Nc Form D 403 Instructions

Nc Form D 403 Instructions - Edit your nc d 403 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your. Taxformfinder has an additional 44 north carolina income tax forms that you may. C corporation tax return tax return: If copies are needed, the department will request them at a later date. S corporation tax return tax return: Apportionment percentage for partnerships that have one or more nonresident. Web file now with turbotax related north carolina corporate income tax forms: Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Calendar year fiscal year what's this?

Apportionment percentage for partnerships that have one or more nonresident. Sign it in a few clicks draw your. Pay a bill or notice (notice required) sales and use tax file. S corporation tax return tax return: Web file now with turbotax related north carolina corporate income tax forms: Calendar year fiscal year what's this? If copies are needed, the department will request them at a later date. Web complete this web form for assistance. Taxformfinder has an additional 44 north carolina income tax forms that you may. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:.

If copies are needed, the department will request them at a later date. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. C corporation tax return tax return: Taxformfinder has an additional 44 north carolina income tax forms that you may. Web complete this web form for assistance. Calendar year fiscal year what's this? Sign it in a few clicks draw your. Edit your nc d 403 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Pay a bill or notice (notice required) sales and use tax file. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,.

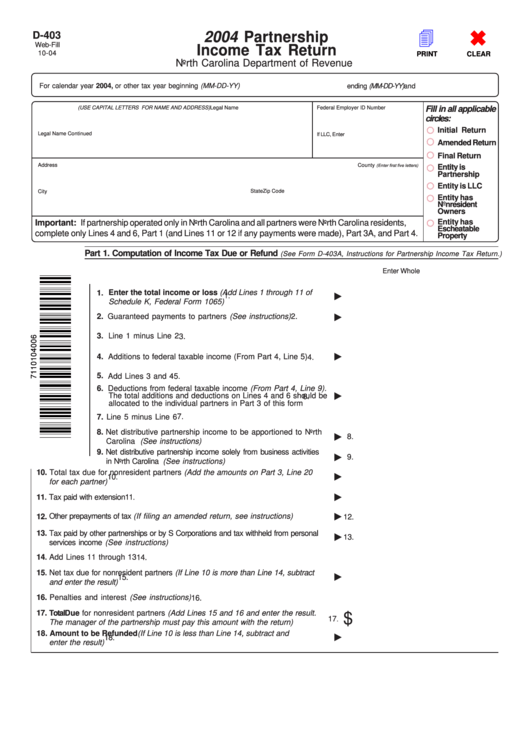

Fillable Form D403 Parthership Tax Return 2004 printable

Edit your nc d 403 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Taxformfinder has an additional 44 north carolina income tax forms that you may. Web complete this web form for assistance. Calendar year fiscal year what's this? S corporation tax return tax return:

