Illinois 1040 Form 2021

Illinois 1040 Form 2021 - Web up to $40 cash back fill fillable illinois 1040, edit online. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Department of the treasury—internal revenue service. Irs use only—do not write or staple in this. For more information about the illinois. 2023 illinois estimated income tax payments for individuals: This form is for income earned in tax year 2022, with tax returns due in april. Information see the instructions for line 5 and. We last updated the individual income tax return in january 2023, so this is the. Payment voucher for individual income tax:

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. 2020 estimated income tax payments for individuals use this form for. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. 2023 illinois estimated income tax payments for individuals: Income tax rate the illinois income tax rate is 4.95 percent. Web illinois department of revenue. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. 2022 credit for tax paid to other states. Department of the treasury—internal revenue service. These where to file addresses.

Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. 2022 employee's illinois withholding allowance certificate:. Payment voucher for individual income tax: Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in illinois. 2020 estimated income tax payments for individuals use this form for. Department of the treasury—internal revenue service. 2023 illinois estimated income tax payments for individuals: We last updated the individual income tax return in january 2023, so this is the. Amended individual income tax return: Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly.

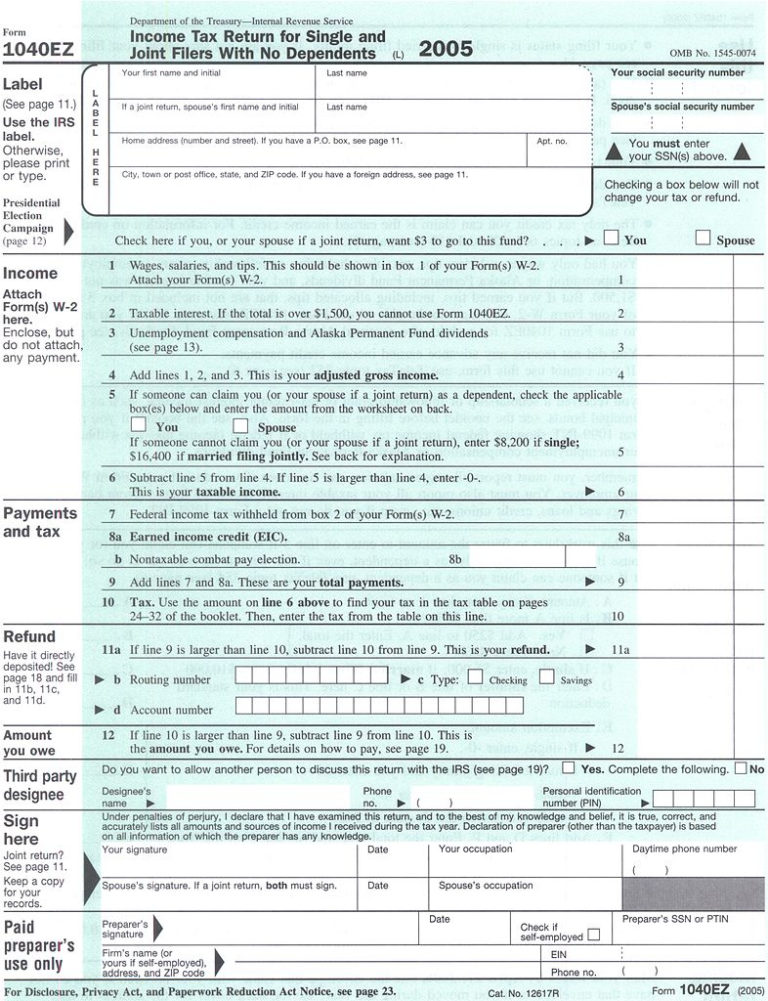

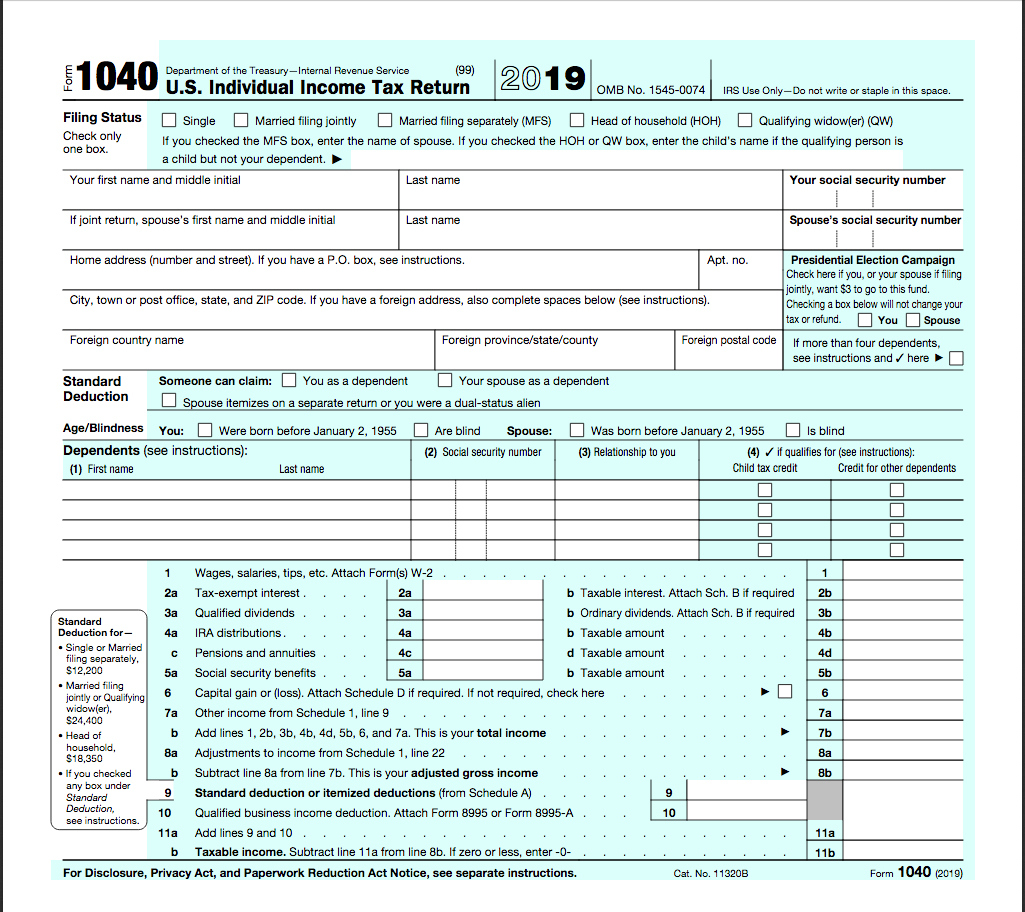

File Form 1040EZ 2005 Jpg Wikipedia 2021 Tax Forms 1040 Printable

2022 estimated income tax payments for individuals. We last updated the individual income tax return in january 2023, so this is the. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. These where to file addresses. This form is for income earned in tax year 2022, with tax returns due.

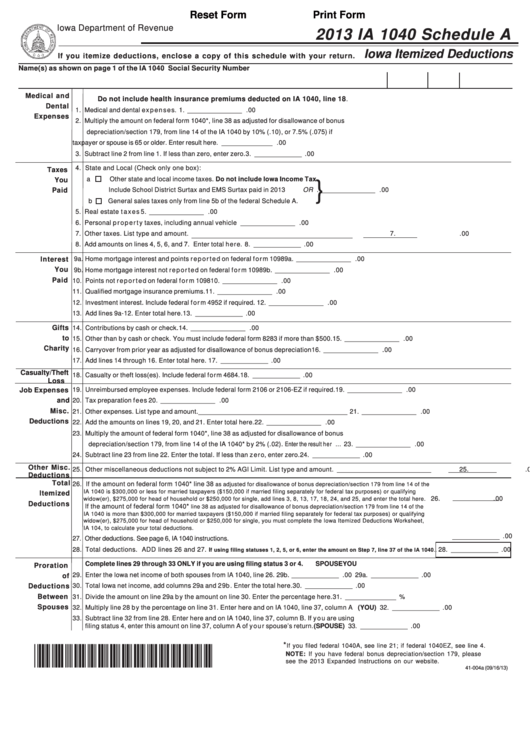

Illinois 1040 schedule form Fill out & sign online DocHub

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. This form is for income earned in tax year 2022, with tax returns due in april. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in illinois. Department of the treasury—internal revenue.

