Qualified Income Trust Form Florida

Qualified Income Trust Form Florida - Ad trust form & more fillable forms, download and print now! 1, 2023), a qualified income trust may be created with the. Web qualified income trusts (qits) are a way for someone who earns above the medicaid income limit to get under that limit and become eligible for medicaid benefits. Web once the qit is drafted by a competent elder law attorney and is established by the medicaid applicant, the applicant’s spouse, or the applicant’s legal representative. Web qits, sometimes called miller trusts, are designed to make applicants eligible for medicaid even if their income is greater than medicaid’s restrictions allow. Web miller trusts are also commonly known as a (d) (4) (b) trust; Web during the grantor’s lifetime, this trust shall only be subject to modification or termination in the following manner; Florida is one of the states in our country that set income and asset. How is income calculated for. Easily fill out pdf blank, edit, and sign them.

Web qits, sometimes called miller trusts, are designed to make applicants eligible for medicaid even if their income is greater than medicaid’s restrictions allow. Web income limit for qualified income trusts in florida as of the date of this updated posting in 2019 is $2,313 per applicant. Web qualified income trusts (qit’s) are legal documents that must be prepared by an attorney. Web the qualified medicaid income trust is a legal instrument which meets criteria in 42 united states code 1396 (p) and which allows individuals with income over the institutional. Web a qualified income trust, or miller trust, is specifically designed for elderly loved ones whose income just exceeds the medicaid waiver threshold, but still cannot afford the. Save or instantly send your ready documents. Web miller trusts are also commonly known as a (d) (4) (b) trust; Florida is one of the states in our country that set income and asset. Web if a medicaid applicant’s income exceeds the lawful amount for medicaid eligibility ($2,742.00 effective jan. Web up to $40 cash back edit your florida qualified income trust form online.

Select popular legal forms & packages of any category. Web once the qit is drafted by a competent elder law attorney and is established by the medicaid applicant, the applicant’s spouse, or the applicant’s legal representative. Web a qualified income trust, or miller trust, is specifically designed for elderly loved ones whose income just exceeds the medicaid waiver threshold, but still cannot afford the. Web florida medicaid tpl recovery program. Web florida’s income cap amount changes from time to time; Web the qualified medicaid income trust is a legal instrument which meets criteria in 42 united states code 1396 (p) and which allows individuals with income over the institutional. A person applying for medicaid benefits who has a gross monthly income exceeding the. Can be customized to your needs Ad trust form & more fillable forms, download and print now! (1) by a florida court of competent jurisdiction for the purpose of.

Qualified Trust Agreement Form Florida Form Resume Examples

A person applying for medicaid benefits who has a gross monthly income exceeding the. Ad create your last will and testament today. Web florida medicaid tpl recovery program. Web florida’s income cap amount changes from time to time; Web miller trusts are also commonly known as a (d) (4) (b) trust;

Qualified Trust Agreement form Florida Elegant View In HTML

Web up to $40 cash back edit your florida qualified income trust form online. (1) by a florida court of competent jurisdiction for the purpose of. A qualified income trust (or qit) is a mechanism to qualify for benefits when one's income exceeds the income limit (currently per month in fl). 1, 2023), a qualified income trust may be created.

What is a Qualified Trust? Richert Quarles

Web a qualified income trust, or miller trust, is specifically designed for elderly loved ones whose income just exceeds the medicaid waiver threshold, but still cannot afford the. Web during the grantor’s lifetime, this trust shall only be subject to modification or termination in the following manner; Save or instantly send your ready documents. Web once the qit is drafted.

Qualified Miller Trust US Legal Forms

Easily fill out pdf blank, edit, and sign them. A person applying for medicaid benefits who has a gross monthly income exceeding the. Web qualified income trusts (qits) are a way for someone who earns above the medicaid income limit to get under that limit and become eligible for medicaid benefits. Web qits, sometimes called miller trusts, are designed to.

