Idaho Form 41 Instructions 2021

Idaho Form 41 Instructions 2021 - Rounding round the amounts on the return to the nearest whole dollar. Web the idaho state tax commission oct. 1) taxpayers must compute the amount of state corporate income tax at 6.5 percent of state. 21, 2021 released form 41, corporation income tax return, with instructions. You’re registered with the idaho secretary of state to do business in idaho. Line 20 interest from idaho municipal securities enter interest income from securities issued by the state of idaho and its political subdivisions if included We can't cover every circumstance in our guides. Download past year versions of this tax form as pdfs here: If you amend your federal return, you also must file an amended idaho income tax return. Individual income tax rates now range from 1% to 6.5%, and the number of tax brackets has been reduced from seven to five.

Heading file the 2021 return for calendar year 2021 or a Individual income tax rates now range from 1% to 6.5%, and the number of tax brackets has been reduced from seven to five. Download past year versions of this tax form as pdfs here: We can't cover every circumstance in our guides. You’re doing business in idaho. You’re registered with the idaho secretary of state to do business in idaho. Idaho accepts the federal approval of the s corporation election. Web a corporation filing as an s corporation for federal income tax purposes must file idaho form 41s if either of the following are true: Web business income business income tax forms form 41 form 41 corporation income tax return and instructions show entries previous 1 next this information is for general guidance only. Form 41, corporation income tax return and instructions 2022.

Rounding round the amounts on the return to the nearest whole dollar. This guidance may not apply to your situation. Individual income tax rates now range from 1% to 6.5%, and the number of tax brackets has been reduced from seven to five. Preserving limited losses idaho taxpayers can keep the benefit of losses that exceed the federal limit and carry them forward as Heading file the 2021 return for calendar year 2021 or a Web effective january 1, 2021, all tax rates have been decreased. Web business income business income tax forms form 41 form 41 corporation income tax return and instructions show entries previous 1 next this information is for general guidance only. Web the idaho state tax commission oct. You’re doing business in idaho. Taxpayers must file the 2021 return for calendar year 2021 or a fiscal year that begins in 2021.

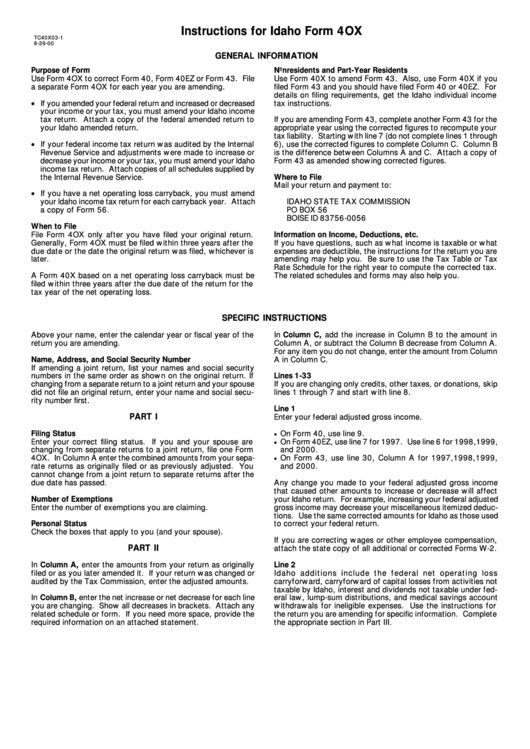

Instructions For Idaho Form 4ox printable pdf download

Make sure you check the amended return box and enter the reason for amending. Rounding round the amounts on the return to the nearest whole dollar. Form 41, corporation income tax return and instructions 2022. Web use form 41 to amend your idaho income tax return. Idaho accepts the federal approval of the s corporation election.

Form 41 Idaho Corporation Tax Return YouTube

21, 2021 released form 41, corporation income tax return, with instructions. This form shows the shareholder’s proportionate share of idaho additions, subtractions, and credit information. Preserving limited losses idaho taxpayers can keep the benefit of losses that exceed the federal limit and carry them forward as Web the idaho state tax commission oct. You’re doing business in idaho.

