Ohio Nonresident Tax Form

Ohio Nonresident Tax Form - This form is for income earned in tax year 2022, with tax returns due in april 2023. 5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. If you make $70,000 a year living in california you will be taxed $11,221. Beginning with tax year 2021, individuals with ohio taxable nonbusiness income of $25,000 or less are not subject to ohio income tax. Your average tax rate is 11.67% and your marginal tax rate is. Ohio it 1040 and sd 100 forms. Web ohio it 1040 and sd 100 forms. Complete, edit or print tax forms instantly. Web ohio state tax non resident i live and work in texas. Nonresident taxpayers who are eligible to file form it nrs may now make their statement using the it.

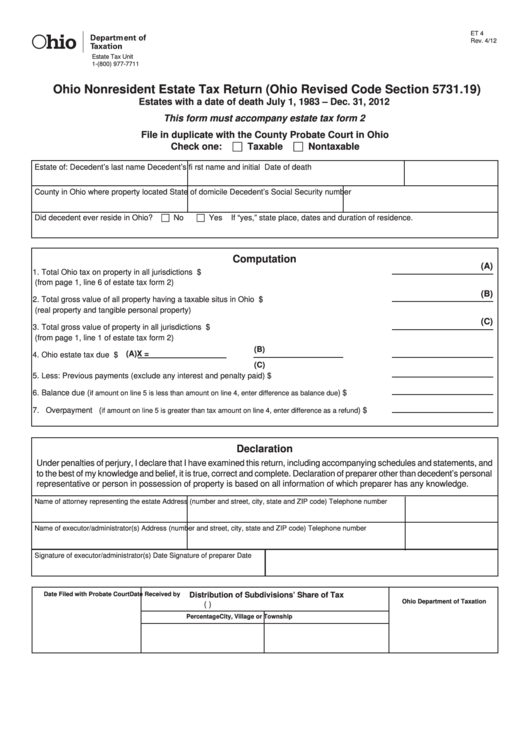

Web ohio it 1040 and sd 100 forms. The ohio department of taxation provides a searchable repository of individual tax forms for. Ohio it 1040 and sd 100 forms. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the ohio nonresident estate tax return in march 2023, so this is the latest version of form et 4, fully updated for tax year 2022. My wife owns a rental property in ohio. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. Web 4) did not claim homestead exemption for an ohio property during the tax year. Your average tax rate is 11.67% and your marginal tax rate is. An exception is for full year nonresidents.

Web we last updated ohio form it nrs in february 2023 from the ohio department of taxation. Web ohio income tax tables. Ohio it 1040 and sd 100 forms. Complete, edit or print tax forms instantly. Web 4) did not claim homestead exemption for an ohio property during the tax year. It will take several months for the department to process your paper return. The ohio department of taxation provides a searchable repository of individual tax forms for. Web ohio it 1040 and sd 100 forms. This form is for taxpayers claiming the nonresident. An exception is for full year nonresidents.

Fillable Form Et 4 Ohio Nonresident Estate Tax Return (Ohio Revised

Beginning with tax year 2021, individuals with ohio taxable nonbusiness income of $25,000 or less are not subject to ohio income tax. The ohio department of taxation provides a searchable repository of individual tax forms for. Register and subscribe now to work on oh ez individual resident tax return city of toledo. The only ohio money made is the money.