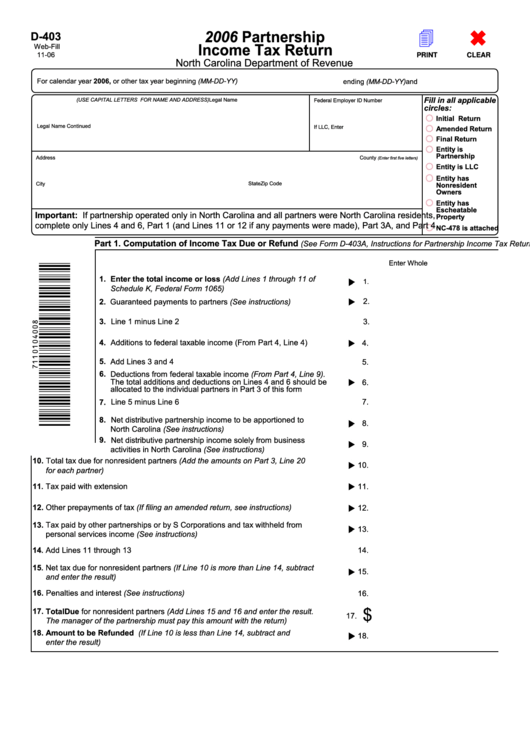

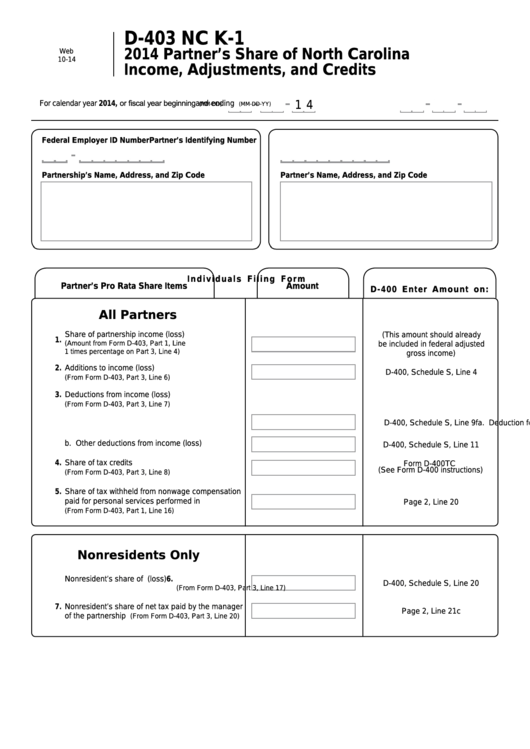

Fillable Form D403 Partnership Tax Return 2006, Form Nc K1

Pay a bill or notice (notice required) sales and use tax file. Web complete this web form for assistance. Edit your nc d 403 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic.

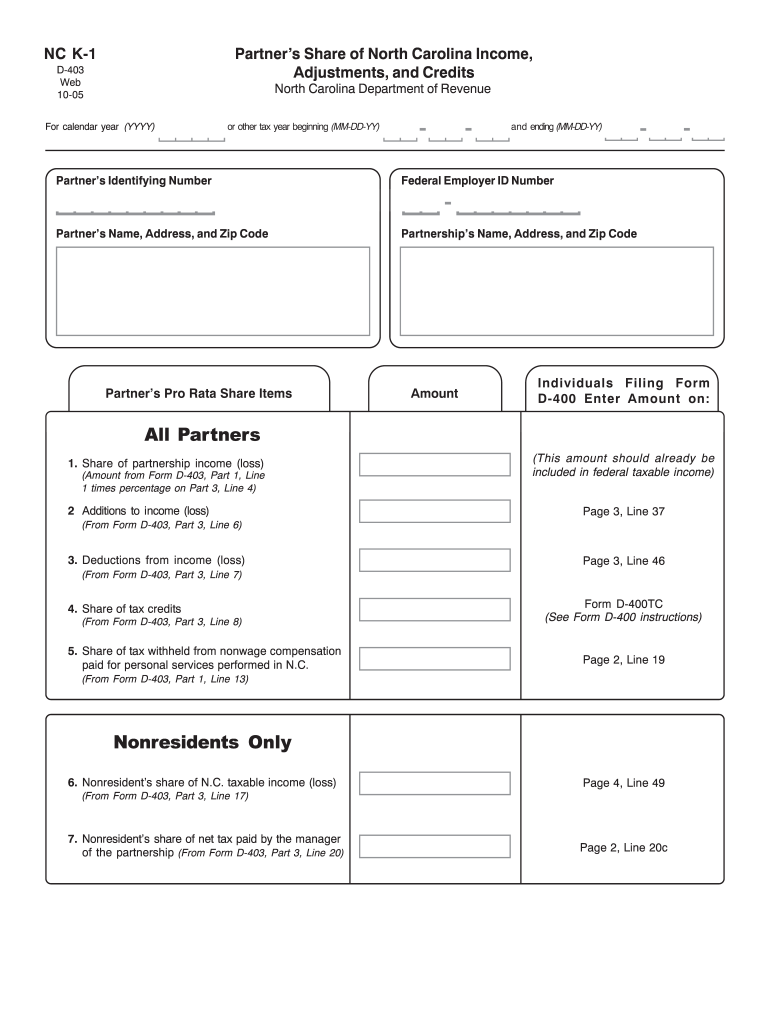

NC DoR D403 K1 2005 Fill out Tax Template Online US Legal Forms

Pay a bill or notice (notice required) sales and use tax file. Taxformfinder has an additional 44 north carolina income tax forms that you may. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. S corporation tax return tax.

