Mo State Tax Extension Form

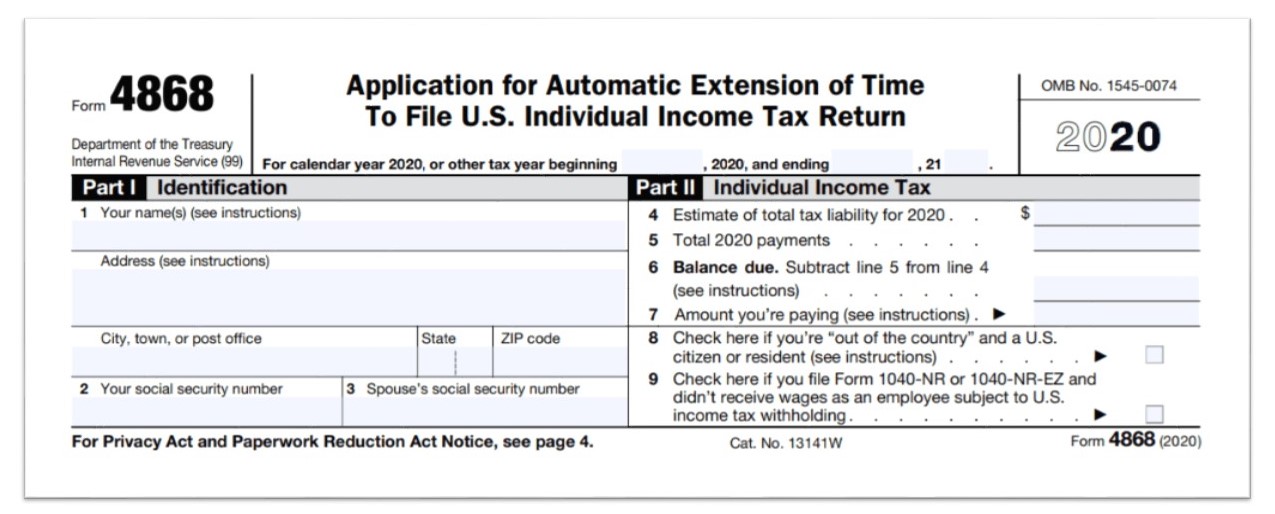

Mo State Tax Extension Form - Ask yourself whether you expect to owe state taxes or not? When is the deadline to file an extension. What form does the state require to file an extension? Web attach a copy of your federal extension (federal form 4868 or 2688) with your missouri income tax return when you file. Here are instructions on whether you should. Web extensions state brackets state income tax extensions are listed by each state below. Web make an extension payment; You seek a missouri extension exceeding the federal. Web if you have a valid federal tax extension (irs form 4868), you will automatically be granted a missouri tax extension. Missouri’s tax extension is automatic, so there is no formal application or written request to submit.