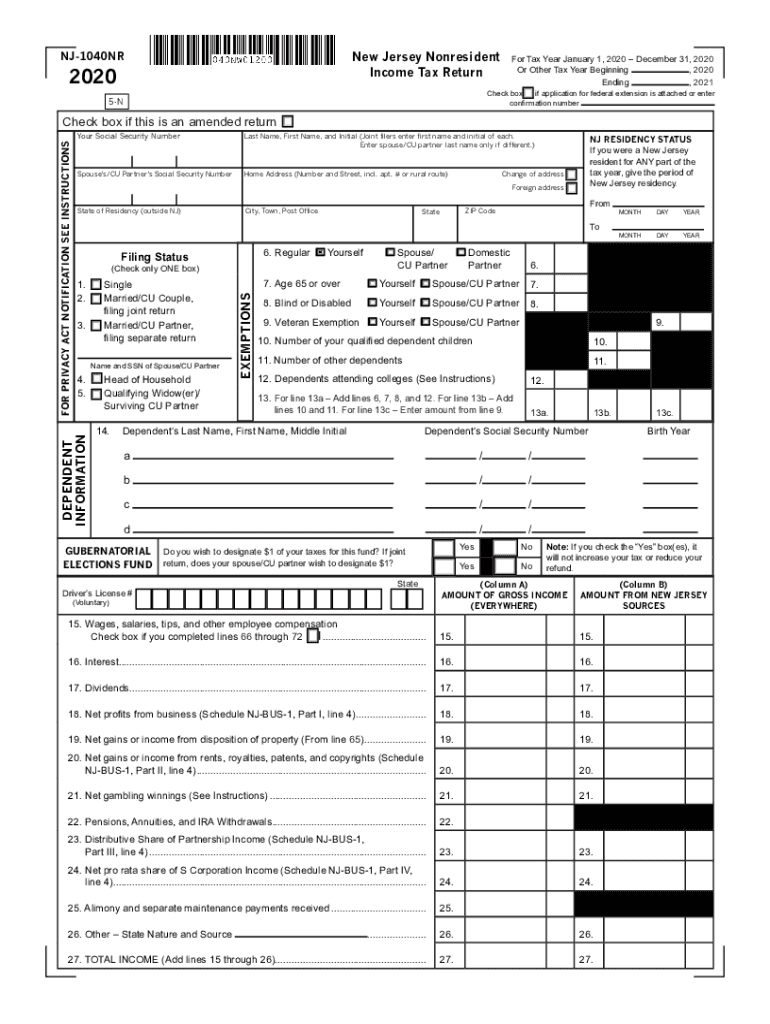

2020 Nj 1040Nr Fill Out and Sign Printable PDF Template signNow

Web we last updated ohio form it nrs in february 2023 from the ohio department of taxation. Web access the forms you need to file taxes or do business in ohio. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax.

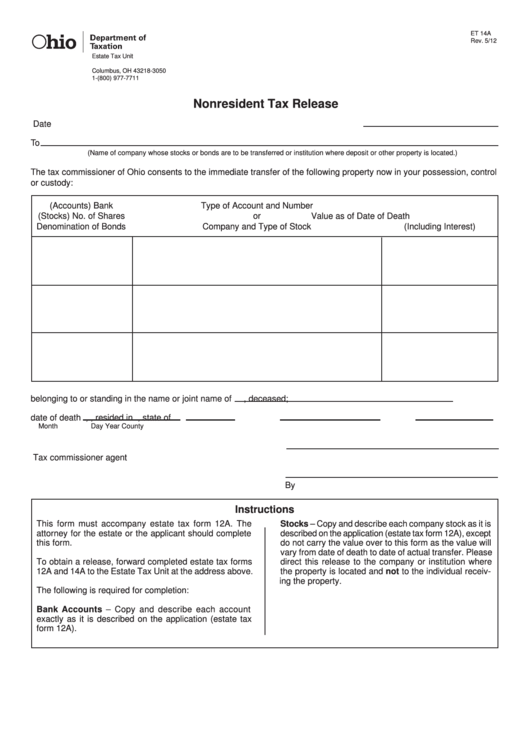

Fillable Form Et 14a Nonresident Tax Release Ohio Department Of

Register and subscribe now to work on oh ez individual resident tax return city of toledo. Web access the forms you need to file taxes or do business in ohio. My wife owns a rental property in ohio. 5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. Web we.

