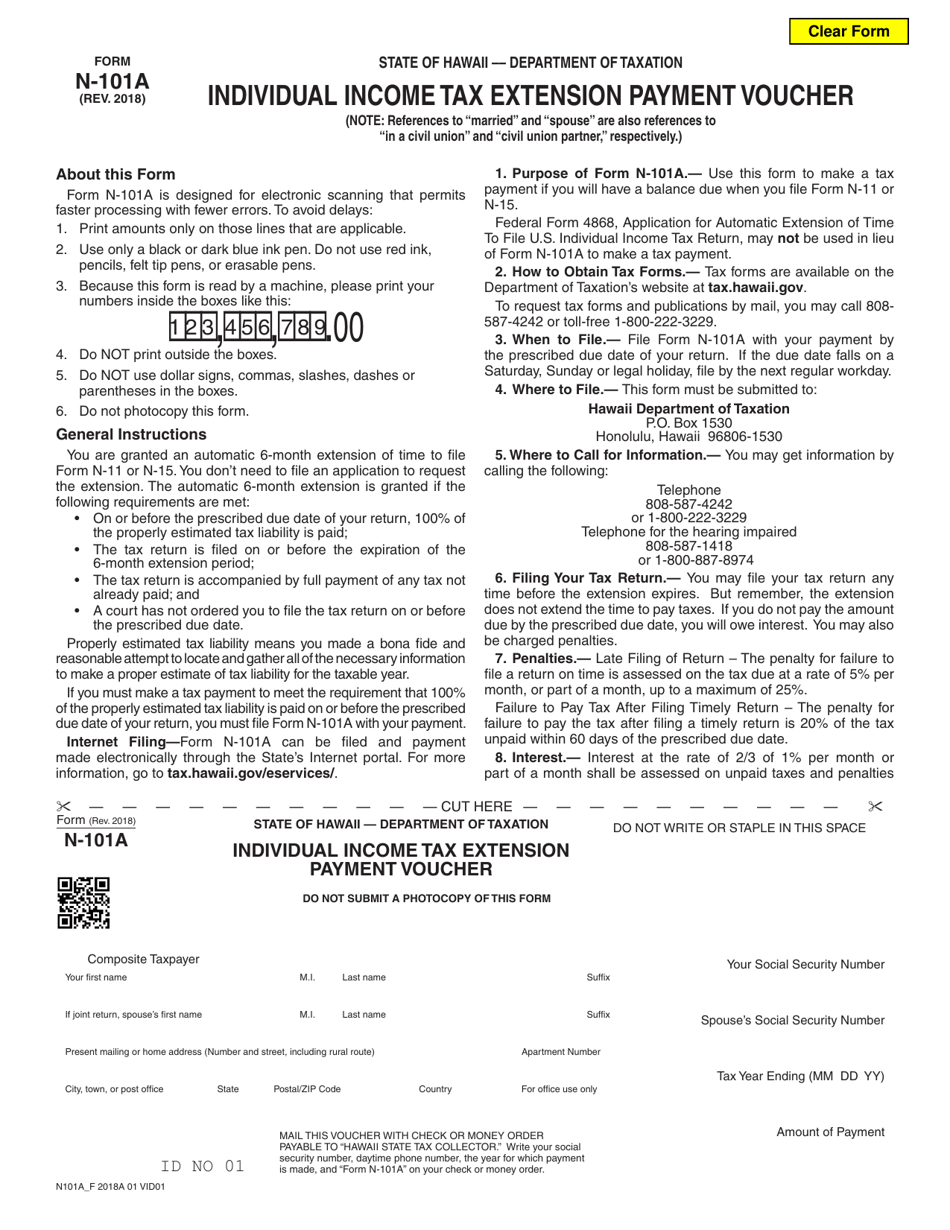

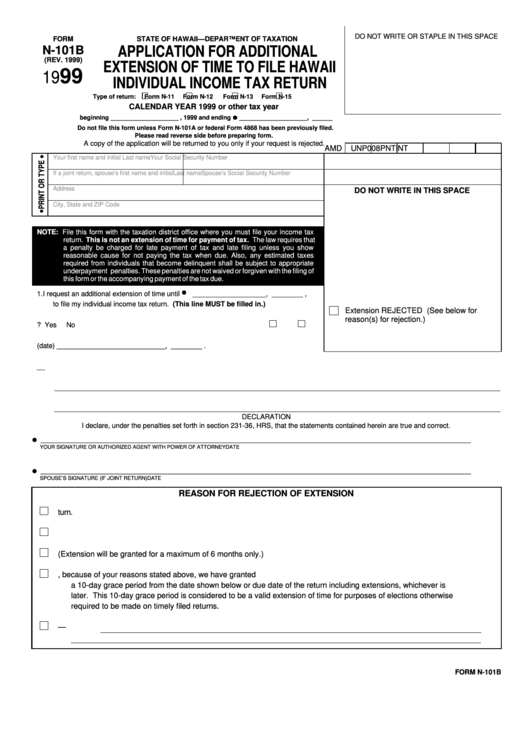

Hawaii State Tax Extension Form - Web does hawaii accept the federal form 4868, application for automatic extension of time to file u.s. Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year. How to pay the state tax due? Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for calendar year filers). To ensure your privacy, a “clear form” button. Web your state extension form is free. File this form to request an extension even if you are not making a payment. For information and guidance in. Web file your personal tax extension now! 2019) do not write in this space state of hawaii — department of taxation application for automatic extension of.