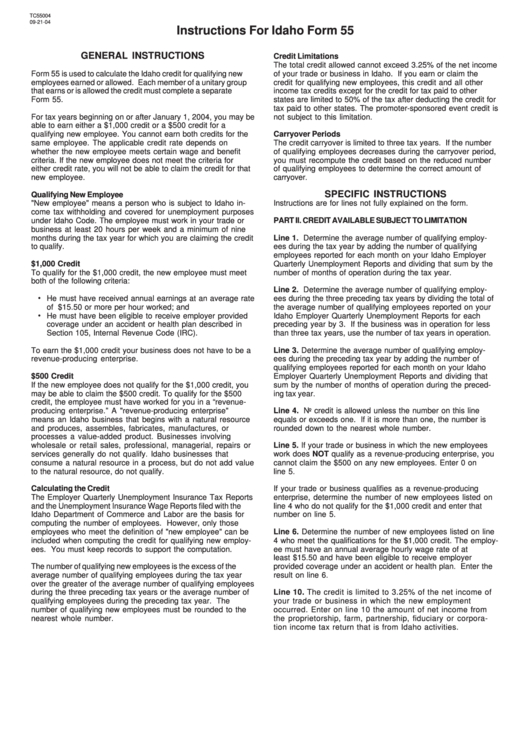

Instructions For Idaho Form 55 2004 printable pdf download

21, 2021 released form 41, corporation income tax return, with instructions. This form shows the shareholder’s proportionate share of idaho additions, subtractions, and credit information. This guidance may not apply to your situation. Form 41, corporation income tax return and instructions 2022. Idaho accepts the federal approval of the s corporation election.

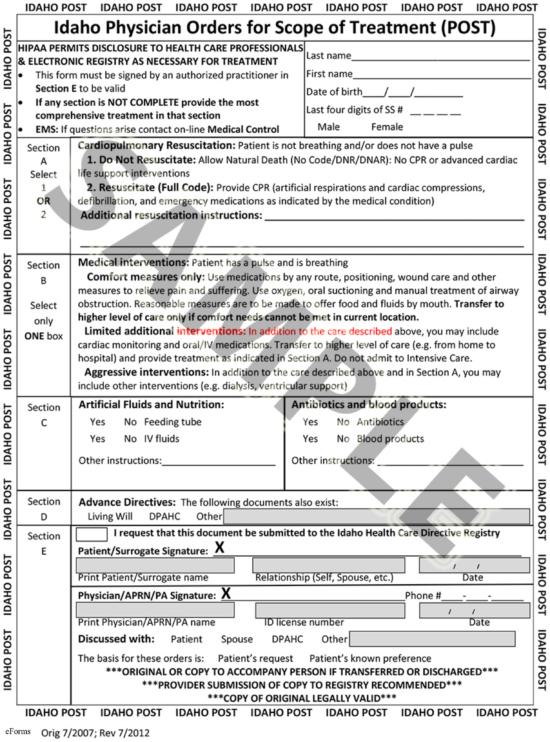

Free Idaho Do Not Resuscitate (DNR) Order Form PDF eForms

21, 2021 released form 41, corporation income tax return, with instructions. Tax laws are complex and change regularly. This guidance may not apply to your situation. Web business income business income tax forms form 41 form 41 corporation income tax return and instructions show entries previous 1 next this information is for general guidance only. Idaho accepts the federal approval.

