Il 2210 Form

Il 2210 Form - Sign it in a few clicks draw your signature, type it,. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,. Edit your il il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. This form allows you to figure penalties you may owe if you did not make timely estimated. This form allows you to figure penalties you may owe if you did not make timely estimated. The irs will generally figure your penalty for you and you should not file. This includes any corrected return fi led before the extended due date of the. This includes any corrected return fi led before the extended due date of the.

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. This includes any corrected return fi led before the extended due date of the. Sign it in a few clicks draw your signature, type it,. Web general information what is the purpose of this form? This includes any corrected return fi led before the extended due date of the. Statement of person claiming refund due a deceased taxpayer: Use get form or simply click on the template preview to open it in the editor. This form is for income earned in tax year 2022, with tax returns due in april. Designed by the illinois department of. The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax.

This form allows you to figure penalties you may owe if you did not make timely estimated. Use get form or simply click on the template preview to open it in the editor. Edit your il il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in april. This includes any corrected return fi led before the extended due date of the. The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,. The irs will generally figure your penalty for you and you should not file. • for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. Web general information what is the purpose of this form?

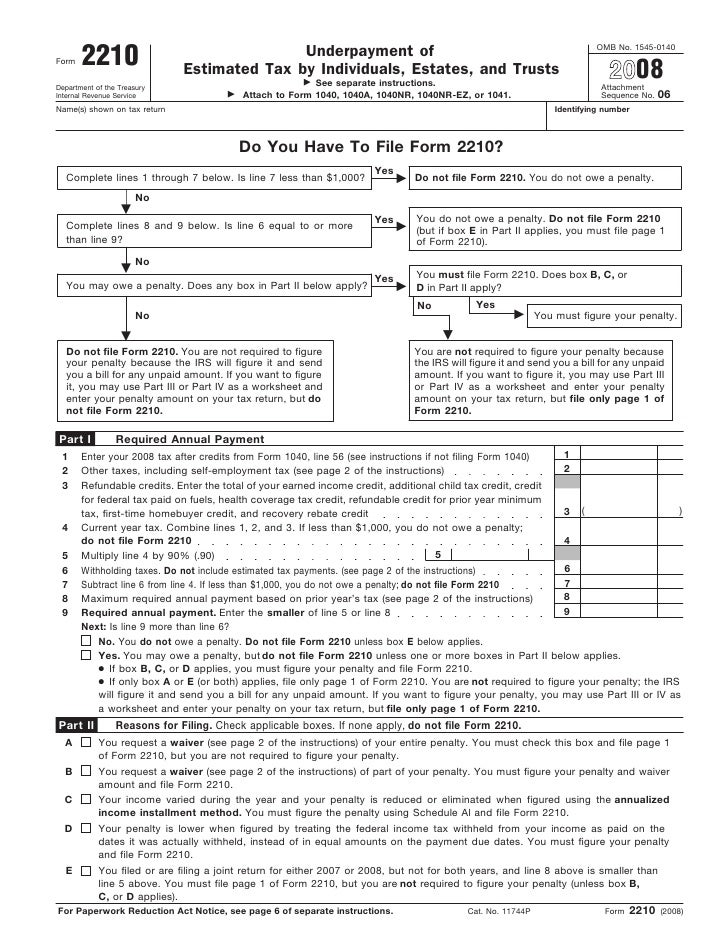

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Sign it in a few clicks draw your signature, type it,. This form is for income earned in tax year 2022, with tax returns due in april. Start completing the fillable fields and carefully. Edit your illinois il 2210 online type text, add images,.