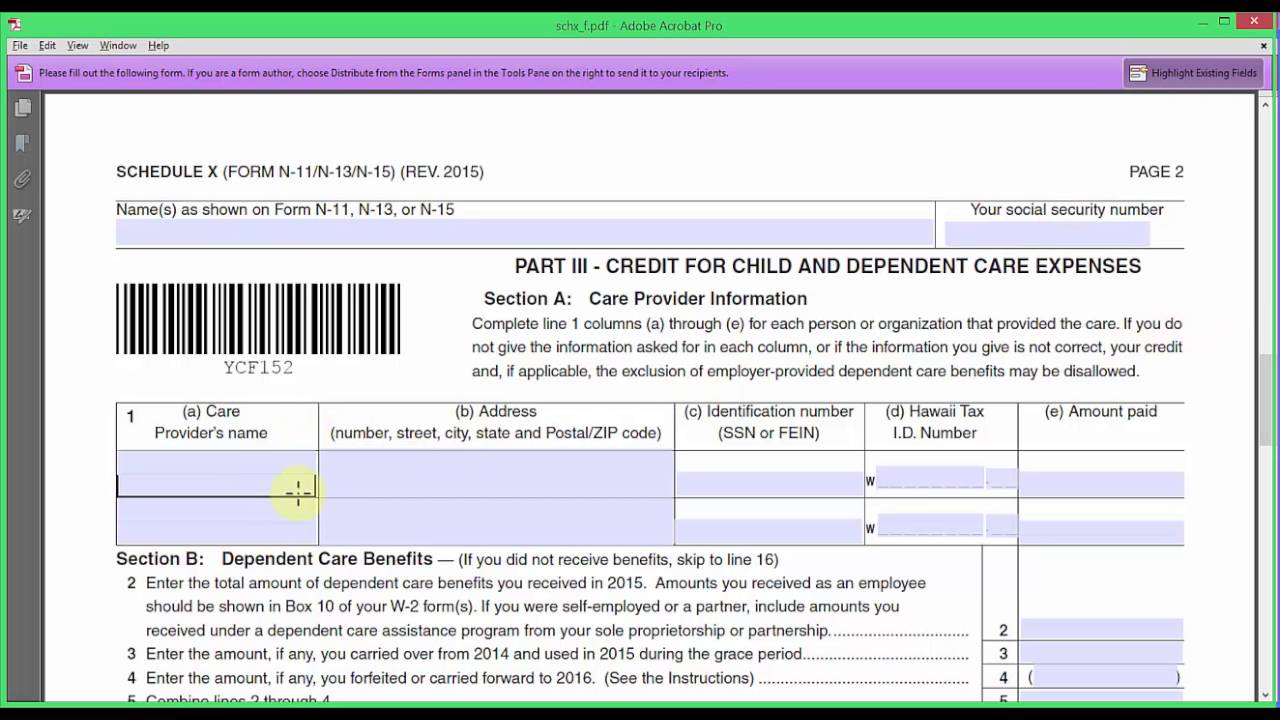

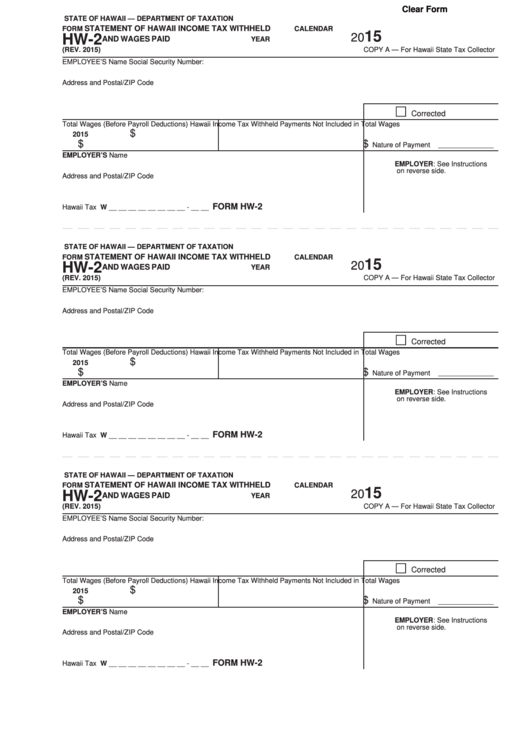

Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year. Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options. To ensure your privacy, a “clear form” button. Web file your personal tax extension now! Web your state extension form is free. File this form to request an extension even if you are not making a payment. How to pay the state tax due? Individual income tax return, in lieu of the hawaii. Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for calendar year filers).

Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options. Web does hawaii accept the federal form 4868, application