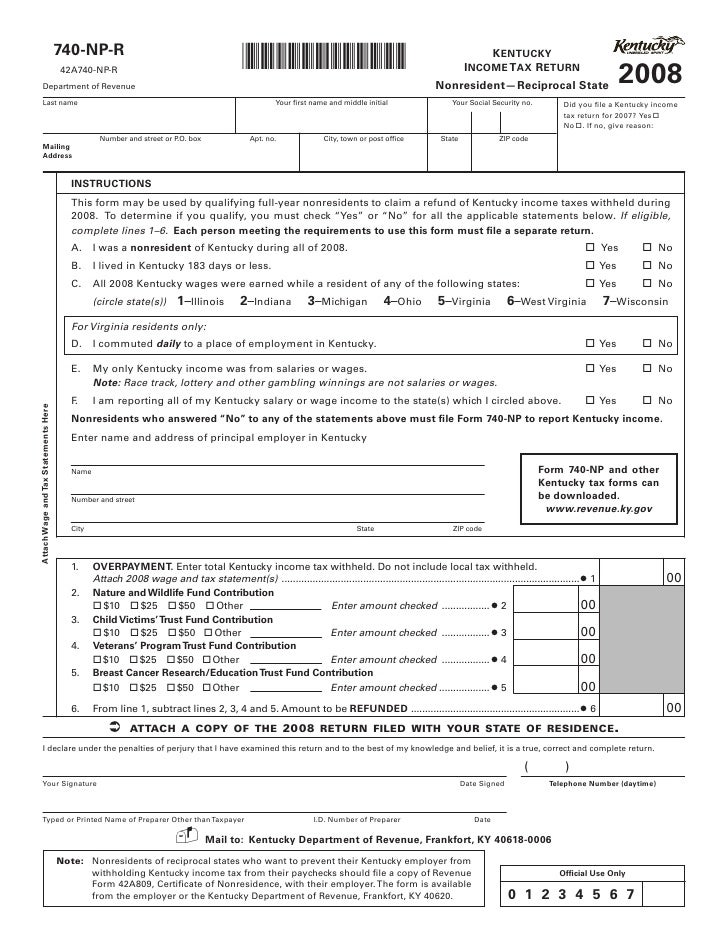

Kentucky Unemployment Back Pay Form NEMPLOY

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web 4) did not claim homestead exemption for an ohio property during the tax year. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for.

Fill Free fillable Ohio IT NRC Allocation and Apportionment

If you make $70,000 a year living in california you will be taxed $11,221. Beginning with tax year 2021, individuals with ohio taxable nonbusiness income of $25,000 or less are not subject to ohio income tax. Web ohio income tax tables. Register and subscribe now to work on oh ez individual resident tax return city of toledo. My wife owns.

Form 1040NR U.S. Nonresident Alien Tax Return Form (2014

5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. Ohio it 1040 and sd 100 forms. Your average tax rate is 11.67% and your marginal tax rate is. Register and subscribe now to work on oh ez individual resident tax return city of toledo. You can download or print.

State Of Ohio Tax Withholding Tables 2017 Review Home Decor

5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. It will take several months for the department to process your paper return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the ohio nonresident statement (formerly form.