NC DoR D400TC 2015 Fill out Tax Template Online US Legal Forms

S corporation tax return tax return: Pay a bill or notice (notice required). Apportionment percentage for partnerships that have one or more nonresident. Web complete this web form for assistance. C corporation tax return tax return:

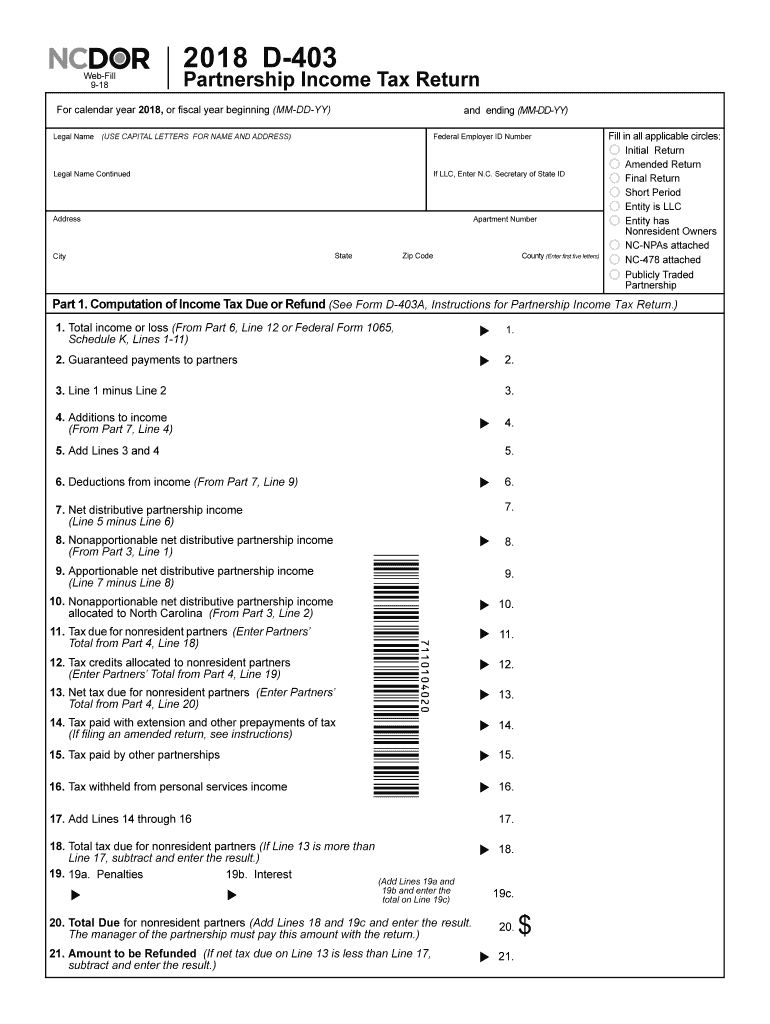

2018 Form NC DoR D403 Fill Online, Printable, Fillable, Blank pdfFiller

C corporation tax return tax return: S corporation tax return tax return: Web complete this web form for assistance. If copies are needed, the department will request them at a later date. Edit your nc d 403 instructions online type text, add images, blackout confidential details, add comments, highlights and more.

