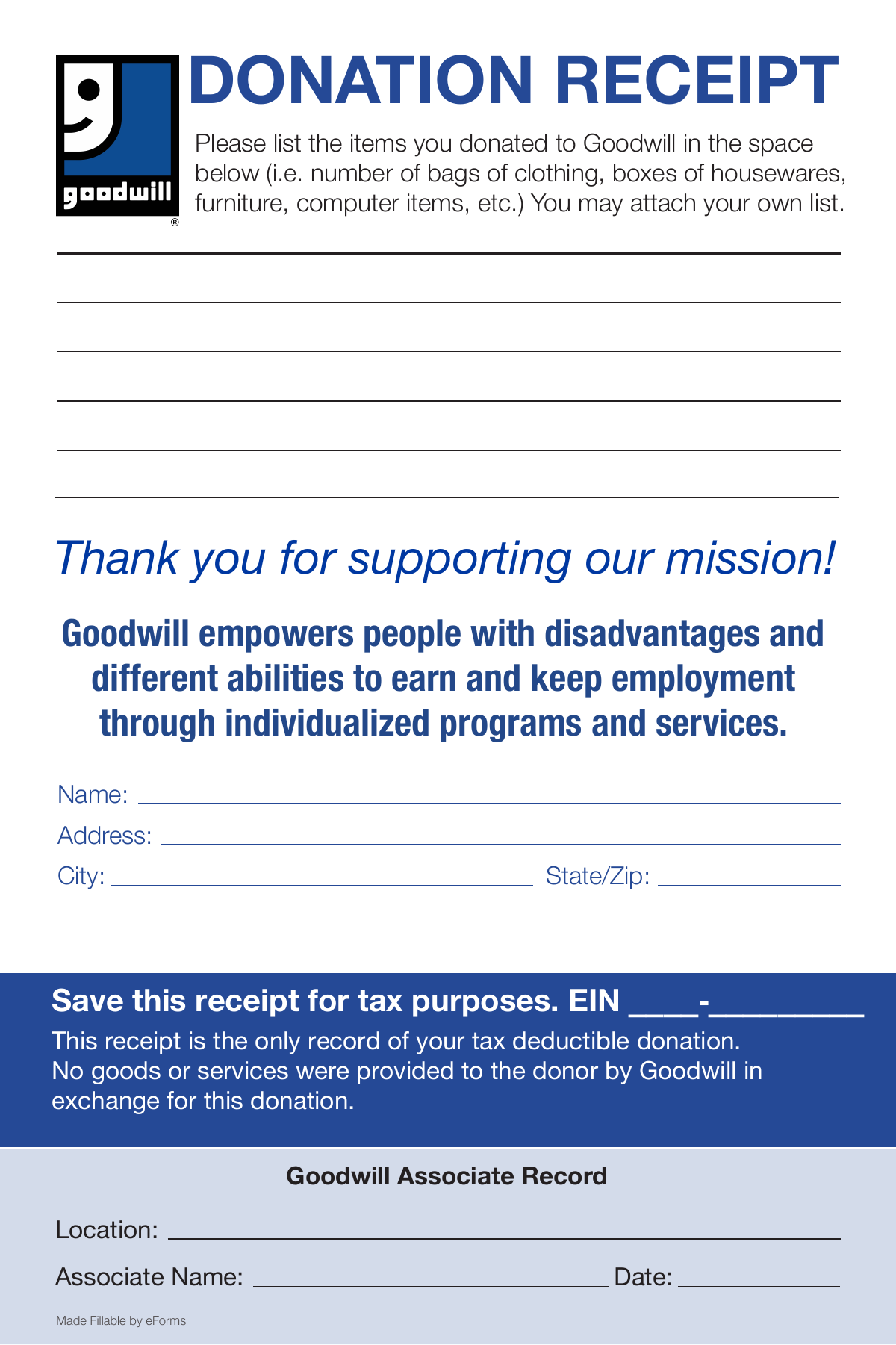

Printable Goodwill Donation Form

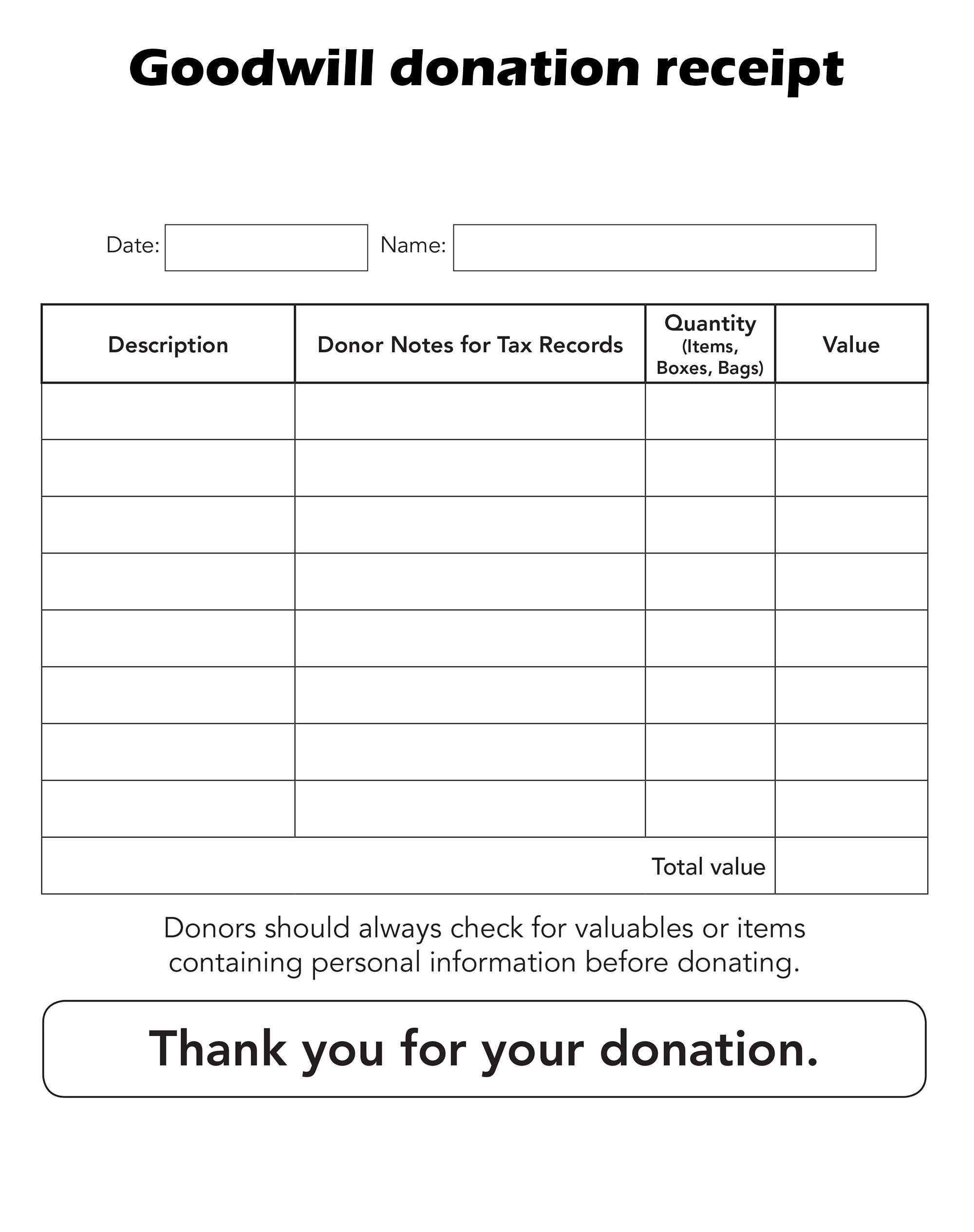

Printable Goodwill Donation Form - Web download your fillable goodwill donation receipt in pdf. Web goodwill donation receipt template. Books, records, cds, videotapes, and dvds. A goodwill donation receipt is used to claim a tax deduction for any donations made to goodwill, such as clothing or household items. Choose the correct version of the editable pdf form from the list and get started filling it out. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Use this receipt when filing your taxes. Web donating to goodwill is easy! It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Easily fill out pdf blank, edit, and sign them.