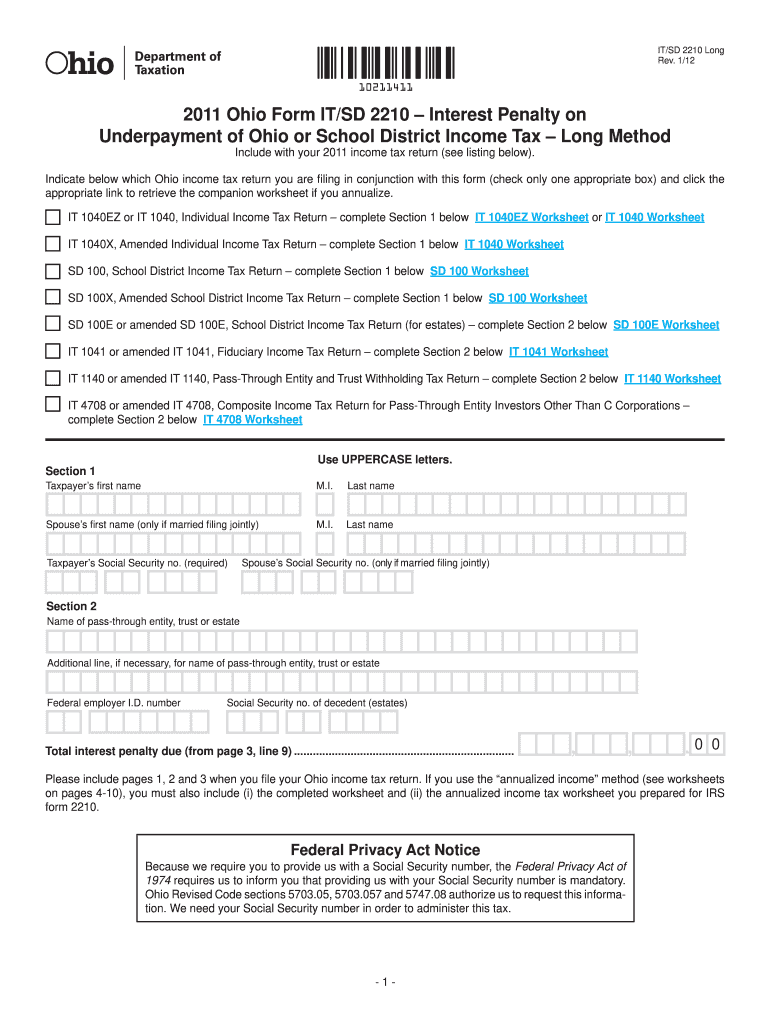

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

This form is for income earned in tax year 2022, with tax returns due in april. This form allows you to figure penalties you may owe if you did not make timely estimated. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Easily fill out pdf blank, edit, and sign.

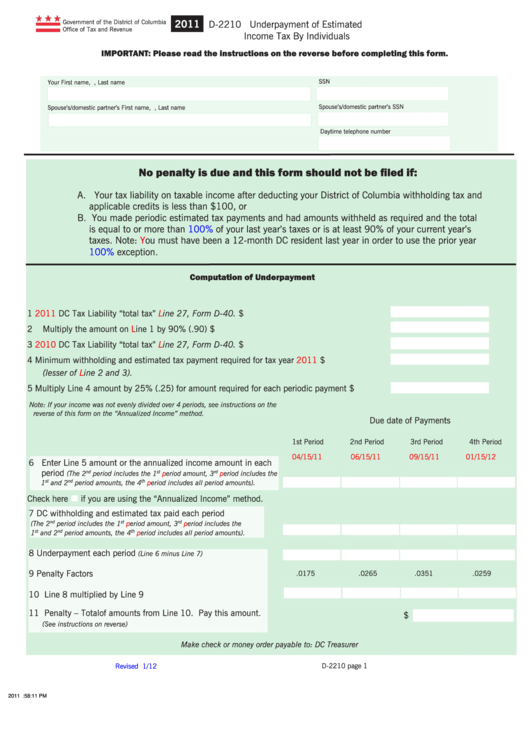

Form D2210 Underpayment Of Estimated Tax By Individuals

Designed by the illinois department of. • for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,. The irs will.

2210 Form Fill Out and Sign Printable PDF Template signNow

The irs will generally figure your penalty for you and you should not file form 2210. This includes any corrected return fi led before the extended due date of the. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. • for most filers, if your federal tax withholdings and timely payments are not.

