Put Calendar Spread

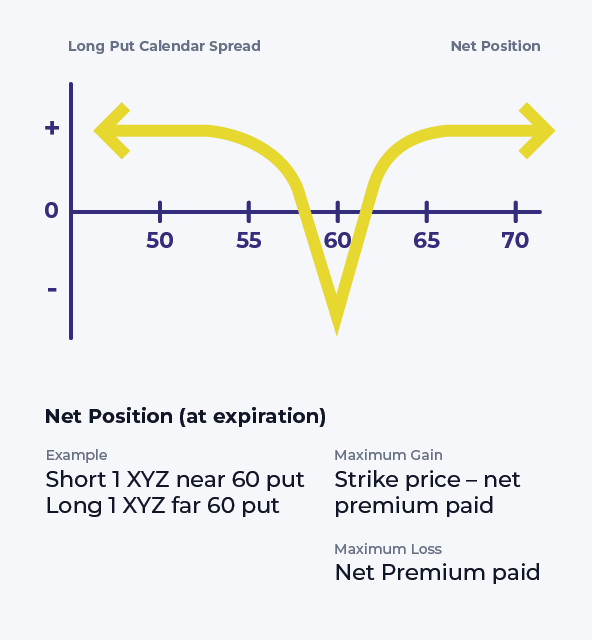

Put Calendar Spread - Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Web learn how to run a calendar spread with puts, selling and buying options with the same strike price but different expiration dates. Web learn how to use a long put calendar spread to combine a bearish and a bullish outlook on a stock. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities. Das verfallsdatum der verkauften put. Web in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade long enough to get some profits.

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web learn how to run a calendar spread with puts, selling and buying options with the same strike price but different expiration dates. Das verfallsdatum der verkauften put. Web in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade long enough to get some profits. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. This strategy can capture time value and. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration.

Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Web learn how to run a calendar spread with puts, selling and buying options with the same strike price but different expiration dates. This strategy can capture time value and. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. Web learn how to use a long put calendar spread to combine a bearish and a bullish outlook on a stock. Das verfallsdatum der verkauften put. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

Long Calendar Spread with Puts Strategy With Example

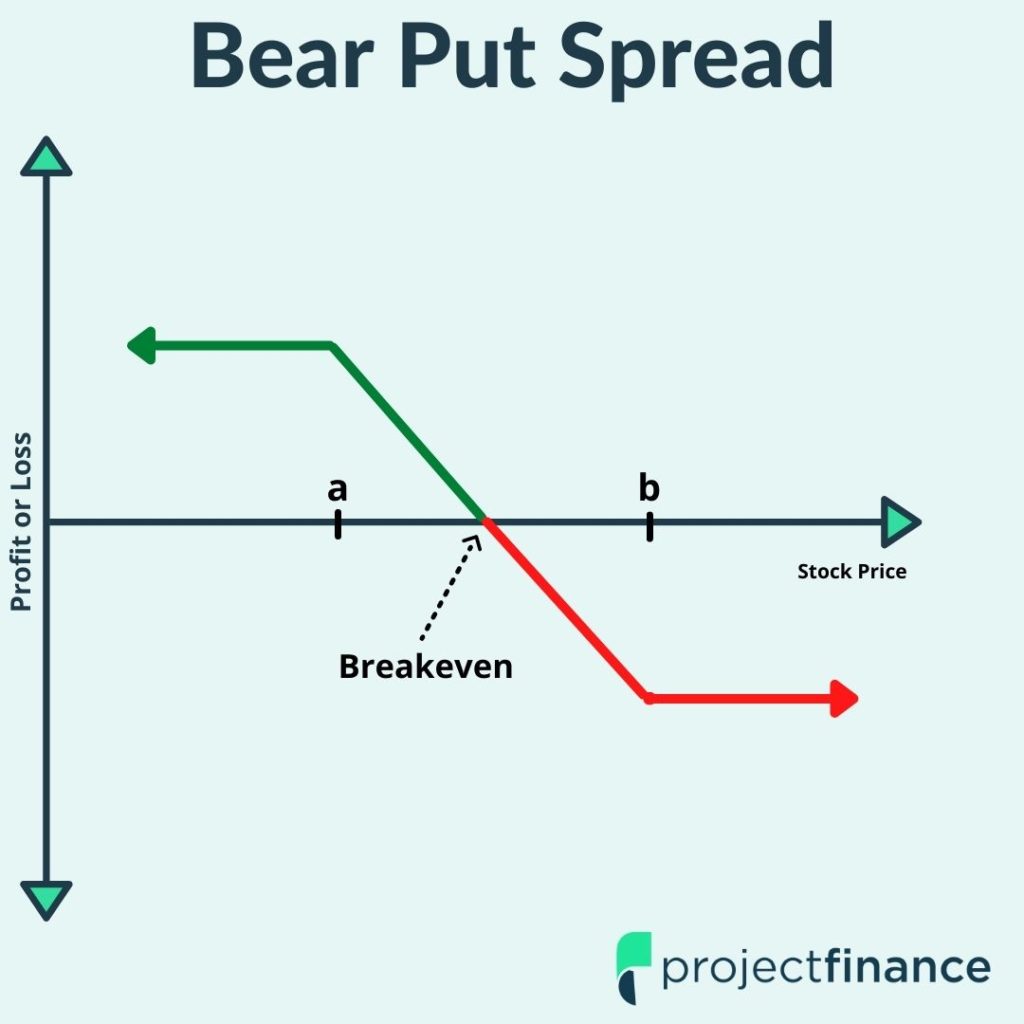

Web learn how to run a calendar spread with puts, selling and buying options with the same strike price but different expiration dates. Web in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade long enough to get some profits. Web a calendar spread allows option traders to take.

