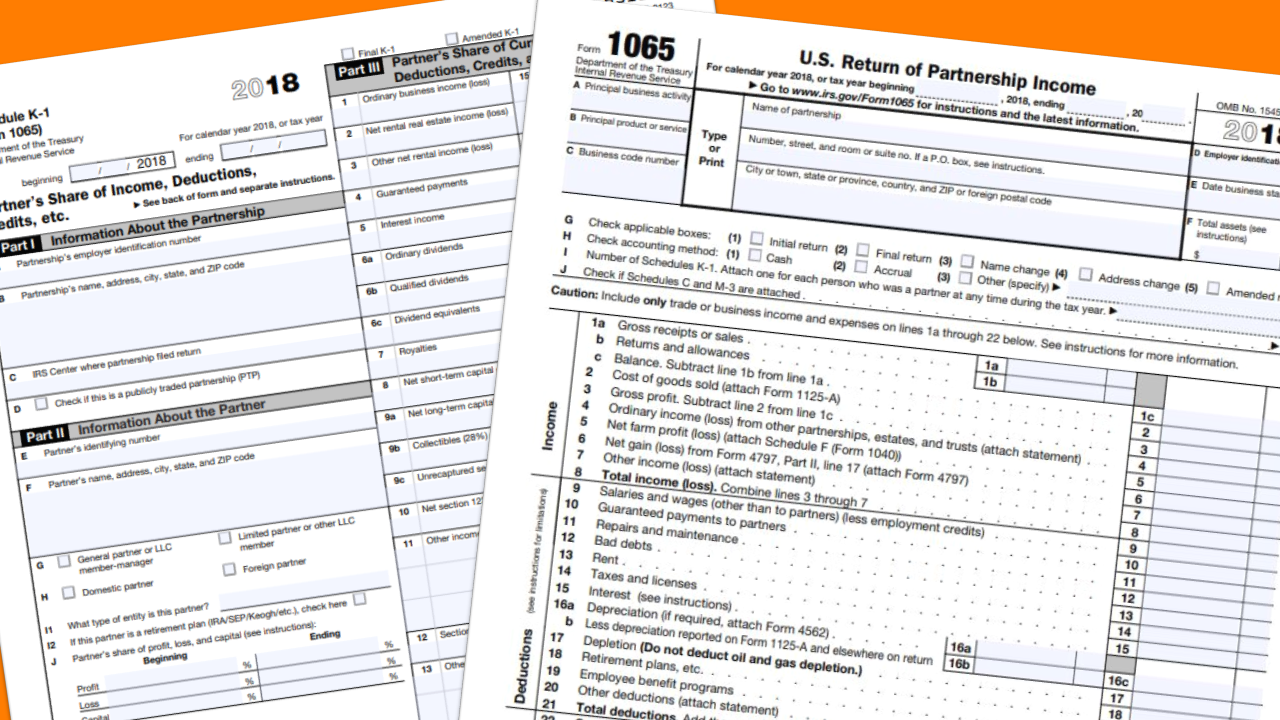

Partnership Form 1065

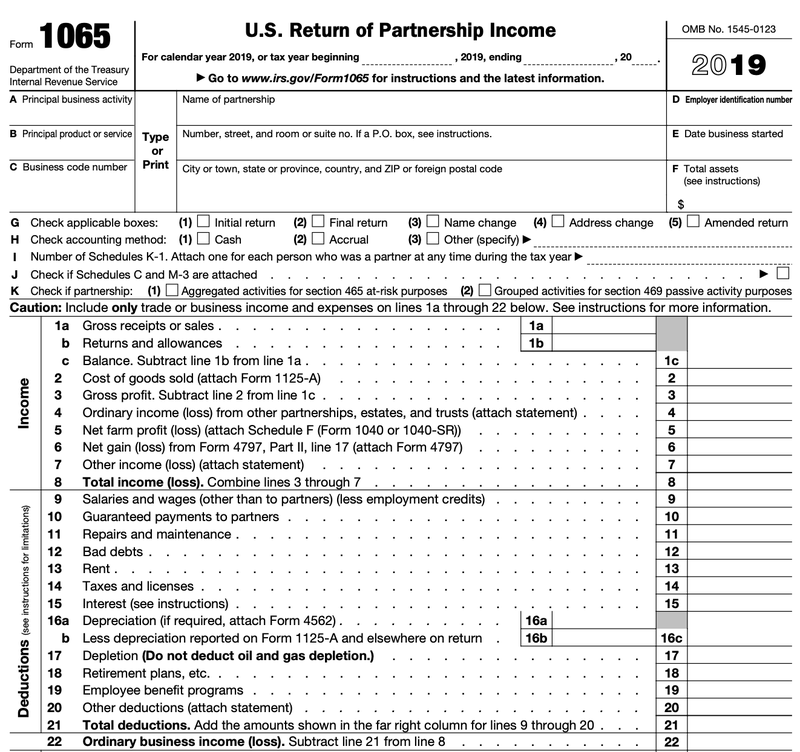

Partnership Form 1065 - For calendar year 2022, or tax year beginning / / 2022. You can also reference these irs partnership instructions for additional information. Or getting income from u.s. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Report the amount as it is reported to you. Web where to file your taxes for form 1065. Ending / / partner’s share of income, deductions, credits, etc. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. If the partnership's principal business, office, or agency is located in:

Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and credits of a business. Department of the treasury internal revenue service. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code. For calendar year 2022, or tax year beginning / / 2022. Part i information about the partnership. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or paid from this form. Or getting income from u.s. Web where to file your taxes for form 1065. Report the amount as it is reported to you.

Ending / / partner’s share of income, deductions, credits, etc. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. And the total assets at the end of the tax year are: If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code. The partners of the partnership or one of the members of the joint venture or. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or paid from this form. To obtain information and missouri tax forms, access our web site at:. For calendar year 2022, or tax year beginning / / 2022. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and credits of a business. Part i information about the partnership.

