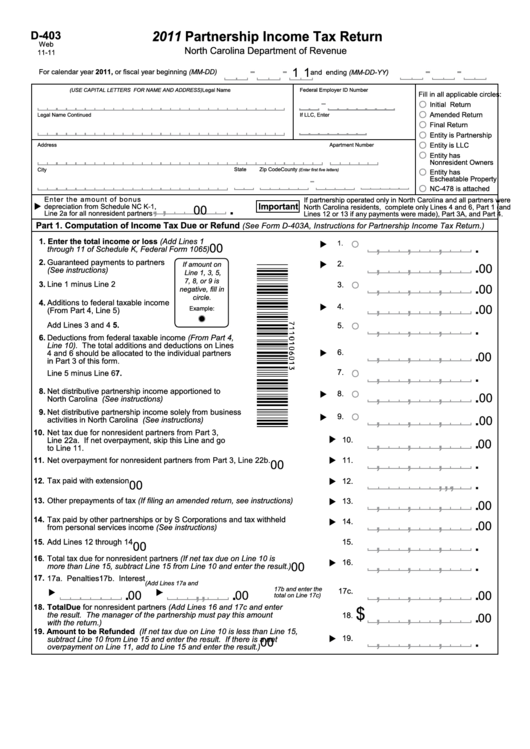

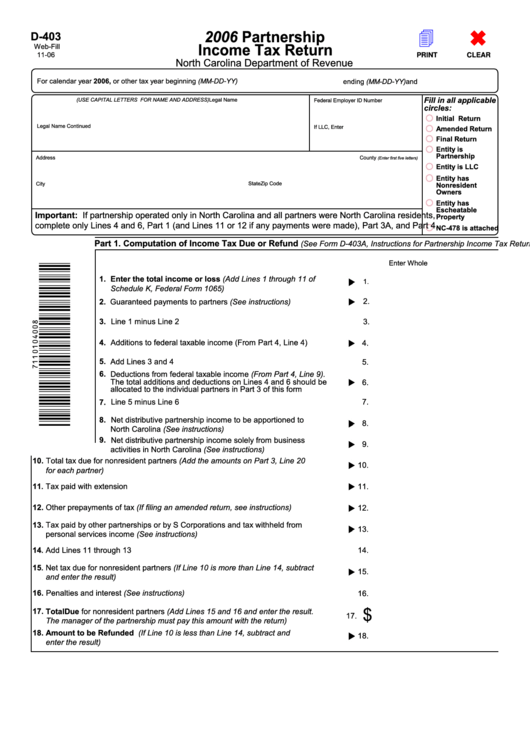

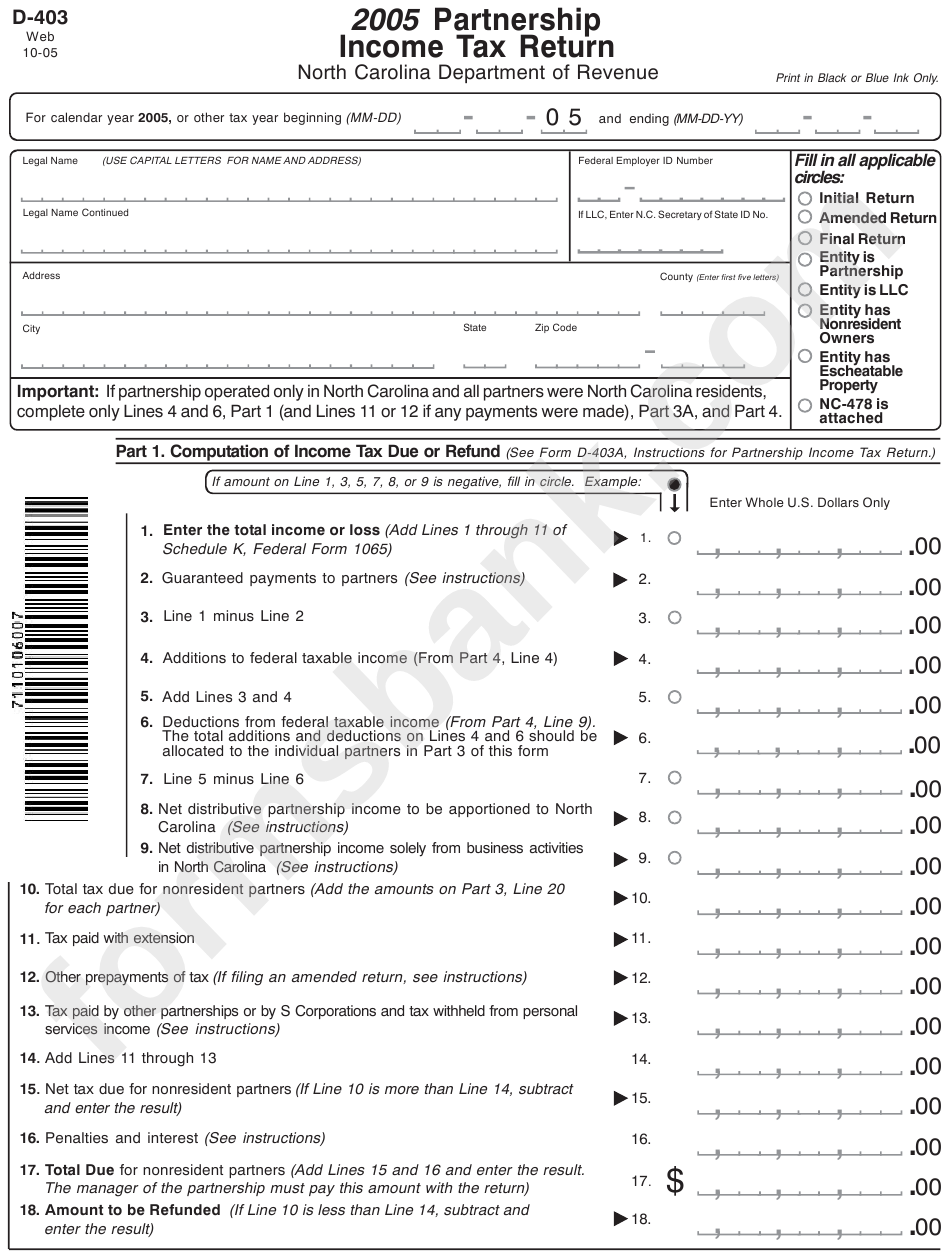

North Carolina Form D 403

North Carolina Form D 403 - Complete, edit or print tax forms instantly. The partnership tax return is due on or before the 15th day of the fourth month following the close of the income year. Third party file and pay option: January 31, 2022 individual income electronic filing options and requirements sales and use electronic filing options and requirements withholding electronic filing options and requirements corporate income and franchise electronic filing options and requirements motor carrier (ifta/in) electronic filing options and. Third party file and pay option: We will update this page with a new version of the form for 2024 as soon as it is made available by the north. This form is for income earned in tax year 2022, with tax returns due in april 2023. The days of distressing complicated tax and legal forms have ended. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent it. If copies are needed, the department will request them at a later date.

Third party file and pay option: This form is for income earned in tax year 2022, with tax returns due in april 2023. The days of distressing complicated tax and legal forms have ended. A partnership whose only activity is as an investment partnership is not considered to be doing business in north carolina. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. January 31, 2022 individual income electronic filing options and requirements sales and use electronic filing options and requirements withholding electronic filing options and requirements corporate income and franchise electronic filing options and requirements motor carrier (ifta/in) electronic filing options and. Third party file and pay option: Web follow the simple instructions below: A legal name (first 10 characters) 4.

A partnership whose only activity is as an investment partnership is not considered to be doing business in north carolina. Complete, edit or print tax forms instantly. Additions to income (loss) (to form. A legal name (first 10 characters) 4. The partnership tax return is due on or before the 15th day of the fourth month following the close of the income year. Web safety measures are in place to protect your tax information. If copies are needed, the department will request them at a later date. Web follow the simple instructions below: Third party file and pay option: Get ready for tax season deadlines by completing any required tax forms today.

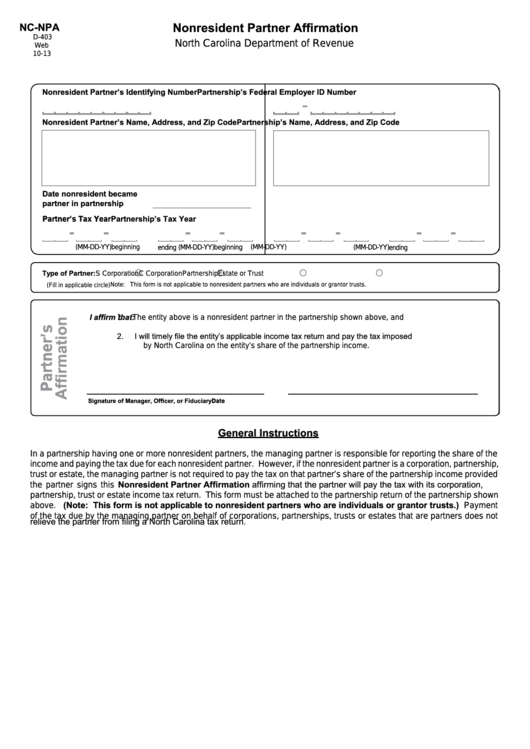

Form NcNpa Nonresident Partner Affirmation printable pdf download

Third party file and pay option: We will update this page with a new version of the form for 2024 as soon as it is made available by the north. A legal name (first 10 characters) 4. If copies are needed, the department will request them at a later date. A partnership whose only activity is as an investment partnership.

