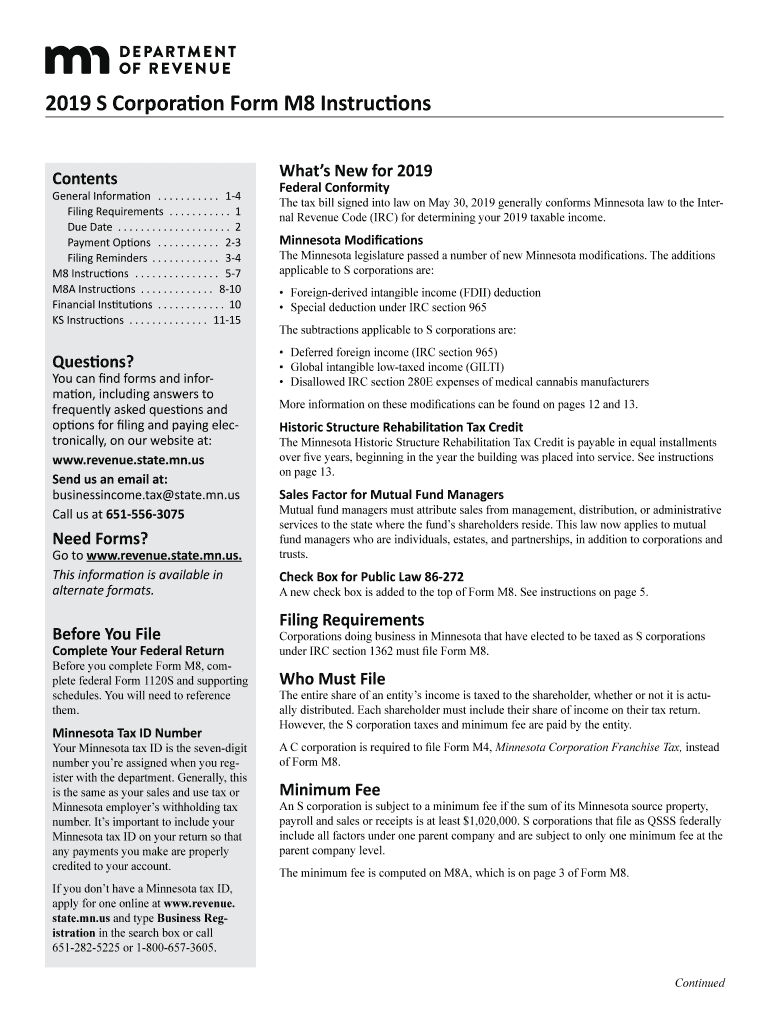

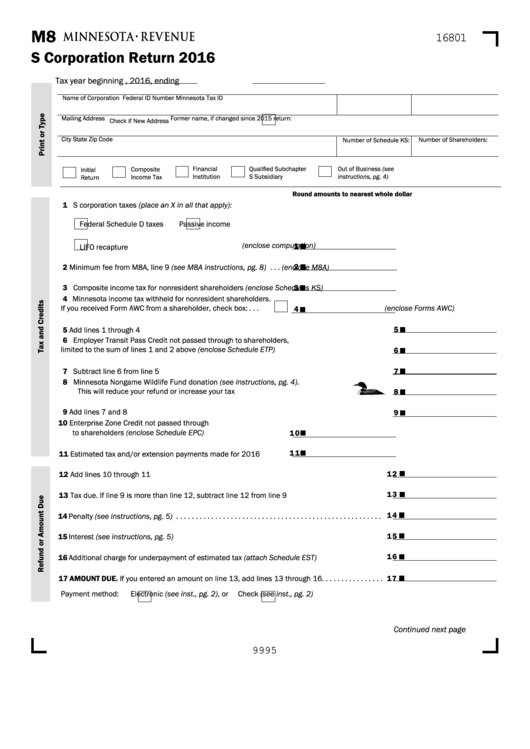

Minnesota Form M8

Minnesota Form M8 - Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Federal schedule d taxes passive income / / federal id number minnesota tax id former name, if changed since 2021. Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. Minnesota s corporation income tax mail station 1770 st. Web name of corporation federal id number minnesota tax id mailing address. Form m8—s corporation return form m8a—apportionment and minimum fee schedule. .9 enter this amount on line 2 of your form m8. Any amount not claimed on line 7 of form m8 may be passed through to. Who must file the entire share of an entity’s income is taxed to the shareholder, whether or not it is actually distributed. Web what is the minnesota m8 form?

Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Who must file the entire share of an entity’s income is taxed to the shareholder, whether or not it is actually distributed. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. .9 enter this amount on line 2 of your form m8. Form m8—s corporation return form m8a—apportionment and minimum fee schedule. Web what is the minnesota m8 form? Or form m2x, amended income tax return for estates and trusts. Web name of corporation federal id number minnesota tax id mailing address. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8.

Partnerships receiving schedules kpc with positive values on lines 10a. Or form m2x, amended income tax return for estates and trusts. Web you will need this information to complete form m4, corporation franchise tax return, form m8, s corporation return, or form m3, partnership return, and you must include this schedule when you file your return. Now it requires at most thirty minutes, and you can accomplish it from any location. The entire share of an entitys income is taxed to the shareholder, whether or not it is actually. Check if new address former name, if changed since 2018 return: Web we last updated the s corporation return (m8 and m8a) in february 2023, so this is the latest version of form m8, fully updated for tax year 2022. City number of shareholders:state zip code. In addition, the s corporation may have to pay a minimum fee based on property, payroll, and sales attributable to. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8.

Minnesota Certification Preapplication Information Form Download

Form m8—s corporation return form m8a—apportionment and minimum fee schedule. .9 enter this amount on line 2 of your form m8. Web fill online, printable, fillable, blank 2020 m8, s corporaon return (minnesota department of revenue) form. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment. Web.

