Ma Solar Tax Credit Form

Ma Solar Tax Credit Form - Web this tax credit can be combined with the federal solar tax credit for even greater savings come tax season. Web home energy audits. Complete schedule sc and enter the amount of the credit using credit code septic on schedule cms. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. 1 80% the massachusetts global warming solutions act’s (gwsa) call for a cut in greenhouse. Web how do you file for the federal solar tax credit in massachusetts? Web how it works the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through. Web you can find rebates, loans and financing for electric vehicles, appliances, home energy assessments, solar electricity and far more and then go directly to the sponsor’s website. This form is for income earned in tax year 2022, with tax. The credit is worth 15% of the total cost of the system, but there.

In calculating the available credit amount, the. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. Web we last updated the solar and wind energy credit in april 2023, so this is the latest version of schedule ec, fully updated for tax year 2022. Complete schedule sc and enter the amount of the credit using credit code septic on schedule cms. You can download or print current or. Do not complete part ii. Web this tax credit can be combined with the federal solar tax credit for even greater savings come tax season. Web national grid additional benefits of solar power in massachusetts: Web the maximum allowable credit for a taxpayer is $1,000 during the entire time the taxpayer resides in the same principal residence. This form is for income earned in tax year 2022, with tax.

Although there is a $5,000 limit on the credit, ppa or. 1 80% the massachusetts global warming solutions act’s (gwsa) call for a cut in greenhouse. Web the 2023 chevrolet bolt. The credit is worth 15% of the total cost of the system, but there. Web the federal solar tax credit (solar itc) lets homeowners claim 30% of an installed solar pv system’s cost as a tax credit with form 5695. The federal tax credit falls to 26% starting in 2033. You can download or print current or. Web massachusetts homeowners can also receive a credit on their state income taxes when they install solar panels. Find local solar quotes get quote join the 1,587 homeowners who got free quotes in the past 30. Web the maximum allowable credit for a taxpayer is $1,000 during the entire time the taxpayer resides in the same principal residence.

Understanding How Solar Tax Credits Work

Web we last updated massachusetts schedule ec in april 2023 from the massachusetts department of revenue. Web national grid additional benefits of solar power in massachusetts: The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web the federal solar tax credit (solar itc) lets homeowners claim 30% of an installed solar pv system’s cost.

Applying for the Solar Tax Credit is as Easy as 123! ARE Solar

Web you can find rebates, loans and financing for electric vehicles, appliances, home energy assessments, solar electricity and far more and then go directly to the sponsor’s website. 30%, up to a lifetime. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web we last updated the solar and wind energy credit in april.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

It added income limits, price caps and. Complete schedule sc and enter the amount of the credit using credit code septic on schedule cms. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web how do you file for the federal solar tax credit in massachusetts? Web you can find rebates, loans and financing.

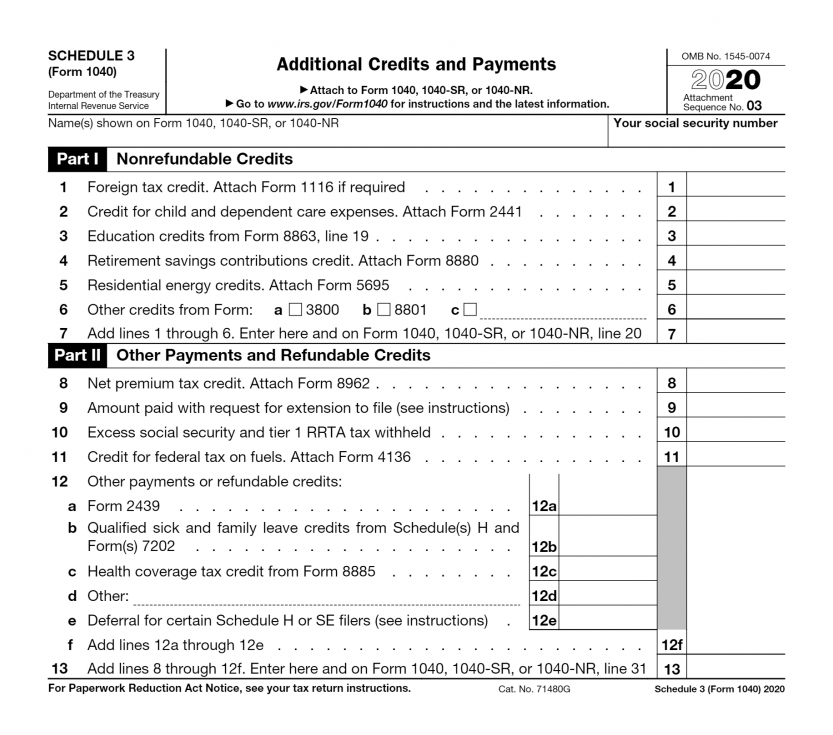

2020 Solar Tax Forms Solar Energy Solutions

Do not complete part ii. Web this tax credit can be combined with the federal solar tax credit for even greater savings come tax season. Wondering whether you qualify, or how to file? The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Solar tax credits and programs massachusetts solar tax exemptions there are two.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

The federal tax credit falls to 26% starting in 2033. Wondering whether you qualify, or how to file? This form is for income earned in tax year 2022, with tax. Web home energy audits. Web how it works the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from.

arizona solar tax credit form Donny Somers

Find local solar quotes get quote join the 1,587 homeowners who got free quotes in the past 30. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web to claim the credit on your tax return: Web massachusetts homeowners can also receive a credit on their state income taxes when they install solar panels..

