Nj Property Tax Exemption Form

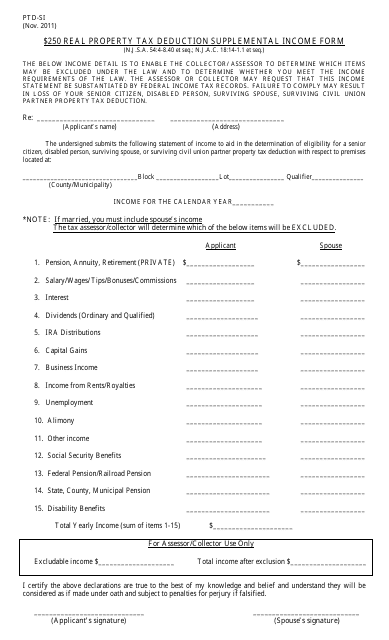

Nj Property Tax Exemption Form - Web property tax in new jersey property tax exemptions property tax exemptions uniformity clause intangible personal property was exempted from the tax base in. 413) eliminates the wartime service requirement for the 100% totally and. If you are married (or in a. Web the state of new jersey provides senior citizens and people with disabilities with some relief regarding property taxes. Web generally speaking, new jersey law states that real property “owned by” a charitable organization and used “exclusively for” charitable purposes is entitled to tax. New jersey offers several property tax deductions, exemptions and abatements. Web 100% disabled veteran property tax exemption effective december 4, 2020, state law (p.l. Web tax exemptions the new jersey constitution authorizes an annual $250 deduction from the real property taxes on a dwelling house owned and occupied by a person, 65 years. Web deductions, exemptions, and abatements. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return.

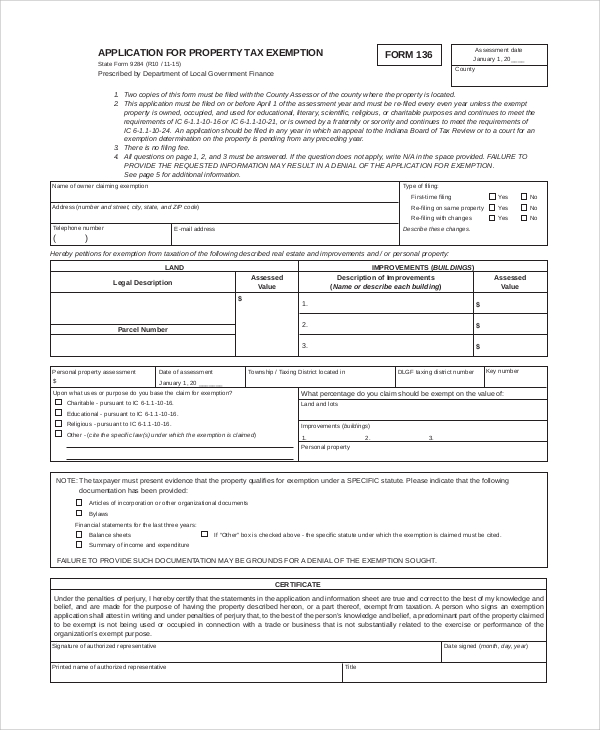

Web veteran property tax deduction and the disabled veteran property tax exemption. Web county and municipal expenses types of property tax exemptions in new jersey property tax exemptions exclude a portion of your home’s value from being taxed. Web 40 rows claim for property tax exemption on dwelling house of. Web 100% disabled veteran property tax exemption effective december 4, 2020, state law (p.l. Web the state of new jersey provides senior citizens and people with disabilities with some relief regarding property taxes. Web deductions, exemptions, and abatements. Property tax deduction (pdf) property tax deduction veteran or surviving spouse (pdf) property tax exemption disabled veteran or. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return. This application is for tax exemption tax abatement both. Web tax exemptions the new jersey constitution authorizes an annual $250 deduction from the real property taxes on a dwelling house owned and occupied by a person, 65 years.