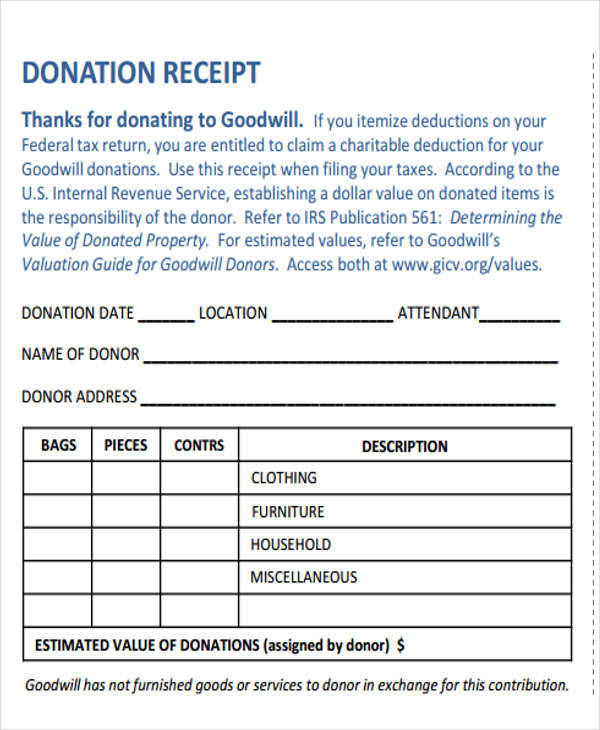

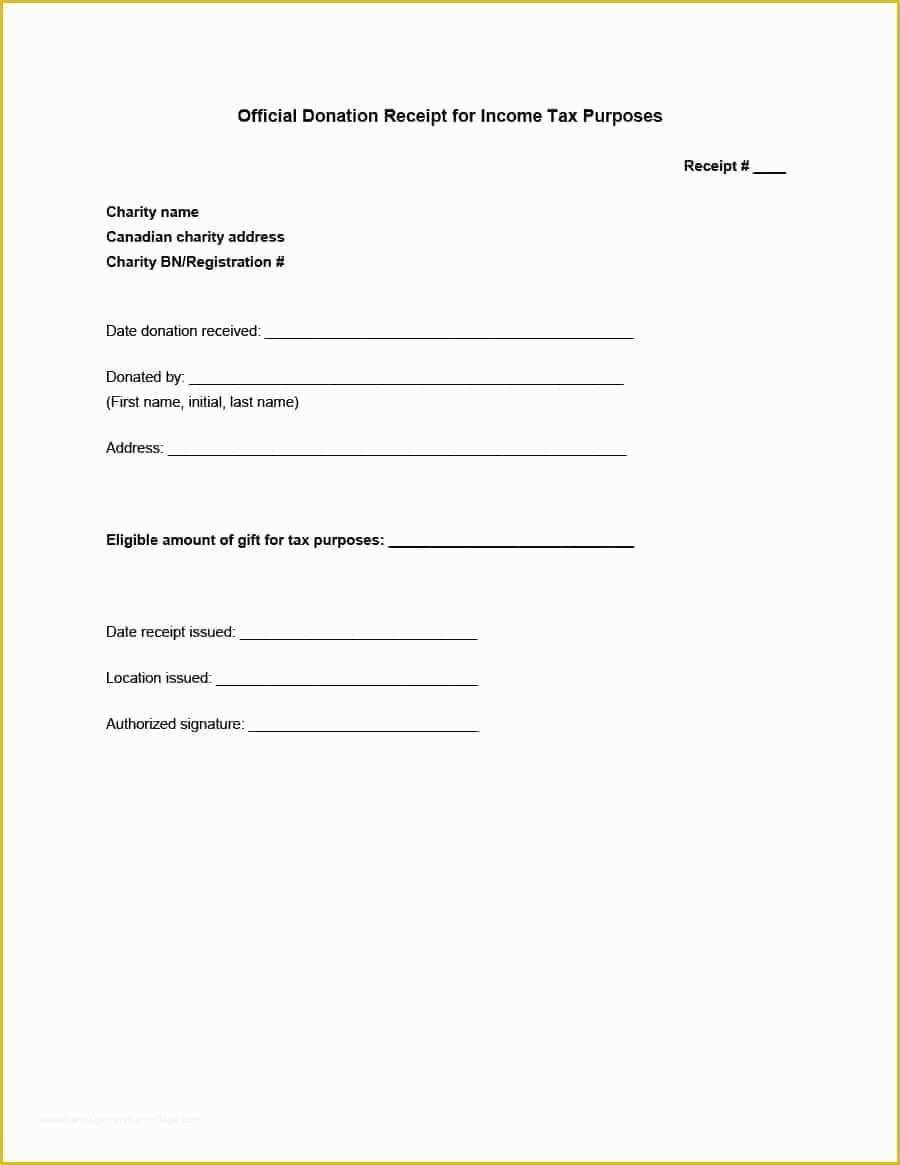

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Web you may now use the link below to download the receipt, fill it in and print it for your records. Web get a donation receipt thank you for donating! Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Use this receipt when filing your taxes. Choose the correct version of the editable pdf form from the list and get started filling it out. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. We happily accept donations of new or gently used items, including: To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores.