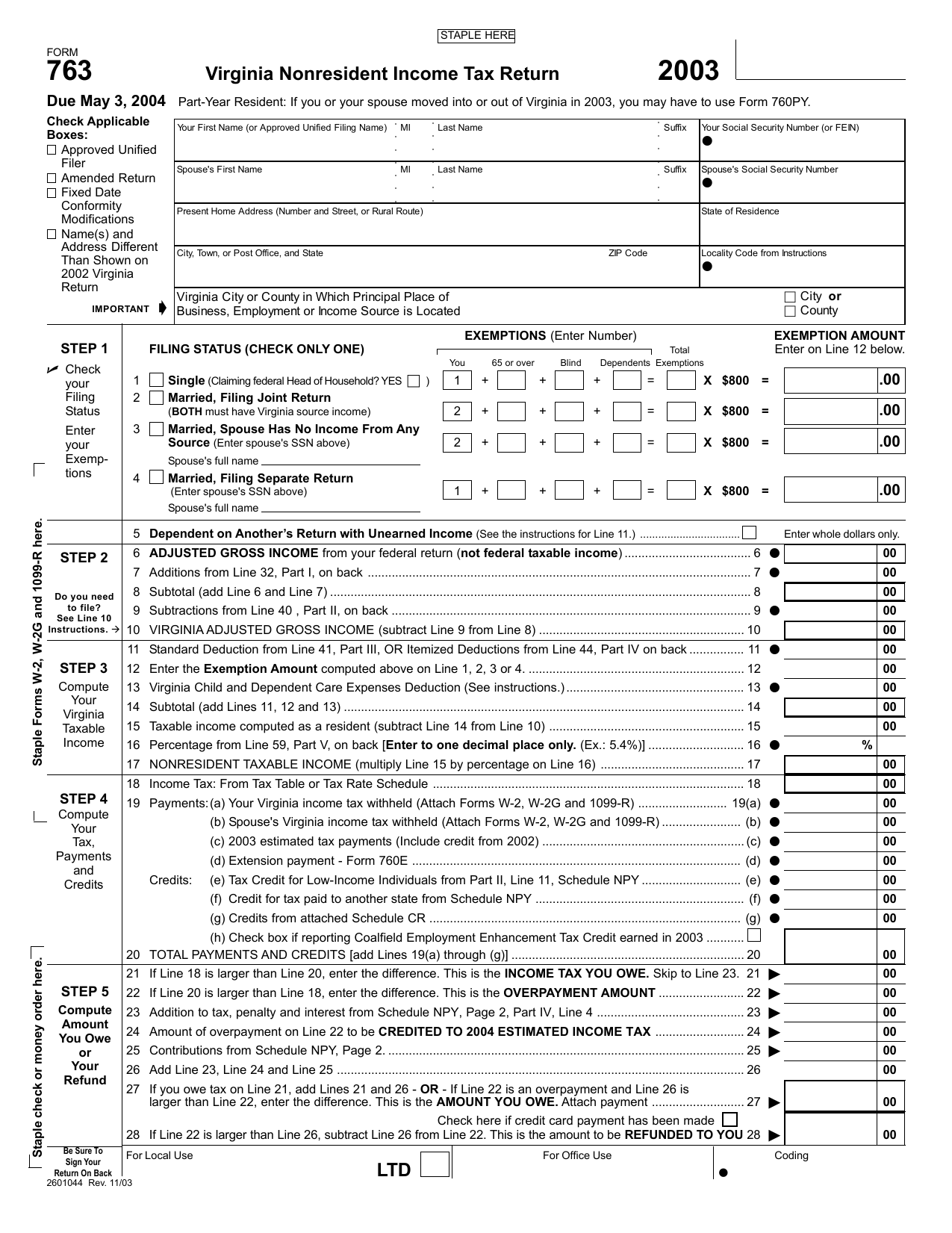

Virginia Nonresident Tax Return LTD

Web we last updated ohio form it nrs in february 2023 from the ohio department of taxation. The ohio department of taxation provides a searchable repository of individual tax forms for. Web access the forms you need to file taxes or do business in ohio. Your average tax rate is 11.67% and your marginal tax rate is. Web we last.

