Louisiana Tax Exemption Form

Louisiana Tax Exemption Form - Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. & girls state of louisiana, in exemption certificate. Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file. Web this form is to be completed by an authorized buyer and forwarded to the seller for retention. You can find resale certificates for other states here. Web you may be entitled to claim exemption from withholding louisiana income tax if you meet one of the two qualifications below. (c) you performed employment duties in more than one state during the calendar year; (d) the wages are not paid for employment as a. File your clients' individual, corporate and composite partnership extension in bulk.

(d) the wages are not paid for employment as a. You can download a pdf of the louisiana exemption certificate for. (c) you performed employment duties in more than one state during the calendar year; If any of these links are broken, or you can't find the form you need, please let us know. Web find out when all state tax returns are due. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. File your clients' individual, corporate and composite partnership extension in bulk. (b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year; Web for your wages to be exempt from louisiana income taxes, (a) you must be a nonresident of louisiana;

It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. You incurred no liability for louisiana income tax for the prior year and you anticipate that you will incur no liability for such income tax for the current year. For this purpose, you incur tax liability if your. Web you may be entitled to claim exemption from withholding louisiana income tax if you meet one of the two qualifications below. Boys state of louisiana, inc. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. (d) the wages are not paid for employment as a. & girls state of louisiana, in exemption certificate. Misuse of the certificate by the seller or the purchaser will subject either party to the civil and criminal penalties provided by law.

Louisiana Hotel Tax Exempt Form Fill Online, Printable, Fillable

(d) the wages are not paid for employment as a. You can find resale certificates for other states here. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. For this purpose, you incur tax liability if your. Web a sales tax exemption.