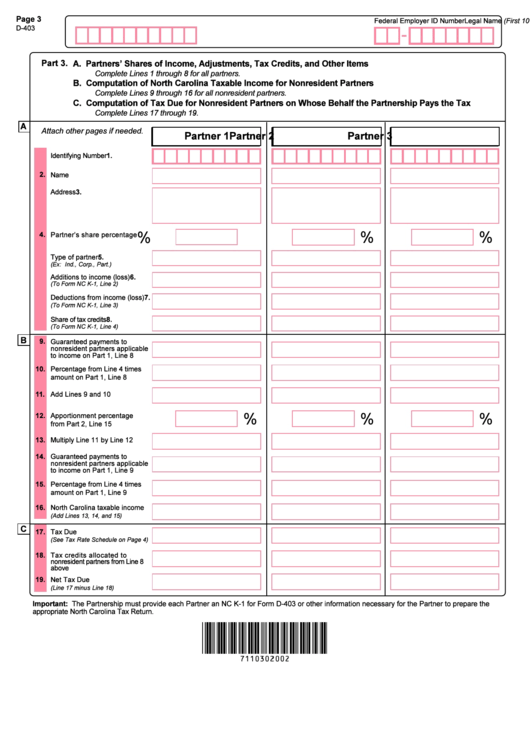

Form D403 North Carolina Tax Return printable pdf download

The days of distressing complicated tax and legal forms have ended. January 31, 2022 individual income electronic filing options and requirements sales and use electronic filing options and requirements withholding electronic filing options and requirements corporate income and franchise electronic filing options and requirements motor carrier (ifta/in) electronic filing options and. Additions to income (loss) (to form. The partnership tax.

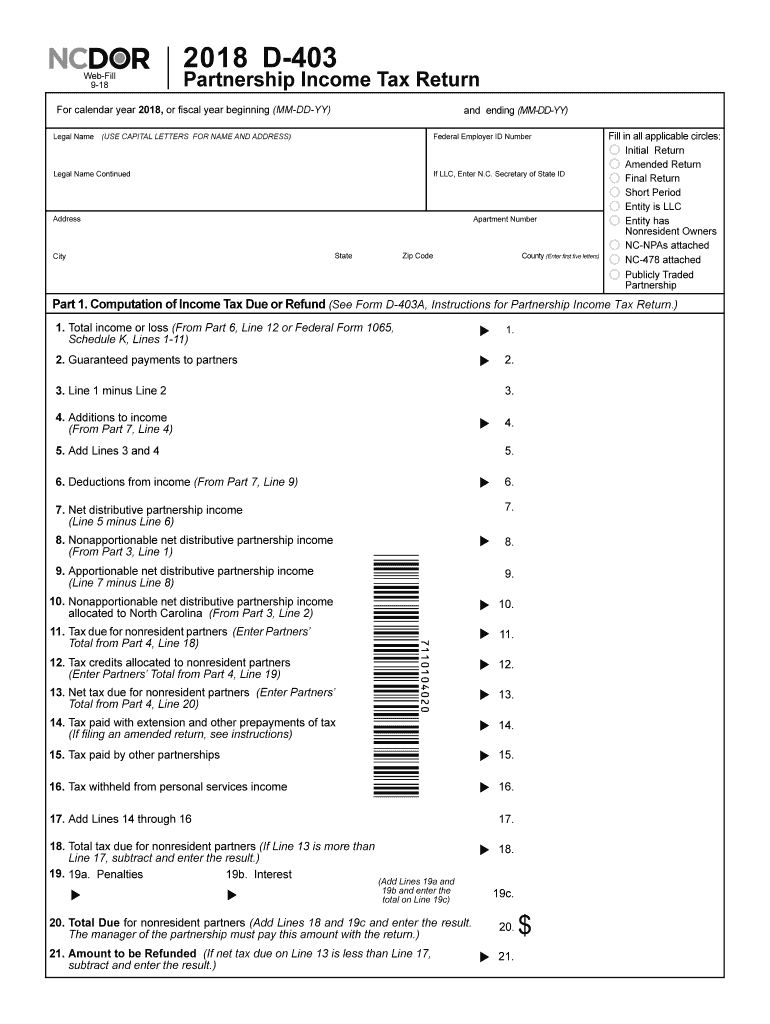

2018 Form NC DoR D403 Fill Online, Printable, Fillable, Blank pdfFiller

We will update this page with a new version of the form for 2024 as soon as it is made available by the north. January 31, 2022 individual income electronic filing options and requirements sales and use electronic filing options and requirements withholding electronic filing options and requirements corporate income and franchise electronic filing options and requirements motor carrier (ifta/in).