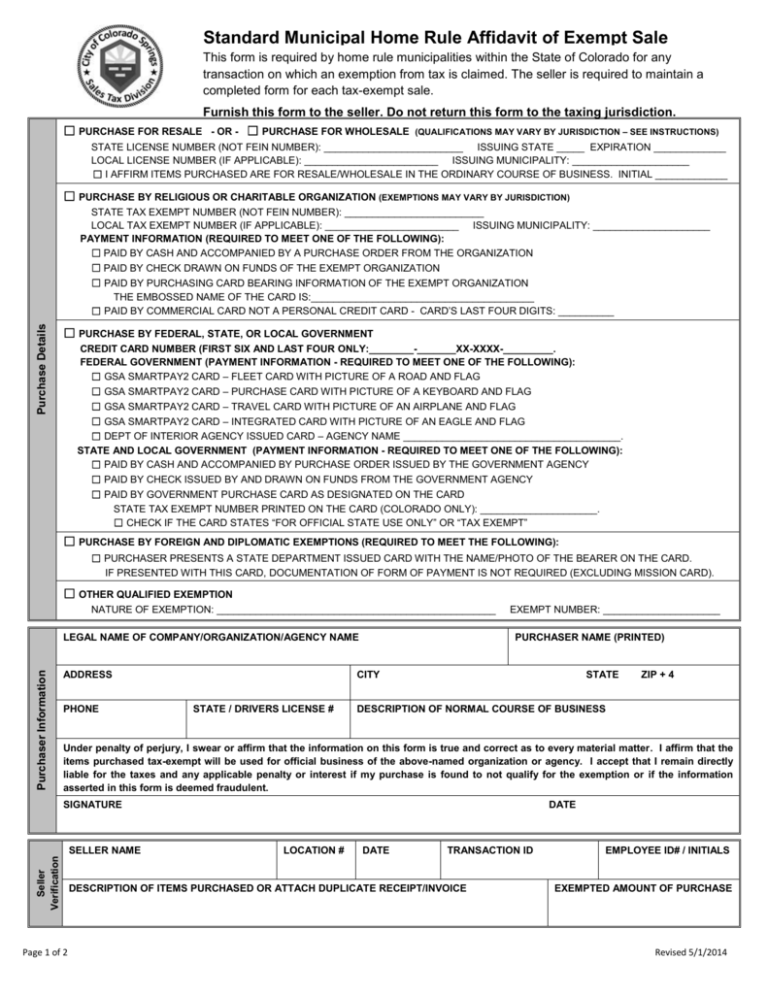

Web deductions, exemptions, and abatements. Web property tax in new jersey property tax exemptions property tax exemptions uniformity clause intangible personal property was exempted from the tax base in. Web corporation business tax. Web this form is prescribed by the director, division of taxation, as required by law. Web the state of new jersey provides senior citizens and people with disabilities with some relief regarding property taxes. Web the undersigned certifies that there is no requirement to pay the new jersey sales and/or use tax on the purchase or purchases covered by this certificate because the tangible. Web generally speaking, new jersey law states that real property “owned by” a charitable organization and used “exclusively for” charitable purposes is entitled to tax. Web county and municipal expenses types of property tax exemptions in new jersey property tax exemptions exclude a portion of your home’s value from being taxed. If you meet certain requirements, you may have the right to. New jersey offers several property tax deductions, exemptions and abatements.