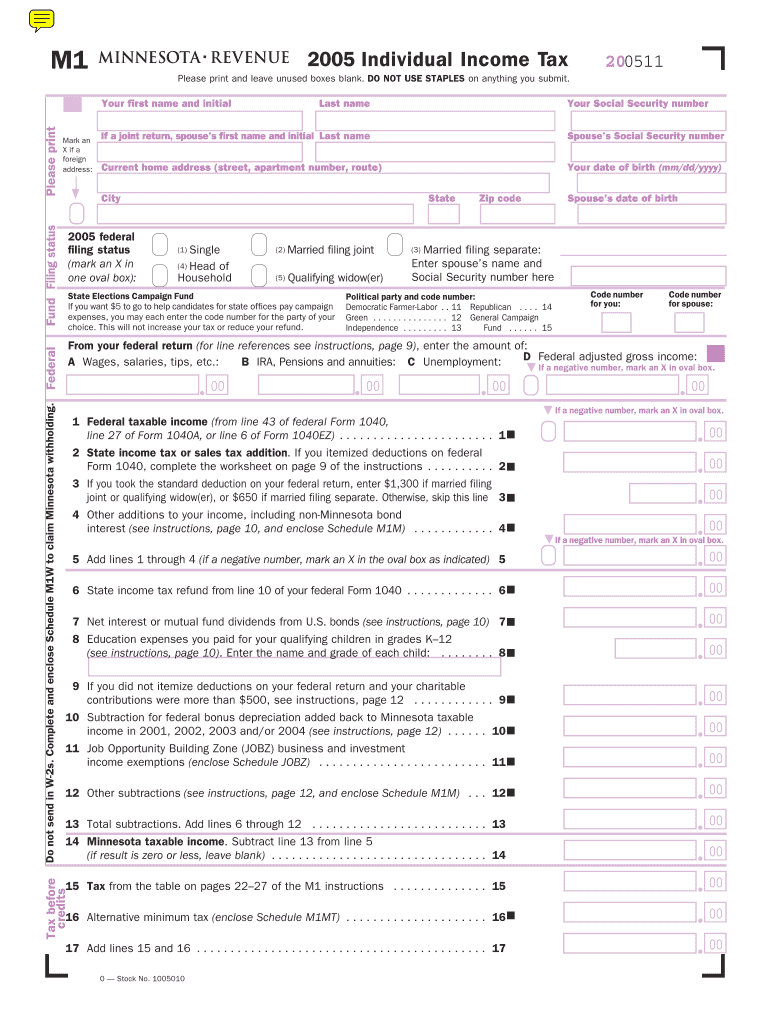

M1 Mn State Tax Form Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Once completed you can sign your. Web what is the minnesota m8 form? Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile.

Buy M8 Form C Flat Washers (BS4320) Marine Stainless Steel (A4

Federal schedule d taxes passive income / / federal id number minnesota tax id former name, if changed since 2021. Web what is the minnesota m8 form? Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. City number of shareholders:state zip code. Download or email m8.

ANM8 Flare Pistol Commemorative Air Force Minnesota Wing

Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Complete, edit or print tax forms instantly. Use form m8x to make a claim for refund and report changes to your minnesota liability. Federal schedule d taxes passive income / / federal id number minnesota tax id.

Fill Free fillable 2020 M8, S Corporaon Return (Minnesota Department

Federal schedule d taxes passive income / / federal id number minnesota tax id former name, if changed since 2021. How you can finish mn dor m8 instructions easy. Or form m2x, amended income tax return for estates and trusts. Web we last updated the s corporation return (m8 and m8a) in february 2023, so this is the latest version.

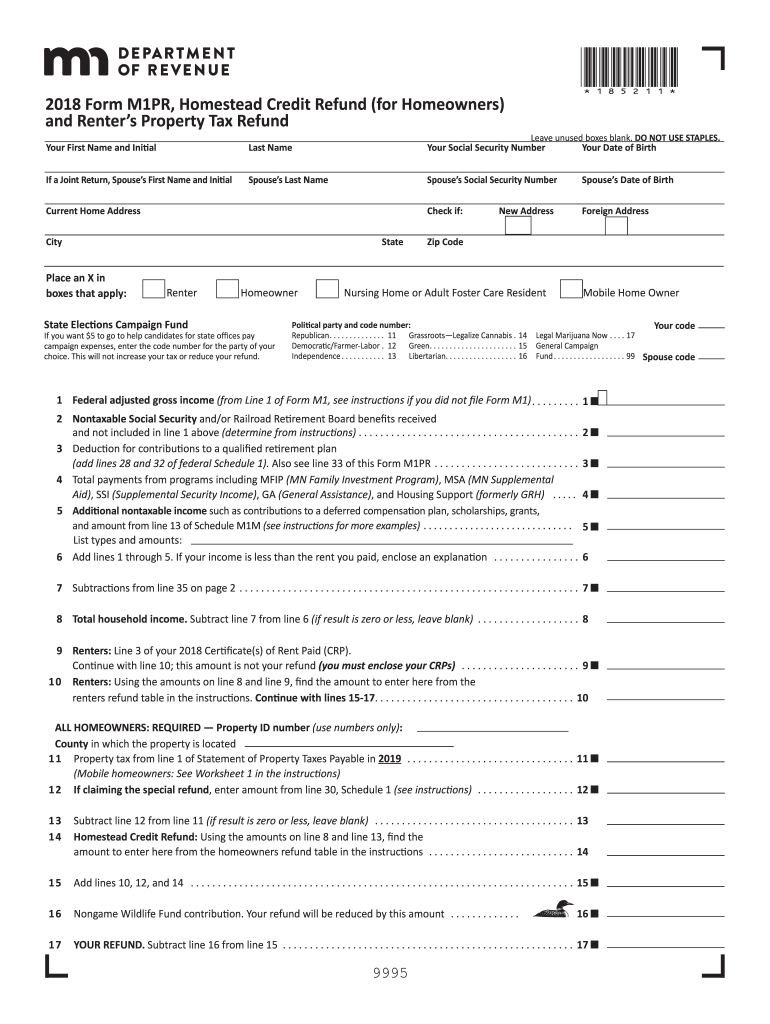

How To File Minnesota Property Tax Refund

Edit your form m8 online type text, add images, blackout confidential details, add comments, highlights and more. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Download or email m8 instr & more fillable forms, register and subscribe now! Web what is the minnesota m8 form?.