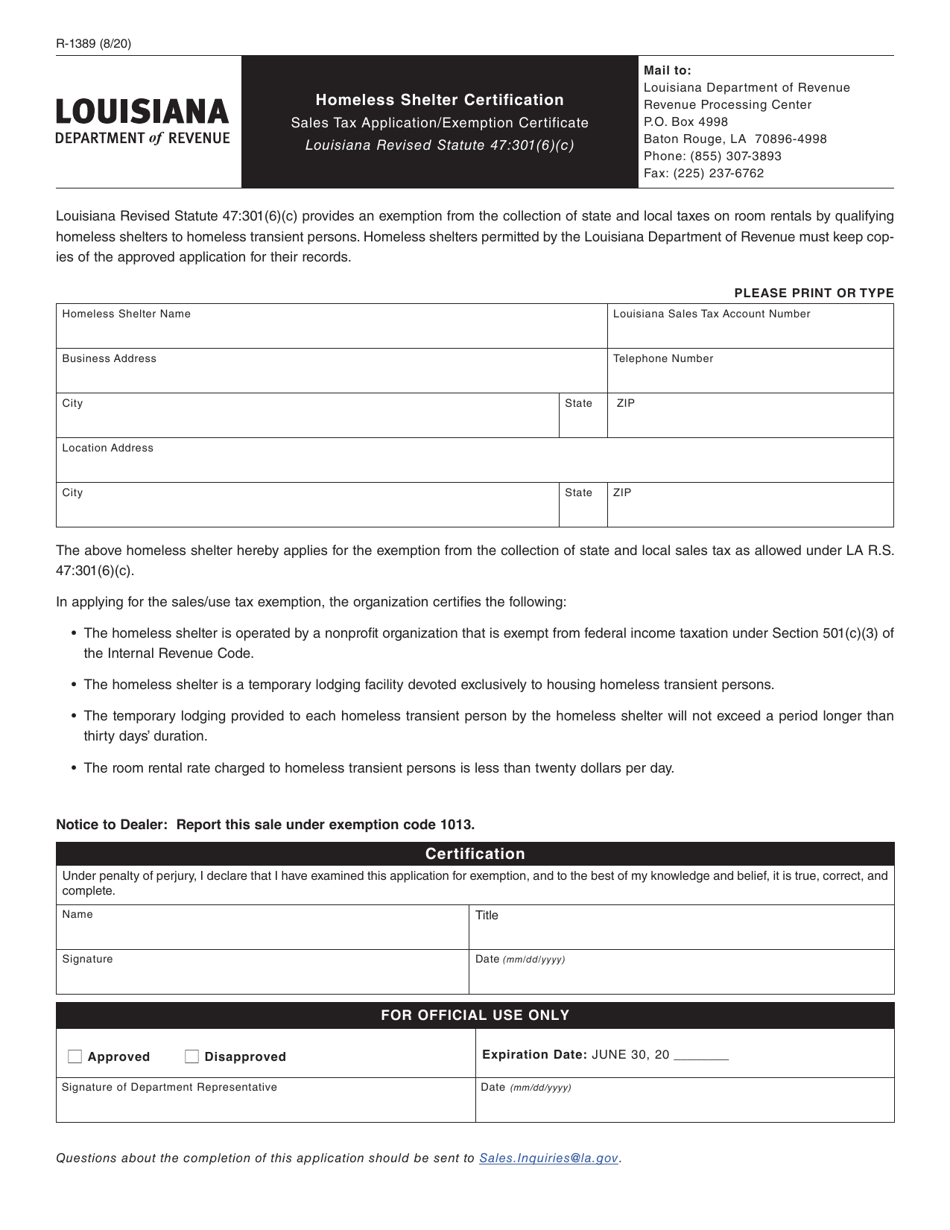

Form R1389 Download Fillable PDF or Fill Online Homeless Shelter

For this purpose, you incur tax liability if your. You incurred no liability for louisiana income tax for the prior year and you anticipate that you will incur no liability for such income tax for the current year. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name.