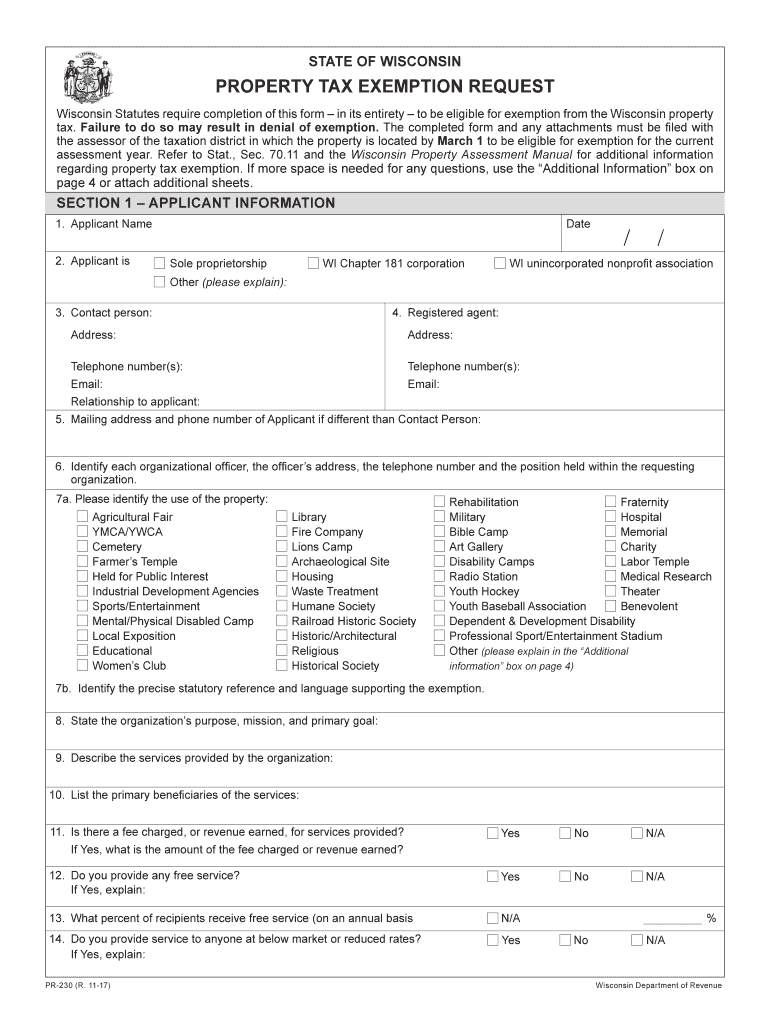

Wisconsin Property Tax Exemption Form Fill Out and Sign Printable PDF

Web deductions, exemptions, and abatements. Web generally speaking, new jersey law states that real property “owned by” a charitable organization and used “exclusively for” charitable purposes is entitled to tax. Web 40 rows claim for property tax exemption on dwelling house of. If you meet certain requirements, you may have the right to. Web county and municipal expenses types of.

