Michigan W 4 Form

Michigan W 4 Form - Any altering of a form to change a tax year or any reported tax period outside of. C.permanent home (domicile) is located in the following renaissance zone: Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. If you fail or refuse to submit. A) your spouse, for whom you have. To download michigan income tax form go to. Web instructions included on form: This form is for income earned in tax year 2022, with tax returns due in april. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Web 2020 sales, use and withholding 4% and 6% monthly/quarterly and amended monthly/quarterly worksheet:

If too little is withheld, you will generally owe tax when you file your tax return. To download michigan income tax form go to. Web 2020 sales, use and withholding 4% and 6% monthly/quarterly and amended monthly/quarterly worksheet: Web city tax withholding (w4) forms if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. New hire operations center, p.o. A) your spouse, for whom you have. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Access the wolverine access web site click. Resources state michigan w4 web page (18.98 kb) news fye 2023 bi. Any altering of a form to change a tax year or any reported tax period outside of.

New hire operations center, p.o. Web 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017. C.permanent home (domicile) is located in the following renaissance zone: Ad get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april. If too little is withheld, you will generally owe tax when you file your tax return. To download federal tax forms go to www.irs.gov. Resources state michigan w4 web page (18.98 kb) news fye 2023 bi. Sales and other dispositions of capital assets: Web instructions for completing the 8233.

How Do I Claim 0 On My W 4 2020 eetidesigns

Any altering of a form to change a tax year or any reported tax period outside of. Web instructions included on form: If you fail or refuse to file this form, your employer must withhold michigan. If you fail or refuse to submit. If too little is withheld, you will generally owe tax when you file your tax return.

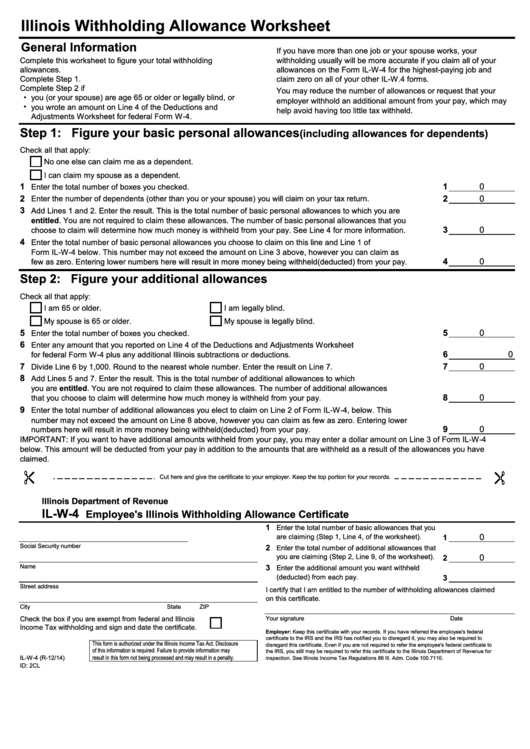

Illinois W 4 Form Printable 2022 W4 Form

Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. If you fail or refuse to submit. Access the wolverine access web.