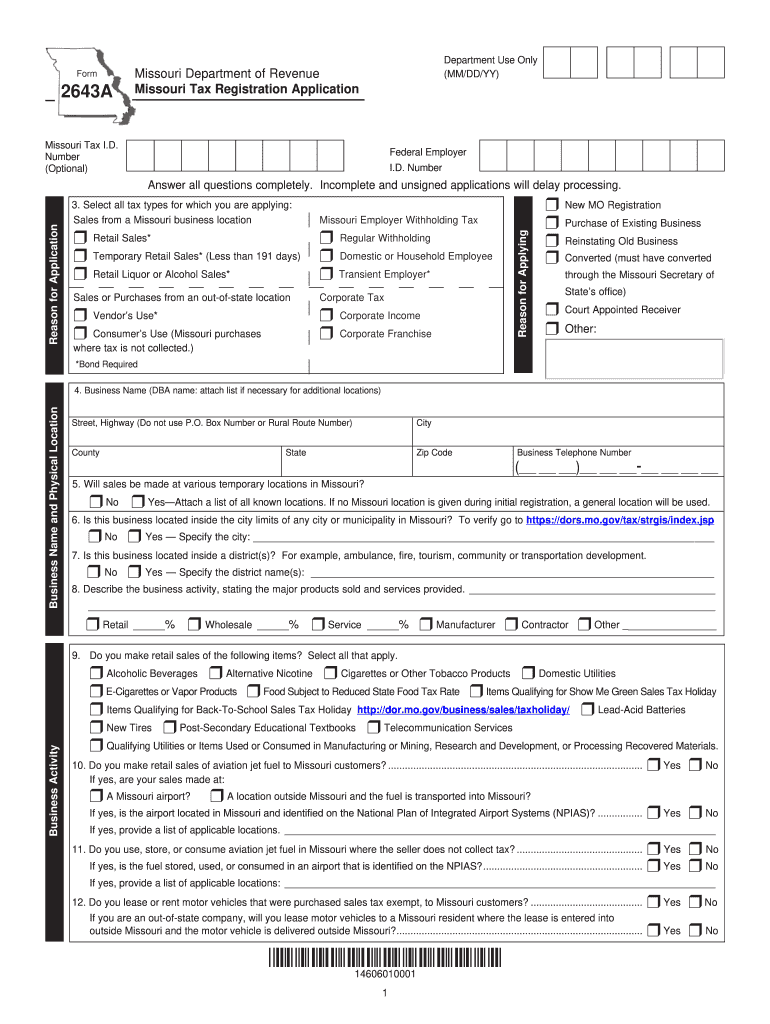

Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. A tax extension does not give you more time to pay state. Web missouri tax extension form: Missouri’s tax extension is automatic, so there is no formal application or written request to submit. Web if you have a valid federal tax extension (irs form 4868), you will automatically be granted a missouri tax extension. Web attach a copy of your federal extension (federal form 4868 or 2688) with your missouri income tax return when you file. Ask yourself whether you expect to owe state taxes or not? Web corporate extension payments can also be made under this selection; You seek a missouri extension exceeding the federal. Web housing & utilities consumer protection renew your missouri license plates, register your vehicle and reserve your personalized license plate.

Does missouri support tax extension for personal income tax returns? Web make an extension payment; You seek a missouri extension exceeding the federal. When is the deadline to file an extension. Web housing & utilities consumer protection renew your missouri license plates, register your vehicle and reserve your personalized license plate. Missouri’s tax extension is automatic, so there is no formal application or written request to submit. If you would like to file an extension,. Here are instructions on whether you should. You will automatically receive a missouri. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64.