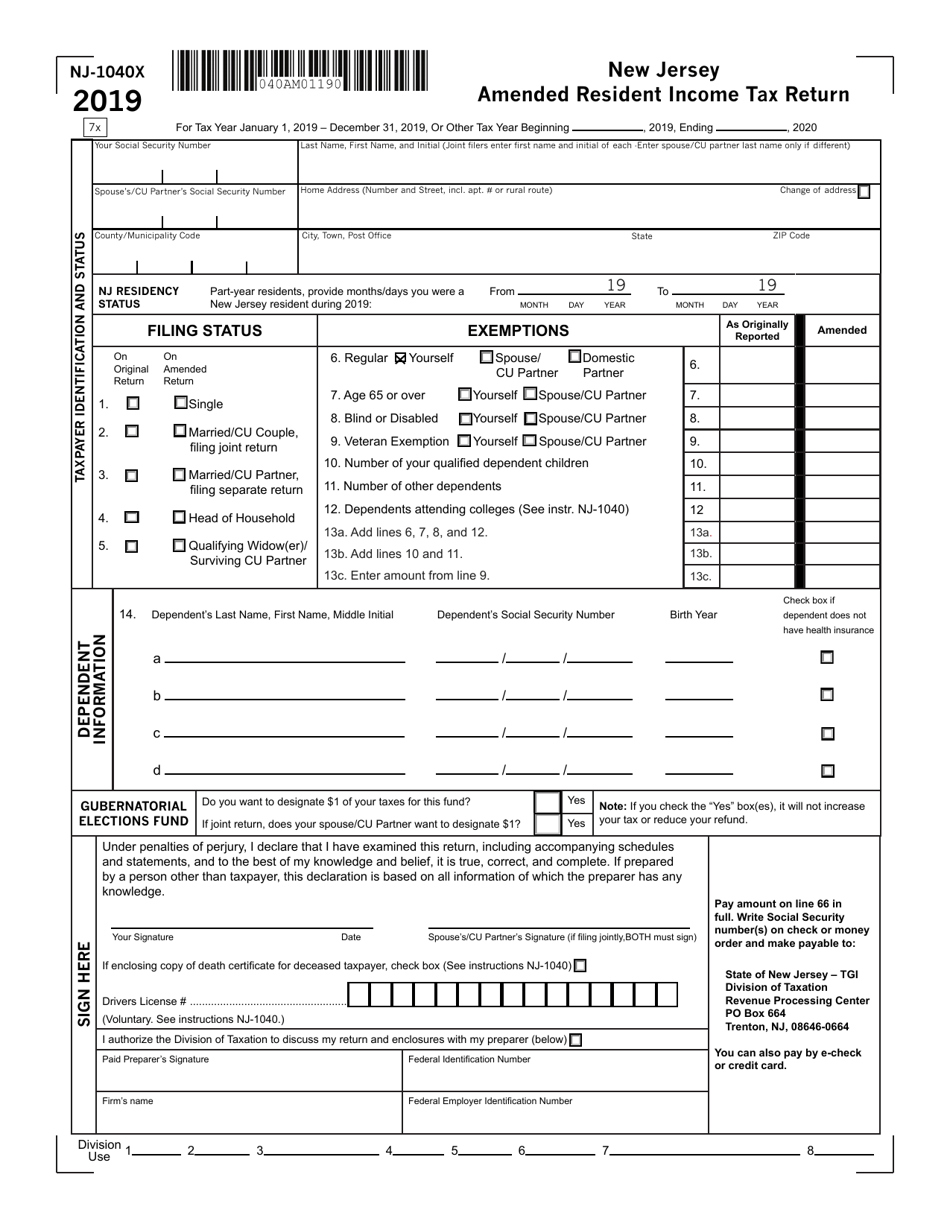

Form NJ1040X Download Fillable PDF or Fill Online New Jersey Amended

You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return. New jersey offers several property tax deductions, exemptions and abatements. Web county and municipal expenses types of property tax exemptions in new jersey property tax exemptions exclude a portion of your home’s value from being taxed. Web property tax in.