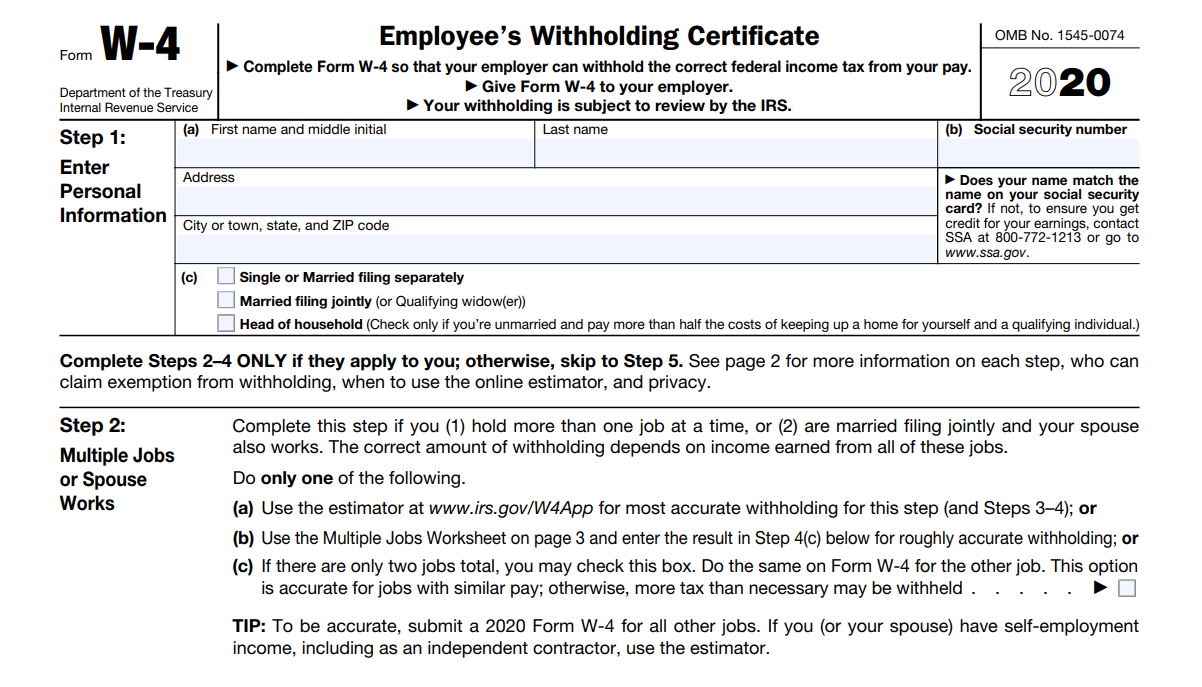

W4 Form 2020 W4 Forms TaxUni

If too little is withheld, you will generally owe tax when you file your tax return. Web instructions for completing the 8233. To download federal tax forms go to www.irs.gov. You must file a revised form. Web instructions included on form:

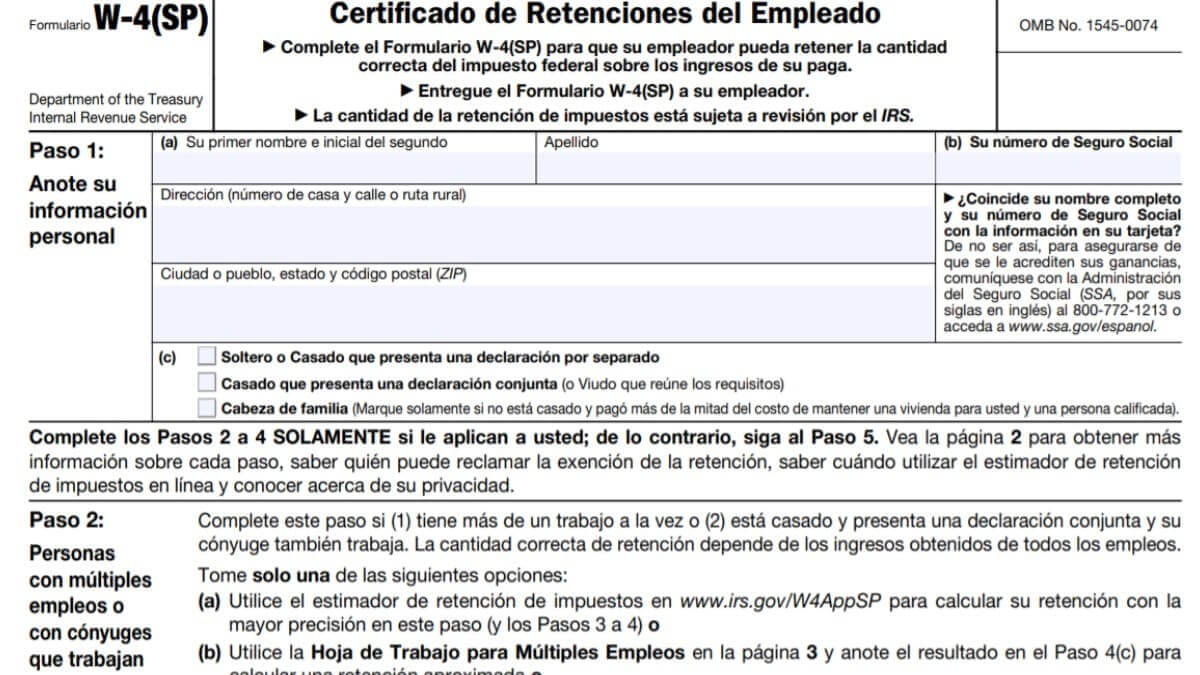

W4 2021 Form Spanish Printable 2022 W4 Form

If you fail or refuse to submit. C.permanent home (domicile) is located in the following renaissance zone: If too little is withheld, you will generally owe tax when you file your tax return. This form is for income. Web instructions included on form:

State Of Michigan Payroll Calendar Image Calendar Template 2022

Web 2021 sales, use and withholding 4% and 6% monthly/quarterly and amended monthly/quarterly worksheet: To download federal tax forms go to www.irs.gov. Sales and other dispositions of capital assets: Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. Access the wolverine access web site click.

