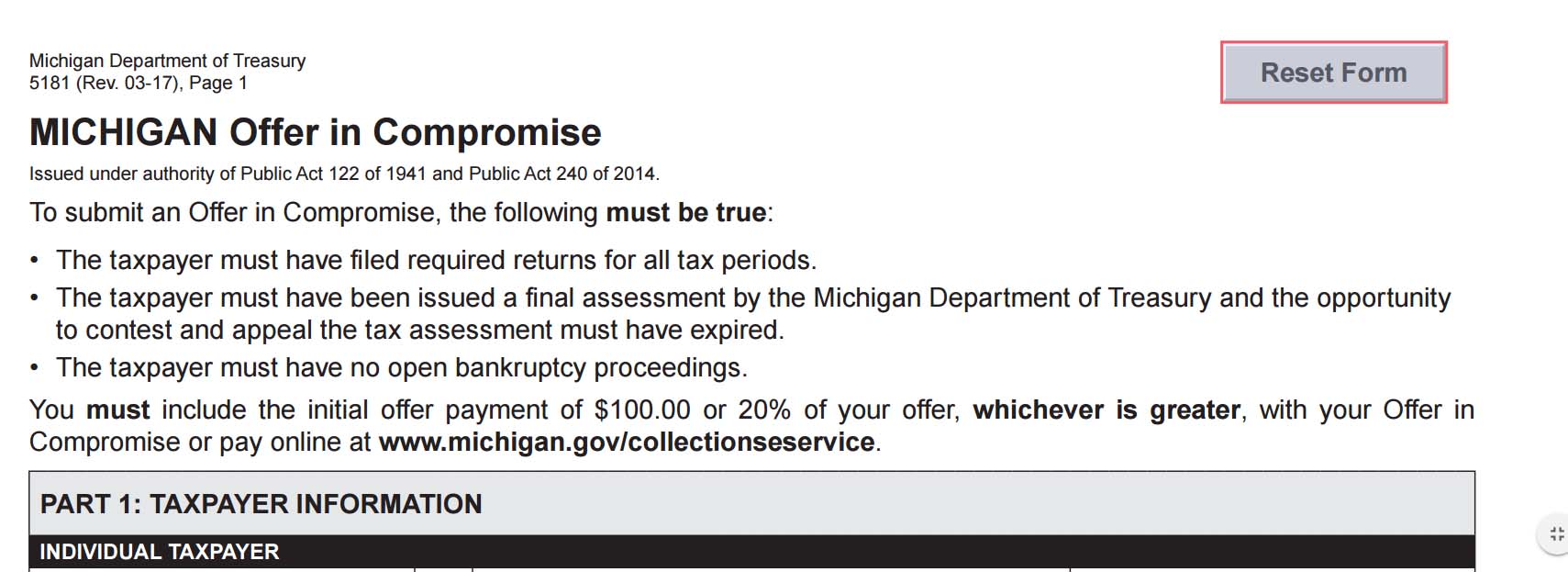

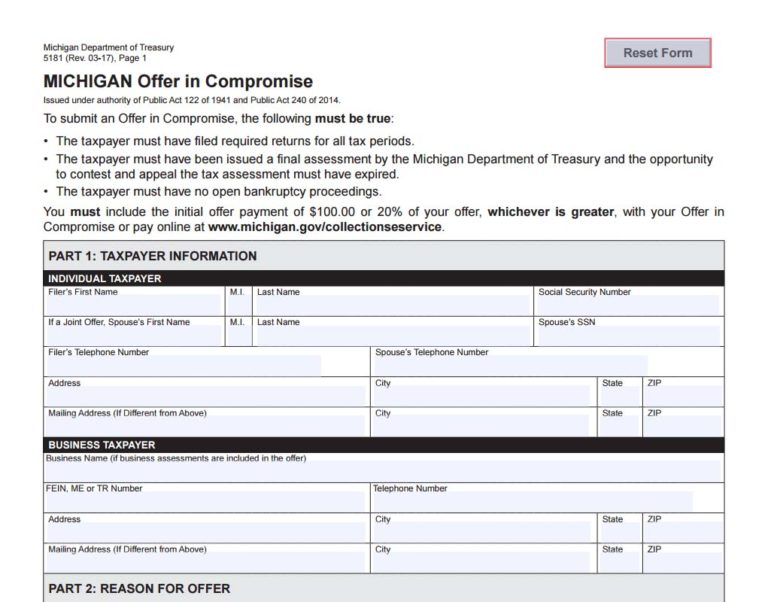

Michigan Offer In Compromise Form 5181

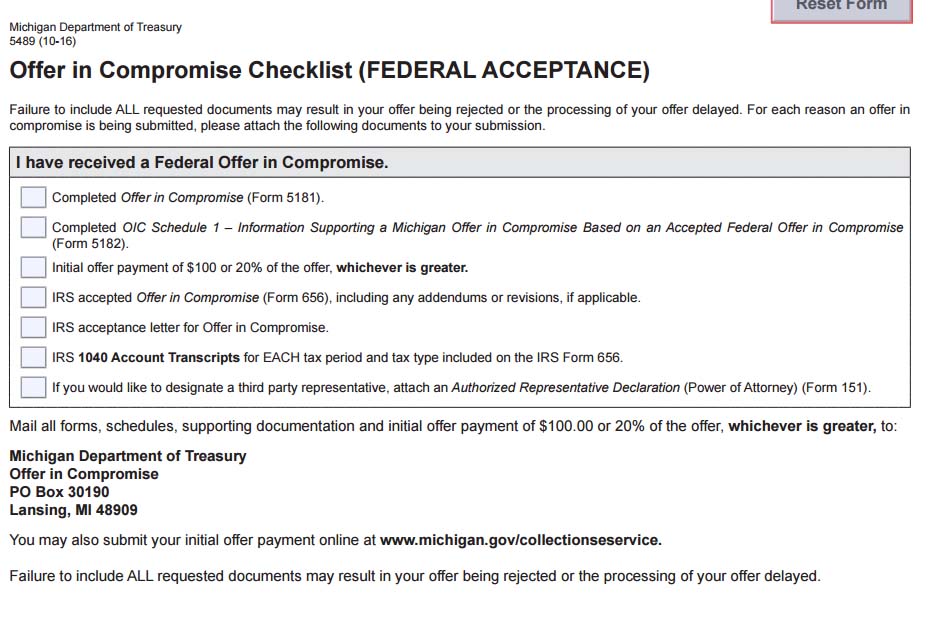

Michigan Offer In Compromise Form 5181 - Submit form 5181, form 5184, schedule 2b. Web (form 5182), and include all documents requested in the instructions. Web offer in compromise (form 5181). Web taxpayers who wish to submit an oic must submit the offer using form 5181. The schedule you file is. Evidence of (1) furnishing or offering or promising to furnish, or (2) accepting or offering or promising to accept, a valuable consideration in. Web the taxpayer must complete and submit form 5181, michigan offer in compromise. Web the business doubt as to collectability (michigan) form is 17 pages long and contains: Web on june 16, 2015, governor rick snyder signed into law enrolled sb 100,1 eliminating the requirement that taxpayers pay all taxes, penalties, and interest before they can have. 11 they must submit this form along with all accompanying information and a non.

Web offer in compromise (form 5181). Web (form 5182), and include all documents requested in the instructions. Web on june 16, 2015, governor rick snyder signed into law enrolled sb 100,1 eliminating the requirement that taxpayers pay all taxes, penalties, and interest before they can have. Submit form 5181 and form 5183, schedule 2a. Web the business doubt as to collectability (michigan) form is 17 pages long and contains: Web taxpayers who wish to submit an oic must submit the offer using form 5181. Submit form 5181, form 5184, schedule 2b. 11 they must submit this form along with all accompanying information and a non. Submit form 5181 and schedule 3. Web 1) every offer in compromise filed with the michigan department of treasury must include form 5181.

(see instructions for more information on doubt as to collectability.) complete and. Submit form 5181, form 5184, schedule 2b. Submit form 5181 and form 5183, schedule 2a. To submit an offer in compromise,. Web taxpayers who wish to submit an oic must submit the offer using form 5181. Evidence of (1) furnishing or offering or promising to furnish, or (2) accepting or offering or promising to accept, a valuable consideration in. Submit form 5181 and schedule 3. Web taxpayers who wish to submit an oic must submit the offer using form 5181. Web the taxpayer must complete and submit form 5181, michigan offer in compromise. Web on june 16, 2015, governor rick snyder signed into law enrolled sb 100,1 eliminating the requirement that taxpayers pay all taxes, penalties, and interest before they can have.