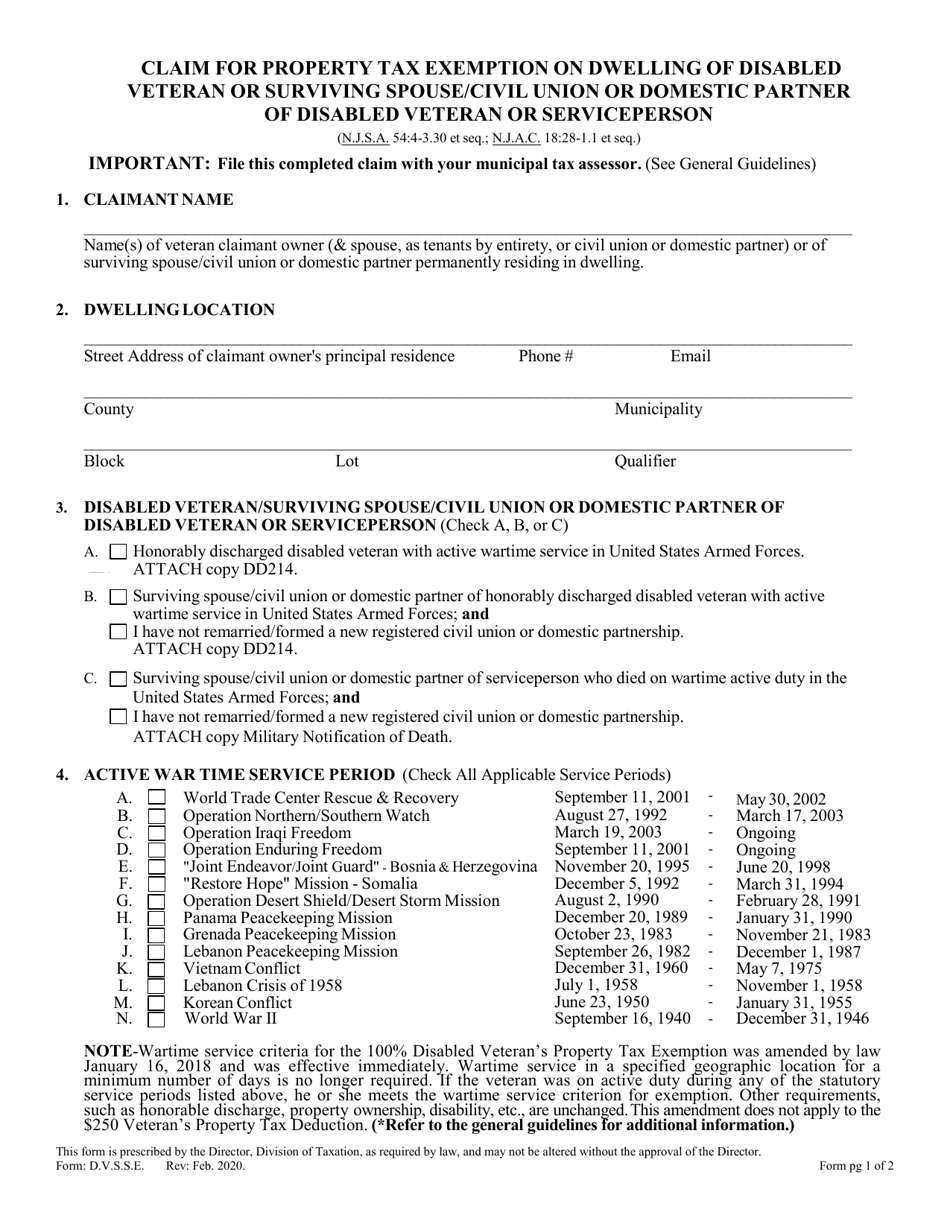

New Jersey Claim for Property Tax Exemption on Dwelling of Disabled

Web claim form property tax exemption for disabled veterans: Web county and municipal expenses types of property tax exemptions in new jersey property tax exemptions exclude a portion of your home’s value from being taxed. Web your tax assessor determines the assessed value of the property with and without the automatic fire suppression system. Full exemption from property taxes on.

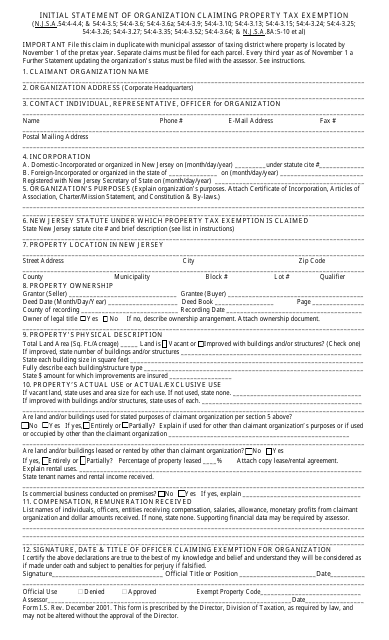

Form I.S. Download Fillable PDF or Fill Online Initial Statement of

If you meet certain requirements, you may have the right to. Full exemption from property taxes on a principal residence for certain totally and. Web generally speaking, new jersey law states that real property “owned by” a charitable organization and used “exclusively for” charitable purposes is entitled to tax. Web property tax in new jersey property tax exemptions property tax.

Property Tax Exemption Report Nonprofit Organization Tax Exemption

Web division of assessment property tax forms property tax forms in this section you can view the sample tax assessment notice mailed to all property owners during the month. Full exemption from property taxes on a principal residence for certain totally and. Web 100% disabled veteran property tax exemption effective december 4, 2020, state law (p.l. This application is for.

New Jersey Property Tax Records Online Property Walls

Web corporation business tax. The subject property is a one. Web this form is prescribed by the director, division of taxation, as required by law. Full exemption from property taxes on a principal residence for certain totally and. New jersey offers several property tax deductions, exemptions and abatements.