Form 1065 Us Return Of Partnership United States Tax Forms

Ending / / partner’s share of income, deductions, credits, etc. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. If the partnership's principal business, office, or agency is located in: Part i information about the partnership. Return of partnership income is a tax document issued by the internal revenue.

Partnership Tax (Form 1065) / AvaxHome

Use the following internal revenue service center address: Box 1 ordinary business income (loss): The partners of the partnership or one of the members of the joint venture or. Ending / / partner’s share of income, deductions, credits, etc. Web where to file your taxes for form 1065.

Eligible Partnerships Granted Extension to File Form 1065 and Schedules K1

If the partnership's principal business, office, or agency is located in: Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. If the partnership reports unrelated business taxable income to an ira partner on.

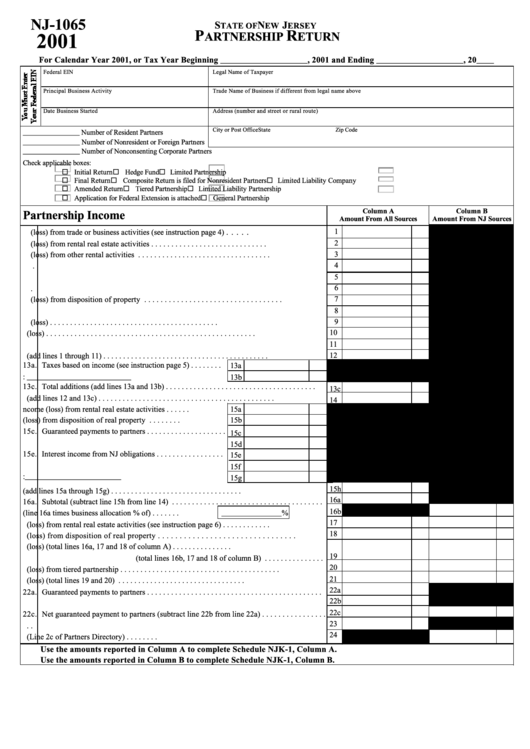

Form Nj1065 New Jersey Partnership Return 2001 printable pdf download

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Ending / / partner’s share of income, deductions, credits, etc. To obtain information and missouri tax forms, access our web site at:. You can also reference these irs partnership instructions for additional information. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc.

