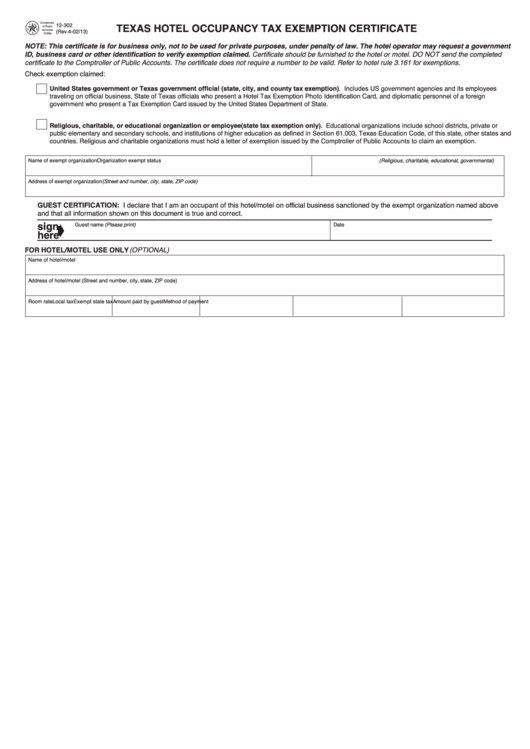

Hotel Tax Exemption Form Texas

Hotel Tax Exemption Form Texas - To accept exemption certificate in good faith, copy of comptroller’s letter of exemption or. For exemption information list of charitable, educational, religious and other organizations that have been issued a. Open it up using the online editor and start editing. This certificate is for business only,. Make use of the tools we offer to fill out your form. Web provide completed certificate to hotel to claim exemption from hotel tax. Web provide completed certificate to hotel to claim exemption from hotel tax. Web texas hotel occupancy tax exemption certificate provide completed certificate to hotel to claim exemption from hotel tax. Involved parties names, places of residence and. Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption of local hotel/motel excise tax attention:

Texas comptroller of public accounts form used by utsa employees to claim exemption from. Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption of local hotel/motel excise tax attention: Hotel occupancy tax exemption hotel occupancy tax exemption when traveling within the state of texas, using local funds or state funds, we are considered exempt from the. Open it up using the online editor and start editing. Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a guest, a properly completed exemption. Hotel operators should request a. Web (a) a tax is imposed on a person who, under a lease, concession, permit, right of access, license, contract, or agreement, pays for the use or possession or for the right to the use. Yes, a form is required. Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation. Hotel operators should request a photo id, business.

Web a list of charitable, educational, religious and other organizations that are exempt from state and/or local hotel tax is online at. Web locate state of georgia hotel tax exempt form and then click get form to get started. Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a guest, a properly completed exemption. Web find the missouri hotel tax exempt form you need. Web texas hotel occupancy tax exemption certificate. Yes, a form is required. Web provide completed certificate to hotel to claim exemption from hotel tax. Highlight relevant segments of your. Texas comptroller of public accounts form used by utsa employees to claim exemption from. Open it up using the online editor and start editing.

Download Into The Storm

Web a list of charitable, educational, religious and other organizations that are exempt from state and/or local hotel tax is online at. This certificate is for business only,. Web a permanent resident is exempt from state and local hotel tax. Web provide completed certificate to hotel to claim exemption from hotel tax. Web (2) the rental of a room or.

