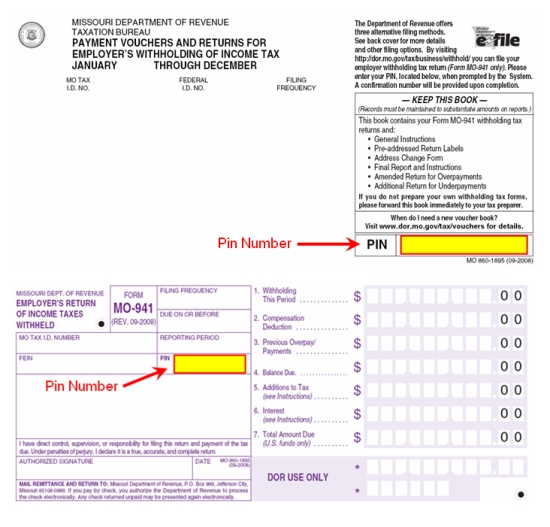

Mo 941 Form

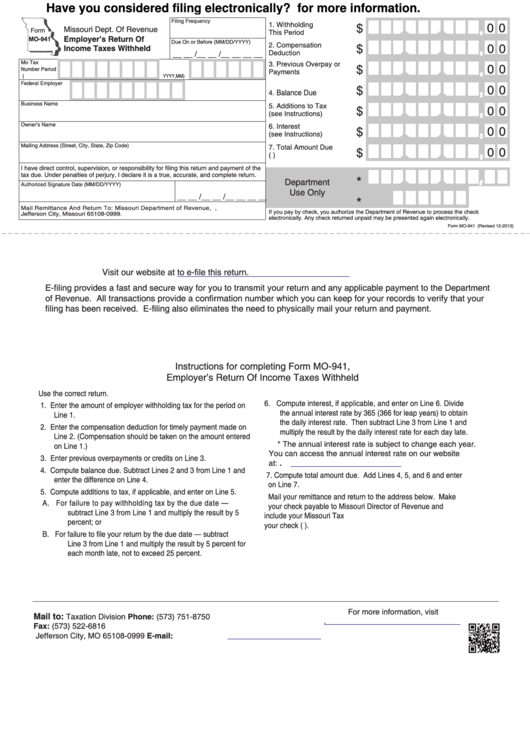

Mo 941 Form - You will need the following information to complete this transaction: Submit a letter containing the missouri tax identification number and effective date of the last payroll. Information can be submitted by one of the following methods: Fill out and mail to: You can print other missouri tax forms here. Employer's withholding tax return correction: Web form 941 for 2023: For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Missouri division of employment security, p.o.

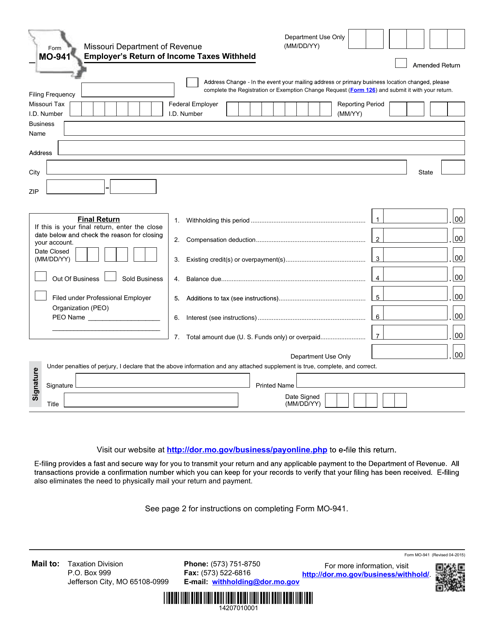

Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Submit a letter containing the missouri tax identification number and effective date of the last payroll. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web form 941 for 2023: Employer's withholding tax final report: For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: A separate filing is not required. Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Employer's withholding tax return correction: Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct.