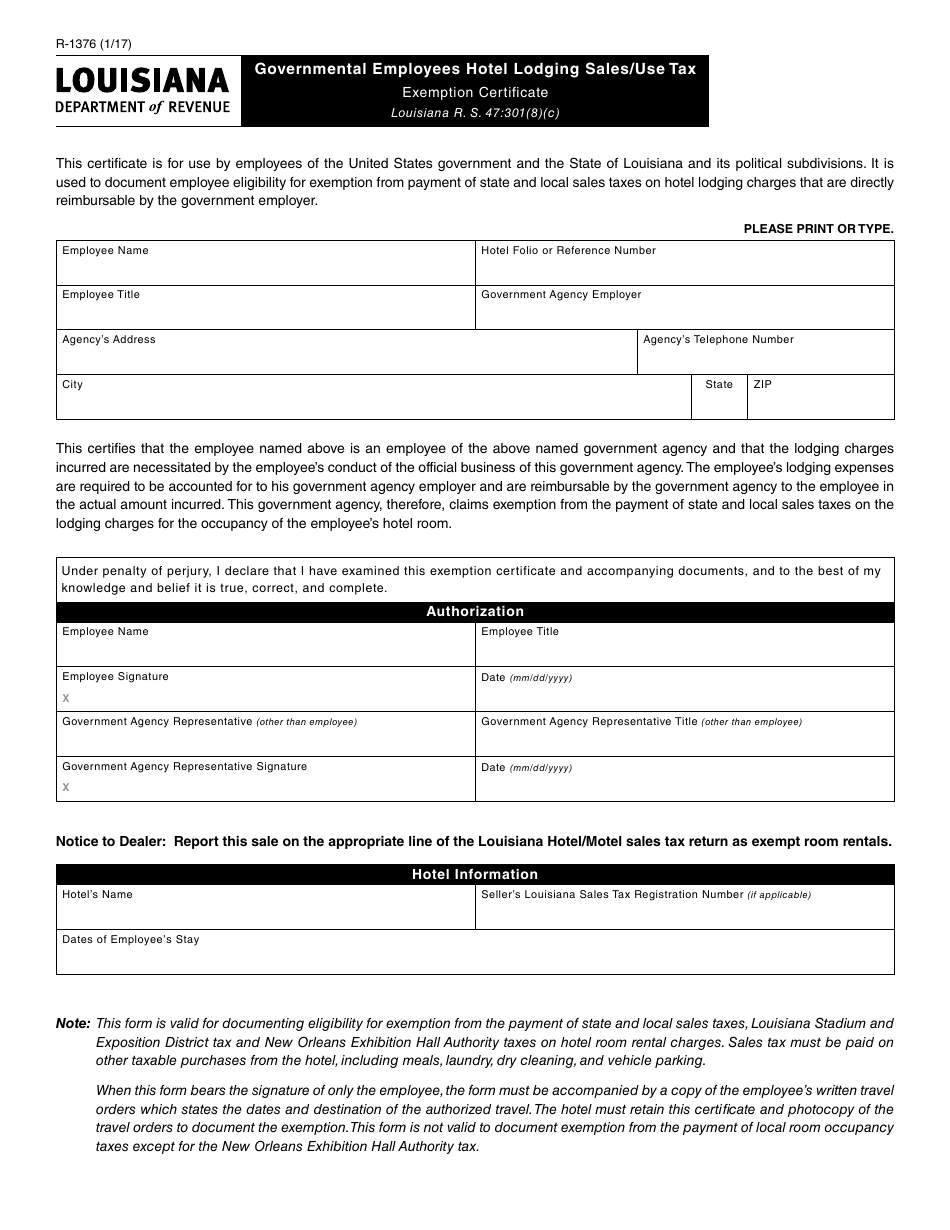

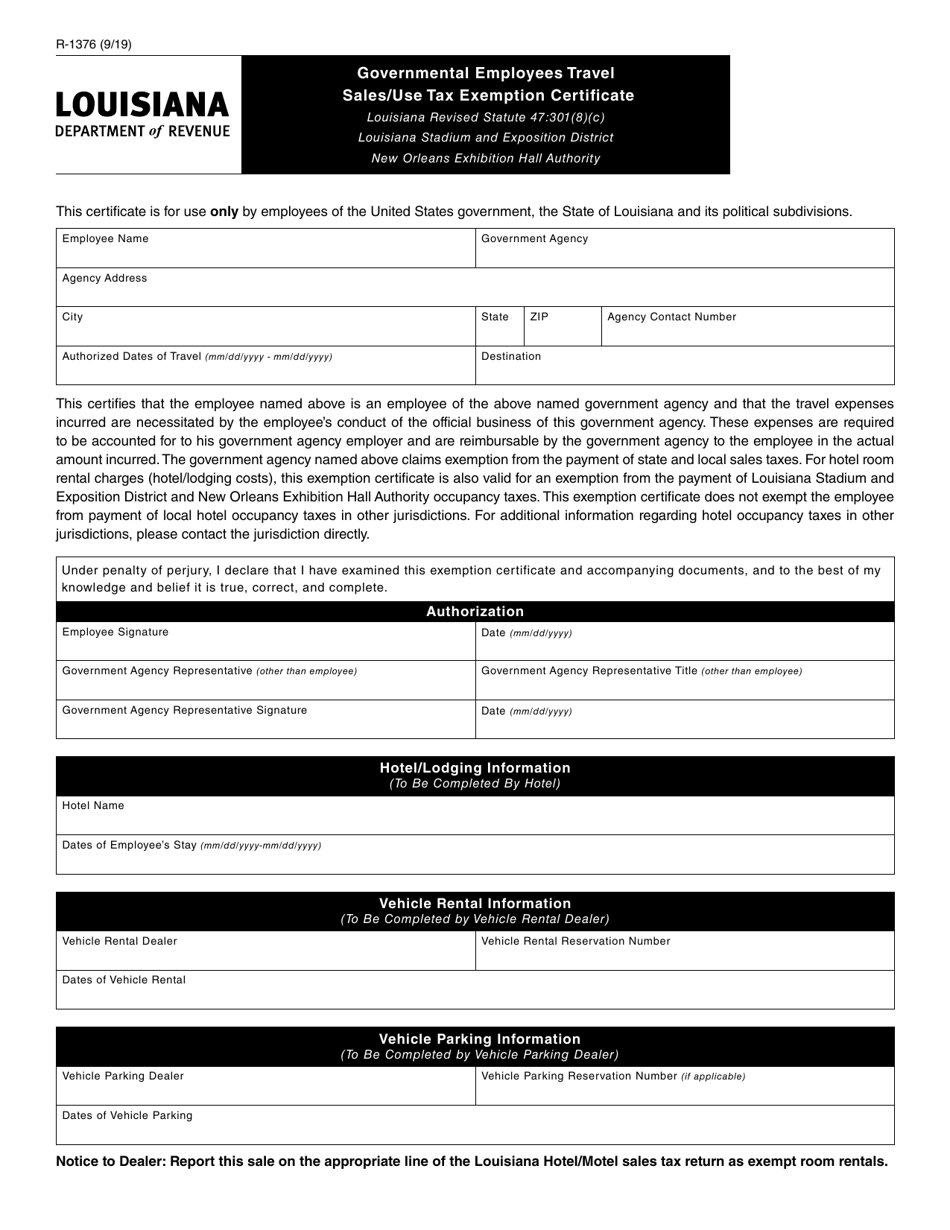

Form R1376 Download Fillable PDF or Fill Online Governmental Employees

Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. Web find out when all state tax returns are due. You can find resale certificates for other states here. You incurred no liability for louisiana.