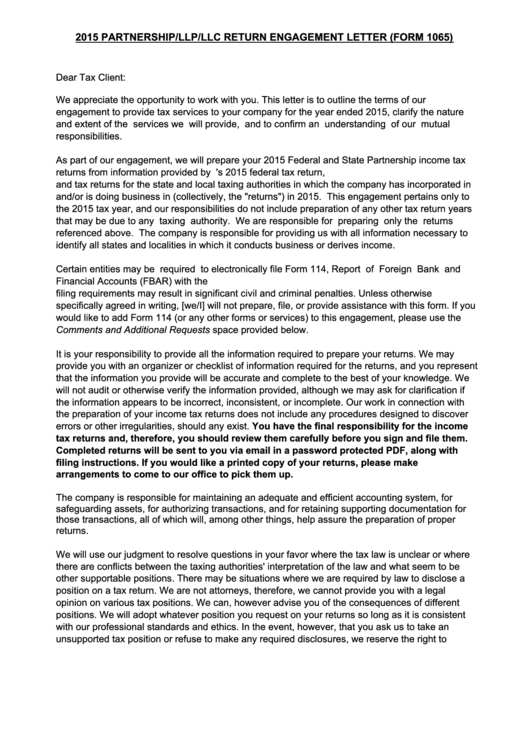

Form 1065 Partnership/llp/llc Return Engagement Letter 2015

Box 1 ordinary business income (loss): Department of the treasury internal revenue service. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. If the partnership's principal business, office, or agency is located in:

Where do i mail my 1065 tax form exoticvsera

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. To obtain information and missouri tax forms, access our web site at:. And the total assets at the end of the tax year are: Box 1 ordinary business income (loss): Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits.

