Property Tax Exemption California Form

Property Tax Exemption California Form - Web the following forms are prescribed and/or recommended by the california state board of equalization and pertain to local county assessments, exemption claims, exclusions, and changes in ownership for property taxation purposes. The owner no longer occupies the dwelling as his or her principal place of residence on the lien date; Attach form (s) ftb 3803 to your tax return. Code section 218, exemption from property taxation, dwelling: Web property tax forms alert proposition 19 information the home protection for seniors, severely disabled, families, and victims of wildfire or natural disasters act disaster relief information property owners impacted by the recent winter storms may be eligible for property tax relief. Add the amount of tax, if any, from each form ftb 3803, line 9, to the amount of your tax from the tax table or tax rate schedules and enter the result on form 540, line 31. However, it is not possible to address all the unique. Web forms & pubs legal resources exemptions the following is provided as a resource to list types of property tax exemptions and general qualifying factors of each exemption; Or the property is otherwise ineligible. Title to the property changes;

If eligible, sign and file this form with theassessor on or before february 15 or. The owner no longer occupies the dwelling as his or her principal place of residence on the lien date; Title to the property changes; Web the maximum exemption is $7,000 of the full value of the property. Code section 218, exemption from property taxation, dwelling: Web claim for homeowners’ property tax exemption. A homeowners’ exemption will reduce your taxable value by $7,000, and can save you at least $70 on property taxes every year. Once granted, the homeowners' exemption remains in effect until such time as: A person filing for the first time on a property may file anytime after the property or claimant becomes eligible, but no later than february 15 to receive the full exemption for that year. If you own and occupy your home as your principal place of residence, you may apply for a homeowners’ exemption.

Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption of $7,000 from your assessed value. Add the amount of tax, if any, from each form ftb 3803, line 9, to the amount of your tax from the tax table or tax rate schedules and enter the result on form 540, line 31. A person filing for the first time on a property may file anytime after the property or claimant becomes eligible, but no later than february 15 to receive the full exemption for that year. A homeowners’ exemption will reduce your taxable value by $7,000, and can save you at least $70 on property taxes every year. Web forms & pubs legal resources exemptions the following is provided as a resource to list types of property tax exemptions and general qualifying factors of each exemption; Web claim for homeowners’ property tax exemption. Once granted, the homeowners' exemption remains in effect until such time as: Web the following forms are prescribed and/or recommended by the california state board of equalization and pertain to local county assessments, exemption claims, exclusions, and changes in ownership for property taxation purposes. However, it is not possible to address all the unique. On or before the 30th day following the date of notice of supplemental assessment, whichever comes first.

How To Apply For Senior Property Tax Exemption In California PRORFETY

Web the following forms are prescribed and/or recommended by the california state board of equalization and pertain to local county assessments, exemption claims, exclusions, and changes in ownership for property taxation purposes. On or before the 30th day following the date of notice of supplemental assessment, whichever comes first. The owner no longer occupies the dwelling as his or her.

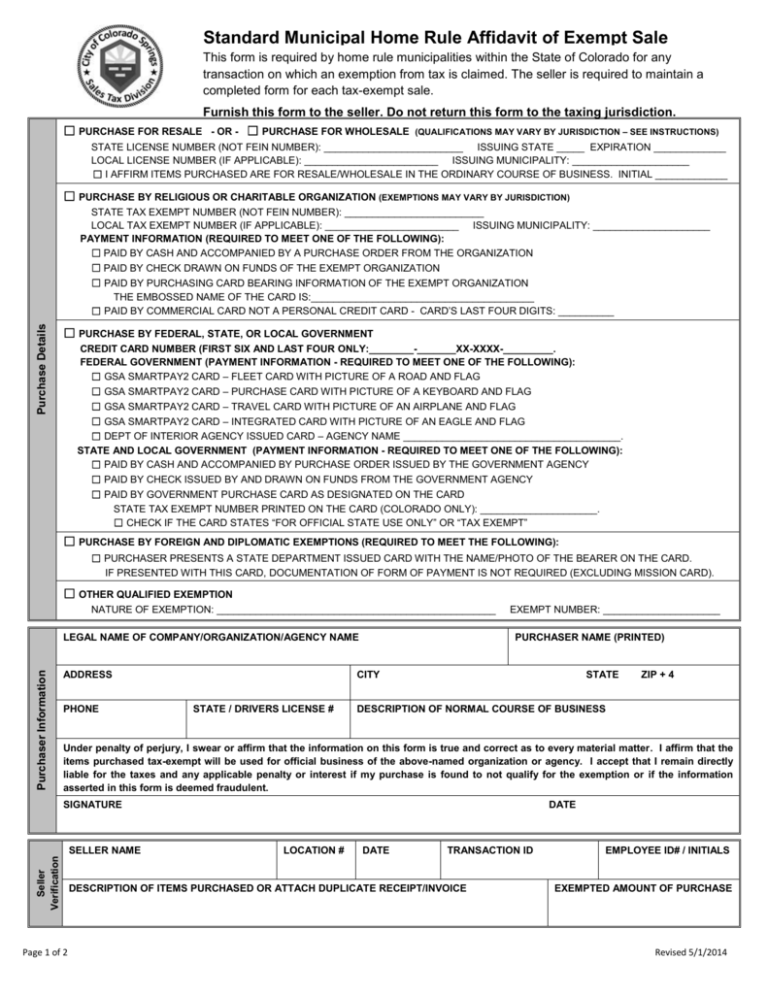

California Tax Exempt Certificate Fill Online, Printable, Fillable

Title to the property changes; Or the property is otherwise ineligible. Code section 218, exemption from property taxation, dwelling: On or before the 30th day following the date of notice of supplemental assessment, whichever comes first. Web file a separate form ftb 3803 for each child whose income you elect to include on your form 540.