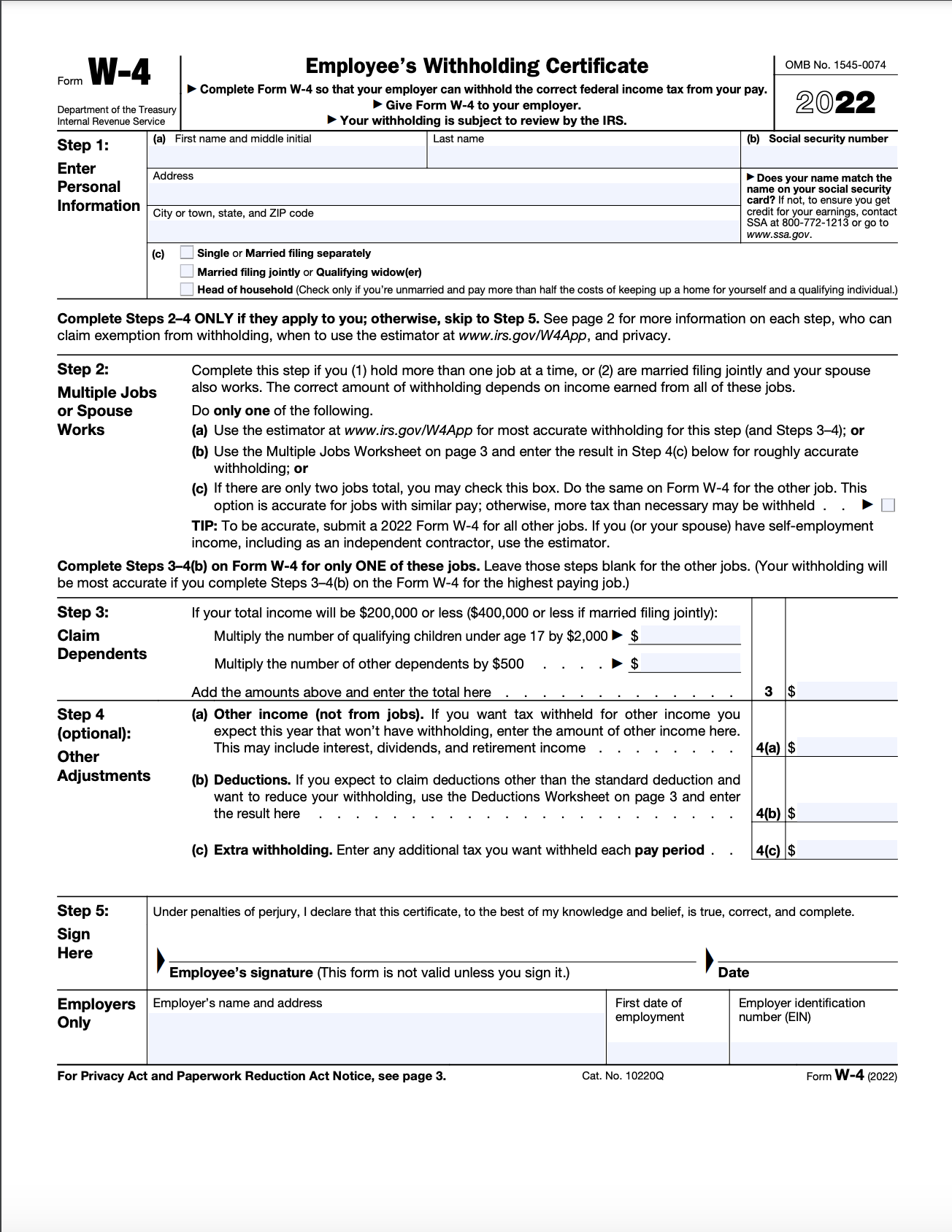

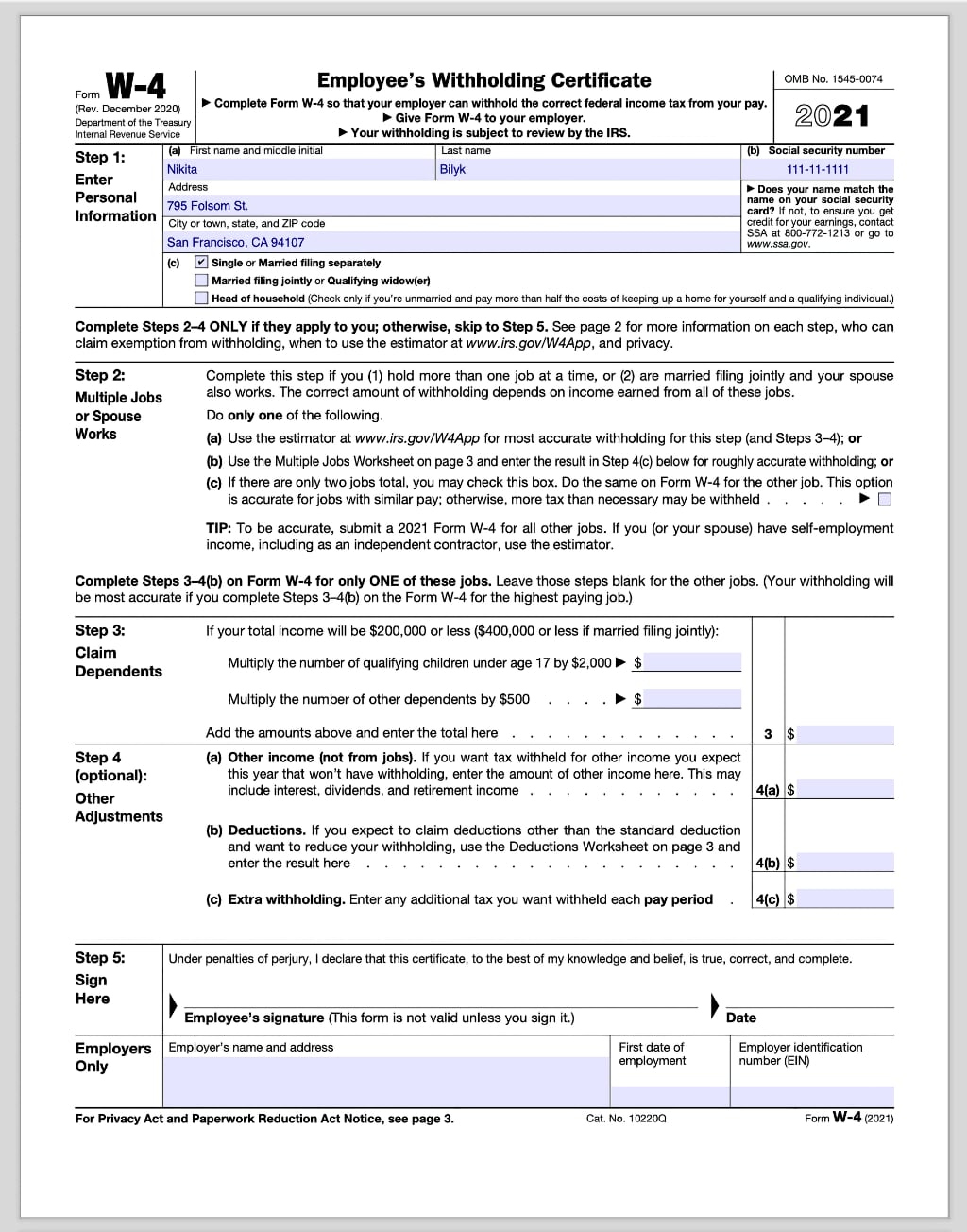

An example of a W4 form, and about how to fill out various important

You must file a revised form. If too little is withheld, you will generally owe tax when you file your tax return. This form is for income. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Ad get ready for tax season deadlines by completing any required tax forms today.

Tax Information · Career Training USA · InterExchange

Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. To download federal tax forms go to www.irs.gov. A) your spouse, for whom you have. Any altering of a form to change a tax year or any reported tax period outside of. Web 2021 sales, use and withholding 4% and 6% monthly/quarterly and amended.

Form Archives Page 59 of 137 PDFSimpli

Web 2021 sales, use and withholding 4% and 6% monthly/quarterly and amended monthly/quarterly worksheet: Any altering of a form to change a tax year or any reported tax period outside of. To download michigan income tax form go to. A) your spouse, for whom you have. Sales and other dispositions of capital assets:

Michigan W 4 2021 2022 W4 Form

You must file a revised form. If too little is withheld, you will generally owe tax when you file your tax return. New hire operations center, p.o. Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. Web 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax.

Michigan W4 App

Web city tax withholding (w4) forms if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Ad get ready for tax season deadlines by completing any required tax forms today. Web instructions for completing the 8233. A) your spouse, for whom you have. To download michigan.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

Web instructions for completing the 8233. Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. This form is for income earned in tax year 2022, with tax returns due in april. Web 2020 sales, use and withholding 4% and 6% monthly/quarterly and amended monthly/quarterly worksheet:

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

A) your spouse, for whom you have. Web city tax withholding (w4) forms if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Access the wolverine access web site click. Web instructions included on form:

This Form Is For Income.

Sales and other dispositions of capital assets: Web 2021 sales, use and withholding 4% and 6% monthly/quarterly and amended monthly/quarterly worksheet: To download federal tax forms go to www.irs.gov. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific.

You Must File A Revised Form.

Web 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017. If you fail or refuse to submit. Resources state michigan w4 web page (18.98 kb) news fye 2023 bi. Ad get ready for tax season deadlines by completing any required tax forms today.