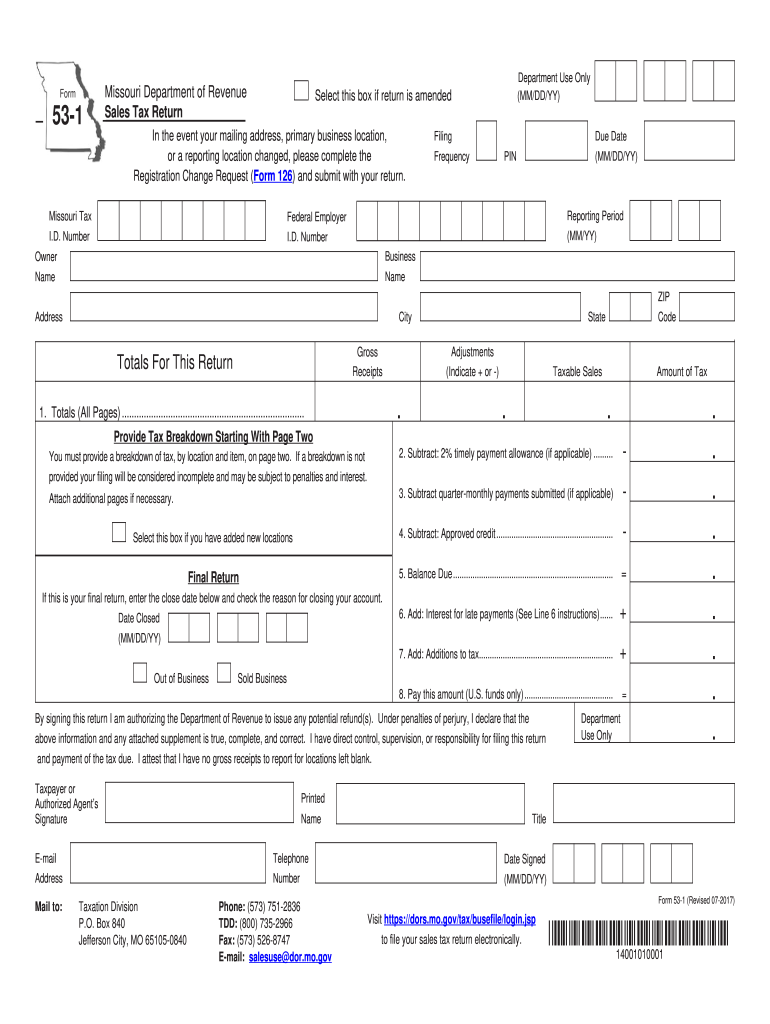

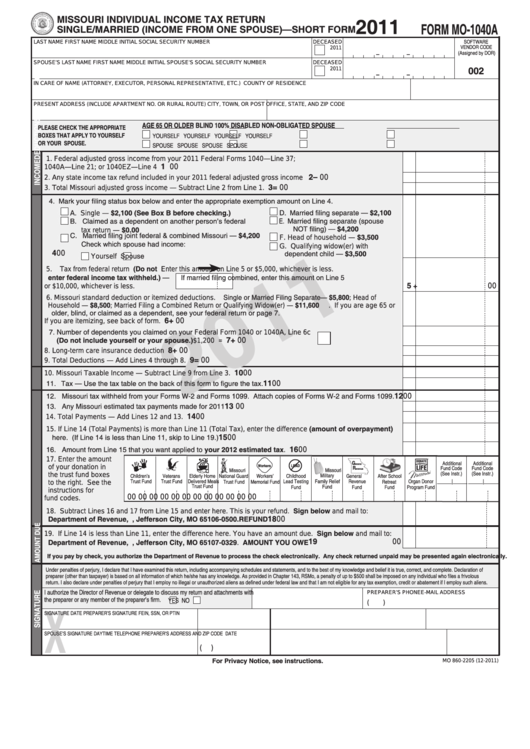

Printable Mo State Tax Forms Printable Form 2021

Here are instructions on whether you should. Web missouri tax extension form: When is the deadline to file an extension. Web extensions state brackets state income tax extensions are listed by each state below. Web make an extension payment;

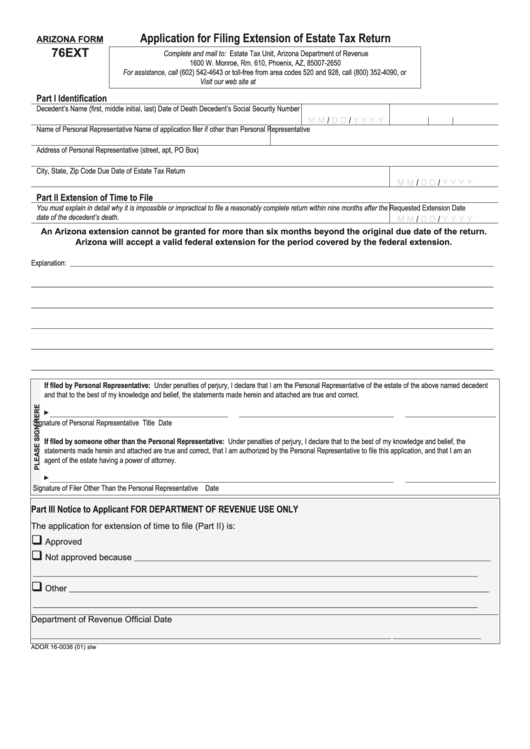

Form 76ext Application For Filing Extension Of Estate Tax Return

Web housing & utilities consumer protection renew your missouri license plates, register your vehicle and reserve your personalized license plate. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. When is the deadline to file an extension. Web the 2022 missouri state income tax return forms for tax year 2022 (jan. Web make an extension payment;

Filing an Tax Extension Due to COVID19 SDG Accountants

Web corporate extension payments can also be made under this selection; [form 4379a] request for information or audit. Web the 2022 missouri state income tax return forms for tax year 2022 (jan. When is the deadline to file an extension. Web attach a copy of your federal extension (federal form 4868 or 2688) with your missouri income tax return when.

Missouri Revenue Form Mo 941 20202021 Fill and Sign Printable

Missouri’s tax extension is automatic, so there is no formal application or written request to submit. When is the deadline to file an extension. Web corporate extension payments can also be made under this selection; Web attach a copy of your federal extension (federal form 4868 or 2688) with your missouri income tax return when you file. Ask yourself whether.

Missouri Tax Forms 2020

You seek a missouri extension exceeding the federal. Web corporate extension payments can also be made under this selection; Web housing & utilities consumer protection renew your missouri license plates, register your vehicle and reserve your personalized license plate. Web make an extension payment; Does missouri support tax extension for personal income tax returns?

MA State Tax Form 128 20162022 Fill out Tax Template Online US

Ask yourself whether you expect to owe state taxes or not? Here are instructions on whether you should. Web an extension of time to file only applies to your missouri state income tax due date, an extension also needs to be filed with the irs to extend your federal tax due date. Addition to tax and interest calculator; Web housing.