Property tax exemption rally planned after slew of WA increases

Web claim for homeowners’ property tax exemption. Web the following forms are prescribed and/or recommended by the california state board of equalization and pertain to local county assessments, exemption claims, exclusions, and changes in ownership for property taxation purposes. Add the amount of tax, if any, from each form ftb 3803, line 9, to the amount of your tax from.

What Is a Homestead Exemption and How Does It Work? LendingTree

Title to the property changes; Once granted, the homeowners' exemption remains in effect until such time as: Web property tax forms alert proposition 19 information the home protection for seniors, severely disabled, families, and victims of wildfire or natural disasters act disaster relief information property owners impacted by the recent winter storms may be eligible for property tax relief. However,.

Partial exemption certificate farm equipment Fill out & sign online

Web the state board of equalization taxpayers’ rights advocate office is committed to helping california taxpayers understand property tax laws, and be aware of exclusions and exemptions available to them. On or before the 30th day following the date of notice of supplemental assessment, whichever comes first. A person filing for the first time on a property may file anytime.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Code section 218, exemption from property taxation, dwelling: Title to the property changes; If you own and occupy your home as your principal place of residence, you may apply for a homeowners’ exemption. Web the maximum exemption is $7,000 of the full value of the property. A person filing for the first time on a property may file anytime after.

New Tax Exempt Form

Web claim for homeowners’ property tax exemption. Attach form (s) ftb 3803 to your tax return. Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption of $7,000 from your assessed value. The owner no longer occupies the dwelling as his or her.

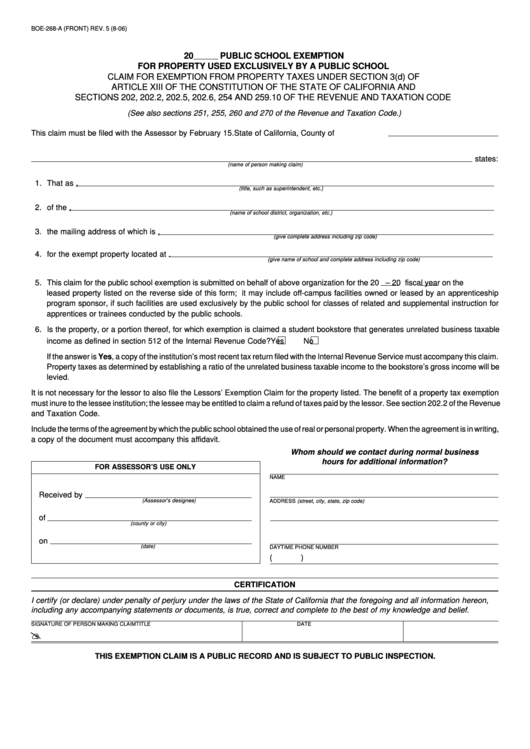

Form Boe268A Claim For Exemption From Property Taxes (Public School

Web the maximum exemption is $7,000 of the full value of the property. Attach form (s) ftb 3803 to your tax return. Or the property is otherwise ineligible. Web the state board of equalization taxpayers’ rights advocate office is committed to helping california taxpayers understand property tax laws, and be aware of exclusions and exemptions available to them. Add the.

Fill Free fillable 2022 CLAIM FOR DISABLED VETERANS' PROPERTY TAX

Code section 218, exemption from property taxation, dwelling: Web the following forms are prescribed and/or recommended by the california state board of equalization and pertain to local county assessments, exemption claims, exclusions, and changes in ownership for property taxation purposes. Web file a separate form ftb 3803 for each child whose income you elect to include on your form 540..

2016 Annual Personal Property Tax Exemption Reminder Right Michigan

However, it is not possible to address all the unique. Web file a separate form ftb 3803 for each child whose income you elect to include on your form 540. Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption of $7,000 from.

Attach Form (S) Ftb 3803 To Your Tax Return.

If eligible, sign and file this form with theassessor on or before february 15 or. Web the maximum exemption is $7,000 of the full value of the property. Web property tax forms alert proposition 19 information the home protection for seniors, severely disabled, families, and victims of wildfire or natural disasters act disaster relief information property owners impacted by the recent winter storms may be eligible for property tax relief. A homeowners’ exemption will reduce your taxable value by $7,000, and can save you at least $70 on property taxes every year.

Title To The Property Changes;

Web forms & pubs legal resources exemptions the following is provided as a resource to list types of property tax exemptions and general qualifying factors of each exemption; Or the property is otherwise ineligible. Web claim for homeowners’ property tax exemption. Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption of $7,000 from your assessed value.

The Owner No Longer Occupies The Dwelling As His Or Her Principal Place Of Residence On The Lien Date;

Web file a separate form ftb 3803 for each child whose income you elect to include on your form 540. On or before the 30th day following the date of notice of supplemental assessment, whichever comes first. If you own and occupy your home as your principal place of residence, you may apply for a homeowners’ exemption. Once granted, the homeowners' exemption remains in effect until such time as:

However, It Is Not Possible To Address All The Unique.

Code section 218, exemption from property taxation, dwelling: Web the following forms are prescribed and/or recommended by the california state board of equalization and pertain to local county assessments, exemption claims, exclusions, and changes in ownership for property taxation purposes. Web the state board of equalization taxpayers’ rights advocate office is committed to helping california taxpayers understand property tax laws, and be aware of exclusions and exemptions available to them. A person filing for the first time on a property may file anytime after the property or claimant becomes eligible, but no later than february 15 to receive the full exemption for that year.