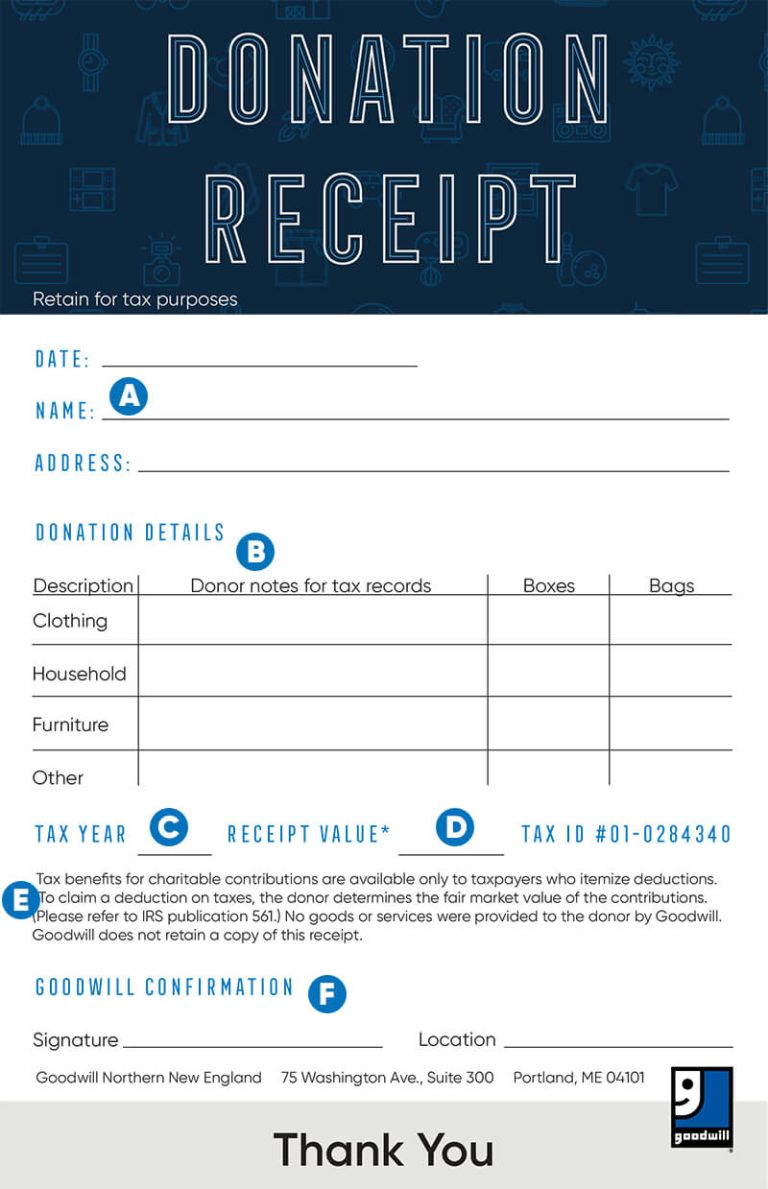

Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. Web donating to goodwill is easy! Your support is essential to fully realizing our mission: If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Web blank printable goodwill donation form use a blank printable goodwill donation form template to make your document workflow more streamlined. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Web a donation receipt must be issued if the donation was given voluntarily, the transfer of amount or goods has been completed and the donor has given the donation with an actual intent of donating to the organization. A goodwill donation receipt is used to claim a tax deduction for any donations made to goodwill, such as clothing or household items. This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont. If you donated to a goodwill in the following areas and need to obtain your donation receipt, please use the contact information below.

Printable Goodwill Donation Form

A goodwill donation receipt is used to claim a tax deduction for any donations made to goodwill, such as clothing or household items. Internal revenue service (irs) requires donors to value their items. Web some goodwill donation centers can help you with your donation receipt and send an electronic copy to your email. We happily accept donations of new or.