for automatic extension of time to file u.s. Web your state extension form is free. Web file your personal tax extension now! Web hawaii filing due date: Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. Individual income tax return, in lieu of the hawaii. Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year. To ensure your privacy, a “clear form” button.

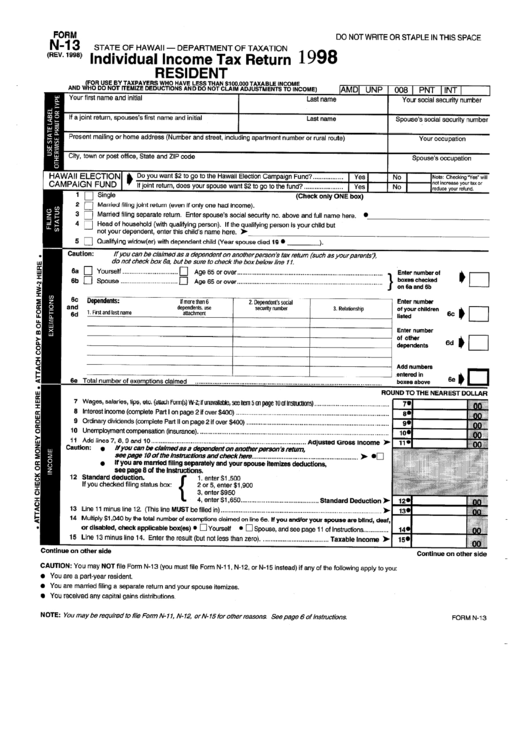

Fillable Form N13 Individual Tax Return Resident Hawaii

Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). You can make a state. Individual income tax return, in lieu of the hawaii. Web hawaii filing due date: Hawaii business tax returns are due by the 20 th.