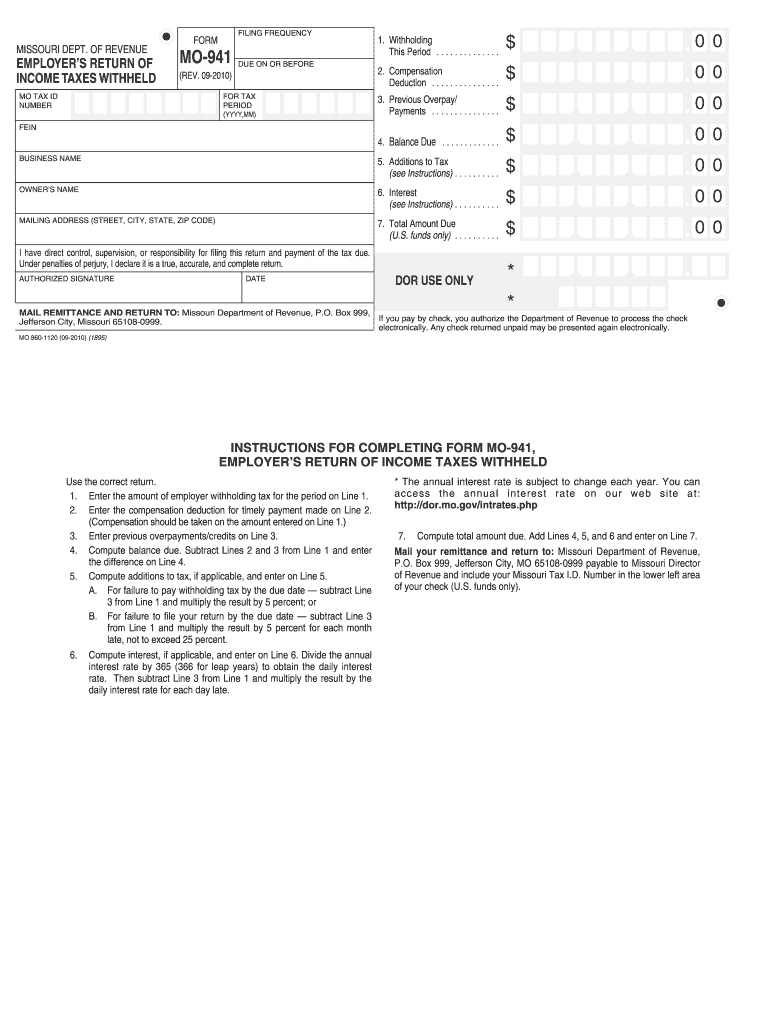

Employer's return of income taxes withheld (note: Missouri division of employment security, p.o. Information can be submitted by one of the following methods: Employer identification number (ein) — name (not. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Fill out and mail to: Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. Submit a letter containing the missouri tax identification number and effective date of the last payroll. Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. A separate filing is not required.

What Is Form 941 and How Do I File It? Ask Gusto

Employer's return of income taxes withheld (note: Missouri division of employment security, p.o. Employer's withholding tax return correction: You will need the following information to complete this transaction: Employer's withholding tax final report:

Skatt utleie april 2016

Date signed (mm/dd/yy) visit our website at. For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: Employer identification number (ein) — name (not. A separate filing is not required. Web form 941 for 2023:

Withholding Tax Credit Inquiry Instructions

Information can be submitted by one of the following methods: Employer identification number (ein) — name (not. Employer's return of income taxes withheld (note: Employer's withholding tax final report: Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct.

Form MO941 Download Fillable PDF or Fill Online Employer's Return of

Date signed (mm/dd/yy) visit our website at. Employer's withholding tax final report: Information can be submitted by one of the following methods: A separate filing is not required. Employer's withholding tax return correction:

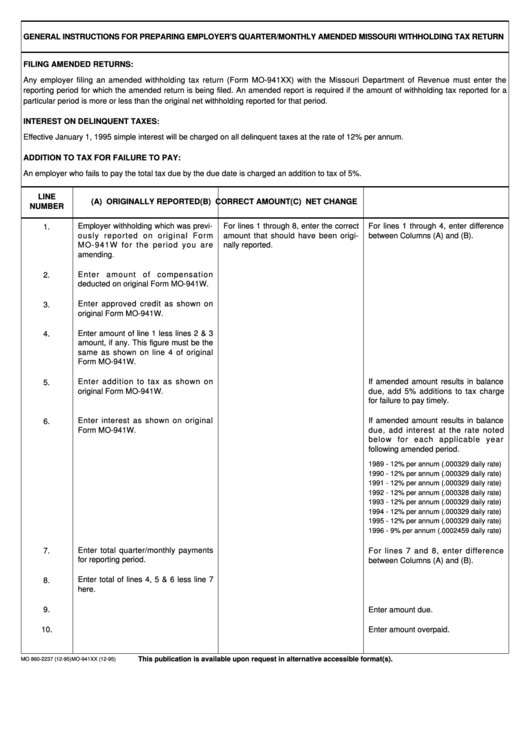

Top Mo941 X Form Templates free to download in PDF format

Employer's withholding tax return correction: You can print other missouri tax forms here. Submit a letter containing the missouri tax identification number and effective date of the last payroll. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Your filing frequency is determined by the amount of income tax that is withheld from the wages you.

Fillable Form Mo941 Employer'S Return Of Taxes Withheld

Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: Missouri division of employment security, p.o. Employer's withholding tax return correction: Web form 941 for 2023:

11 Form Missouri The Ultimate Revelation Of 11 Form Missouri AH

Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. Information can be submitted by one of the following methods: Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Date signed (mm/dd/yy) visit our website at. Web form 941 for 2023:

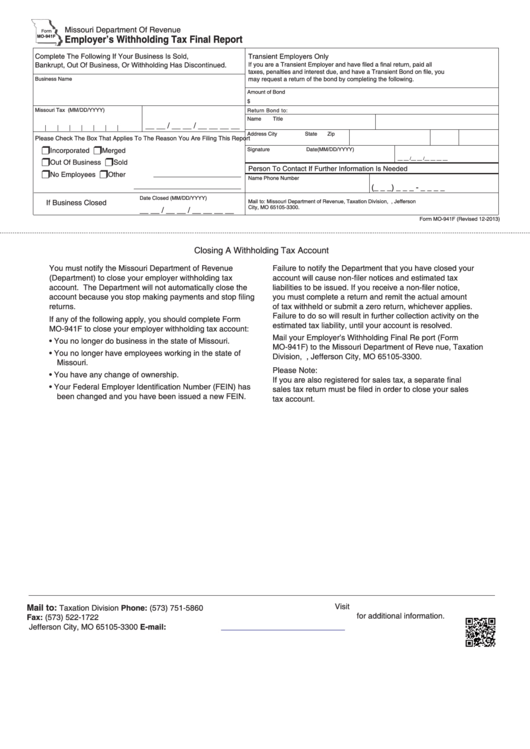

Fillable Form Mo941f Employer'S Withholding Tax Final Report 2013

Fill out and mail to: You can print other missouri tax forms here. Submit a letter containing the missouri tax identification number and effective date of the last payroll. Information can be submitted by one of the following methods: Date signed (mm/dd/yy) visit our website at.

Mo 941 Fill Online, Printable, Fillable, Blank pdfFiller

Employer's withholding tax final report: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Employer identification number (ein) — name (not. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct.

2018 Form MO DOR 5049 Fill Online, Printable, Fillable, Blank pdfFiller

Employer's withholding tax return correction: A separate filing is not required. Date signed (mm/dd/yy) visit our website at. Fill out and mail to: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122.

Under Penalties Of Perjury, I Declare That The Above Information And Any Attached Supplement Is True, Complete, And Correct.

Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Employer's withholding tax return correction: You can print other missouri tax forms here. A separate filing is not required.

Date Signed (Mm/Dd/Yy) Visit Our Website At.

Employer's return of income taxes withheld (note: Employer identification number (ein) — name (not. Missouri division of employment security, p.o. Web form 941 for 2023:

Information Can Be Submitted By One Of The Following Methods:

Employer's withholding tax final report: For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: Fill out and mail to: Web the quarterly contribution and wage report and instructions are available at labor.mo.gov.

You Will Need The Following Information To Complete This Transaction:

Submit a letter containing the missouri tax identification number and effective date of the last payroll. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122.