Irs Form 3520 Penalty

Irs Form 3520 Penalty - Taxpayer has had any dealings with foreign trusts or received large amounts of money from abroad. 4 taxpayer receives a cp15 notice of penalty. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web the irs may also assess a penalty under internal revenue code section 6039f equal to 25 percent of a foreign gift if it is not timely disclosed on a form 3520. Get ready for tax season deadlines by completing any required tax forms today. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Taxpayer becomes the beneficiary of a foreign trust or receives income from a foreign inheritance or gift, the government requires that the taxpayer submit irs form. 2 form 3520 penalty abatement is highly complex. Web in addition, it provides tax relief for taxpayers who’ve been assessed penalties under irc § 6677 for failure to file these forms. 3 tax court lawyer fees, risks, and unknowns.

2 form 3520 penalty abatement is highly complex. Web below are the criteria that must be met in order for a 3520 penalty to be contested in the tax court. Complete, edit or print tax forms instantly. 4 taxpayer receives a cp15 notice of penalty. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Get ready for tax season deadlines by completing any required tax forms today. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Taxpayer has had any dealings with foreign trusts or received large amounts of money from abroad. Web up to 25% for failure to report the receipt of a gift or inheritance from a foreign person (sec. Web 1 form 3520 penalty.

Once a form 3520 penalty is assessed, if the penalty is not satisfied, the irs. Web up to 25% for failure to report the receipt of a gift or inheritance from a foreign person (sec. Get ready for tax season deadlines by completing any required tax forms today. Web in addition, it provides tax relief for taxpayers who’ve been assessed penalties under irc § 6677 for failure to file these forms. Form 3520 penalties begin at $10,000 per violation, and can. Complete, edit or print tax forms instantly. Contents [ hide] 1 exemptions. Web examiners will determine applicable taxes, interest and penalties, including a fraud penalty (75%) for the highest year and a willful fbar penalty (up to 50%) will be. Taxpayer becomes the beneficiary of a foreign trust or receives income from a foreign inheritance or gift, the government requires that the taxpayer submit irs form. When a us person has certain transactions with a foreign trust or received large gifts from a foreign person (including individuals or entities) they may have.

A District Court Determines that a Sole Beneficiary of a Foreign Trust

Failing to file a required form 3520 exposes a us person to enormous penalties. Web the federal district court struck down the irs's imposition of a 35% civil penalty for failing to timely file a form 3520 — an information return used to report,. Contents [ hide] 1 exemptions. Ad talk to our skilled attorneys by scheduling a free consultation.

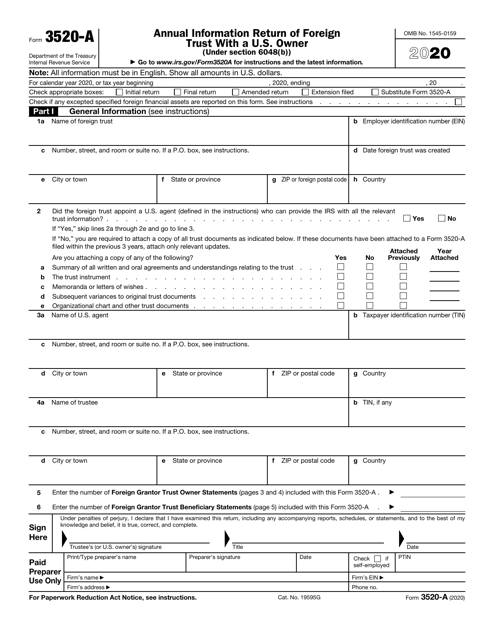

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Web the irs may also assess a penalty under internal revenue code section 6039f equal to 25 percent of a foreign gift if it is not timely disclosed on a form 3520. 2 form 3520 penalty abatement is highly complex. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain.

The Tax Times IRS Sending SemiAutomated Penalties For Late Filed Form

Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web the irs may assess an annual penalty equal to 35 percent of the gross value of the trust or 35 percent of the gross value of the property transferred from the trust.

You Received an IRS CP15 Notice (re Form 3520 Penalty), What Now

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web the federal district court struck down the irs's imposition of a 35% civil penalty for failing to timely file a form 3520 — an information return used to report,. Web the irs may assess an annual penalty equal to 35 percent of the gross value of.

Taking the 3520 Penalty Fight to the IRS by Attacking the Penalty on

Web the irs may assess an annual penalty equal to 35 percent of the gross value of the trust or 35 percent of the gross value of the property transferred from the trust if a form 3520 is. Get ready for tax season deadlines by completing any required tax forms today. Contents [ hide] 1 exemptions. Web the internal revenue.

New IRS Form 3520 Penalty Relief Waiver and Reporting Exemptions under

Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Web in addition, it provides tax relief for taxpayers who’ve been assessed penalties under irc § 6677 for failure to file these forms. 6039f (c) (1) (b)) (form 3520). Get ready for tax.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

Complete, edit or print tax forms instantly. Failing to file a required form 3520 exposes a us person to enormous penalties. 3 tax court lawyer fees, risks, and unknowns. Form 3520 penalties begin at $10,000 per violation, and can. Web the irs may also assess a penalty under internal revenue code section 6039f equal to 25 percent of a foreign.

Bringing the 3520 Penalty Fight to the IRS Contesting a 3520 Penalty

Owner is subject to an initial penalty equal to the greater of $10,000 or 5% of the gross value of the portion of the trust’s assets treated as owned by the u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. Taxpayer becomes the beneficiary of a foreign trust or receives income from a foreign inheritance or.

IRS Creates “International Practice Units” for their IRS Revenue Agents

Web below are the criteria that must be met in order for a 3520 penalty to be contested in the tax court. Owner is subject to an initial penalty equal to the greater of $10,000 or 5% of the gross value of the portion of the trust’s assets treated as owned by the u.s. Web the penalty for filing a.

IRS Form 3520 San Francisco Tax Attorney SF Tax Counsel

4 taxpayer receives a cp15 notice of penalty. Web the internal revenue service (irs) is always interested to know if a u.s. Web 1 form 3520 penalty. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web the penalty for filing a.

Web In Addition, It Provides Tax Relief For Taxpayers Who’ve Been Assessed Penalties Under Irc § 6677 For Failure To File These Forms.

Owner is subject to an initial penalty equal to the greater of $10,000 or 5% of the gross value of the portion of the trust’s assets treated as owned by the u.s. 6039f (c) (1) (b)) (form 3520). Web examiners will determine applicable taxes, interest and penalties, including a fraud penalty (75%) for the highest year and a willful fbar penalty (up to 50%) will be. With respect to the foreign trust.

Web Up To 25% For Failure To Report The Receipt Of A Gift Or Inheritance From A Foreign Person (Sec.

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. 4 taxpayer receives a cp15 notice of penalty. Complete, edit or print tax forms instantly. When a us person has certain transactions with a foreign trust or received large gifts from a foreign person (including individuals or entities) they may have.

Taxpayer Has Had Any Dealings With Foreign Trusts Or Received Large Amounts Of Money From Abroad.

Web the irs may also assess a penalty under internal revenue code section 6039f equal to 25 percent of a foreign gift if it is not timely disclosed on a form 3520. Web the federal district court struck down the irs's imposition of a 35% civil penalty for failing to timely file a form 3520 — an information return used to report,. Form 3520 penalties begin at $10,000 per violation, and can. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web 1 form 3520 penalty. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Web below are the criteria that must be met in order for a 3520 penalty to be contested in the tax court. Web the irs may assess an annual penalty equal to 35 percent of the gross value of the trust or 35 percent of the gross value of the property transferred from the trust if a form 3520 is.