Owners Drawings Quickbooks

Owners Drawings Quickbooks - Enter the payment and use owner equity drawing as the expense (reason) for the payment. Web classify bank transactions for owner's drawings & owner's investments hi nbish11, both ways that you've suggested can work to record your owners' drawings, as quickbooks considers expense transactions and transfers to. Web understanding the difference between an owner’s draw vs. Web recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to the draw accounts. Once done, select save and close. Don't forget to like and subscribe. 16k views 2 years ago. Is there a better way to do this? A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. An owner’s draw is when an owner takes money out of the business.

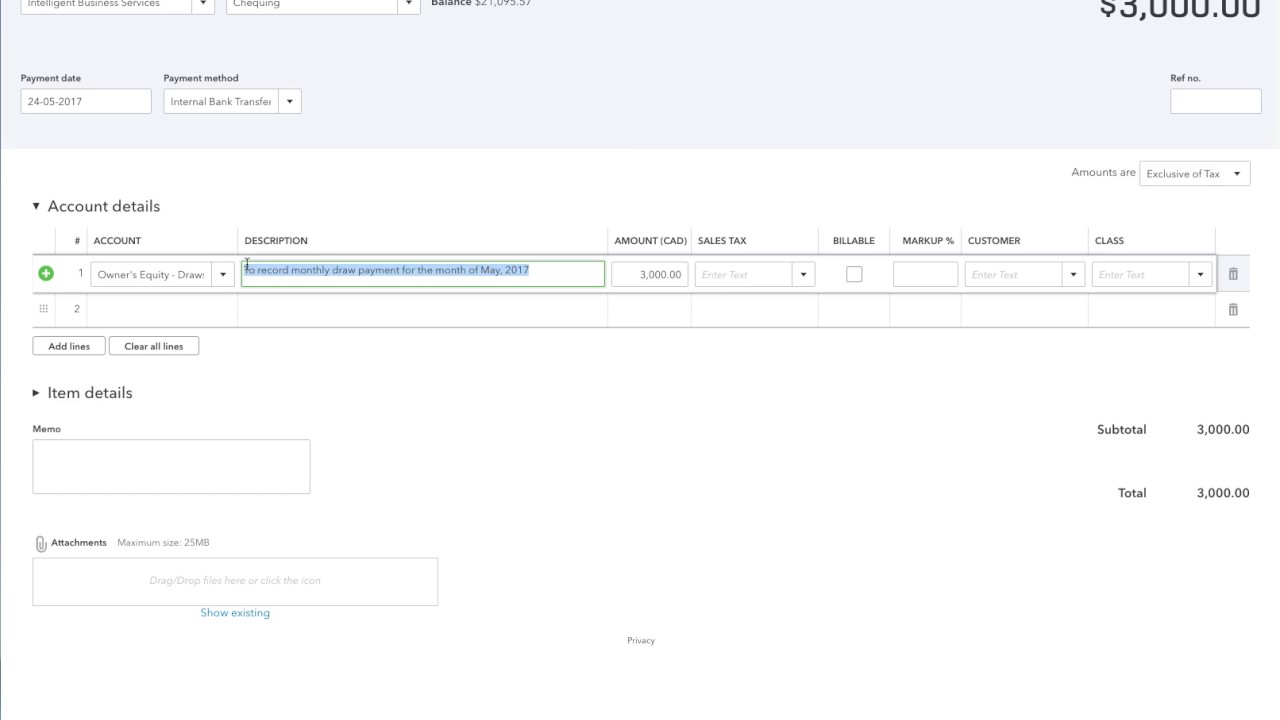

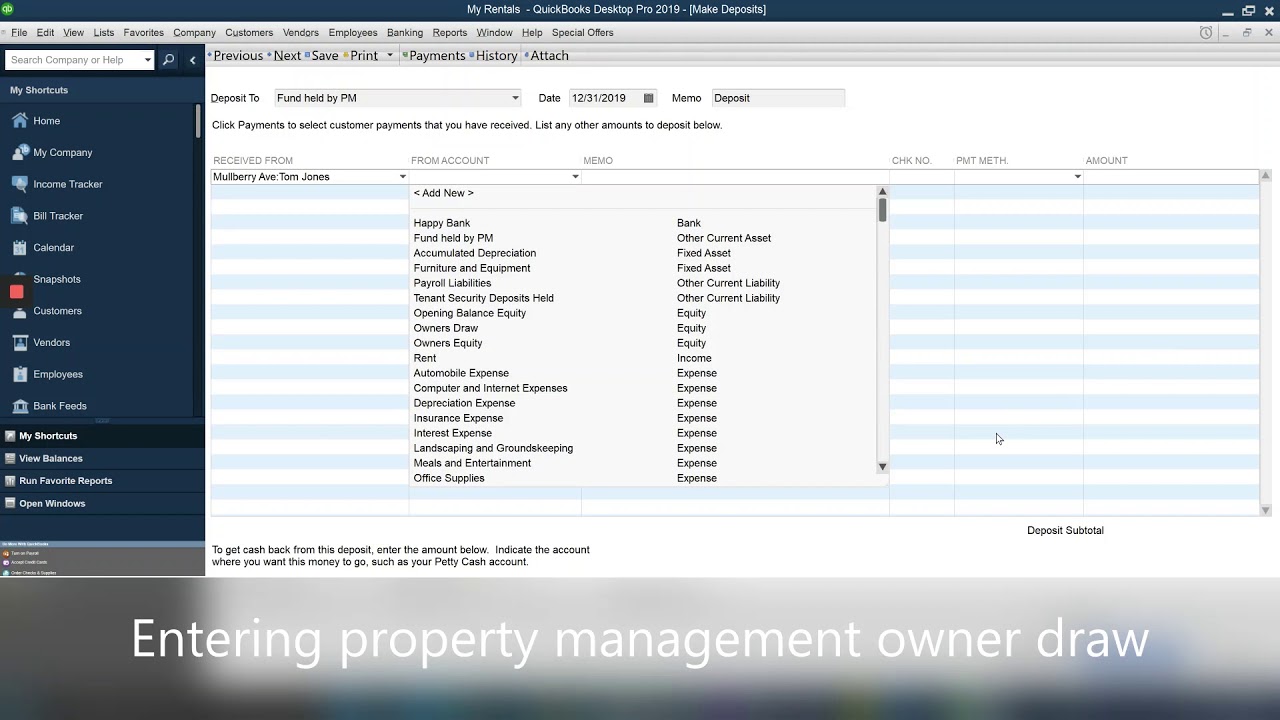

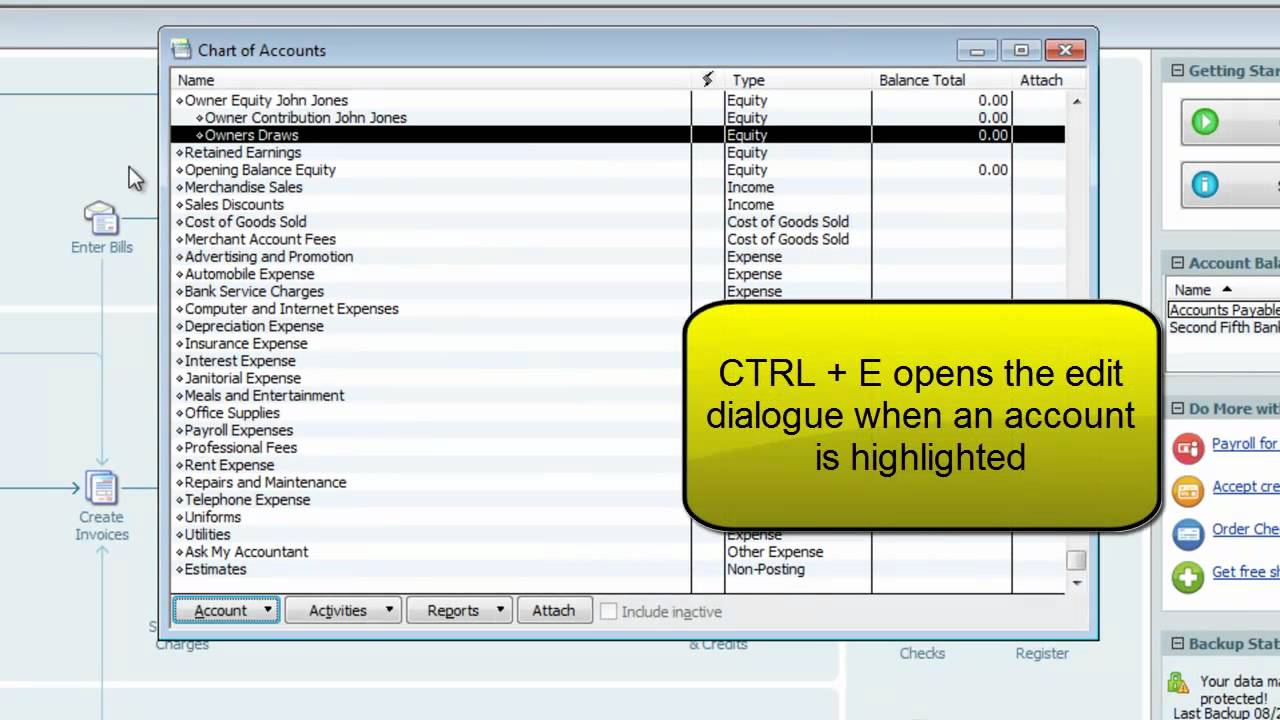

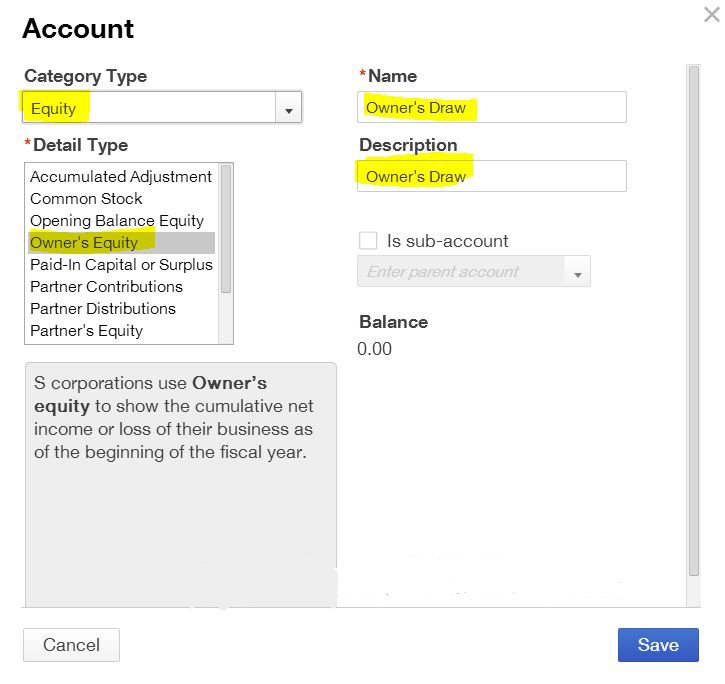

Web creating and tracking owner draw. It is also helpful to maintain current and prior year draw accounts for tax purposes. For a company taxed as a sole proprietor (trader), i recommend you have the following for owner/partner equity accounts. Web to properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal and maintain accurate financial records. Create owner’s draw account under equity type. Select “chart of account” under settings. A clip from mastering quick. Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. From poking around in various threads, i've read that: Sole proprietors can take money directly out of their company as an owner draw and use the funds to pay personal expenses unrelated to the business.

Web in your qbo: Let’s go over what to do when the business. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. Once done, select save and close. It represents a reduction in the owner’s equity in. Or, the owner can take out funds they contributed. As we noted in our earlier articles, drawings are transactions withdrawing equity an owner has either previously put into the business or otherwise built up over time. I used to use quickbooks, but have transitioned to quicken and the account i set up for owner's draw is reporting as unspecified business expense. Web creating and tracking owner draw. Web what is the owner’s draw in quickbooks?