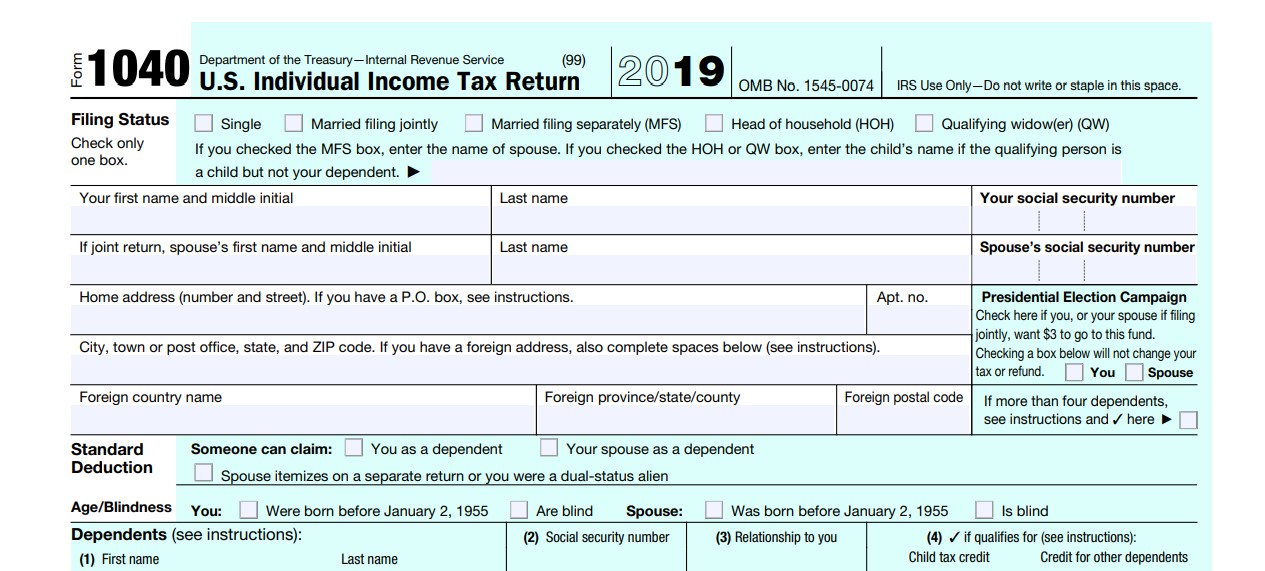

Irs 1040 Form 2020 Printable Illinois 1040 Tax Form 2019 1040 Form

Irs use only—do not write or staple in this. These where to file addresses. Ad get ready for tax season deadlines by completing any required tax forms today. Department of the treasury—internal revenue service. Amended individual income tax return:

Irs 1040 Form 2020 Printable Illinois 1040 Tax Form 2019 1040 Form

This form is for income earned in tax year 2022, with tax returns due in april. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web form title pdf; 2022 employee's illinois withholding allowance certificate:.

IL DoR IL1040 Schedule M 20202022 Fill and Sign Printable Template

Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Ad get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april. Web find irs mailing addresses for taxpayers and tax professionals filing.

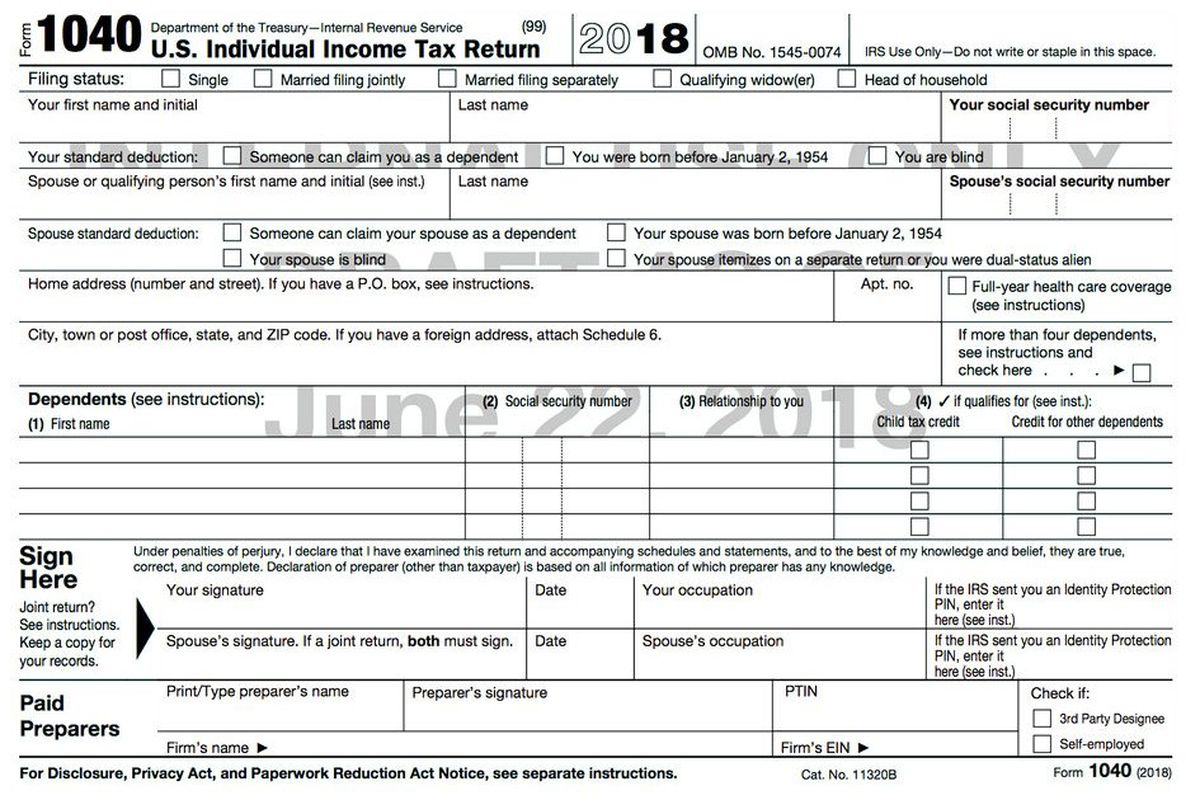

The IRS Shrinks The 1040 Tax Form But The Workload Stays 1040 Form

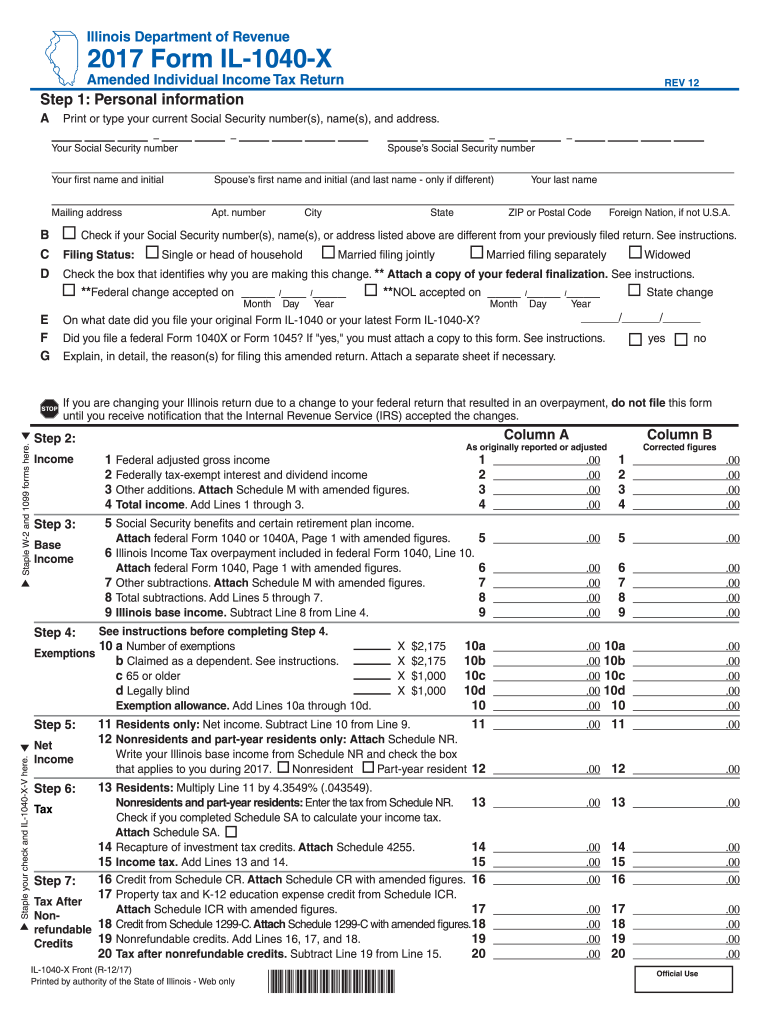

Amended individual income tax return: Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. 2023 estimated income tax payments for individuals. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Department of the treasury—internal revenue service.