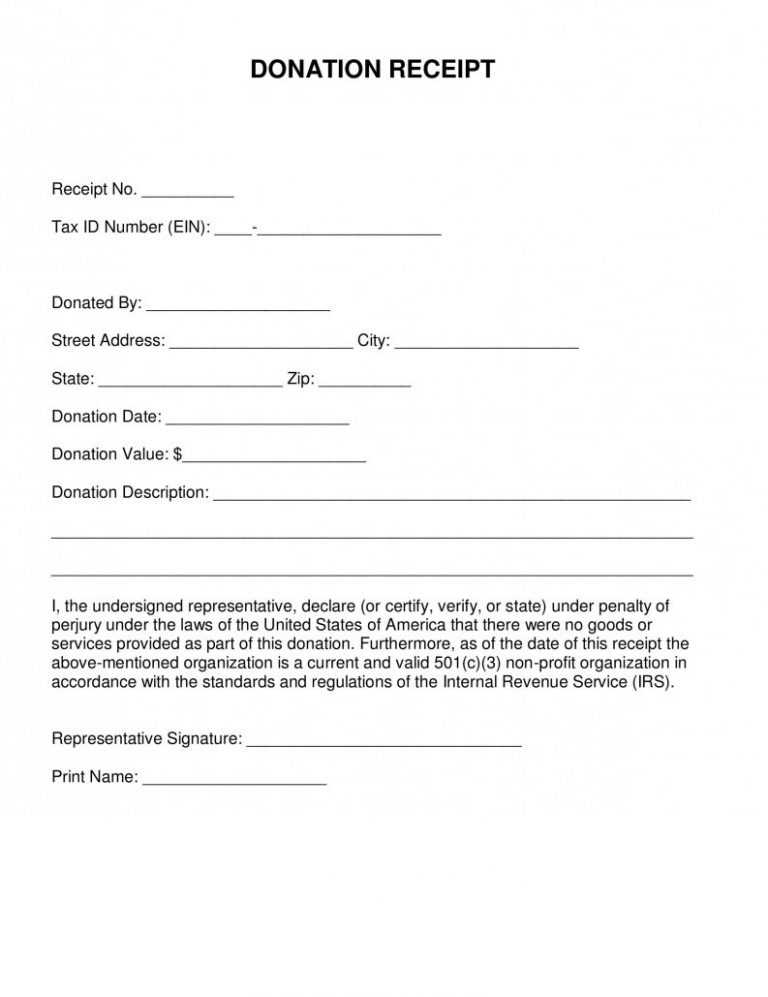

Free Printable Donation Receipt Template

Web goodwill donation receipt template. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. Web a donation receipt must be issued if the donation was given voluntarily, the transfer of amount or goods has been completed and the donor has given the donation with an actual intent of donating to the.