Michigan Offer In Compromise How To Settle MI Tax Debt

Submit form 5181 and form 5183, schedule 2a. Web 1) every offer in compromise filed with the michigan department of treasury must include form 5181. Web offer in compromise (form 5181). I am unable to pay the tax. The schedule you file is.

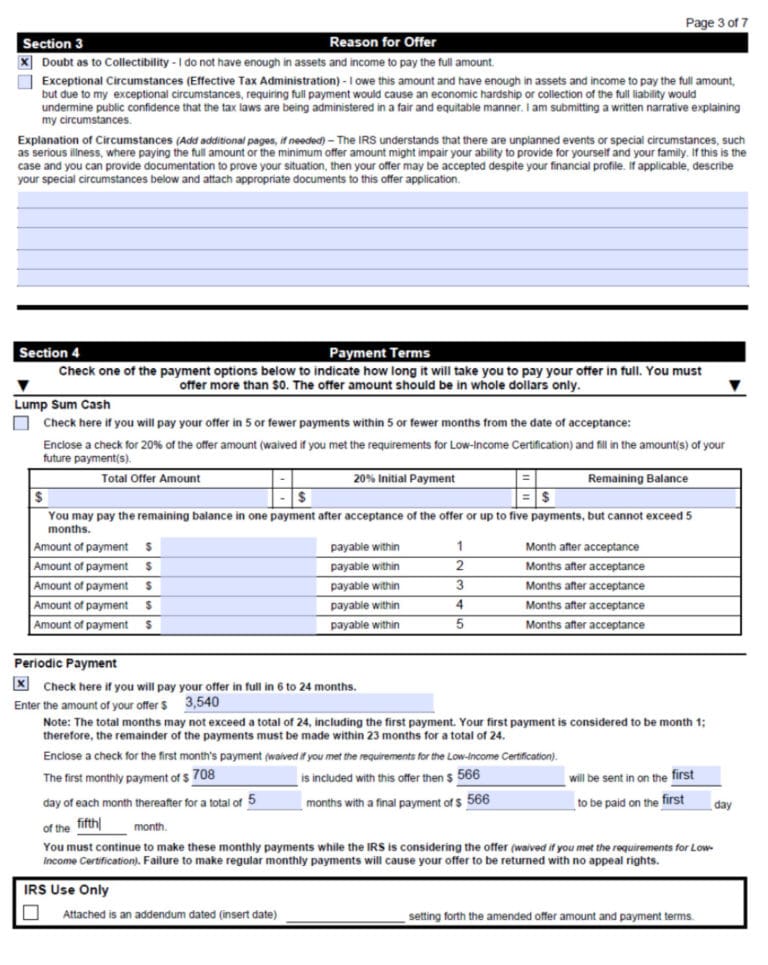

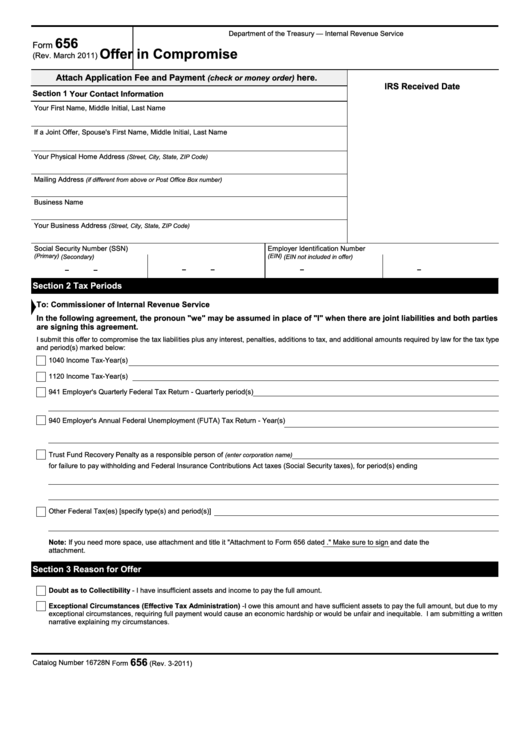

Irs Offer Compromise Form 656 Universal Network

I am unable to pay the tax. Web the business doubt as to collectability (michigan) form is 17 pages long and contains: Web taxpayers who wish to submit an oic must submit the offer using form 5181. Web (form 5182), and include all documents requested in the instructions. Evidence of (1) furnishing or offering or promising to furnish, or (2).

Offer in compromise How to Get the IRS to Accept Your Offer Law

To submit an offer in compromise,. I am unable to pay the tax. Web on june 16, 2015, governor rick snyder signed into law enrolled sb 100,1 eliminating the requirement that taxpayers pay all taxes, penalties, and interest before they can have. Web (form 5182), and include all documents requested in the instructions. Web yes, you can send in a.

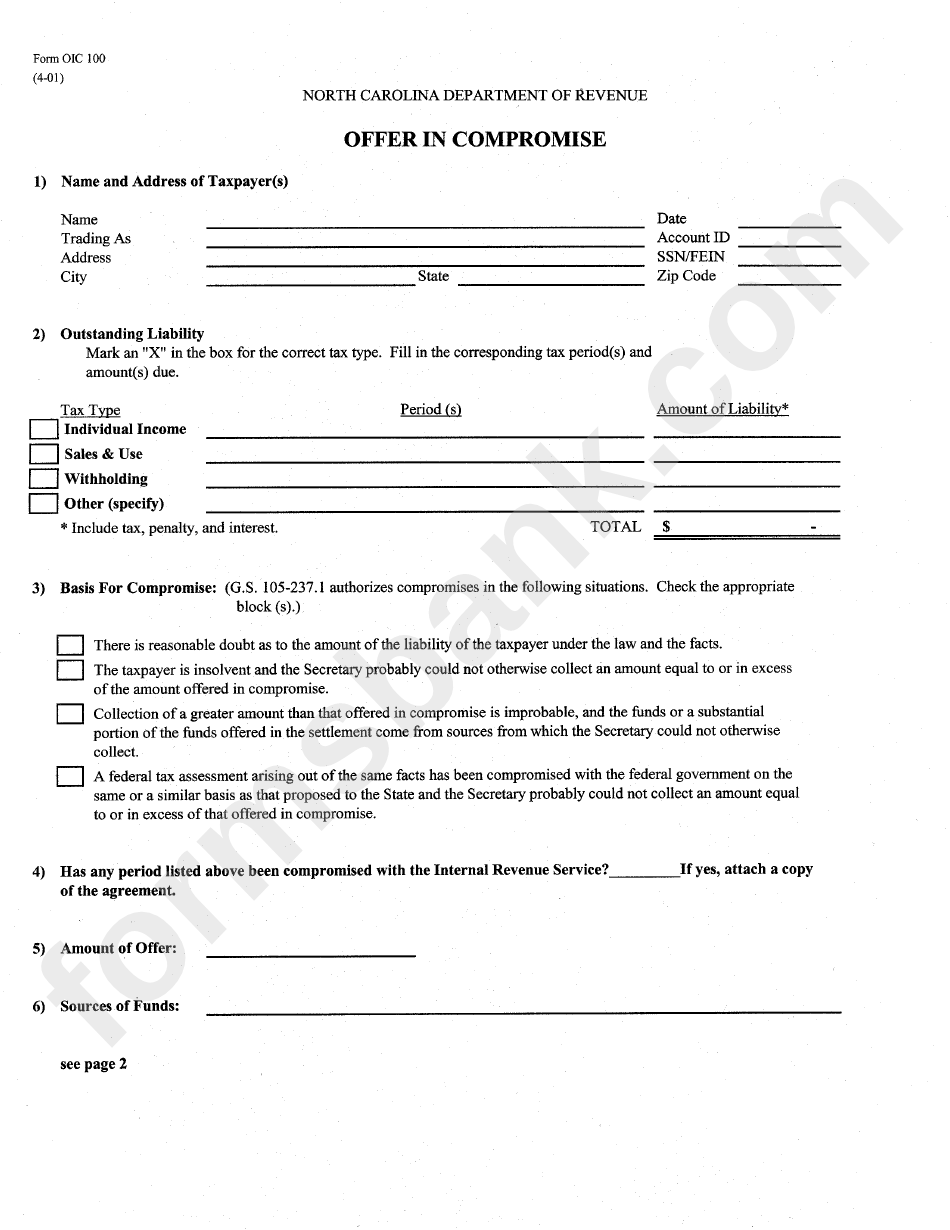

Form Oic 100 Offer In Compromise printable pdf download

Web (form 5182), and include all documents requested in the instructions. Web the taxpayer must complete and submit form 5181, michigan offer in compromise. Web taxpayers who wish to submit an oic must submit the offer using form 5181. The schedule you file is. 11 they must submit this form along with all accompanying information and a non.