2020 ILLINOIS TAX FILING SEASON BEGAN MONDAY JANUARY 27 2021 Tax

Web form title pdf; Web illinois department of revenue. For more information about the illinois. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Information see the instructions for line 5 and.

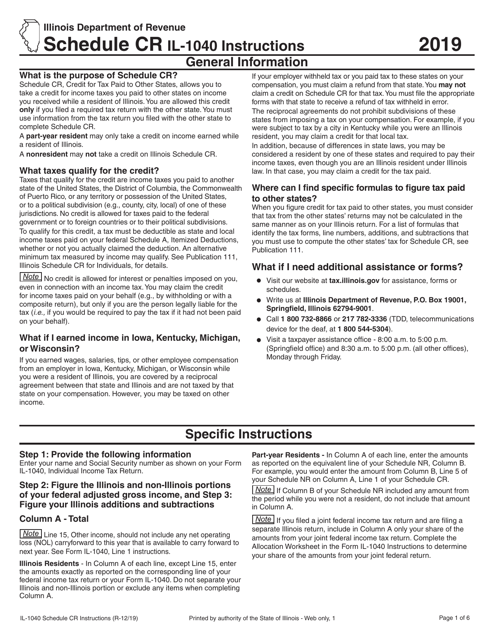

Download Instructions for Form IL1040 Schedule CR Credit for Tax Paid

Complete, edit or print tax forms instantly. We last updated the individual income tax return in january 2023, so this is the. 2022 credit for tax paid to other states. 2021 illinois individual income tax return: 2022 estimated income tax payments for individuals.

Il 1040X Instructions 2017 Fill Out and Sign Printable PDF Template

2021 illinois individual income tax return: For more information about the illinois. Web illinois department of revenue. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Income tax rate the illinois income tax rate is 4.95 percent.

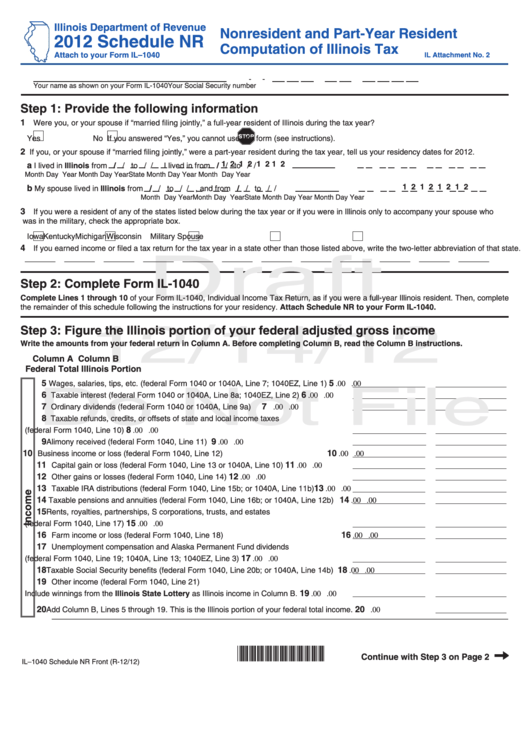

Form Il1040 Draft Schedule Nr Nonresident And PartYear Resident

Department of the treasury—internal revenue service. Information see the instructions for line 5 and. Amended individual income tax return: 2023 illinois estimated income tax payments for individuals: 2022 credit for tax paid to other states.

Web 2021 Illinois Net Loss Deduction.

Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Payment voucher for individual income tax: Irs use only—do not write or staple in this. Web illinois department of revenue.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Amended individual income tax return: These where to file addresses. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in illinois.

For More Information About The Illinois.

2023 illinois estimated income tax payments for individuals: This form is for income earned in tax year 2022, with tax returns due in april. 2022 estimated income tax payments for individuals. 2022 employee's illinois withholding allowance certificate:.

We Last Updated The Individual Income Tax Return In January 2023, So This Is The.

Web illinois department of revenue. Information see the instructions for line 5 and. Income tax rate the illinois income tax rate is 4.95 percent. Department of the treasury—internal revenue service.