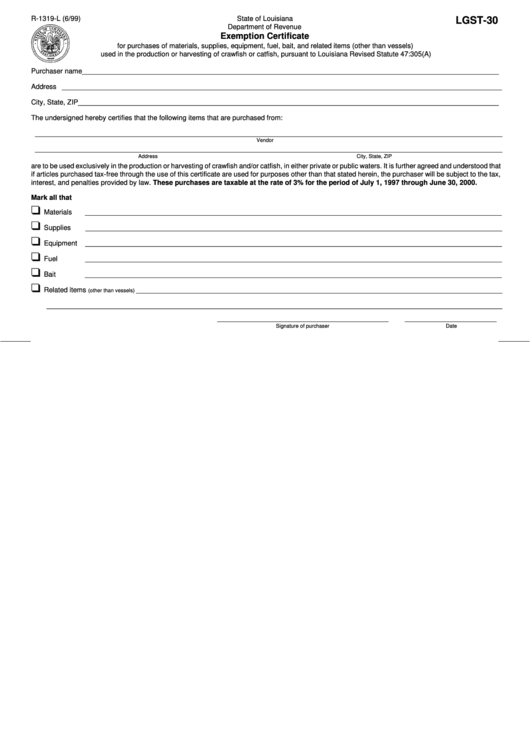

Form R1319 Download Fillable PDF or Fill Online Crawfish Production or

File your clients' individual, corporate and composite partnership extension in bulk. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file. Web this.