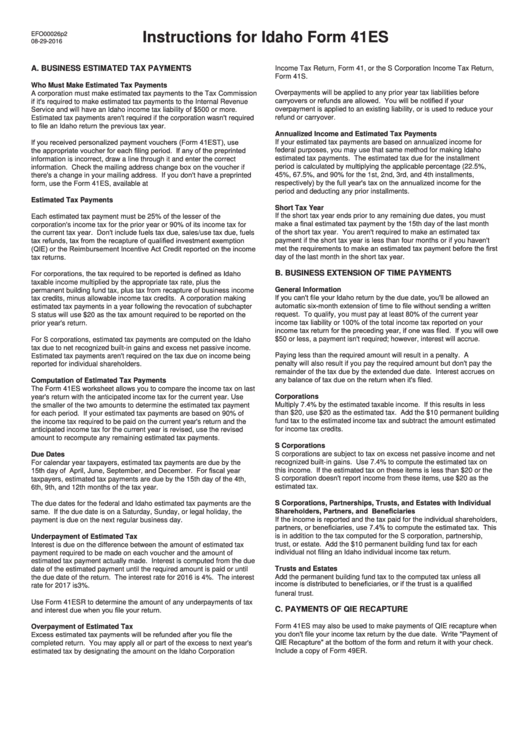

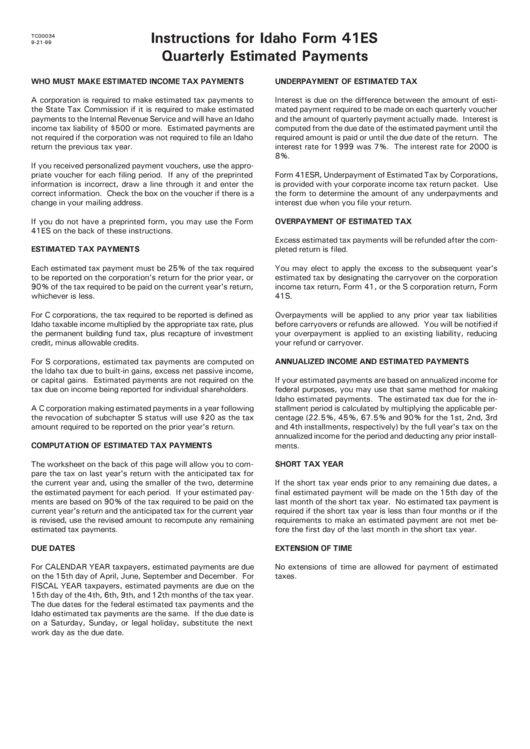

Instructions For Idaho Form 41es printable pdf download

Individual income tax rates now range from 1% to 6.5%, and the number of tax brackets has been reduced from seven to five. Download past year versions of this tax form as pdfs here: 21, 2021 released form 41, corporation income tax return, with instructions. Line 20 interest from idaho municipal securities enter interest income from securities issued by the.

Universitey Of Idaho Calendar 2021 Calendar May 2021

This guidance may not apply to your situation. If you amend your federal return, you also must file an amended idaho income tax return. Taxpayers must file the 2021 return for calendar year 2021 or a fiscal year that begins in 2021. Round down if under 50 cents, round up if 50 cents or more. Web use form 41 to.