2019 Minnesota Instructions Fill Out and Sign Printable PDF Template

Complete, edit or print tax forms instantly. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. City number of shareholders:state zip code. Who must file the entire share of an entity’s income is taxed to the shareholder, whether or not it is actually distributed. Edit your form.

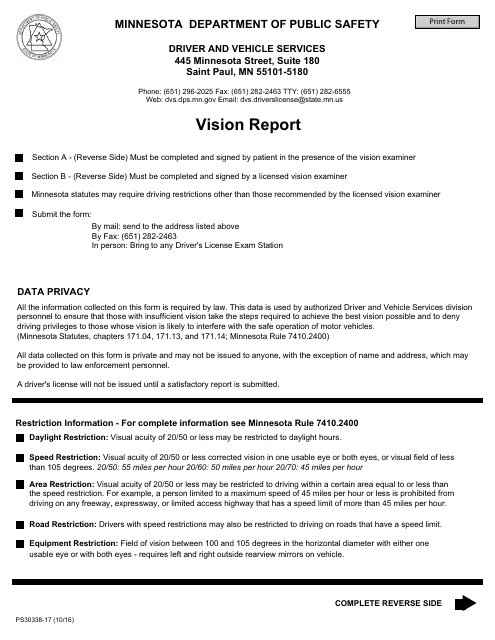

Form PS3033817 Download Fillable PDF or Fill Online Vision Report

Who must file the entire share of an entity’s income is taxed to the shareholder, whether or not it is actually distributed. Check if new address former name, if changed since 2018 return: Ad register and subscribe now to work on your mn dor m8 instructions & more fillable forms. Who must file the entire share of an entity’s income.

Fillable Form M8 S Corporation Return 2016 printable pdf download

Download or email m8 instr & more fillable forms, register and subscribe now! If you checked the s election termination box on your federal form 1120s you must attach a copy of your federal return to your form m8. Once completed you can sign your. If you make a claim for a refund and we do not act on it.

Alena Skalova

Complete, edit or print tax forms instantly. Use fill to complete blank online minnesota department of revenue pdf forms for free. To amend your return, use form m1x, amended minnesota income tax return. Ad register and subscribe now to work on your mn dor m8 instructions & more fillable forms. If you make a claim for a refund and we.

Check If New Address Former Name, If Changed Since 2018 Return:

In addition, the s corporation may have to pay a minimum fee based on property, payroll, and sales attributable to. Who must file the entire share of an entity’s income is taxed to the shareholder, whether or not it is actually distributed. Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. Any amount not claimed on line 7 of form m8 may be passed through to.

Web Corporations Doing Business In Minnesota That Have Elected To Be Taxed As S Corporations Under Irc Section 1362 Must File Form M8.

Once completed you can sign your. If you checked the s election termination box on your federal form 1120s you must attach a copy of your federal return to your form m8. Download or email m8 instr & more fillable forms, register and subscribe now! Web what is the minnesota m8 form?

Who Must File The Entire Share Of An Entity’s Income Is Taxed To The Shareholder, Whether Or Not It Is Actually Distributed.

Partnerships receiving schedules kpc with positive values on lines 10a. If you make a claim for a refund and we do not act on it within six months of the date filed, you may bring an action in the district court or the tax court. Use form m8x to make a claim for refund and report changes to your minnesota liability. Web fill online, printable, fillable, blank 2020 m8, s corporaon return (minnesota department of revenue) form.

Ad Register And Subscribe Now To Work On Your Mn Dor M8 Instructions & More Fillable Forms.

Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Or form m2x, amended income tax return for estates and trusts. Form m8—s corporation return form m8a—apportionment and minimum fee schedule.