How Does the Federal Solar Tax Credit Work?

Web we last updated the solar and wind energy credit in april 2023, so this is the latest version of schedule ec, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax. Solar tax credits and programs massachusetts solar tax exemptions there are two major tax exemptions for. Web the federal solar.

How to Claim Your Solar Tax Credit A.M. Sun Solar

30%, up to a lifetime. Web how it works the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through. Web national grid additional benefits of solar power in massachusetts: The amount of the credit you can take is a percentage of the total improvement expenses in.

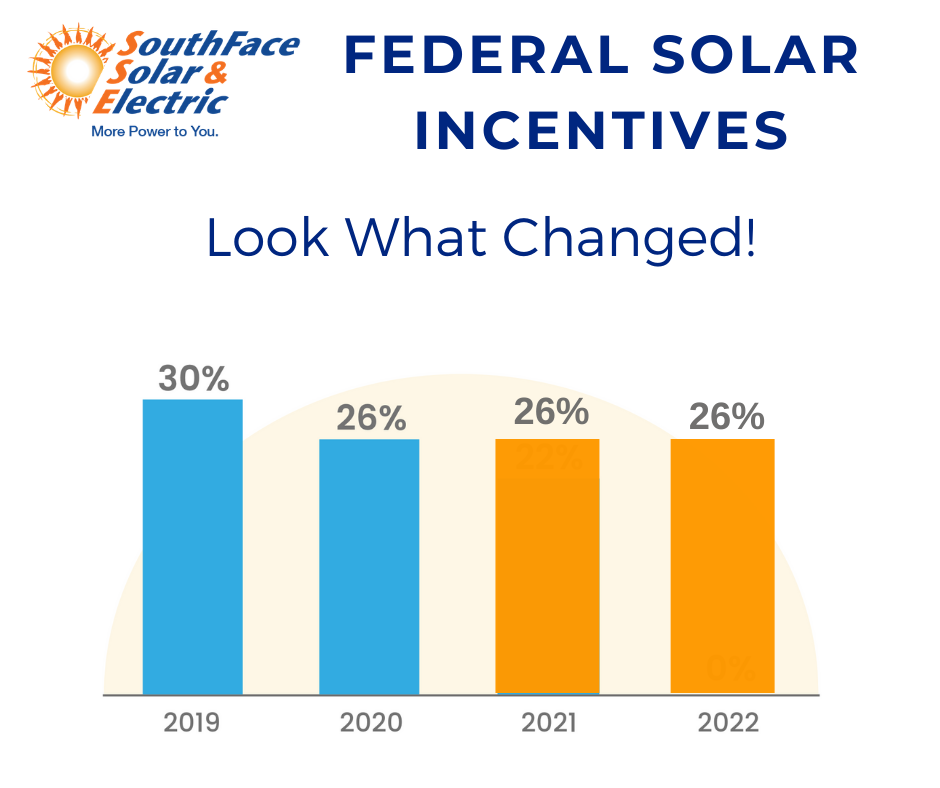

Solar Tax Credit Extension

Web massachusetts homeowners can also receive a credit on their state income taxes when they install solar panels. Web we last updated the solar and wind energy credit in april 2023, so this is the latest version of schedule ec, fully updated for tax year 2022. Web the 2023 chevrolet bolt. If you checked the “no” box, you cannot claim.

How To Claim Your Solar Tax Credit designmlm

This form is for income earned in tax year 2022, with tax. Wondering whether you qualify, or how to file? Web how it works the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through. The credit is worth 15% of the total cost of the system,.

If Your Solar Energy System Costs $20,000, Your Federal Solar Tax Credit Would Be $20,000 X 30% = $6,000.

Wondering whether you qualify, or how to file? The federal tax credit falls to 26% starting in 2033. Web the federal solar tax credit (solar itc) lets homeowners claim 30% of an installed solar pv system’s cost as a tax credit with form 5695. In calculating the available credit amount, the.

Web How Do You File For The Federal Solar Tax Credit In Massachusetts?

Web we last updated massachusetts schedule ec in april 2023 from the massachusetts department of revenue. 30%, up to a lifetime. Web the 2023 chevrolet bolt. Web national grid additional benefits of solar power in massachusetts:

Find Local Solar Quotes Get Quote Join The 1,587 Homeowners Who Got Free Quotes In The Past 30.

Web massachusetts homeowners can also receive a credit on their state income taxes when they install solar panels. Web this tax credit can be combined with the federal solar tax credit for even greater savings come tax season. Web you can find rebates, loans and financing for electric vehicles, appliances, home energy assessments, solar electricity and far more and then go directly to the sponsor’s website. Do not complete part ii.

It Added Income Limits, Price Caps And.

You can download or print current or. Web the maximum allowable credit for a taxpayer is $1,000 during the entire time the taxpayer resides in the same principal residence. 1 80% the massachusetts global warming solutions act’s (gwsa) call for a cut in greenhouse. Web the federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar pv system paid for by the taxpayer.