Mileage Expense Form

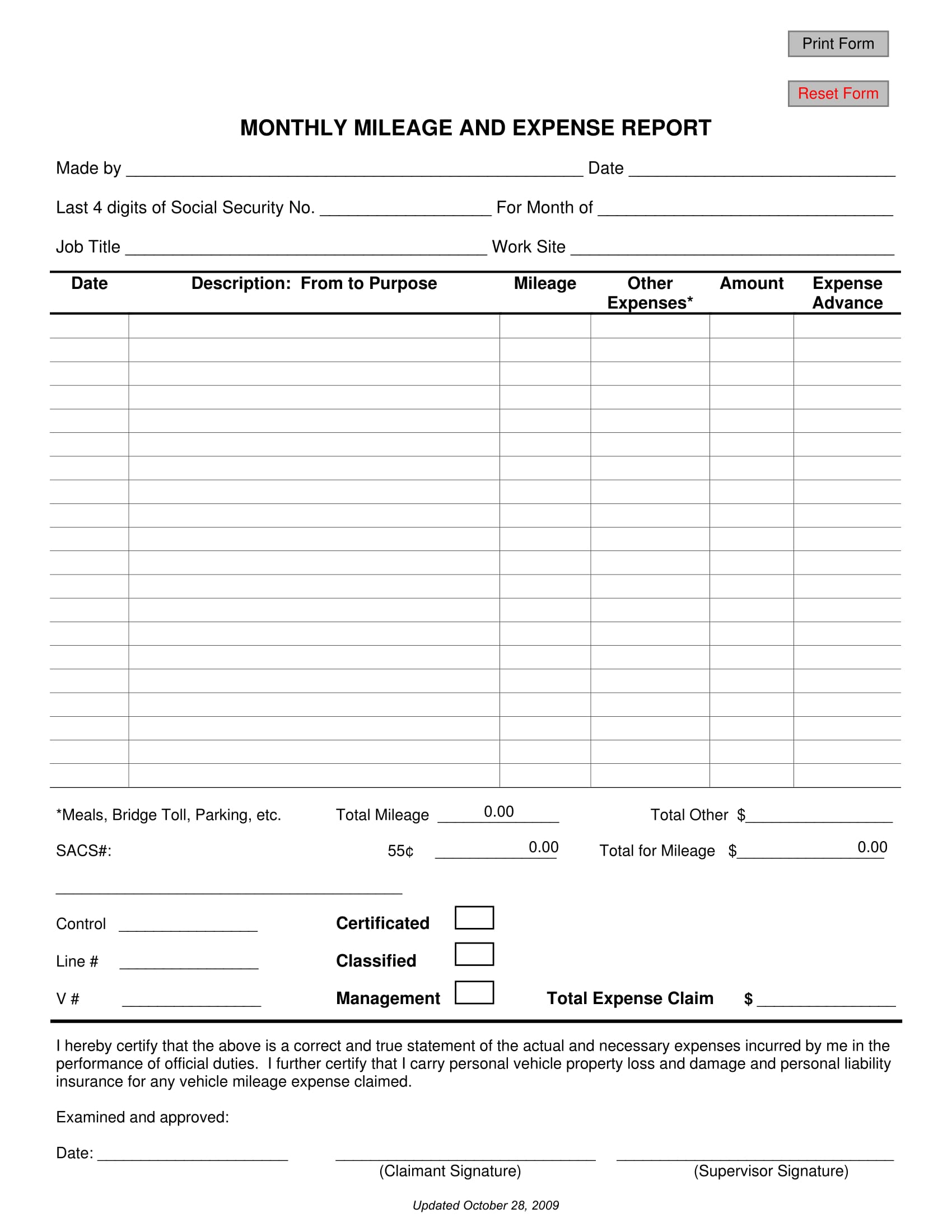

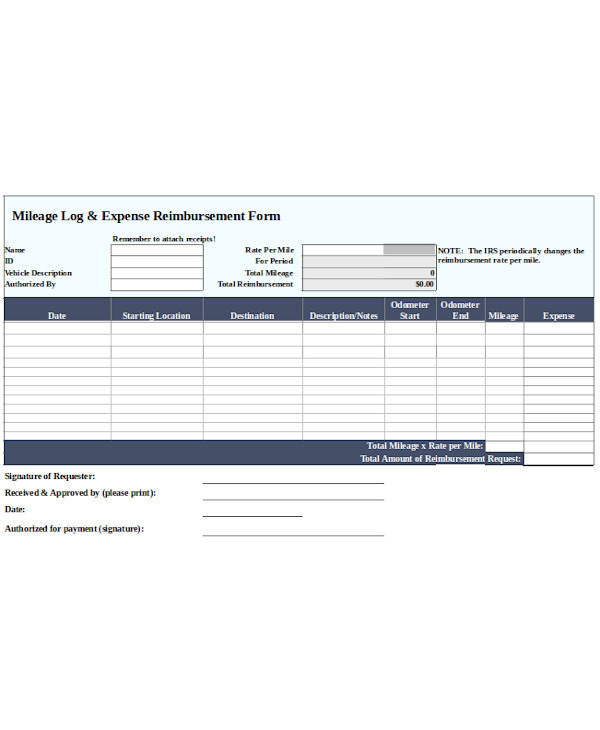

Mileage Expense Form - Simple per diem expense report in pdf The depreciation limits apply under section 179 and section 280f. The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to december 31, 2022. Web the irs mileage rate covers: Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Common maintenance due to wear and tear. Web this expense form was designed for you to print out and keep in the vehicle so you can enter your starting and ending miles using a pen or paper. Table of contents [ show] Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel.

You can also customize the forms and templates according to your needs. Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Web the irs mileage rate covers: Vehicle expenses (insurance, registration, etc.); Common maintenance due to wear and tear. Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Web it’s downloadable, editable, and printable in excel. The depreciation limits apply under section 179 and section 280f.