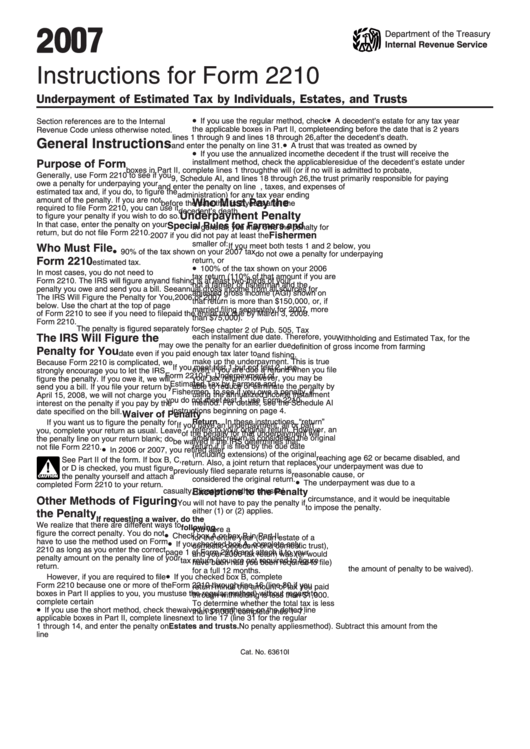

Instructions For Form 2210 Underpayment Of Estimated Tax By

Edit your illinois il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. This form allows you to figure penalties you may owe if you did not make timely estimated. This includes any corrected return fi led before the extended due date of the. The purpose of this form is to figure any penalties you.

Form 2210Underpayment of Estimated Tax

The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,. • for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. Save or instantly send your ready documents. The irs.

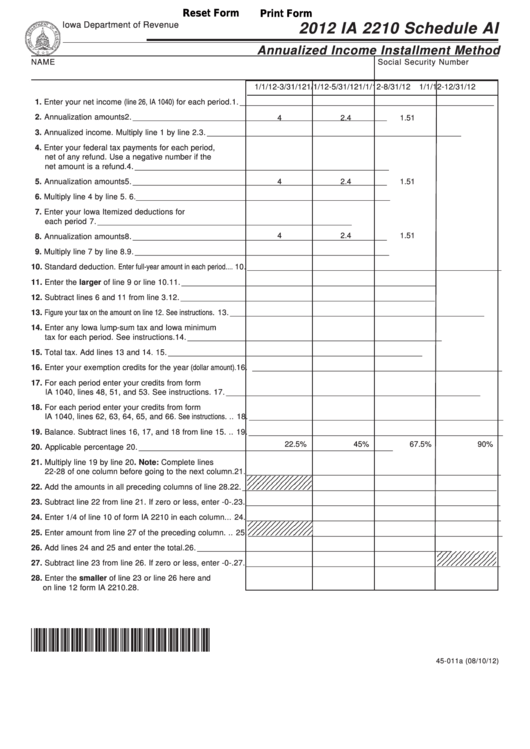

Fillable Form Ia 2210 Schedule Ai Annualized Installment

This includes any corrected return fi led before the extended due date of the. Easily fill out pdf blank, edit, and sign them. This form allows you to figure penalties you may owe if you did not make timely estimated. This includes any corrected return fi led before the extended due date of the. Use get form or simply click.

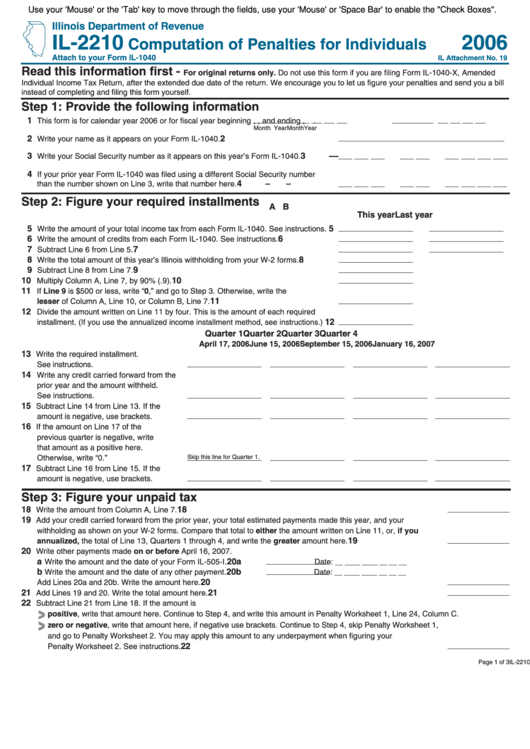

Fillable Form Il2210 Computation Of Penalties For Individuals 2006

Easily fill out pdf blank, edit, and sign them. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Sign it in a few clicks draw your signature, type it,. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. This includes any corrected return.