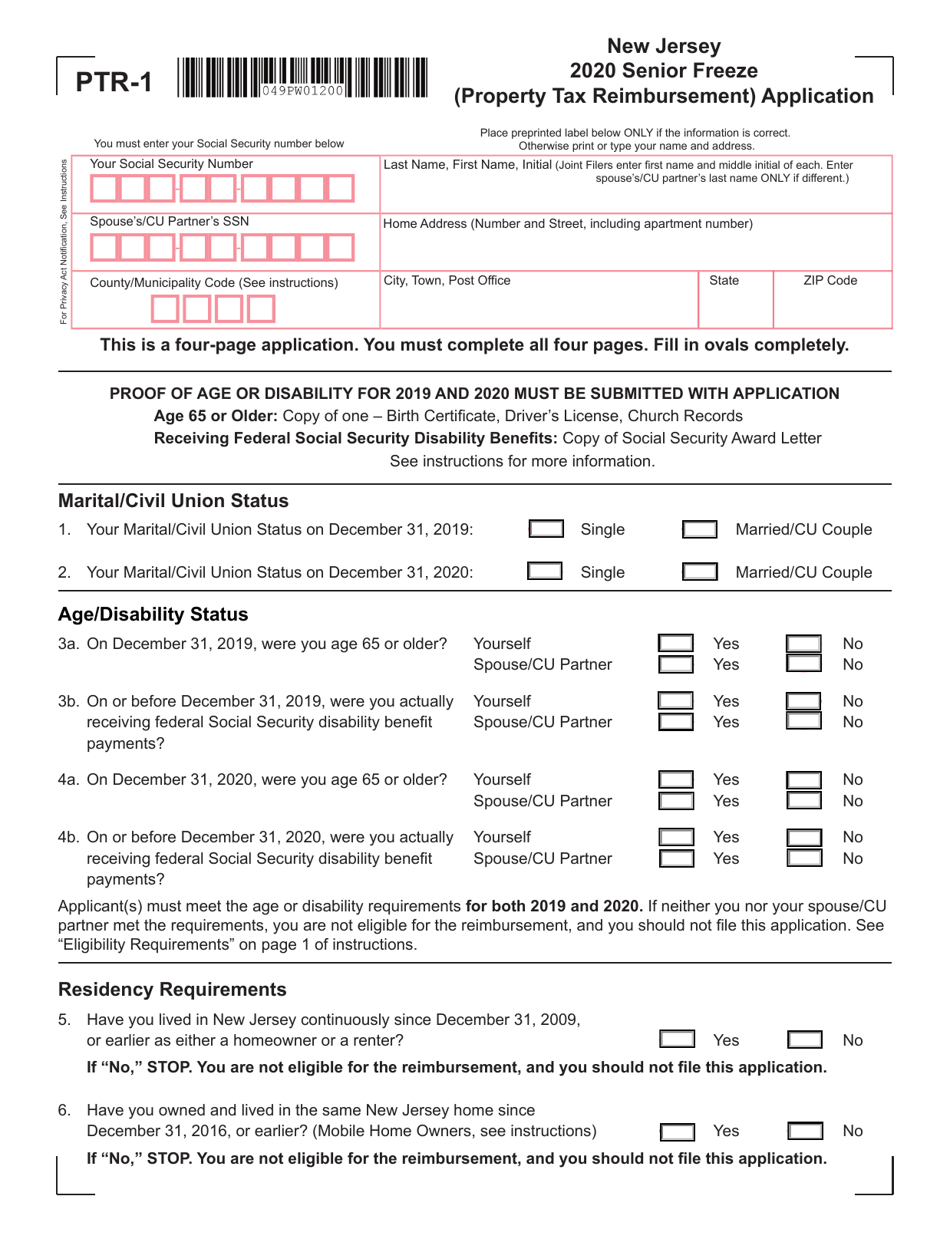

Form PTR1 Download Fillable PDF or Fill Online Senior Freeze (Property

New jersey offers several property tax deductions, exemptions and abatements. Web claim form property tax exemption for disabled veterans: Web property tax in new jersey property tax exemptions property tax exemptions uniformity clause intangible personal property was exempted from the tax base in. This application is for tax exemption tax abatement both. Web this form is prescribed by the director,.

New Tax Exempt Form

New jersey offers several property tax deductions, exemptions and abatements. 413) eliminates the wartime service requirement for the 100% totally and. If you meet certain requirements, you may have the right to. Full exemption from property taxes on a principal residence for certain totally and. Web property tax in new jersey property tax exemptions property tax exemptions uniformity clause intangible.