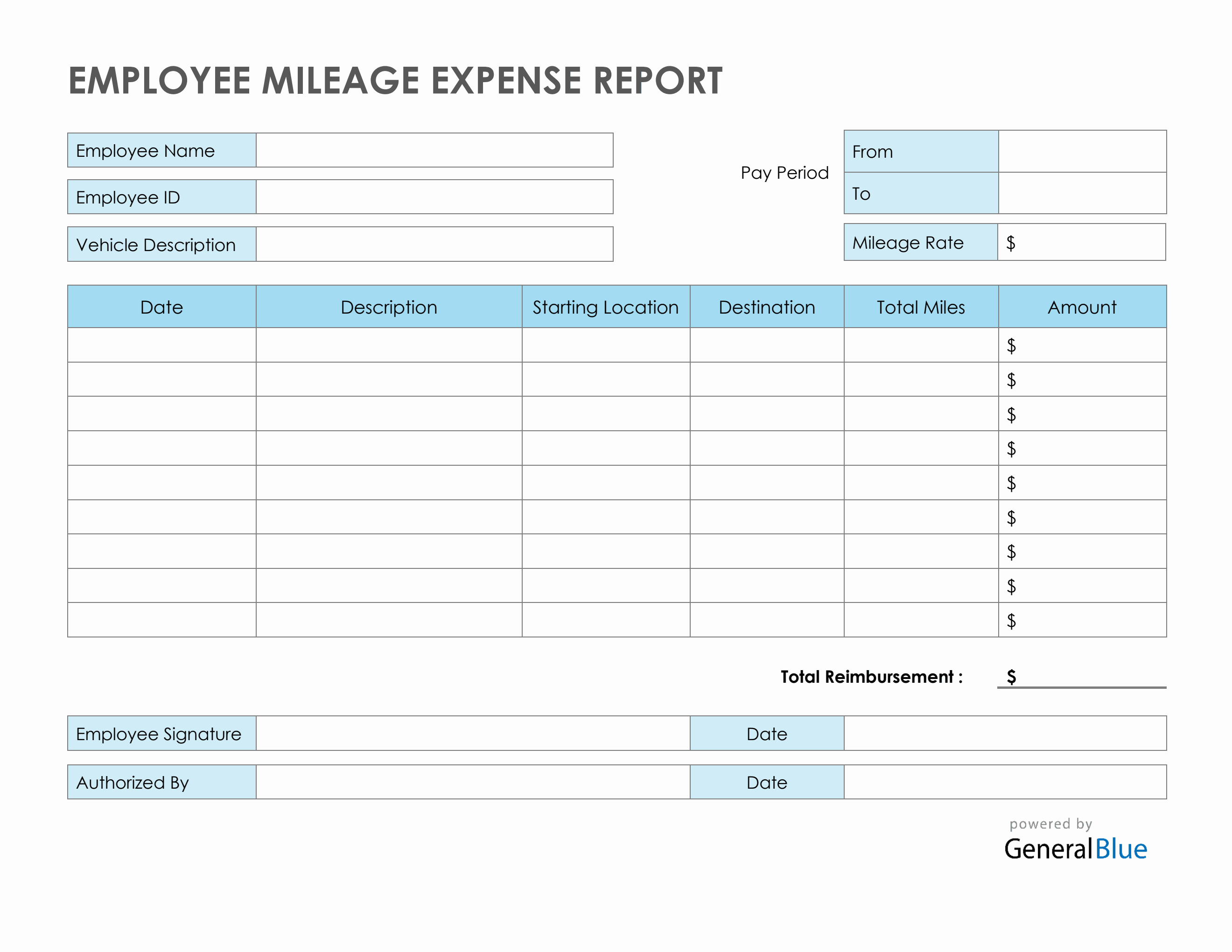

Web the irs mileage rate covers: Vehicle expenses (insurance, registration, etc.); Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Simple per diem expense report in pdf Common maintenance due to wear and tear. You can also customize the forms and templates according to your needs. Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,. Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes.

Mileage Expense Form Template Free SampleTemplatess SampleTemplatess