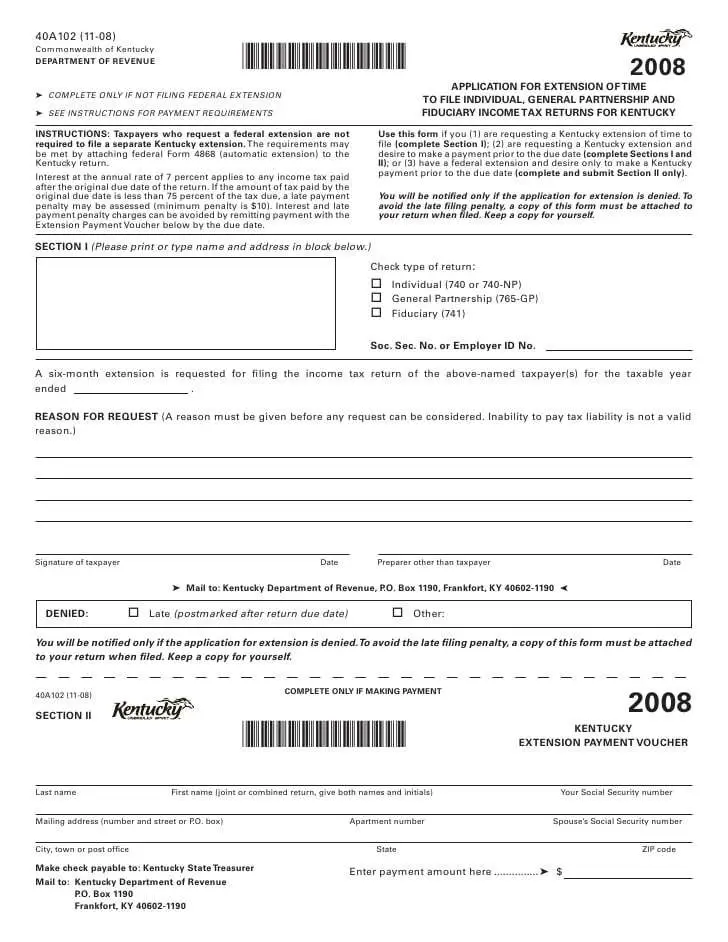

How To Apply For State Tax Extension

Individual income tax return, in lieu of the hawaii. For information and guidance in. To ensure your privacy, a “clear form” button. How to pay the state tax due? Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options.