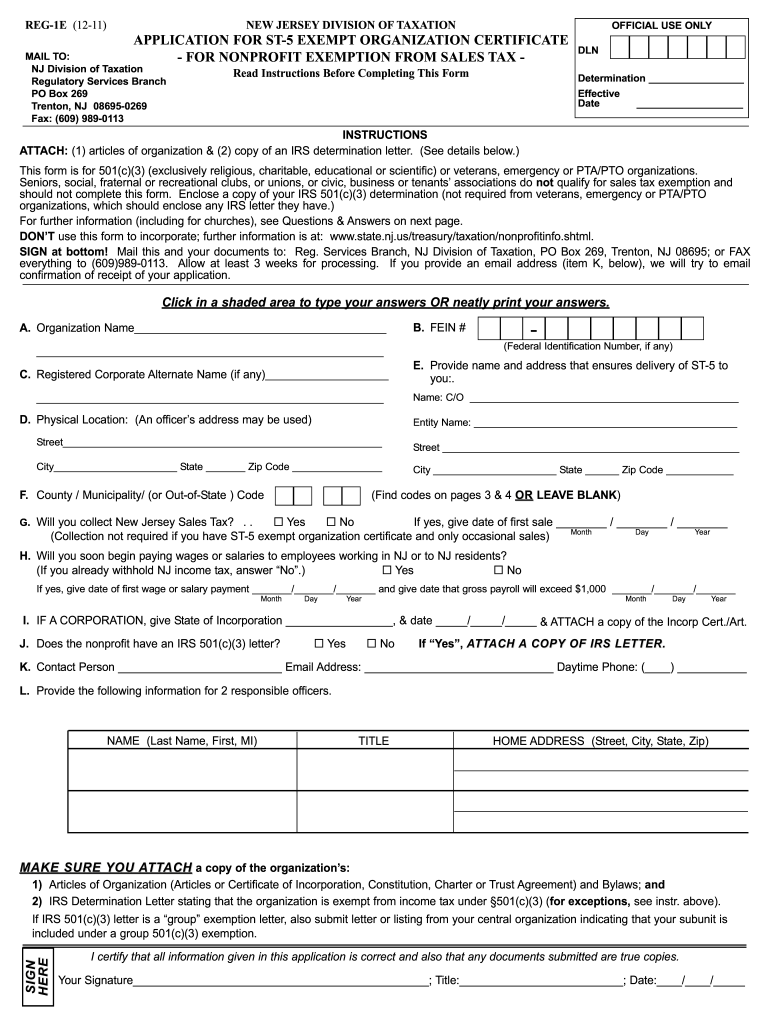

2011 Form NJ REG1E Fill Online, Printable, Fillable, Blank pdfFiller

Web 100% disabled veteran property tax exemption effective december 4, 2020, state law (p.l. Full exemption from property taxes on a principal residence for certain totally and. Web veteran property tax deduction and the disabled veteran property tax exemption. If you meet certain requirements, you may have the right to. Web corporation business tax.

FREE 10+ Sample Tax Exemption Forms in PDF

Web generally speaking, new jersey law states that real property “owned by” a charitable organization and used “exclusively for” charitable purposes is entitled to tax. Web property tax in new jersey property tax exemptions property tax exemptions uniformity clause intangible personal property was exempted from the tax base in. Web the state of new jersey provides senior citizens and people.

Property Tax Deduction (Pdf) Property Tax Deduction Veteran Or Surviving Spouse (Pdf) Property Tax Exemption Disabled Veteran Or.

Web deductions, exemptions, and abatements. Web property tax in new jersey property tax exemptions property tax exemptions uniformity clause intangible personal property was exempted from the tax base in. Web your tax assessor determines the assessed value of the property with and without the automatic fire suppression system. Web 100% disabled veteran property tax exemption effective december 4, 2020, state law (p.l.

Web Claim Form Property Tax Exemption For Disabled Veterans:

If you meet certain requirements, you may have the right to. If you are married (or in a. Web generally speaking, new jersey law states that real property “owned by” a charitable organization and used “exclusively for” charitable purposes is entitled to tax. The amount of exemption is the difference between.

Web Corporation Business Tax.

Web county and municipal expenses types of property tax exemptions in new jersey property tax exemptions exclude a portion of your home’s value from being taxed. New jersey offers several property tax deductions, exemptions and abatements. Full exemption from property taxes on a principal residence for certain totally and. This application is for tax exemption tax abatement both.

Web Tax Exemptions The New Jersey Constitution Authorizes An Annual $250 Deduction From The Real Property Taxes On A Dwelling House Owned And Occupied By A Person, 65 Years.

Web veteran property tax deduction and the disabled veteran property tax exemption. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return. Web division of assessment property tax forms property tax forms in this section you can view the sample tax assessment notice mailed to all property owners during the month. 413) eliminates the wartime service requirement for the 100% totally and.