You can also customize the forms and templates according to your needs. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Table of contents [ show] The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to.

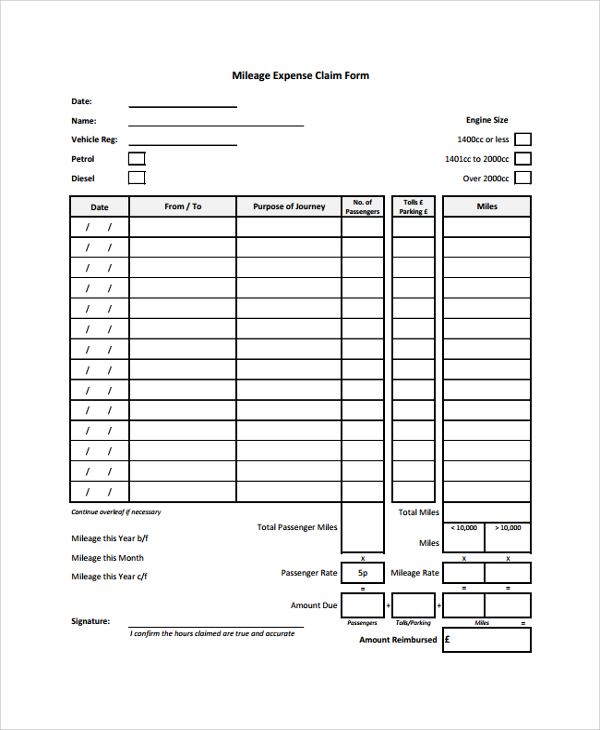

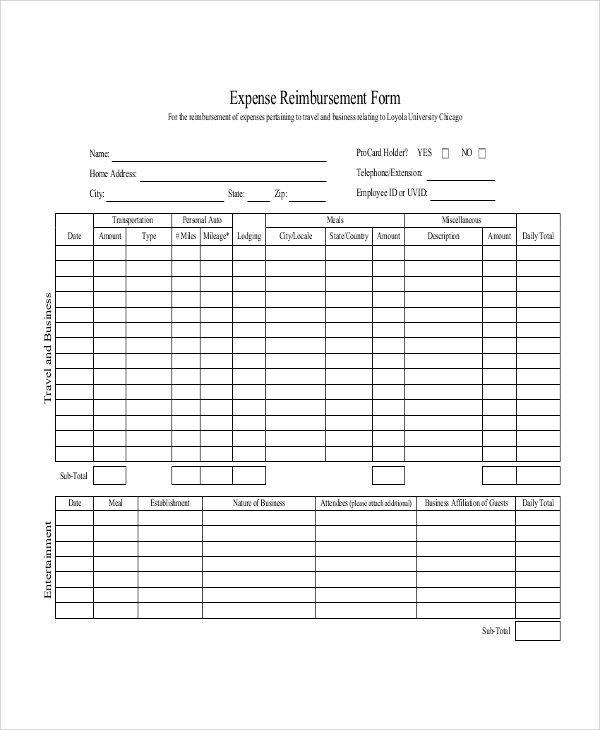

FREE 8+ Sample Expense Forms in PDF MS Word

Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. This employee mileage reimbursement template features sections for employee name, employee id, vehicle description,.