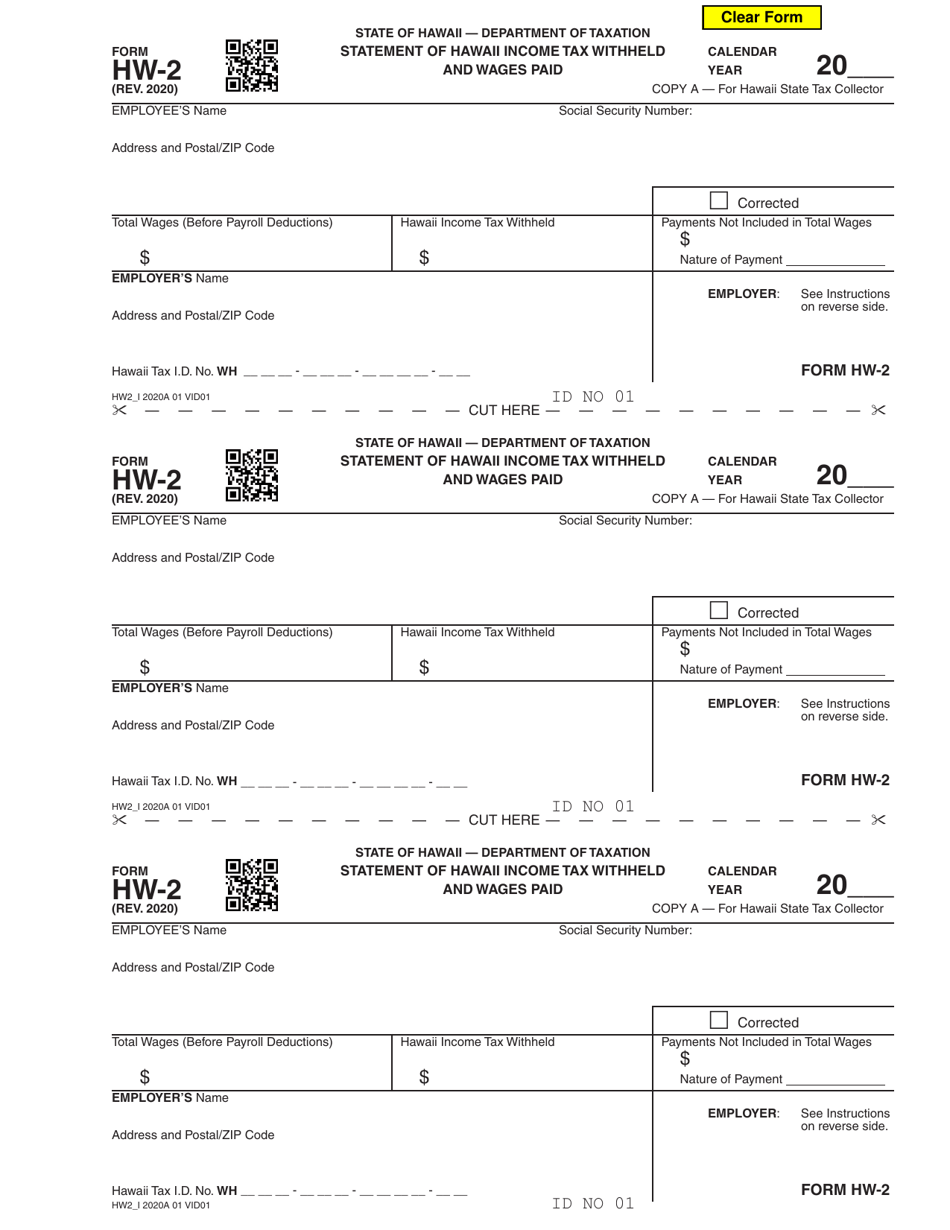

Form HW2 Download Fillable PDF or Fill Online Statement of Hawaii

Web file your personal tax extension now! File this form to request an extension even if you are not making a payment. Web hawaii filing due date: Web does hawaii accept the federal form 4868, application for automatic extension of time to file u.s. Web start gathering your tax records so you have enough time to obtain all forms and.