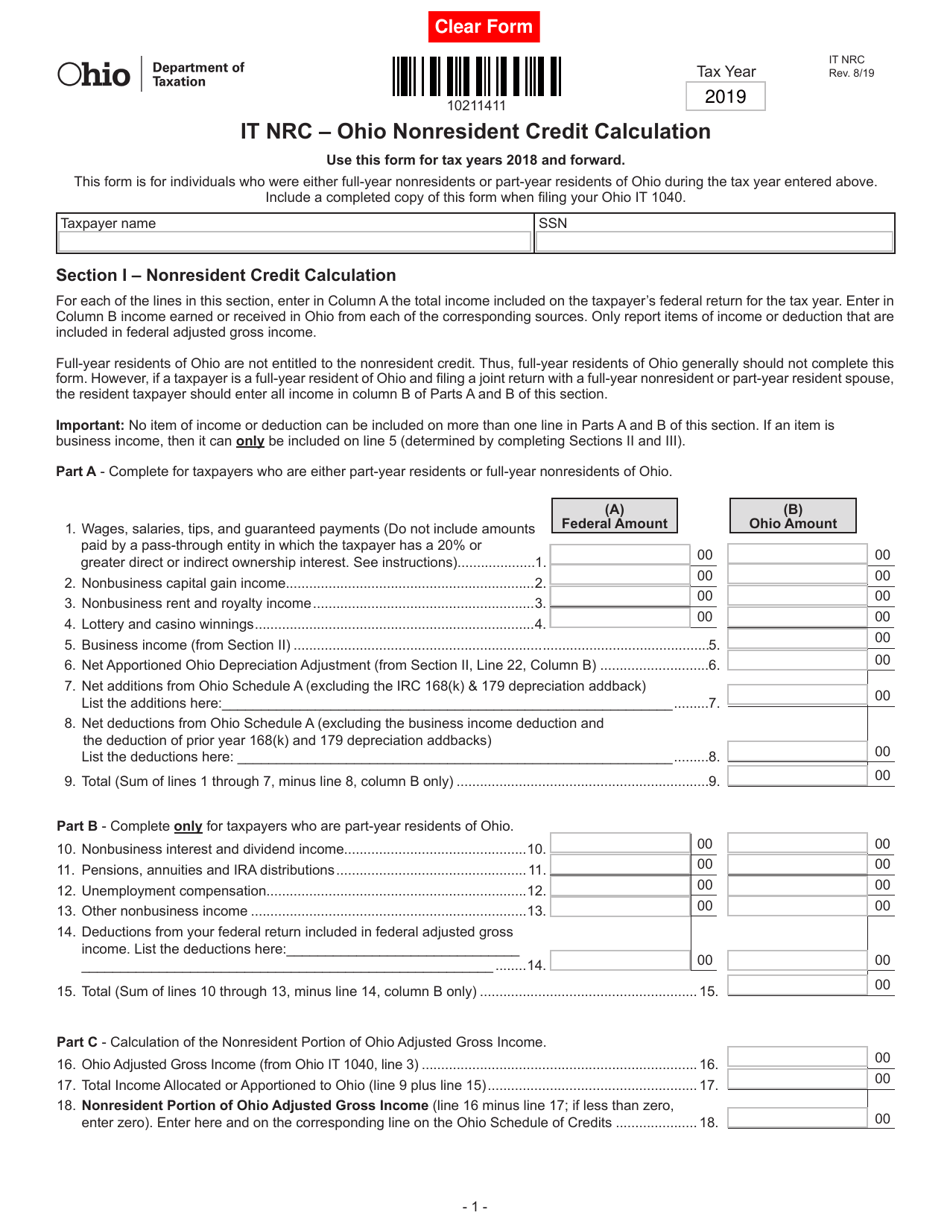

Form IT NRC Download Fillable PDF or Fill Online Ohio Nonresident

Ohio it 1040 and sd 100 forms. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web ohio it 1040 and sd 100 forms. Web we last updated the ohio nonresident estate tax return in march 2023, so this is the latest version of form et 4, fully updated for tax year.

Fill Free fillable IT NRC Ohio Nonresident Credit Calculation 8/19

This form is for income earned in tax year 2022, with tax returns due in april 2023. You can download or print current. Web ohio it 1040 and sd 100 forms. 5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. Ohio it 1040 and sd 100 forms.

Register And Subscribe Now To Work On Oh Ez Individual Resident Tax Return City Of Toledo.

It will take several months for the department to process your paper return. Ohio it 1040 and sd 100 forms. Complete, edit or print tax forms instantly. Your average tax rate is 11.67% and your marginal tax rate is.

Web We Last Updated Ohio Form It Nrs In February 2023 From The Ohio Department Of Taxation.

This form is for income earned in tax year 2022, with tax returns due in april 2023. An exception is for full year nonresidents. Web we last updated the ohio nonresident estate tax return in march 2023, so this is the latest version of form et 4, fully updated for tax year 2022. The only ohio money made is the money from that rental property.

Nonresident Taxpayers Who Are Eligible To File Form It Nrs May Now Make Their Statement Using The It.

Web ohio state tax non resident i live and work in texas. If you make $70,000 a year living in california you will be taxed $11,221. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. The ohio department of taxation provides a searchable repository of individual tax forms for.

You Can Download Or Print Current.

Web ohio income tax tables. This form is for taxpayers claiming the nonresident. Beginning with tax year 2021, individuals with ohio taxable nonbusiness income of $25,000 or less are not subject to ohio income tax. Web 4) did not claim homestead exemption for an ohio property during the tax year.