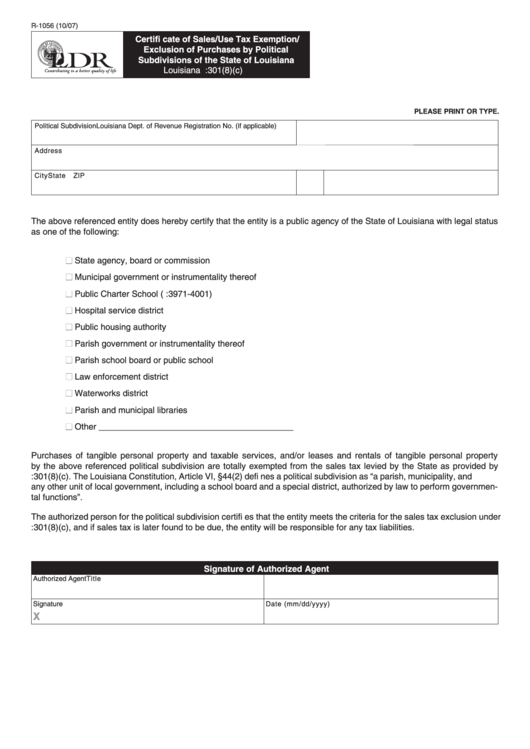

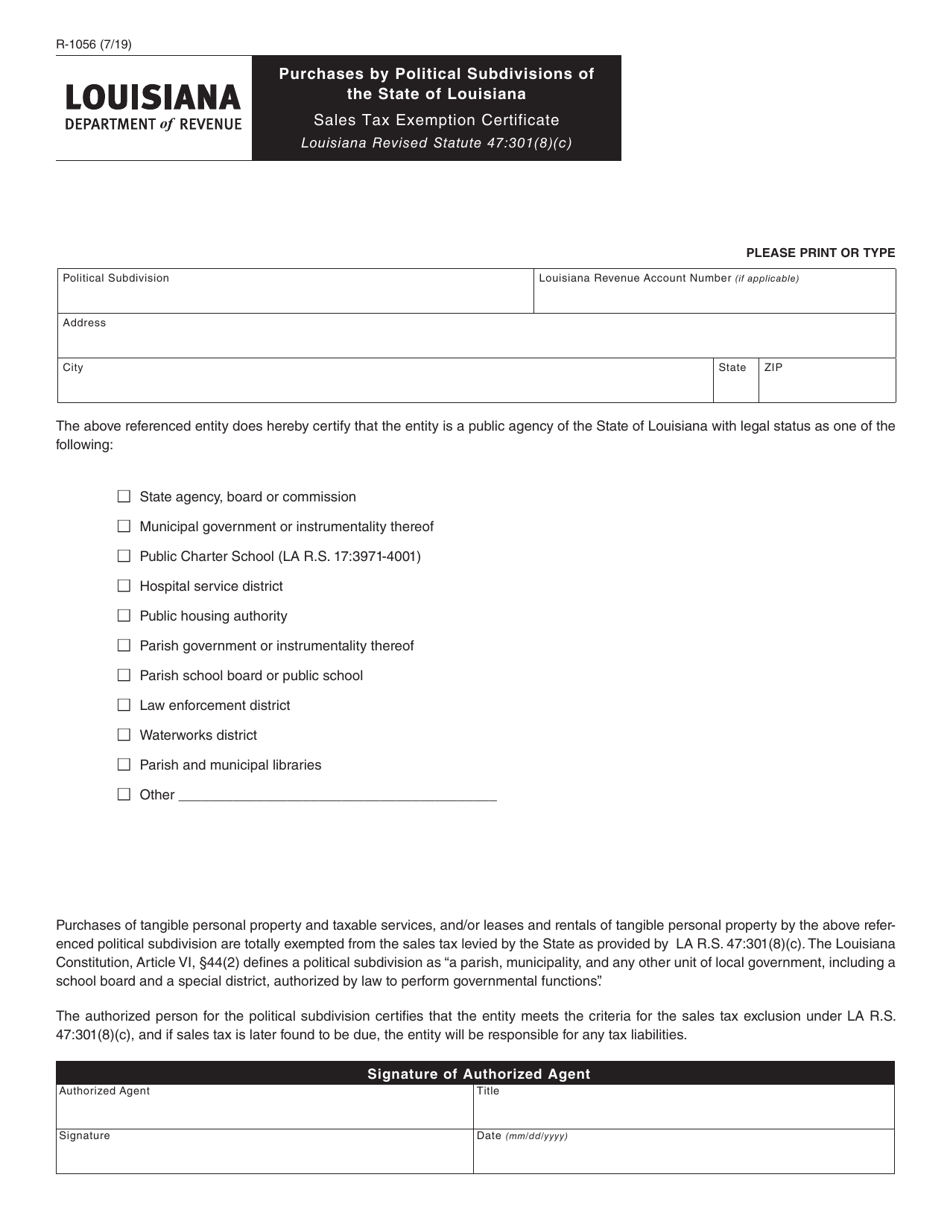

Fillable Form R1056 Certifi Cate Of Sales/use Tax Exemption

Web certificate of sales/use tax exemption/exclusion of purchases by political subdivisions of the state of louisiana. Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. & girls state of louisiana,.

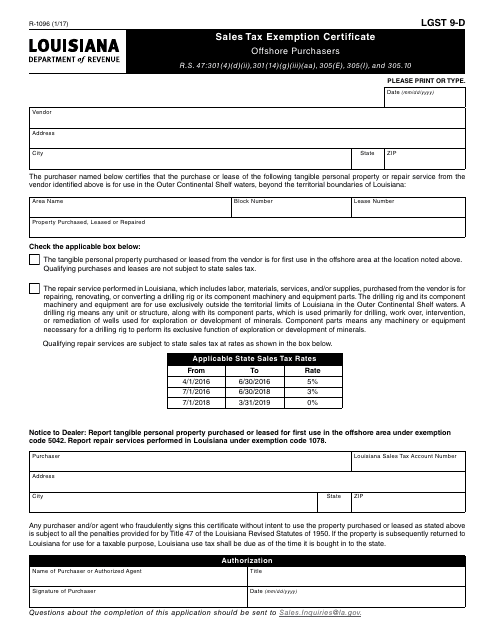

Form R1096 Download Fillable PDF or Fill Online Sales Tax Exemption

Web find out when all state tax returns are due. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. For this purpose, you incur tax liability if your. Web this certificate is for use.

Fillable Form R1319L Exemption Certificate State Of Louisiana

See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. You can find resale certificates for other states here. Web find out when all state tax returns are due..

Form R1376 Download Fillable PDF or Fill Online Governmental Employees

& girls state of louisiana, in exemption certificate. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. File your clients' individual, corporate and.

Form R1056 Download Fillable PDF or Fill Online Certificate of Sales

It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. (d) the wages are not paid for employment as a. (b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year; You can.

Tax Exemption Form Fill Online, Printable, Fillable, Blank pdfFiller

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the louisiana sales tax. You can find resale certificates for other states here. For this purpose, you incur tax liability if your. Web find out when all state tax returns are due. Misuse of the certificate.

Web For Your Wages To Be Exempt From Louisiana Income Taxes, (A) You Must Be A Nonresident Of Louisiana;

(b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year; You can download a pdf of the louisiana exemption certificate for. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. If any of these links are broken, or you can't find the form you need, please let us know.

Misuse Of The Certificate By The Seller Or The Purchaser Will Subject Either Party To The Civil And Criminal Penalties Provided By Law.

Boys state of louisiana, inc. For this purpose, you incur tax liability if your. Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file. You can find resale certificates for other states here.

& Girls State Of Louisiana, In Exemption Certificate.

You incurred no liability for louisiana income tax for the prior year and you anticipate that you will incur no liability for such income tax for the current year. (c) you performed employment duties in more than one state during the calendar year; See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions.

It Is Used To Document Employee Eligibility For Exemption From Payment Of State Sales Taxes On Hotel Lodging Charges That Are Directly Reimbursable By The Government Employer.

Web certificate of sales/use tax exemption/exclusion of purchases by political subdivisions of the state of louisiana. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the louisiana sales tax. Web this form is to be completed by an authorized buyer and forwarded to the seller for retention. (d) the wages are not paid for employment as a.