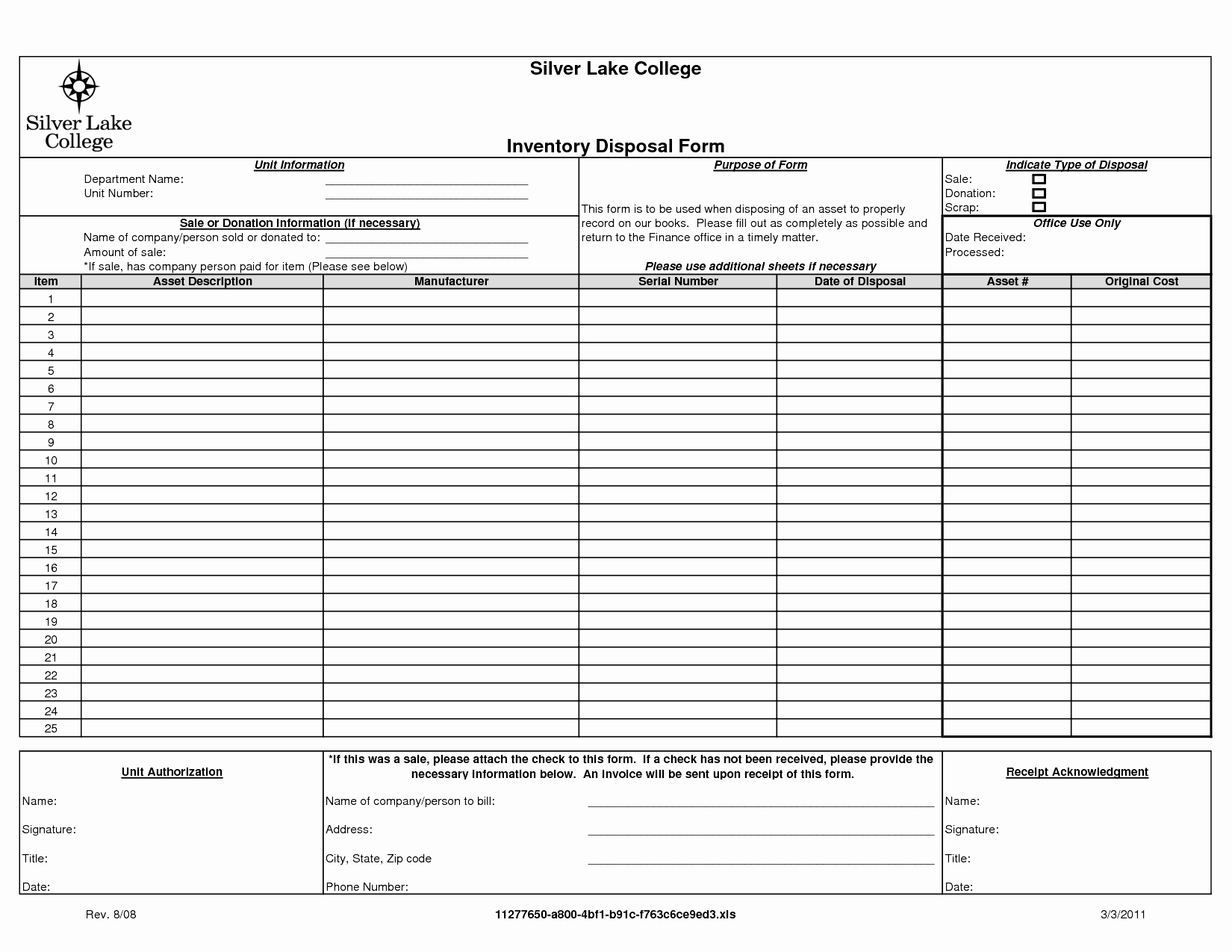

Printable Goodwill Donation Form

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. If you donated to a goodwill in the following areas and need to obtain your donation receipt, please use the contact information below. If you itemize deductions on your federal tax return, you are entitled to claim a charitable.

Free Sample Printable Donation Receipt Template Form

Goodwill donation receipt is a document issued by goodwill industries to individuals who donate items to their organization. Use this receipt when filing your taxes. Thanks for donating to goodwill. Assume the following items are in good condition, and remember: Housewares, dishes, glassware, and small appliances.

Printable Goodwill Donation Receipt

Internal revenue service (irs) requires donors to value their items. Internal revenue service (irs) requires donors to value their items. Web you may now use the link below to download the receipt, fill it in and print it for your records. Web goodwill donation receipt template. Web a limited number of local goodwill organizations offer the convenience of electronic receipts.

Printable Goodwill Donation Receipt

Web blank printable goodwill donation form use a blank printable goodwill donation form template to make your document workflow more streamlined. Assume the following items are in good condition, and remember: Choose the correct version of the editable pdf form from the list and get started filling it out. Web but if you’re already thinking of organizing a charitable activity.

Free Printable Donation Receipt Templates [PDF, Word, Excel]

Web the goodwill donation form template is a simple yet effective tool designed to capture essential information from donors seamlessly. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Save or instantly send your ready documents. Use this receipt when filing your taxes. Web some goodwill donation centers can.

Goodwill Printable Donation Receipt

Choose the correct version of the editable pdf form from the list and get started filling it out. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. To help guide you, goodwill industries international has compiled a list providing price ranges for items.

Printable Goodwill Donation Receipt

Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Web a donation receipt must be issued if the donation was given voluntarily, the transfer of amount or goods has been completed and the donor has given the donation with an actual intent of donating.

40 Donation Receipt Templates & Letters [Goodwill, Non Profit] For

To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Save or instantly send your ready documents. Use this receipt when filing your taxes. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code..

Web The Goodwill Donation Form Template Is A Simple Yet Effective Tool Designed To Capture Essential Information From Donors Seamlessly.

Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. Your support is essential to fully realizing our mission: Web download your fillable goodwill donation receipt in pdf. Web find and fill out the correct goodwill donation receipt online.

Use This Receipt When Filing Your Taxes.

This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont. Use this receipt when filing your taxes. Web a donation receipt must be issued if the donation was given voluntarily, the transfer of amount or goods has been completed and the donor has given the donation with an actual intent of donating to the organization. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike.

Web Get A Donation Receipt Thank You For Donating!

Internal revenue service (irs) requires donors to value their items. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations.

If You Itemize Deductions On Your Federal Tax Return, You Are Entitled To Claim A Charitable Deduction For Your Goodwill Donations.

It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web some goodwill donation centers can help you with your donation receipt and send an electronic copy to your email. But in this article, i’ll show you how to complete the donation receipt form and value your items for your tax deductions.

![Free Printable Donation Receipt Templates [PDF, Word, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/07/Blank-Printable-Donation-Receipt.jpg?gid=710)

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit] For](https://douglasbaseball.com/wp-content/uploads/2019/11/40-donation-receipt-templates-letters-goodwill-non-profit-for-donation-report-template.jpg)