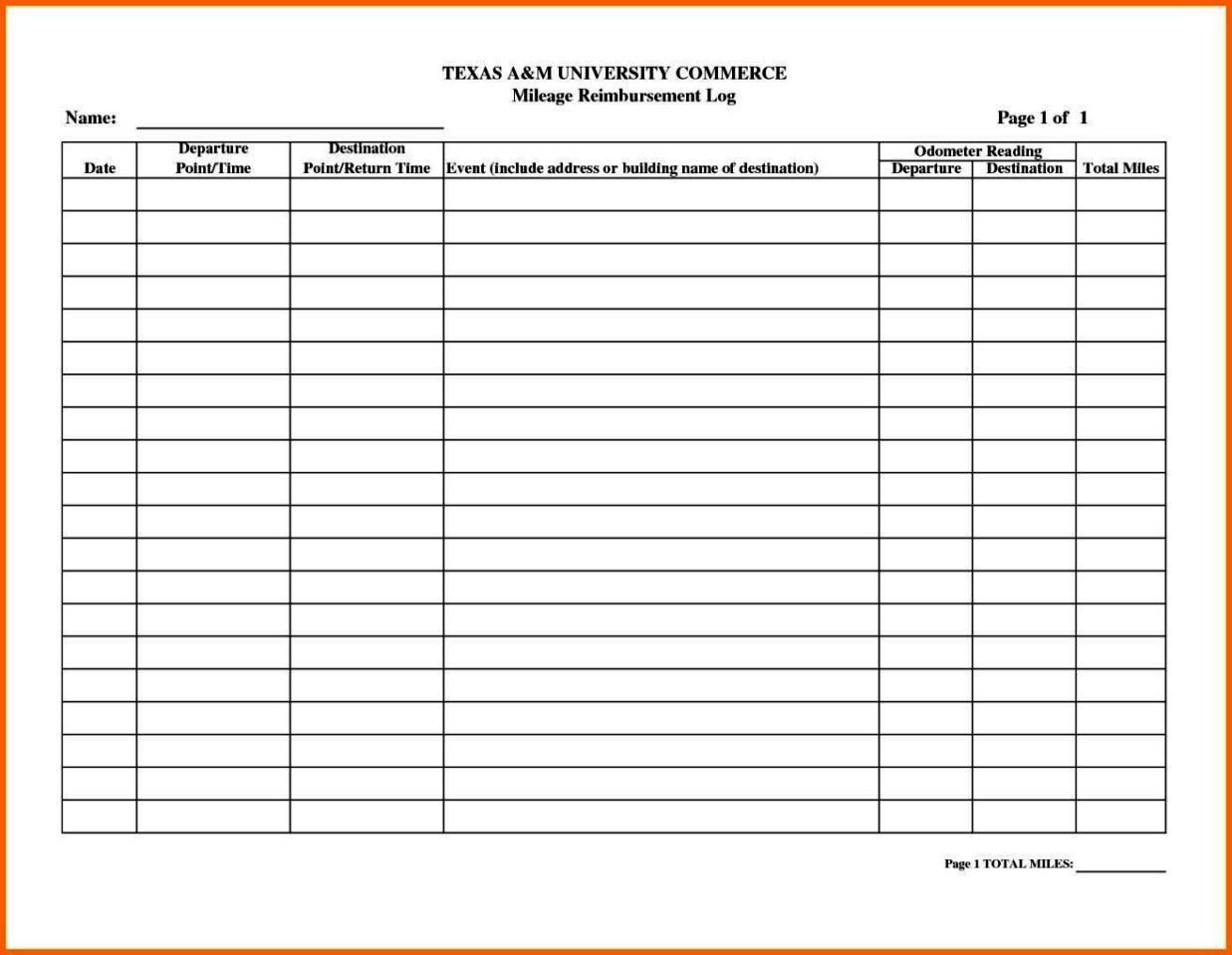

FREE 11+ Sample Mileage Reimbursement Forms in MS Word PDF Excel

The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to december 31, 2022. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. Many business.