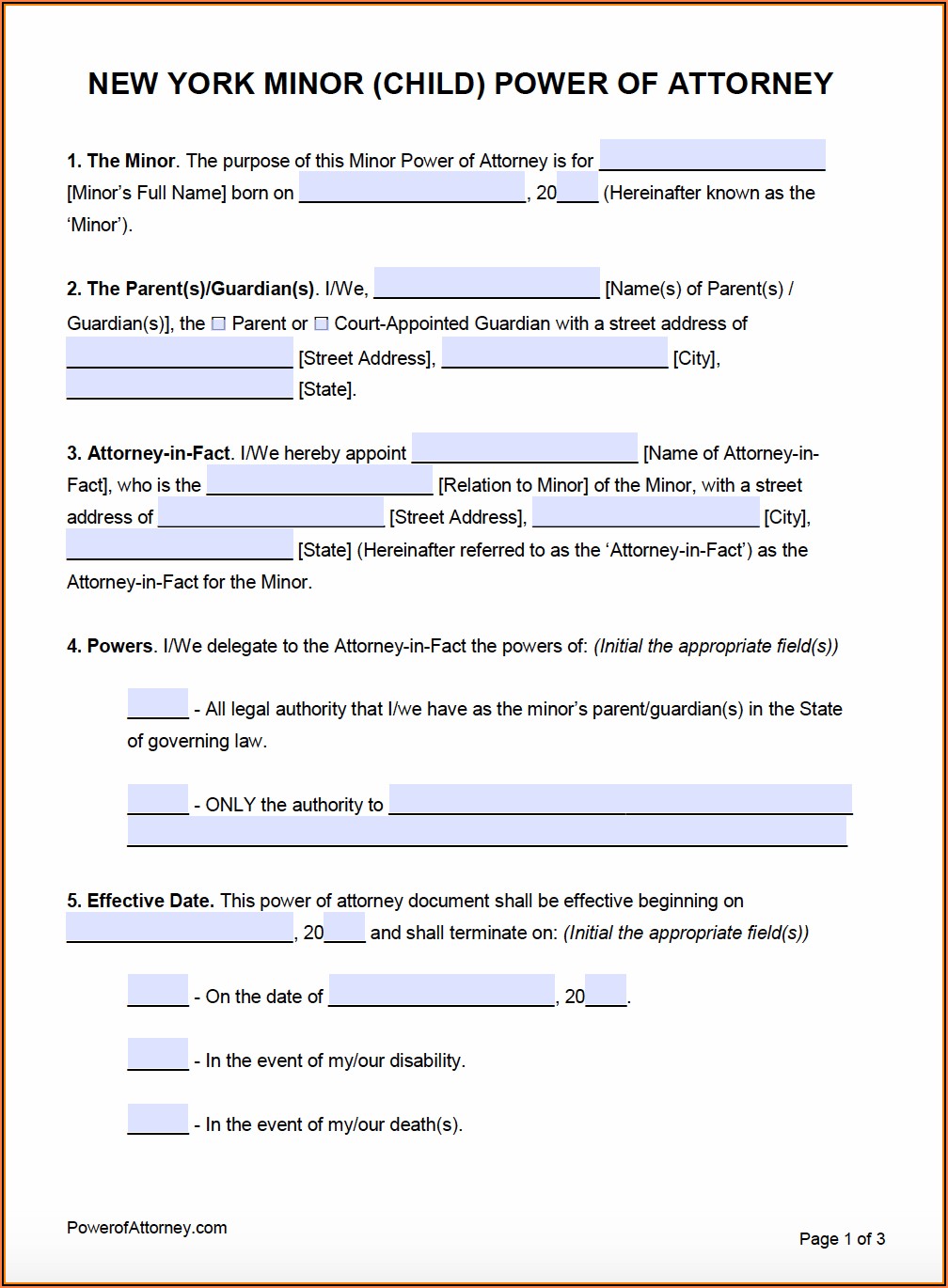

Temporary Guardianship Form Idaho Form Resume Examples GM9OGKl9DL

Web business income business income tax forms form 41 form 41 corporation income tax return and instructions show entries previous 1 next this information is for general guidance only. Form 41, corporation income tax return and instructions 2022. Taxpayers must file the 2021 return for calendar year 2021 or a fiscal year that begins in 2021. We can't cover every.

File S Bridgerecovery Nsg Folder Med Destruction Controlled Medication

Make sure you check the amended return box and enter the reason for amending. Web effective january 1, 2021, all tax rates have been decreased. Taxpayers must file the 2021 return for calendar year 2021 or a fiscal year that begins in 2021. This guidance may not apply to your situation. Individual income tax rates now range from 1% to.

Instructions For Idaho Form 41es Quarterly Estimated Payments printable

You’re doing business in idaho. Make sure you check the amended return box and enter the reason for amending. Download past year versions of this tax form as pdfs here: Line 20 interest from idaho municipal securities enter interest income from securities issued by the state of idaho and its political subdivisions if included You’re registered with the idaho secretary.

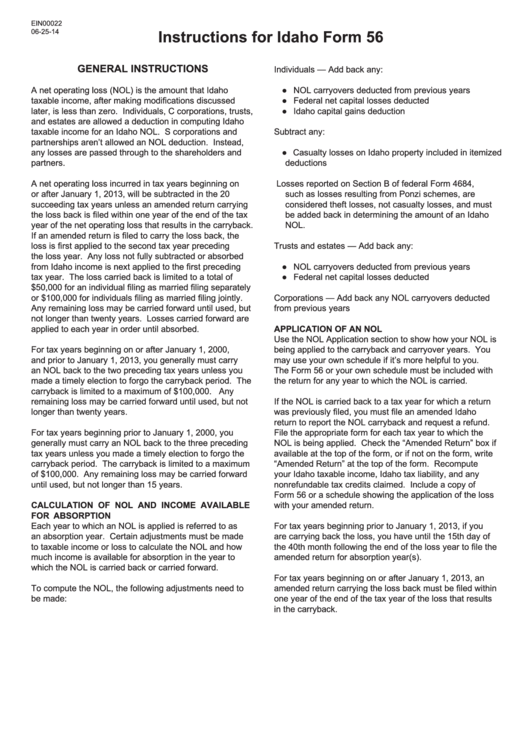

Instructions For Idaho Form 56 printable pdf download

Download past year versions of this tax form as pdfs here: 1) taxpayers must compute the amount of state corporate income tax at 6.5 percent of state. Web a corporation filing as an s corporation for federal income tax purposes must file idaho form 41s if either of the following are true: If you amend your federal return, you also.

1) Taxpayers Must Compute The Amount Of State Corporate Income Tax At 6.5 Percent Of State.

Web effective january 1, 2021, all tax rates have been decreased. Make sure you check the amended return box and enter the reason for amending. You’re doing business in idaho. We can't cover every circumstance in our guides.

Web Use Form 41 To Amend Your Idaho Income Tax Return.

Download past year versions of this tax form as pdfs here: Round down if under 50 cents, round up if 50 cents or more. If you amend your federal return, you also must file an amended idaho income tax return. Web a corporation filing as an s corporation for federal income tax purposes must file idaho form 41s if either of the following are true:

Taxpayers Must File The 2021 Return For Calendar Year 2021 Or A Fiscal Year That Begins In 2021.

21, 2021 released form 41, corporation income tax return, with instructions. Tax laws are complex and change regularly. This form shows the shareholder’s proportionate share of idaho additions, subtractions, and credit information. This guidance may not apply to your situation.

Rounding Round The Amounts On The Return To The Nearest Whole Dollar.

Form 41, corporation income tax return and instructions 2022. Heading file the 2021 return for calendar year 2021 or a Line 20 interest from idaho municipal securities enter interest income from securities issued by the state of idaho and its political subdivisions if included You’re registered with the idaho secretary of state to do business in idaho.