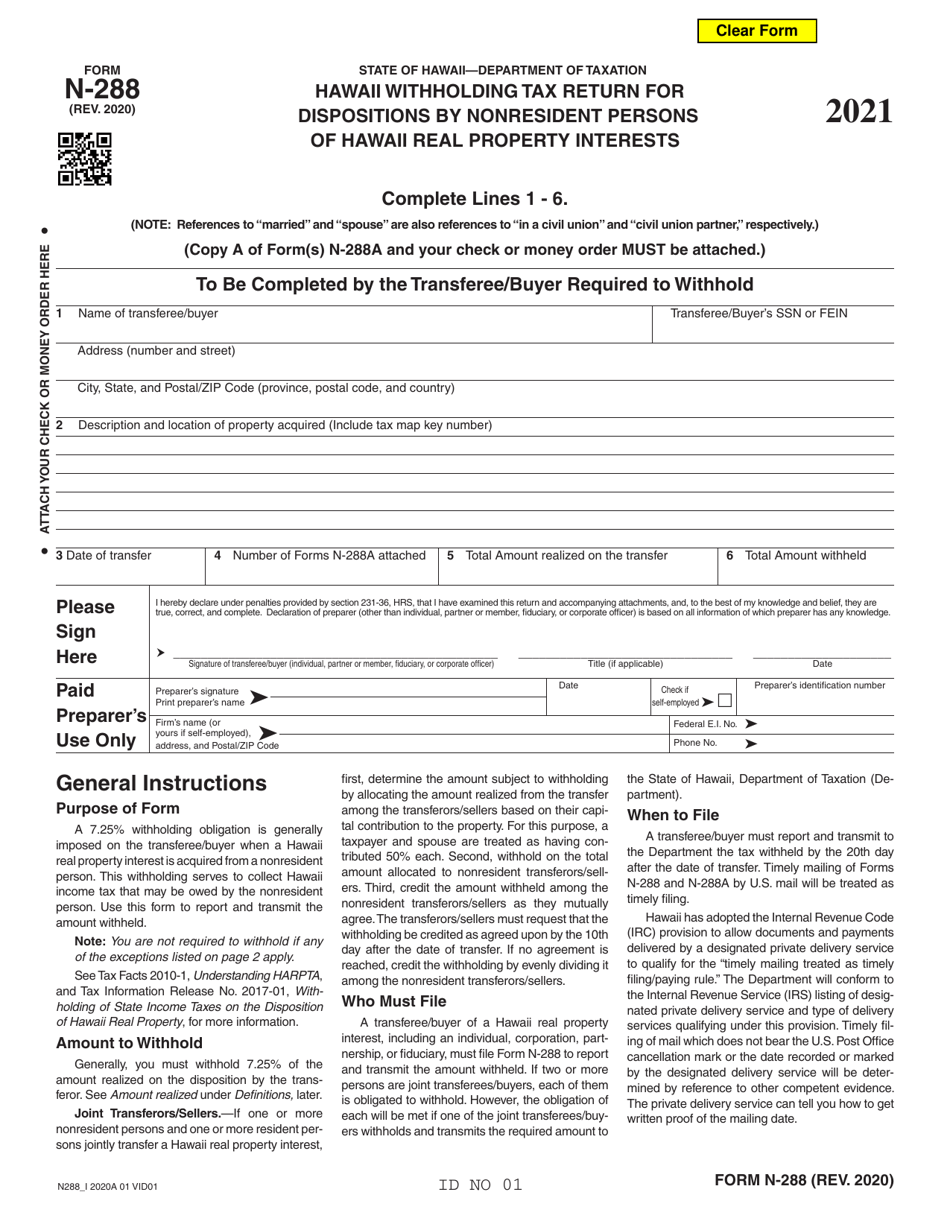

Form N288 Download Fillable PDF or Fill Online Hawaii Withholding Tax

Web hawaii filing due date: Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options. 2019) do not write in this space state of hawaii —.

Form N101A Fill Out, Sign Online and Download Fillable PDF, Hawaii

Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Web hawaii filing due date: Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax.

Form N101b Application For Additional Extension Of Time To File

Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year. Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. Hawaii business tax returns.

Hawaii N11 Tax Return, Part 4 (tax credits) YouTube

Web does hawaii accept the federal form 4868, application for automatic extension of time to file u.s. Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options. Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing.

Fillable Form Hw2 Statement Of Hawaii Tax Withheld And Wages

Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. Web hawaii filing due date: Web your state extension form is free. 2019) do not write in this space state of hawaii — department of taxation application for automatic extension of..