Form D400 Download Fillable PDF or Fill Online Individual Tax

The partnership tax return is due on or before the 15th day of the fourth month following the close of the income year. Get ready for tax season deadlines by completing any required tax forms today. Ad edit, sign and print tax forms on any device with uslegalforms. Additions to income (loss) (to form. Payment vouchers are provided to accompany.

North Carolina Form 2a11 T 20202022 Fill and Sign Printable Template

A legal name (first 10 characters) 4. We will update this page with a new version of the form for 2024 as soon as it is made available by the north. Edit, sign and print tax forms on any device with pdffiller. If copies are needed, the department will request them at a later date. January 31, 2022 individual income.

Form D403 Partnership Tax Return, Form Nc K1 Parther'S

Third party file and pay option: Edit, sign and print tax forms on any device with pdffiller. Get ready for tax season deadlines by completing any required tax forms today. January 31, 2022 individual income electronic filing options and requirements sales and use electronic filing options and requirements withholding electronic filing options and requirements corporate income and franchise electronic filing.

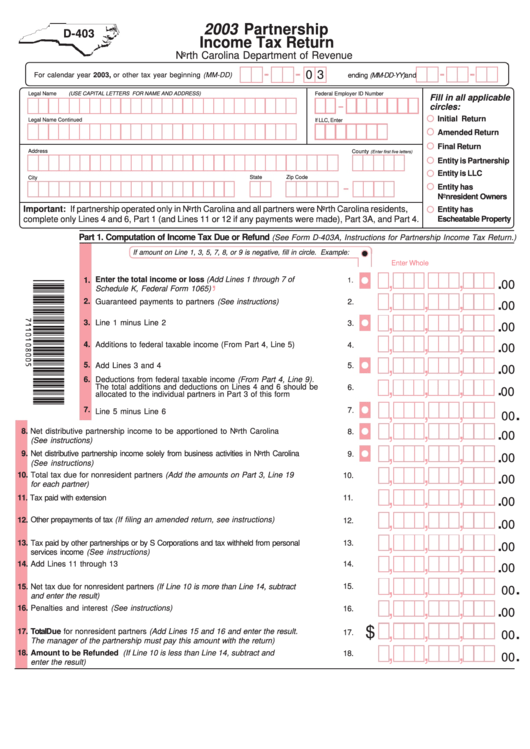

Form D403 Partnership Tax Return 2011 printable pdf download

Additions to income (loss) (to form. Complete, edit or print tax forms instantly. Web safety measures are in place to protect your tax information. A legal name (first 10 characters) 4. Third party file and pay option:

Fillable Form D403 Partnership Tax Return 2006, Form Nc K1

Third party file and pay option: For partners who are c or s corporations, partnerships, estates, or trusts, the box will default to no. Third party file and pay option: We will update this page with a new version of the form for 2024 as soon as it is made available by the north. Get ready for tax season deadlines.

Nc d400 instructions 2016

A legal name (first 10 characters) 4. Web safety measures are in place to protect your tax information. Complete, edit or print tax forms instantly. Edit, sign and print tax forms on any device with pdffiller. Third party file and pay option:

Payment Vouchers Are Provided To Accompany Checks Mailed To Pay Off Tax Liabilities, And Are Used By The Revenue Department To Record The Purpose Of The Check And The Ssn/Ein Of The Taxpayer Who Sent It.

January 31, 2022 individual income electronic filing options and requirements sales and use electronic filing options and requirements withholding electronic filing options and requirements corporate income and franchise electronic filing options and requirements motor carrier (ifta/in) electronic filing options and. Edit, sign and print tax forms on any device with pdffiller. Third party file and pay option: This form is for income earned in tax year 2022, with tax returns due in april 2023.

Ad Edit, Sign And Print Tax Forms On Any Device With Uslegalforms.

We will update this page with a new version of the form for 2024 as soon as it is made available by the north. Additions to income (loss) (to form. Web follow the simple instructions below: The partnership tax return is due on or before the 15th day of the fourth month following the close of the income year.

A Partnership Whose Only Activity Is As An Investment Partnership Is Not Considered To Be Doing Business In North Carolina.

Third party file and pay option: Web safety measures are in place to protect your tax information. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

A Legal Name (First 10 Characters) 4.

Third party file and pay option: For partners who are c or s corporations, partnerships, estates, or trusts, the box will default to no. Third party file and pay option: If copies are needed, the department will request them at a later date.