Nc d400 instructions 2016

Calendar year fiscal year what's this? C corporation tax return tax return: Web file now with turbotax related north carolina corporate income tax forms: Pay a bill or notice (notice required). S corporation tax return tax return:

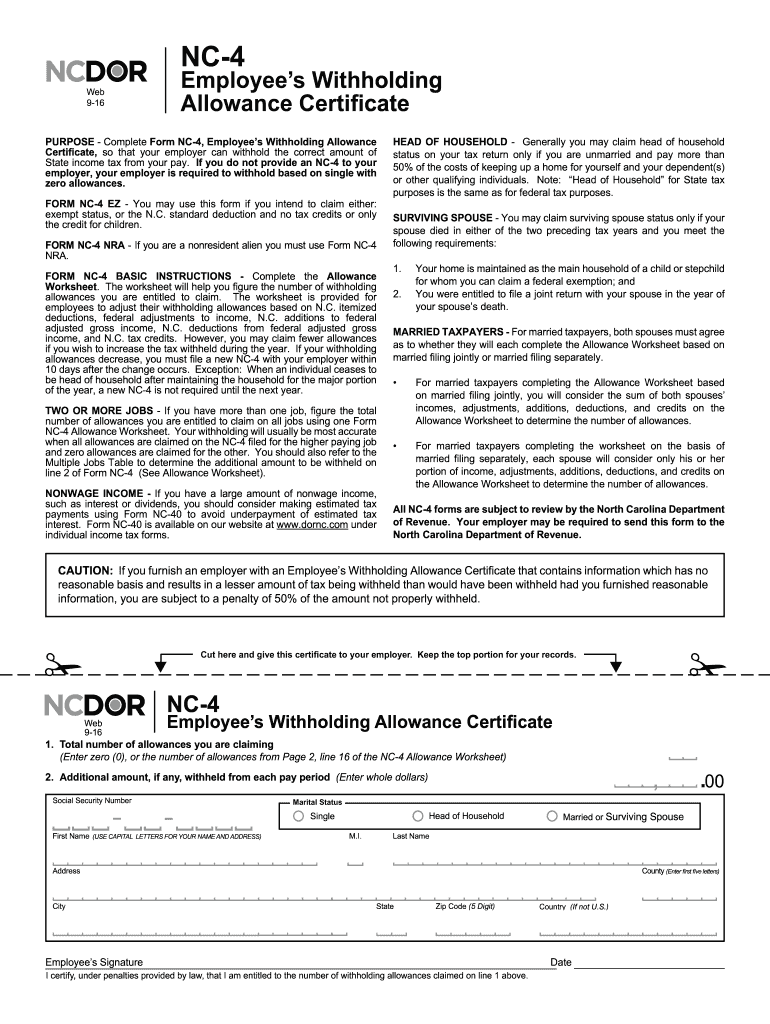

Form NC 4 North Carolina Department of Revenue Fill Out and Sign

C corporation tax return tax return: Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Taxformfinder has an additional 44 north carolina income tax forms that you may. Sign it in a few clicks draw your. Web file now with turbotax.

Form D403 Nc K1 Partner'S Share Of North Carolina

Taxformfinder has an additional 44 north carolina income tax forms that you may. Edit your nc d 403 instructions online type text, add images, blackout confidential details, add comments, highlights and more. S corporation tax return tax return: Apportionment percentage for partnerships that have one or more nonresident. Calendar year fiscal year what's this?