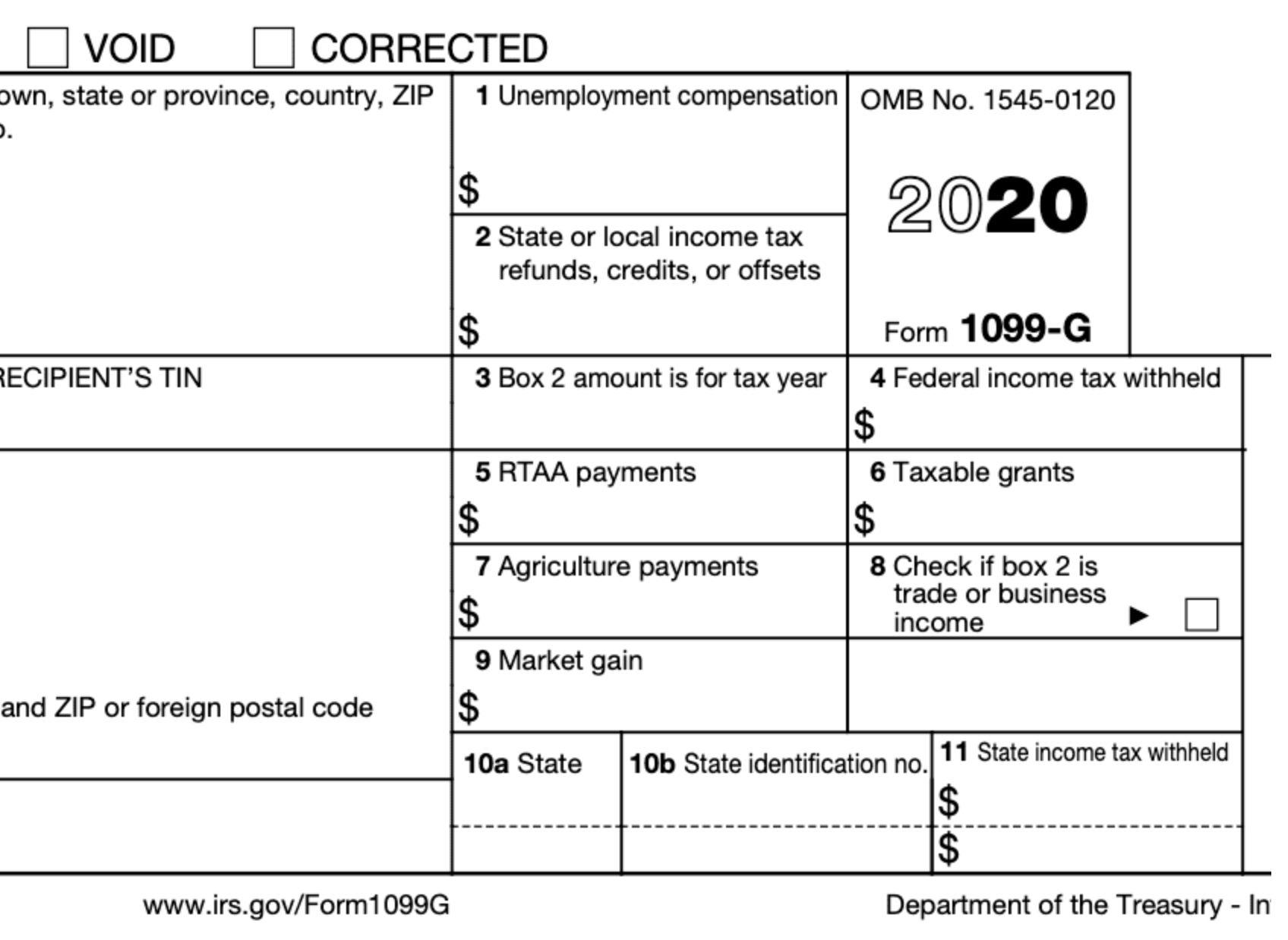

Does Hawaii Tax Unemployment Benefits YUNEMPLO

Web file your personal tax extension now! Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for calendar year filers). How to pay the state tax due? Business tax returns are due by april 20 — or by the 20 th day of the.