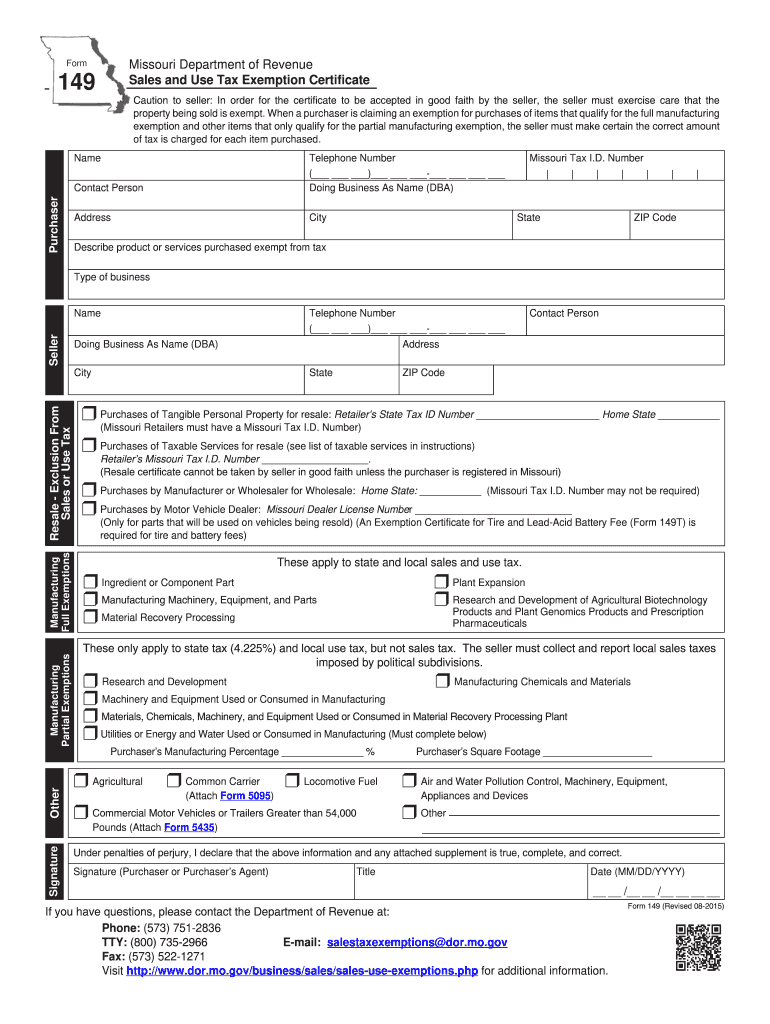

Mo Tax Exemption Form Fill Out and Sign Printable PDF Template signNow

Missouri’s tax extension is automatic, so there is no formal application or written request to submit. Web corporate extension payments can also be made under this selection; Web attach a copy of your federal extension (federal form 4868 or 2688) with your missouri income tax return when you file. Here are instructions on whether you should. Web if you have.

Tax extension deadline approaches

Web an extension of time to file only applies to your missouri state income tax due date, an extension also needs to be filed with the irs to extend your federal tax due date. Web housing & utilities consumer protection renew your missouri license plates, register your vehicle and reserve your personalized license plate. You will automatically receive a missouri..

MO W4 2020 Fill out Tax Template Online US Legal Forms

Web corporate extension payments can also be made under this selection; Missouri’s tax extension is automatic, so there is no formal application or written request to submit. Web attach a copy of your federal extension (federal form 4868 or 2688) with your missouri income tax return when you file. Web housing & utilities consumer protection renew your missouri license plates,.

Missouri Tax Forms 2020

Web make an extension payment; Web an extension of time to file only applies to your missouri state income tax due date, an extension also needs to be filed with the irs to extend your federal tax due date. You will automatically receive a missouri. Does missouri support tax extension for personal income tax returns? Web housing & utilities consumer.

You Will Automatically Receive A Missouri.

You seek a missouri extension exceeding the federal. When is the deadline to file an extension. Ask yourself whether you expect to owe state taxes or not? Web the 2022 missouri state income tax return forms for tax year 2022 (jan.

Web An Extension Of Time To File Only Applies To Your Missouri State Income Tax Due Date, An Extension Also Needs To Be Filed With The Irs To Extend Your Federal Tax Due Date.

Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Web housing & utilities consumer protection renew your missouri license plates, register your vehicle and reserve your personalized license plate. Does missouri support tax extension for personal income tax returns? Here are instructions on whether you should.

Web Attach A Copy Of Your Federal Extension (Federal Form 4868 Or 2688) With Your Missouri Income Tax Return When You File.

Web make an extension payment; Web corporate extension payments can also be made under this selection; Web if you have a valid federal tax extension (irs form 4868), you will automatically be granted a missouri tax extension. What form does the state require to file an extension?

Web Missouri Tax Extension Form:

Missouri’s tax extension is automatic, so there is no formal application or written request to submit. [form 4379a] request for information or audit. Addition to tax and interest calculator; Web extensions state brackets state income tax extensions are listed by each state below.