Michigan Offer In Compromise How To Settle MI Tax Debt

2) every offer must be filed with a schedule. To submit an offer in compromise,. Web the taxpayer must complete and submit form 5181, michigan offer in compromise. (see instructions for more information on doubt as to collectability.) complete and. I am unable to pay the tax.

Case Decision Offer In Compromise For IRS Back Taxes Not

Web taxpayers who wish to submit an oic must submit the offer using form 5181. Web the business doubt as to collectability (michigan) form is 17 pages long and contains: 2) every offer must be filed with a schedule. Web if an entity, as opposed to an individual, is eligible to submit an offer in compromise due to doubt as.

Offer In Compromise July 2017

Web the taxpayer must complete and submit form 5181, michigan offer in compromise. The schedule you file is. Submit form 5181, form 5184, schedule 2b. Web yes, you can send in a new form 5181, “michigan offer in compromise.” this would be processed by treasury personnel as a new application. I am unable to pay the tax.

Fillable Form 656 Offer In Compromise printable pdf download

Web the business doubt as to collectability (michigan) form is 17 pages long and contains: Web the taxpayer must complete and submit form 5181, michigan offer in compromise. Web taxpayers who wish to submit an oic must submit the offer using form 5181. Web (form 5182), and include all documents requested in the instructions. To submit an offer in compromise,.

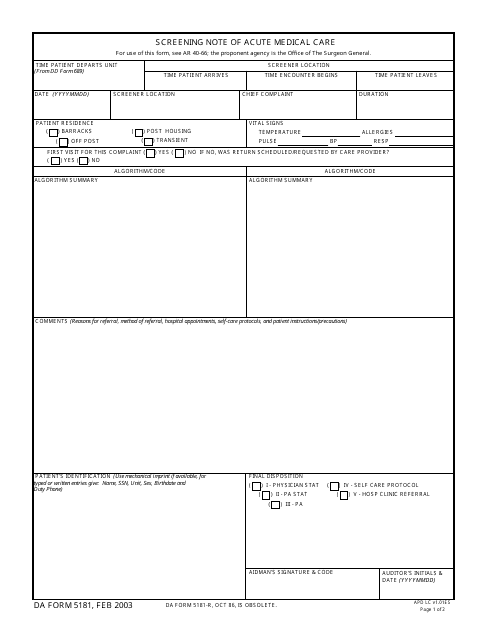

DA Form 5181 Download Fillable PDF, Screening Note of Acute Medical

Web offer in compromise (form 5181). Web the taxpayer must complete and submit form 5181, michigan offer in compromise. Web yes, you can send in a new form 5181, “michigan offer in compromise.” this would be processed by treasury personnel as a new application. Web the business doubt as to collectability (michigan) form is 17 pages long and contains: To.

Michigan Offer In Compromise How To Settle MI Tax Debt

Submit form 5181 and schedule 3. 11 they must submit this form along with all accompanying information and a non. Web 1) every offer in compromise filed with the michigan department of treasury must include form 5181. (see instructions for more information on doubt as to collectability.) complete and. 2) every offer must be filed with a schedule.

Evidence Of (1) Furnishing Or Offering Or Promising To Furnish, Or (2) Accepting Or Offering Or Promising To Accept, A Valuable Consideration In.

11 they must submit this form along with all accompanying information and a non. 2) every offer must be filed with a schedule. Web on june 16, 2015, governor rick snyder signed into law enrolled sb 100,1 eliminating the requirement that taxpayers pay all taxes, penalties, and interest before they can have. Web taxpayers who wish to submit an oic must submit the offer using form 5181.

I Am Unable To Pay The Tax.

Submit form 5181 and form 5183, schedule 2a. Web 1) every offer in compromise filed with the michigan department of treasury must include form 5181. Submit form 5181 and schedule 3. Web taxpayers who wish to submit an oic must submit the offer using form 5181.

11 They Must Submit This Form Along With All Accompanying Information And A Non.

To submit an offer in compromise,. Web the business doubt as to collectability (michigan) form is 17 pages long and contains: Web offer in compromise (form 5181). Web the taxpayer must complete and submit form 5181, michigan offer in compromise.

Web If An Entity, As Opposed To An Individual, Is Eligible To Submit An Offer In Compromise Due To Doubt As To Liability, The Following Documents Need To Be Prepared And Submitted:

(see instructions for more information on doubt as to collectability.) complete and. The schedule you file is. Web (form 5182), and include all documents requested in the instructions. Submit form 5181, form 5184, schedule 2b.