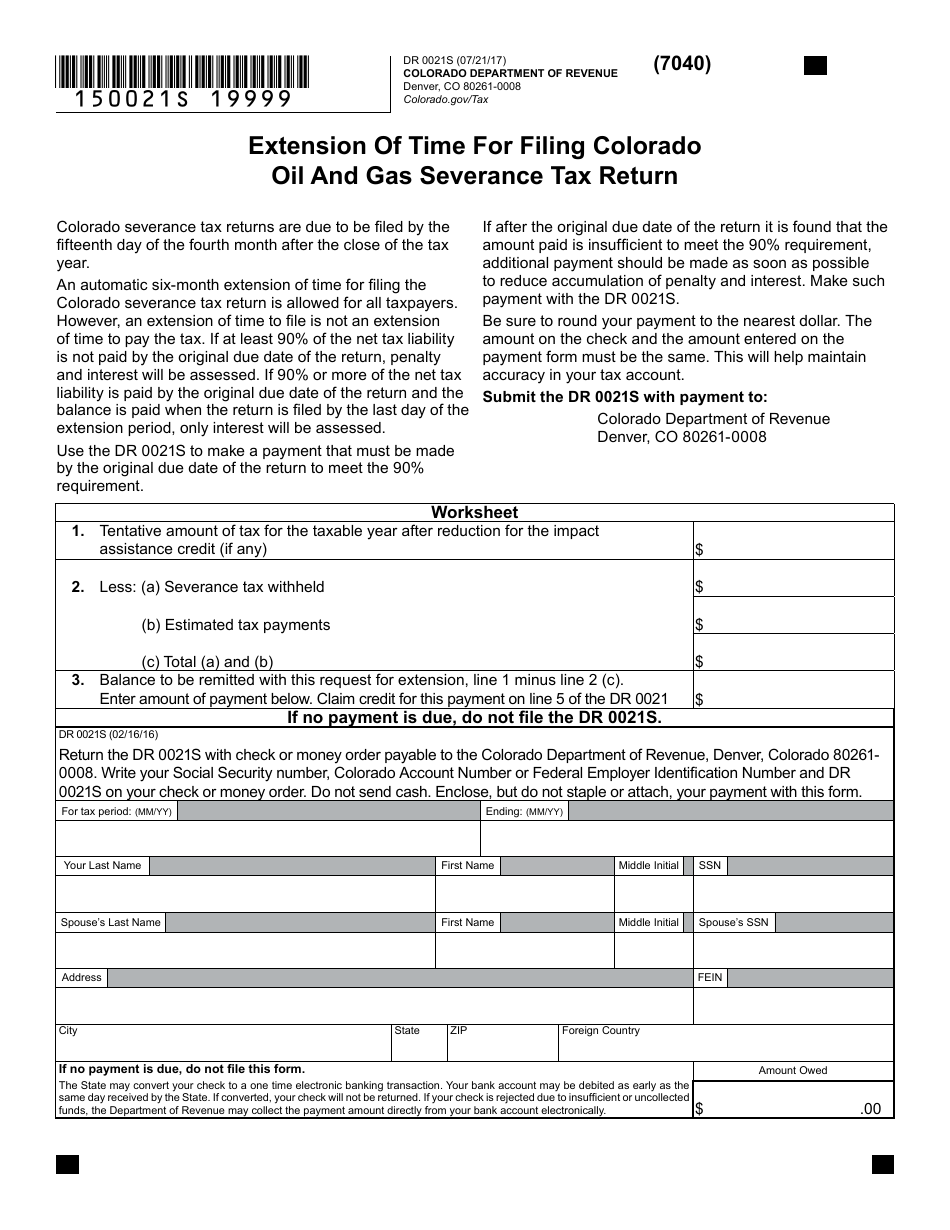

Form DR0021S Download Fillable PDF or Fill Online Extension of Time for

Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year. Web hawaii filing due date: 2019) do not write in this space state of hawaii — department of taxation application for automatic extension of. Web does hawaii accept the federal form 4868, application.

For Information And Guidance In.

2019) do not write in this space state of hawaii — department of taxation application for automatic extension of. How to pay the state tax due? File this form to request an extension even if you are not making a payment. Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,.

Web Hawaii Tax Extension Filing Method (Paper/Electronic) It Supports Both Paper And Electronic Filing Options.

Individual income tax return, in lieu of the hawaii. Web does hawaii accept the federal form 4868, application for automatic extension of time to file u.s. Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year.

Web File Your Personal Tax Extension Now!

Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for calendar year filers). To ensure your privacy, a “clear form” button. You can make a state. Web your state extension form is free.