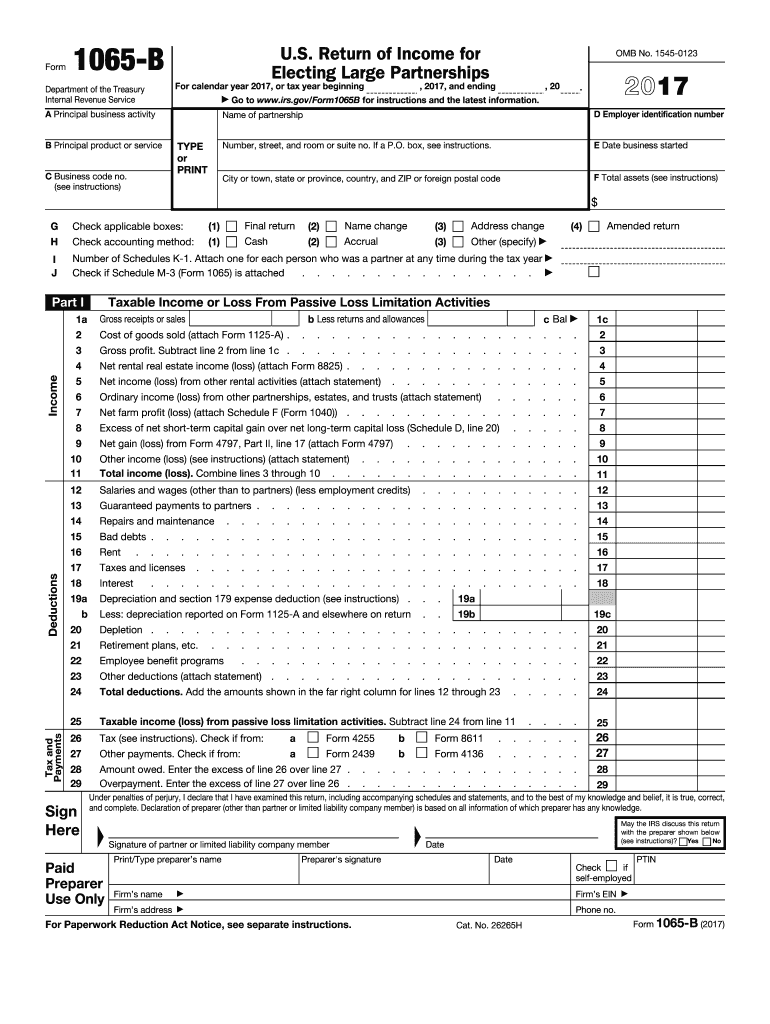

1065 B Fill Out and Sign Printable PDF Template signNow

Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. And the total assets at the end of the tax year are: Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and credits of a.

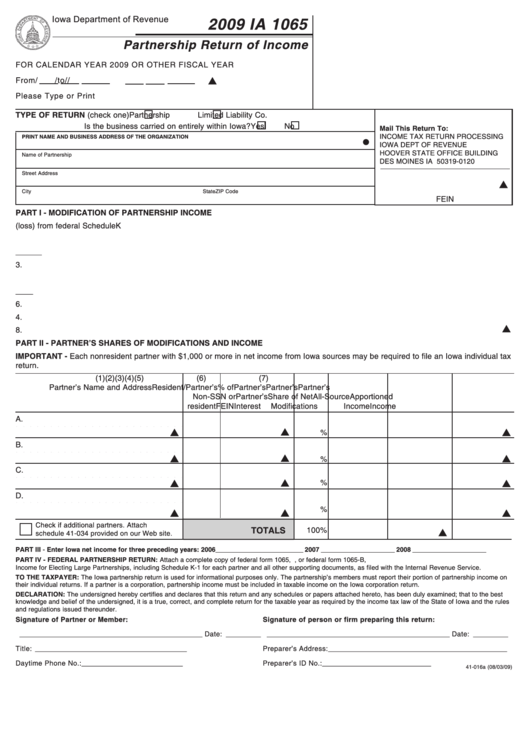

Form Ia 1065 Partnership Return Of 2009 printable pdf download

Box 1 ordinary business income (loss): If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Or getting income from u.s. Use.

Form 1065 U.S. Return of Partnership (2014) Free Download

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Use the following internal revenue service center address: Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Box 1 ordinary business income (loss): If the partnership reports unrelated business taxable income to an ira partner.

Form 10 Attachment Sequence 10 Things To Avoid In Form 10 Attachment

Report the amount as it is reported to you. And the total assets at the end of the tax year are: Any member or partner, regardless of position, may sign the return. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Return of partnership income is a tax document.

If The Partnership Reports Unrelated Business Taxable Income To An Ira Partner On Line 20, Code V, The Partnership Must Report The Ira's Ein On Line 20, Code.

You can also reference these irs partnership instructions for additional information. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Any member or partner, regardless of position, may sign the return. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information.

Web Form 1065 Is An Informational Tax Form Used To Report The Income, Gains, Losses, Deductions And Credits Of A Partnership Or Llc, But No Taxes Are Calculated Or Paid From This Form.

Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Or getting income from u.s. Use the following internal revenue service center address: Report the amount as it is reported to you.

Return Of Partnership Income Is A Tax Document Issued By The Internal Revenue Service (Irs) Used To Declare The Profits, Losses, Deductions, And Credits Of A Business.

Part i information about the partnership. Department of the treasury internal revenue service. Web where to file your taxes for form 1065. The partners of the partnership or one of the members of the joint venture or.

If The Partnership's Principal Business, Office, Or Agency Is Located In:

Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Ending / / partner’s share of income, deductions, credits, etc. To obtain information and missouri tax forms, access our web site at:. And the total assets at the end of the tax year are: