Mailing Address For Form 941-X

Mailing Address For Form 941-X - The irs provides different addresses for businesses located in. Web where to mail form 941? Web internal revenue service p.o. The employee retention credit is presented on line 18a and line 26a of the april 2022. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Box 409101 ogden, ut 84409 special filing addresses for exempt organizations; Web mailing addresses for forms 941. The mailing address of your form 941. Enter the calendar year of the quarter you’re correcting, and select the date you discovered. Web form 941 x mailing address entirely depends on your business location.

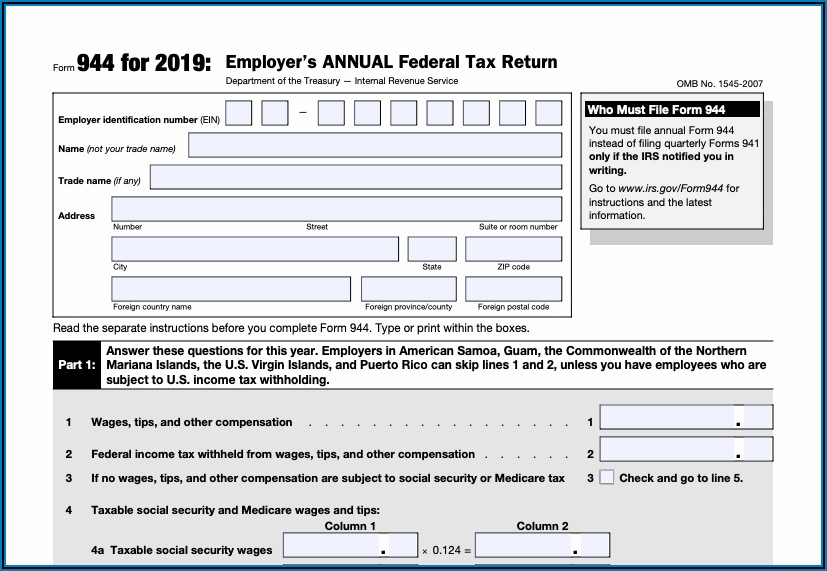

Enter the calendar year of the quarter you’re correcting, and select the date you discovered. Now that you’re allowed to have both your ppp loans and. The employee retention credit is presented on line 18a and line 26a of the april 2022. The mailing address of your form 941. Connecticut, delaware, district of columbia,. Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. Web where to mail form 941? Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web 22 rows addresses for forms beginning with the number 9. Web form 941 x mailing address entirely depends on your business location.

Web form 941 x mailing address entirely depends on your business location. ( for a copy of a form, instruction, or publication) address to mail form to irs: If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Web internal revenue service p.o. Web where to mail form 941? The employee retention credit is presented on line 18a and line 26a of the april 2022. Web mailing addresses for forms 941. Now that you’re allowed to have both your ppp loans and. Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. The mailing address of your form 941.

1040 Es Form Mailing Address Form Resume Examples My3aZYk8wp

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Now that you’re allowed to have both your ppp loans and. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses where paper. The employee retention.

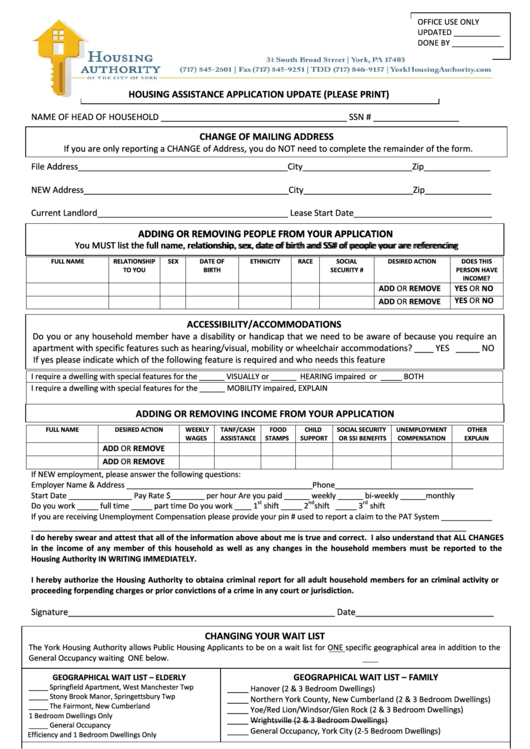

FREE 35+ Change Forms in PDF

Connecticut, delaware, district of columbia,. Box 409101 ogden, ut 84409 special filing addresses for exempt organizations; Now that you’re allowed to have both your ppp loans and. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses where paper. The employee retention credit is presented on.

Irs Form 1040x Mailing Address Form Resume Examples Ze12Dg03jx

If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Federal, state, and local governmental entities; Web where to mail form 941? Now that you’re allowed to have both your ppp loans and. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns.

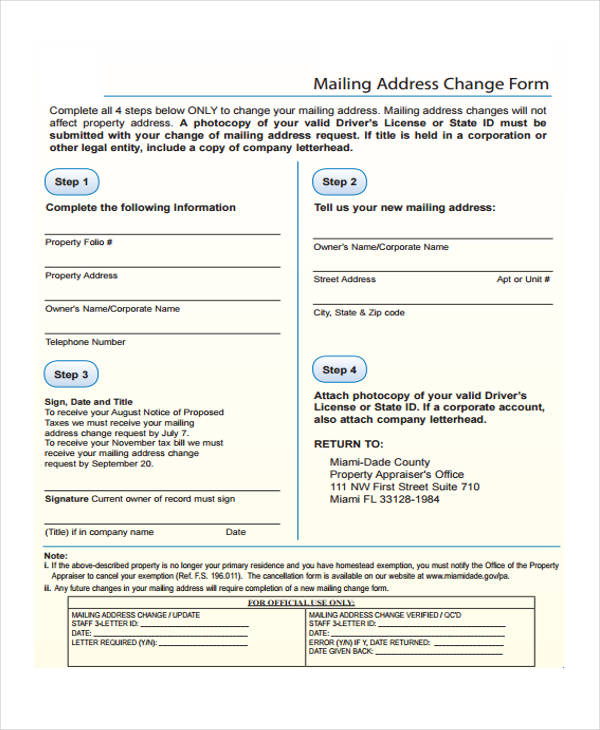

Change Of Mailing Address Form printable pdf download

The mailing address of your form 941. The irs provides different addresses for businesses located in. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web internal revenue service p.o. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced.

Irs 501 C 3 Change Of Address Form Form Resume Examples pv9wX1zeY7

Connecticut, delaware, district of columbia,. Federal, state, and local governmental entities; Web 22 rows addresses for forms beginning with the number 9. Box 409101 ogden, ut 84409 special filing addresses for exempt organizations; The employee retention credit is presented on line 18a and line 26a of the april 2022.

Form 941 X mailing address Fill online, Printable, Fillable Blank

Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. The mailing address you use depends on your business’s location. The employee retention credit is presented on line 18a and line 26a of the april 2022. Web 22 rows addresses for forms beginning with.

Form BR001 Download Fillable PDF or Fill Online Employer Designated

Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. Federal, state, and local governmental entities; Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. The mailing address of your form 941. Web.

Free Printable Address Book Template in 2020 Address book template

The mailing address of your form 941. The employee retention credit is presented on line 18a and line 26a of the april 2022. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web internal revenue service p.o. Now that you’re allowed to have both your ppp loans and.

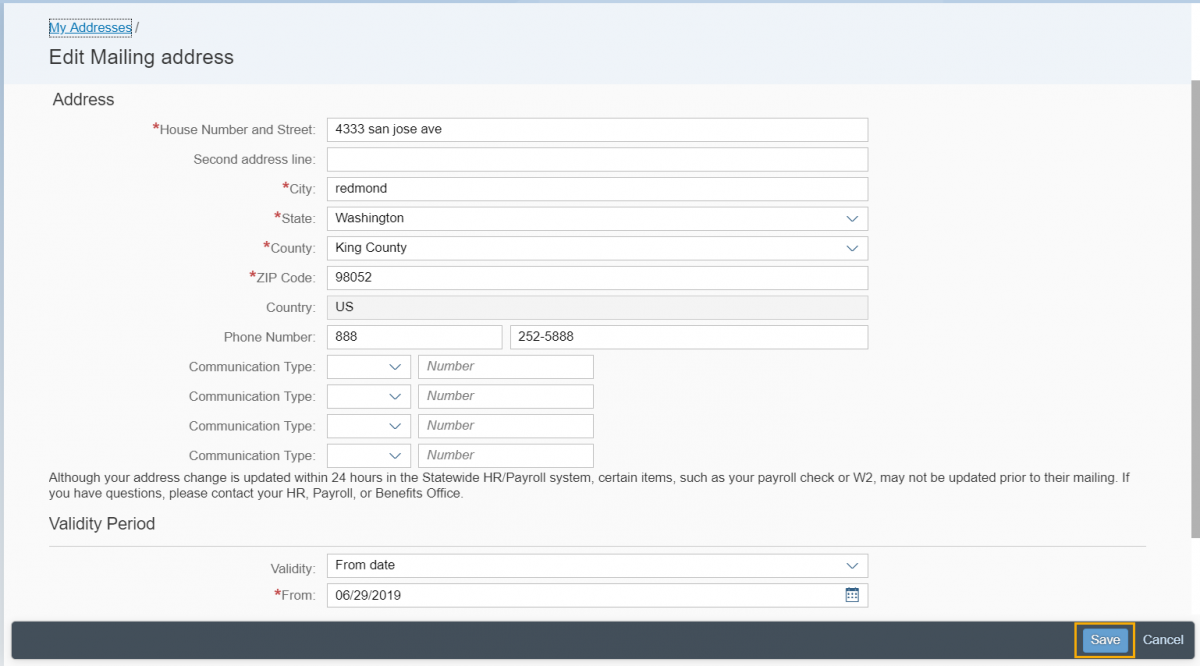

MyPortal create mailing address Office of Financial Management

The irs provides different addresses for businesses located in. The mailing address you use depends on your business’s location. The practitioner can change the overpayment amount to $100 ($500 erc less the $400 that is still owed. Web mailing addresses for forms 941. Federal, state, and local governmental entities;

FREE 9+ Sample Address Request Forms in MS Word PDF

Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. Web 22 rows addresses for forms beginning with the number 9. Web form 941 x mailing address entirely depends on your business location. Web mailing addresses for forms 941. The employee retention credit is.

The Mailing Address You Use Depends On Your Business’s Location.

The employee retention credit is presented on line 18a and line 26a of the april 2022. Box 409101 ogden, ut 84409 special filing addresses for exempt organizations; ( for a copy of a form, instruction, or publication) address to mail form to irs: Web form 941 x mailing address entirely depends on your business location.

Web Internal Revenue Service P.o.

Web 22 rows addresses for forms beginning with the number 9. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Web mailing addresses for forms 941. Federal, state, and local governmental entities;

Connecticut, Delaware, District Of Columbia,.

The mailing address of your form 941. The irs provides different addresses for businesses located in. Web form 941 mailing addresses are changed | irs encourages electronic filing of employment tax returns the irs announced that, effective immediately, the addresses where paper. The practitioner can change the overpayment amount to $100 ($500 erc less the $400 that is still owed.

Web Where To Mail Form 941?

Web after reading this article, you’ll know how to fill out the forms correctly and the exact mailing address to use when filing your tax returns. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Now that you’re allowed to have both your ppp loans and. Enter the calendar year of the quarter you’re correcting, and select the date you discovered.