Owner's Draw Via Direct Deposit QuickBooks Online Tutorial The Home

Owner’s draw refers to the process of withdrawing money from a business for personal use by the owner. Upon setting up the owner’s equity account, quickbooks enables users to categorize these transactions appropriately. Create owner’s draw account under equity type. Business owners can withdraw profits earned by the company. Enter the payment and use owner equity drawing as the expense.

how to take an owner's draw in quickbooks Ulysses Fennell

Web from understanding what owner’s draw is and how to record it in quickbooks to the essential steps for zeroing out owner’s draw, this article aims to provide a clear and actionable roadmap for business owners and accounting professionals alike. Important offers, pricing details & disclaimers. If you want more insights on how to better record this transaction specific to.

How to enter the property management owner draw to QuickBooks YouTube

Upon setting up the owner’s equity account, quickbooks enables users to categorize these transactions appropriately. Web to properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal and maintain accurate financial records. For sole proprietors, an owner’s draw is the only option for payment. Web understanding the difference between.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Web from understanding what owner’s draw is and how to record it in quickbooks to the essential steps for zeroing out owner’s draw, this article aims to provide a clear and actionable roadmap for business owners and accounting professionals alike. For sole proprietors, an owner’s draw is the only option for payment. Upon setting up the owner’s equity account, quickbooks.

Owners draw balances

The owner's equity is made up of different funds, including money you've invested in your business. Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. A clip from mastering quick. Web in your qbo: Web zero out owner's draw / contribution accounts into owner's equity account.

Quickbooks Owner Draws & Contributions YouTube

I used to use quickbooks, but have transitioned to quicken and the account i set up for owner's draw is reporting as unspecified business expense. The owner's equity is made up of different funds, including money you've invested in your business. Don't forget to like and subscribe. Web if you're a sole proprietor, you must be paid with an owner's.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

It is also helpful to maintain current and prior year draw accounts for tax purposes. Enter the payment and use owner equity drawing as the expense (reason) for the payment. Upon setting up the owner’s equity account, quickbooks enables users to categorize these transactions appropriately. Web the owner's draws are usually taken from your owner's equity account. This will handle.

Owners draw QuickBooks Desktop Setup, Record & Pay Online

If you want more insights on how to better record this transaction specific to your business and situation we suggest contacting your accountant. Sole proprietors can take money directly out of their company as an owner draw and use the funds to pay personal expenses unrelated to the business. I used to use quickbooks, but have transitioned to quicken and.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Know that you can select the equity account when creating a check for the owner. Select “chart of account” under settings. Don't forget to like and subscribe. Qb automatically provides a retained earnings account with a closing entry for the net income at the end of. Web to setup owner’s draw in the chart of accounts (coa):

Owners Draw Quickbooks Desktop DRAWING IDEAS

Enter the payment and use owner equity drawing as the expense (reason) for the payment. An owner’s draw is when an owner takes money out of the business. Web to setup owner’s draw in the chart of accounts (coa): For a company taxed as a sole proprietor (trader), i recommend you have the following for owner/partner equity accounts. The money.

An Owner’s Draw Is When An Owner Takes Money Out Of The Business.

Web zero out owner's draw / contribution accounts into owner's equity account. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Or, the owner can take out funds they contributed. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee.

A Clip From Mastering Quick.

This will handle and track the withdrawals of the company's assets to pay an owner. An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. Upon setting up the owner’s equity account, quickbooks enables users to categorize these transactions appropriately. Web to setup owner’s draw in the chart of accounts (coa):

Web Business Owners Often Use The Company’s Bank And Credit Card Accounts To Pay Personal Bills And Expenses, Or Simply Withdraw Money To Pay Themselves.

Web recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to the draw accounts. Web an owner's draw is how the owner of a sole proprietorship, or one of the partners in a partnership, can take money from the company if needed. Web creating and tracking owner draw. Create owner’s draw account under equity type.

Important Offers, Pricing Details & Disclaimers.

Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw. I used to use quickbooks, but have transitioned to quicken and the account i set up for owner's draw is reporting as unspecified business expense. There is no fixed amount and no fixed interval for these payments. 16k views 2 years ago.