What Is A Calendar Spread Option Strategy Mab Millicent

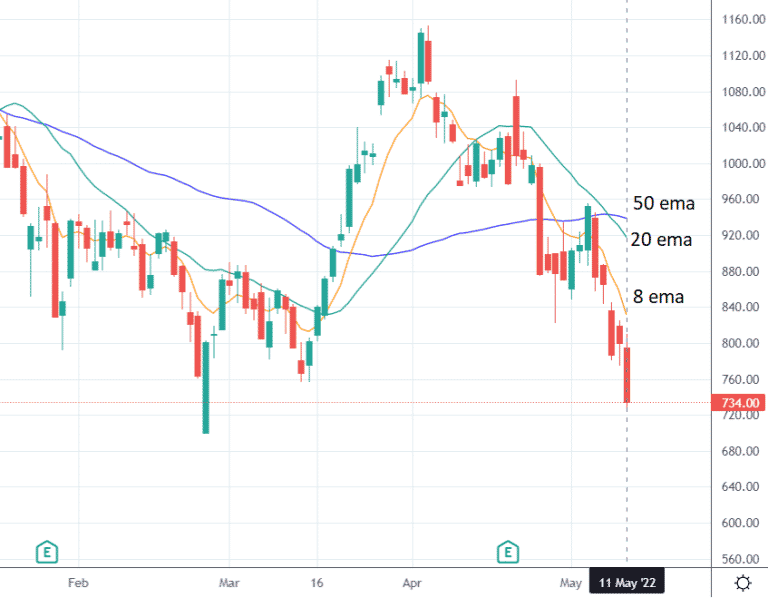

This strategy can capture time value and. Das verfallsdatum der verkauften put. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web learn how to use a long put calendar spread to combine a bearish and a bullish outlook on a stock..

Deep In The Money Put Calendar Spread Aubine Bobbette

Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web learn how to run a calendar spread with puts, selling and buying options with the same strike price but different expiration dates. Web the complex options trading strategy, known as the.

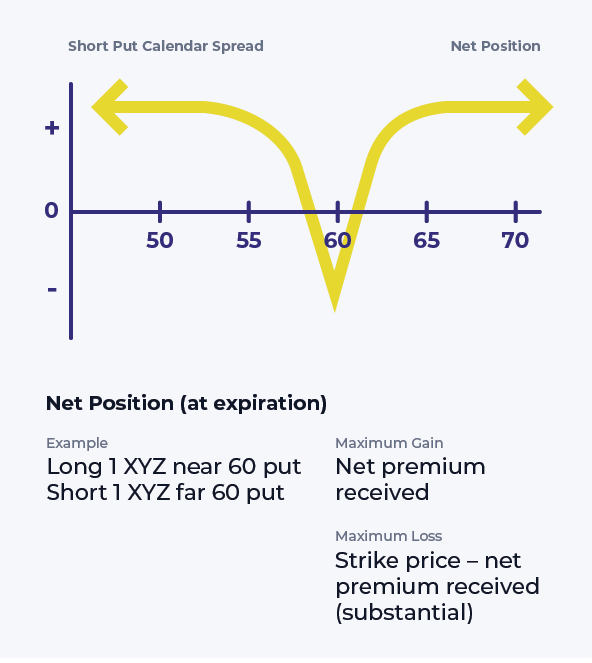

Short Put Calendar Spread Options Strategy

Das verfallsdatum der verkauften put. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. This.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Das verfallsdatum der verkauften put. Web the complex options trading.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. This strategy can capture time value and. Das verfallsdatum der verkauften.

Bearish Put Calendar Spread Option Strategy Guide

Web in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade long enough to get some profits. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Web a long put calendar spread involves buying and selling.

Long put Calendar Long Put calendar Spread Calendar Spread YouTube

Web learn how to run a calendar spread with puts, selling and buying options with the same strike price but different expiration dates. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. Web die kalender spread strategie besteht aus dem leerverkauf einer.

Calendar Put Spread Options Edge

This strategy can capture time value and. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. Web learn how to use a long put calendar spread to combine a bearish and a bullish outlook on a stock. Web the complex options trading.

Bear Put Calendar Spread Anne

Web in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade long enough to get some profits. Das verfallsdatum der verkauften put. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates..

Web A Calendar Spread Is An Option Trade That Involves Buying And Selling An Option On The Same Instrument With The Same Strikes Price, But Different Expiration.

Web in this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade long enough to get some profits. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates.

Web Die Kalender Spread Strategie Besteht Aus Dem Leerverkauf Einer Put Option Und Dem Kauf Einer Put Option Mit Demselben Basispreis.

This strategy can capture time value and. Web learn how to use a long put calendar spread to combine a bearish and a bullish outlook on a stock. Web learn how to run a calendar spread with puts, selling and buying options with the same strike price but different expiration dates. Das verfallsdatum der verkauften put.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)