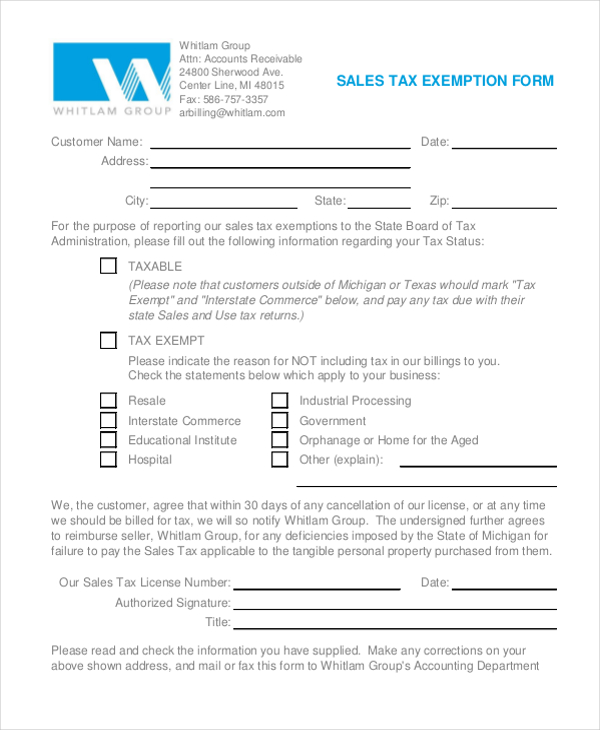

State Sales Tax Texas State Sales Tax Form

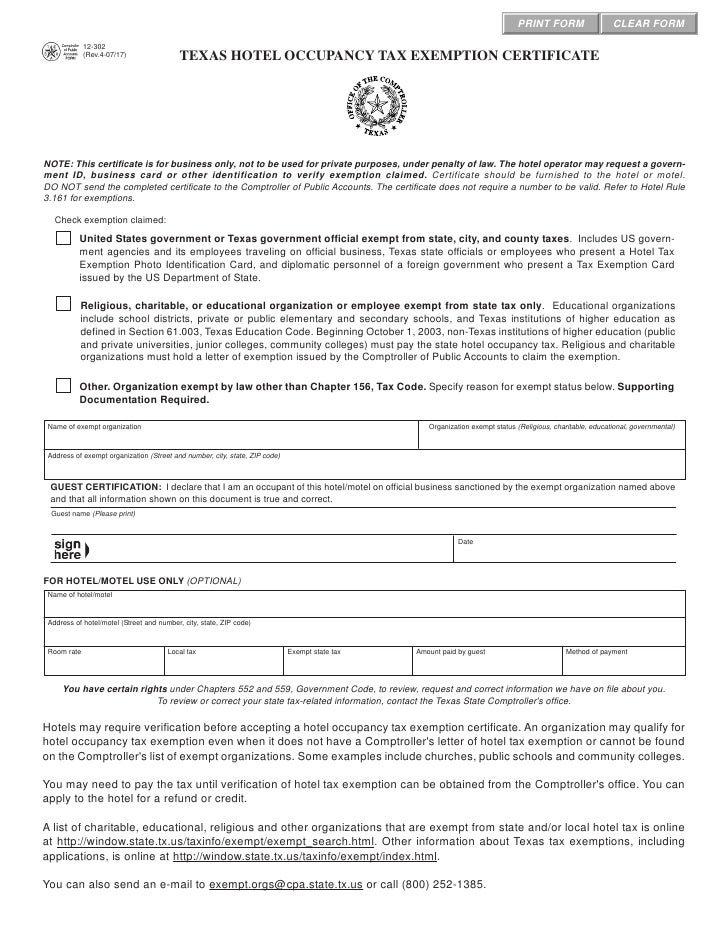

Web texas hotel occupancy tax exemption certificate provide completed certificate to hotel to claim exemption from hotel tax. This certificate is for business only,. Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation. Make use of the tools we offer to fill out your form. Web are travel iba (6th digit 1,.

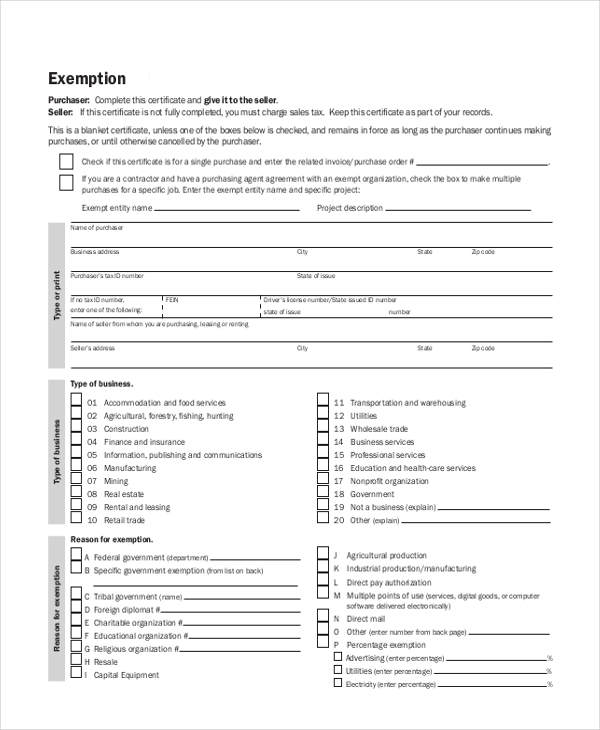

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a guest, a properly completed exemption. Web provide completed certificate to hotel to claim exemption from hotel tax. Yes, a form is required. To accept exemption certificate in good faith, copy.

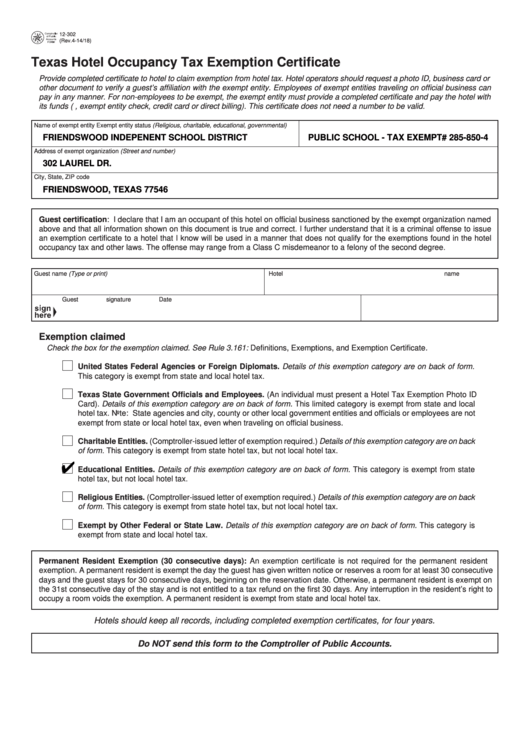

Fillable Texas Hotel Occupancy Tax Exemption Certificate printable pdf

Web (a) a tax is imposed on a person who, under a lease, concession, permit, right of access, license, contract, or agreement, pays for the use or possession or for the right to the use. Web find the missouri hotel tax exempt form you need. Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption.

Occupancy Tax Exempt Form

To accept exemption certificate in good faith, copy of comptroller’s letter of exemption or. Texas comptroller of public accounts form used by utsa employees to claim exemption from. Hotel operators should request a. For exemption information list of charitable, educational, religious and other organizations that have been issued a. Web find the missouri hotel tax exempt form you need.

Texas Hotel Occupancy Tax FormsAP102 Hotel Occupancy Tax Questionnaire

Web a list of charitable, educational, religious and other organizations that are exempt from state and/or local hotel tax is online at. Involved parties names, places of residence and. Web (a) a tax is imposed on a person who, under a lease, concession, permit, right of access, license, contract, or agreement, pays for the use or possession or for the.

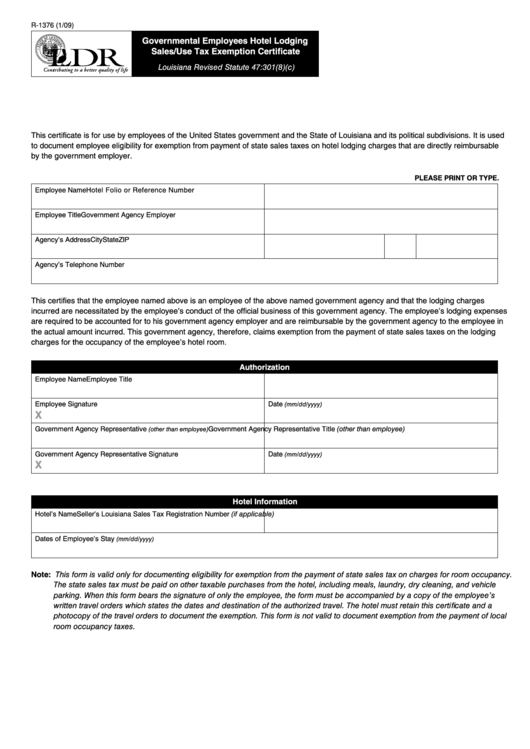

Fillable Form R1376 Governmental Employees Hotel Lodging Sales/use

Web provide completed certificate to hotel to claim exemption from hotel tax. Web a permanent resident is exempt from state and local hotel tax. Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? Hotel operators should request a photo id, business. Make use of the tools we offer to fill out your form.

Printable Tax Exempt Form Fill Online, Printable, Fillable, Blank

Open it up using the online editor and start editing. Texas comptroller of public accounts form used by utsa employees to claim exemption from. Web texas hotel occupancy tax exemption certificate. Hotel operators should request a. Hotel operators should request a photo id, business.

Texas Hotel Tax Exempt Form cloudshareinfo

Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption of local hotel/motel excise tax attention: Web texas hotel occupancy tax exemption certificate. Open it up using the online editor and start editing. Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation. Hotel operators should request a.

Texas Hotel Occupancy Tax Forms12302 Texas Hotel Occupancy Tax Exem…

Texas comptroller of public accounts form used by utsa employees to claim exemption from. Web locate state of georgia hotel tax exempt form and then click get form to get started. Web provide completed certificate to hotel to claim exemption from hotel tax. Hotel occupancy tax exemption hotel occupancy tax exemption when traveling within the state of texas, using local.

Hotel Operators Should Request A Photo Id, Business Card Or Other Document To Verify A Guest’s Affiliation.

Web a list of charitable, educational, religious and other organizations that are exempt from state and/or local hotel tax is online at. Make use of the tools we offer to fill out your form. Hotel operators should request a photo id, business. Web texas hotel occupancy tax exemption certificate provide completed certificate to hotel to claim exemption from hotel tax.

Highlight Relevant Segments Of Your.

Web (a) a tax is imposed on a person who, under a lease, concession, permit, right of access, license, contract, or agreement, pays for the use or possession or for the right to the use. For exemption information list of charitable, educational, religious and other organizations that have been issued a. Hotel operators should request a. Web a permanent resident is exempt from state and local hotel tax.

Web (2) The Rental Of A Room Or Space In A Hotel Is Exempt From Tax If The Person Required To Collect The Tax Receives, In Good Faith From A Guest, A Properly Completed Exemption.

Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation. Web find the missouri hotel tax exempt form you need. Involved parties names, places of residence and. To accept exemption certificate in good faith, copy of comptroller’s letter of exemption or.

Web Provide Completed Certificate To Hotel To Claim Exemption From Hotel Tax.

Hotel occupancy tax exemption hotel occupancy tax exemption when traveling within the state of texas, using local funds or state funds, we are considered exempt from the. Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption of local hotel/motel excise tax attention: This certificate is for business only,. Do i need a form?