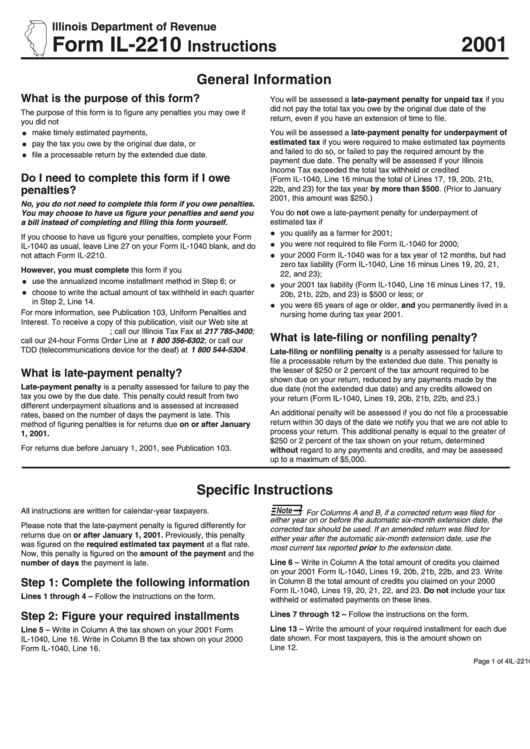

Form Il2210 Instructions 2001 printable pdf download

This form allows you to figure penalties you may owe if you did not make timely estimated. Easily fill out pdf blank, edit, and sign them. This includes any corrected return fi led before the extended due date of the. The irs will generally figure your penalty for you and you should not file form 2210. Edit your illinois il.

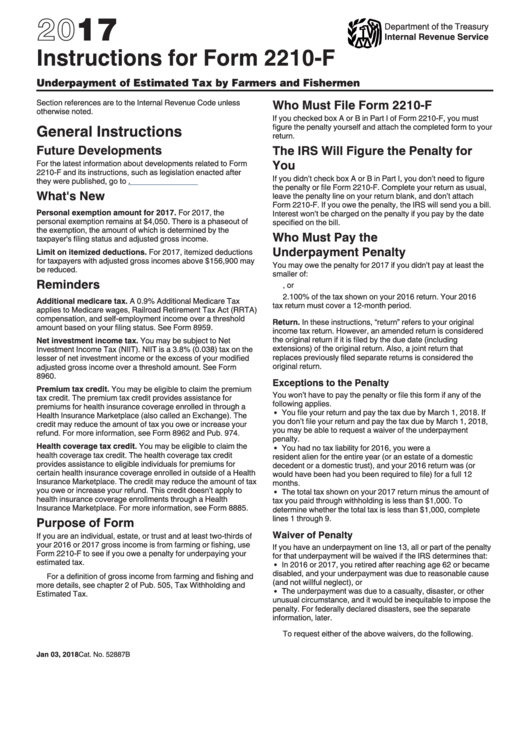

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Statement of person claiming refund due a deceased taxpayer: The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april. This.

The Irs Will Generally Figure Your Penalty For You And You Should Not File Form 2210.

This includes any corrected return fi led before the extended due date of the. This includes any corrected return fi led before the extended due date of the. This form is for income earned in tax year 2022, with tax returns due in april. The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,.

• For Most Filers, If Your Federal Tax Withholdings And Timely Payments Are Not Equal To 90% Of Your Current Year Tax, Or 100% Of The Total Tax From The.

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. This form allows you to figure penalties you may owe if you did not make timely estimated. This form allows you to figure penalties you may owe if you did not make timely estimated. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax.

Web Use Form 2210 To See If You Owe A Penalty For Underpaying Your Estimated Tax.

Sign it in a few clicks draw your signature, type it,. Designed by the illinois department of. Edit your il il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. The irs will generally figure your penalty for you and you should not file.

Sign It In A Few Clicks Draw Your Signature, Type It,.

Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web general information what is the purpose of this form? Edit your illinois il 2210 online type text, add images, blackout confidential details, add comments, highlights and more.