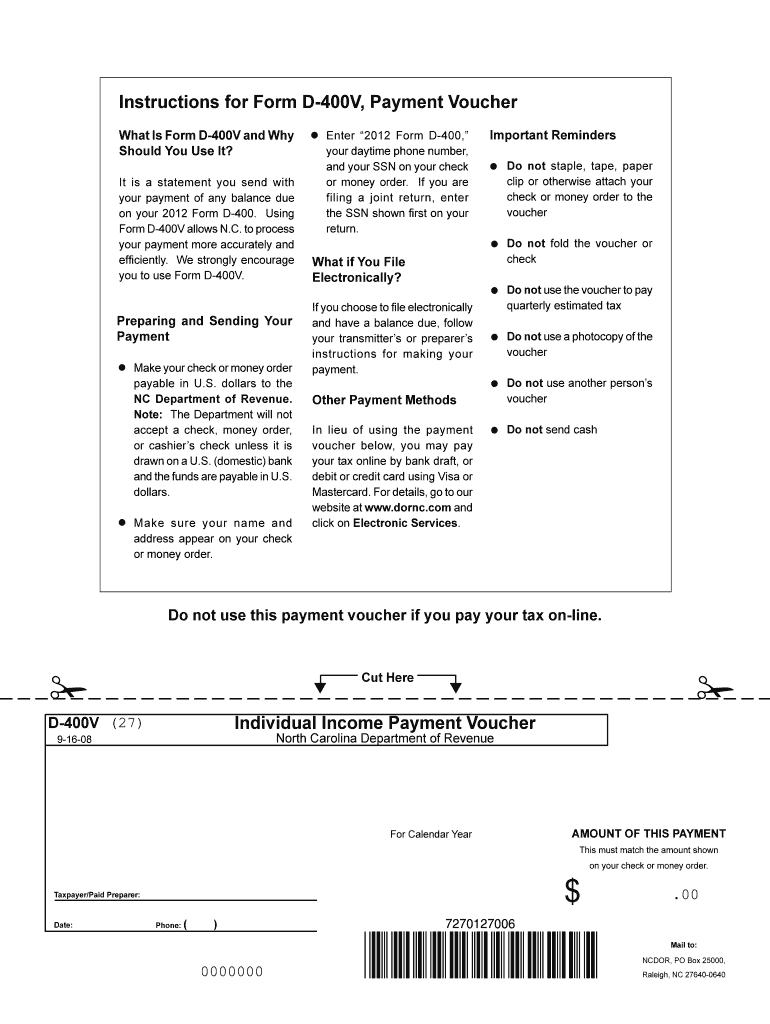

NC DoR D400V 20082022 Fill out Tax Template Online US Legal Forms

S corporation tax return tax return: If copies are needed, the department will request them at a later date. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. C corporation tax return tax return: Edit your nc d 403 instructions online.

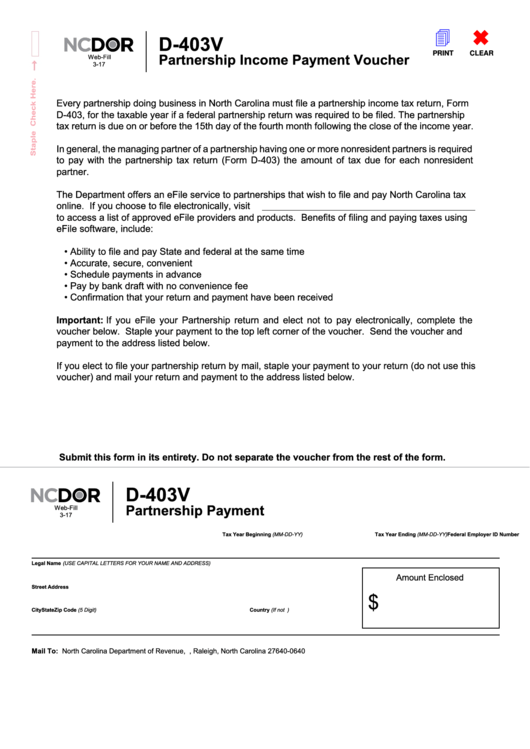

Fillable Form D403v Partnership Payment North Carolina Department

Pay a bill or notice (notice required). Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. C corporation tax return tax return: Calendar year fiscal year what's this? S corporation tax return tax return:

Web The Term “Doing Business In North Carolina” Means The Operation Of Any Business Enterprise Or Activity In North Carolina For Economic Gain, Including, But Not Limited To, The Following:.

Calendar year fiscal year what's this? Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Taxformfinder has an additional 44 north carolina income tax forms that you may. Pay a bill or notice (notice required) sales and use tax file.

S Corporation Tax Return Tax Return:

If copies are needed, the department will request them at a later date. Web complete this web form for assistance. Pay a bill or notice (notice required). C corporation tax return tax return:

Web File Now With Turbotax Related North Carolina Corporate Income Tax Forms:

Sign it in a few clicks draw your. Edit your nc d 403 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Apportionment percentage for partnerships that have one or more nonresident.