FREE 44+ Expense Forms in PDF MS Word Excel

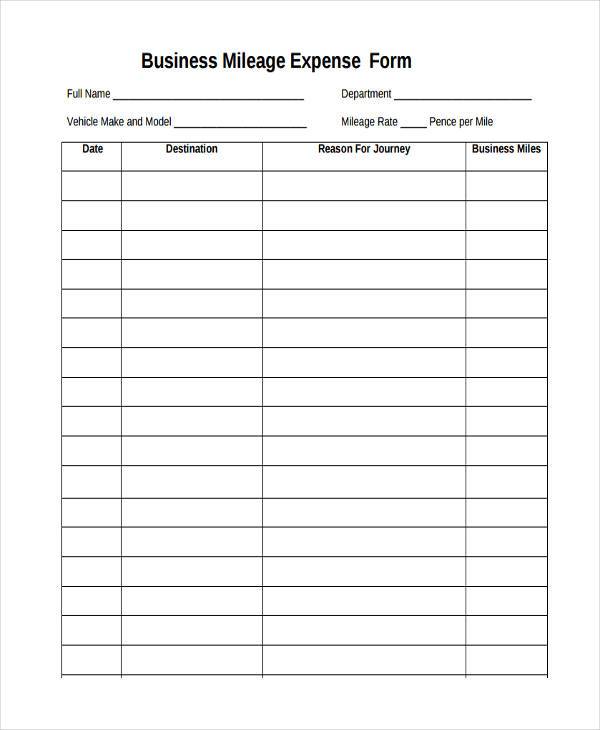

This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,. Web this expense form was designed for you to print out and keep in the vehicle so you can enter your starting and ending miles using a pen or paper. Web mileage expense mileage expense templates free downloadable.

FREE 5+ Mileage Report Forms in MS Word PDF Excel

You can also customize the forms and templates according to your needs. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’ compensation appeals board. Web mileage expense mileage expense templates free downloadable and printable mileage.

FREE 9+ Sample Mileage Reimbursement Forms in PDF Word Excel

Web this expense form was designed for you to print out and keep in the vehicle so you can enter your starting and ending miles using a pen or paper. This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,. Web find optional standard mileage rates to calculate.

8 Travel Expense Report with Mileage Log Excel Templates Excel

Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to december 31, 2022. Common maintenance.

8+ Printable Mileage Log Templates for Personal or Commercial Use

Web the irs mileage rate covers: Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting location,. Web it’s downloadable, editable, and printable in excel. Simple.

Employee Mileage Expense Report Template in Word

Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Vehicle expenses (insurance, registration, etc.); You can also customize the forms and templates according to your needs. Web find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or.

Medical Mileage Expense Form PDFSimpli

Simple per diem expense report in pdf Vehicle expenses (insurance, registration, etc.); Common maintenance due to wear and tear. The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to december 31, 2022. This employee mileage reimbursement template features.

Web Medical Mileage Expense Form If You Need A Medical Mileage Expense Form For A Year Not Listed Here, Please Contact The Information And Assistance Unit At Your Closest District Office Of The Workers’ Compensation Appeals Board.

The 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to december 31, 2022. Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Table of contents [ show] You can also customize the forms and templates according to your needs.

Web It’s Downloadable, Editable, And Printable In Excel.

The depreciation limits apply under section 179 and section 280f. Web mileage expense mileage expense templates free downloadable and printable mileage expense templates that are compatible with pdf and microsoft word and excel. Simple per diem expense report in pdf Web this expense form was designed for you to print out and keep in the vehicle so you can enter your starting and ending miles using a pen or paper.

This Employee Mileage Reimbursement Template Features Sections For Employee Name, Employee Id, Vehicle Description, Pay Period, Mileage Rate, Date, Description, Starting Location,.

Web the irs mileage rate covers: Web / business / operations / mileage log templates 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Vehicle expenses (insurance, registration, etc.); Common maintenance due to wear and tear.