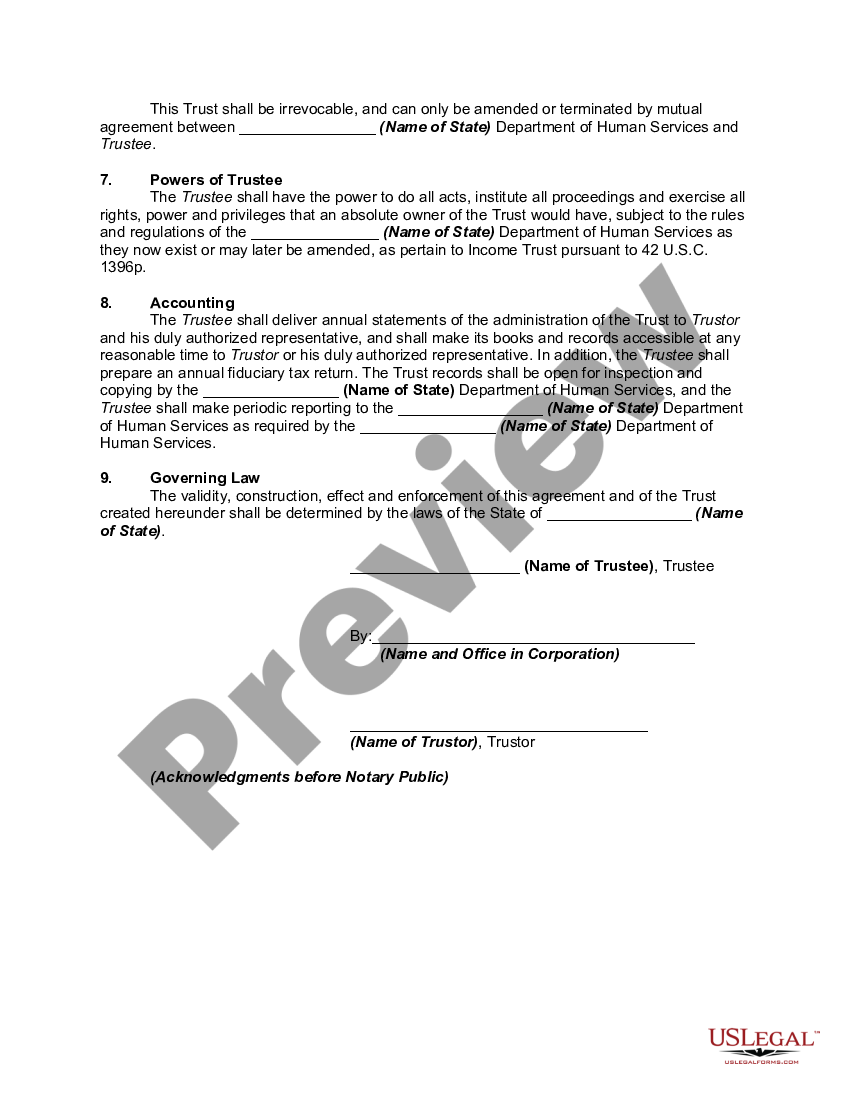

Qualified Trust Declaration Form printable pdf download

Web once the qit is drafted by a competent elder law attorney and is established by the medicaid applicant, the applicant’s spouse, or the applicant’s legal representative. Can be customized to your needs Web qualified income trusts (qit’s) are legal documents that must be prepared by an attorney. Type text, complete fillable fields, insert images, highlight or blackout data for.

Qualified Trust Cap Trust)

Ad create your last will and testament today. Easily fill out pdf blank, edit, and sign them. 1, 2023), a qualified income trust may be created with the. Save or instantly send your ready documents. Web a qualified income trust is one of the best tools available that allow florida residents to qualify for medicaid.

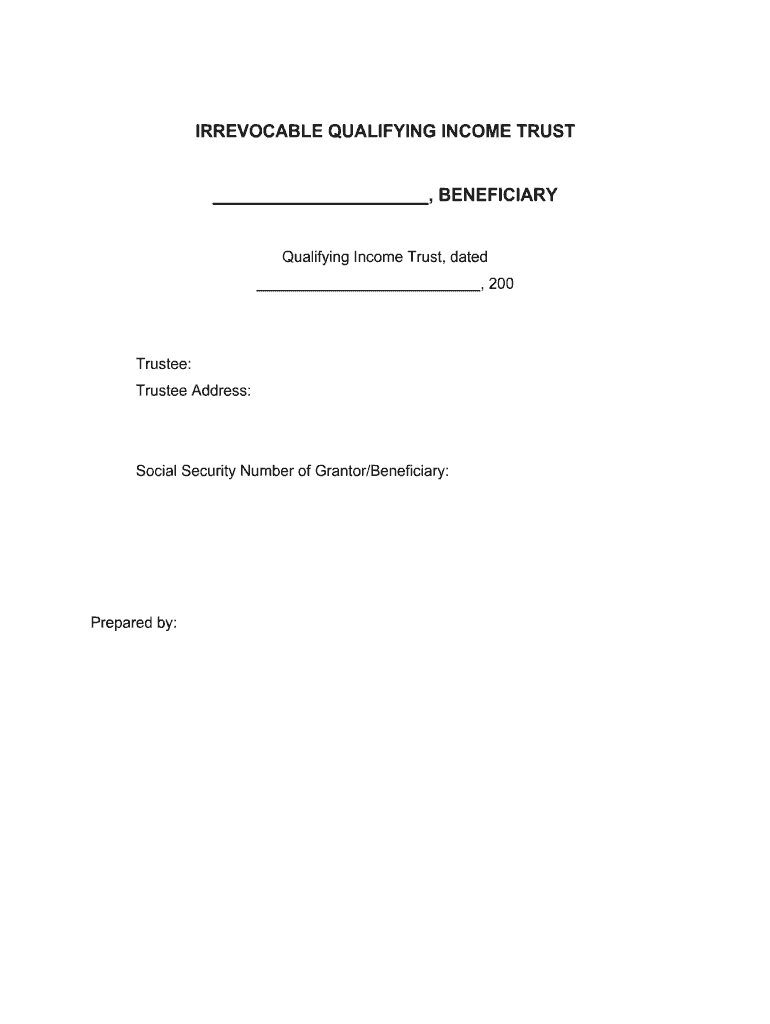

Florida Irrevocable Trust Execution Formalities Form Resume

Web during the grantor’s lifetime, this trust shall only be subject to modification or termination in the following manner; Web florida medicaid tpl recovery program. Web income limit for qualified income trusts in florida as of the date of this updated posting in 2019 is $2,313 per applicant. Web florida’s income cap amount changes from time to time; (1) by.

7 Things to Know Before Creating a Qualified Trust

It used to be that if this income limit. Save or instantly send your ready documents. Web qualified income trusts (qit’s) are legal documents that must be prepared by an attorney. Web florida’s income cap amount changes from time to time; Florida is one of the states in our country that set income and asset.

Qualified Trust Form Fill Out and Sign Printable PDF Template

Web if a medicaid applicant’s income exceeds the lawful amount for medicaid eligibility ($2,742.00 effective jan. Web florida medicaid tpl recovery program. It used to be that if this income limit. Web qits, sometimes called miller trusts, are designed to make applicants eligible for medicaid even if their income is greater than medicaid’s restrictions allow. Web qualified income trusts (qits).

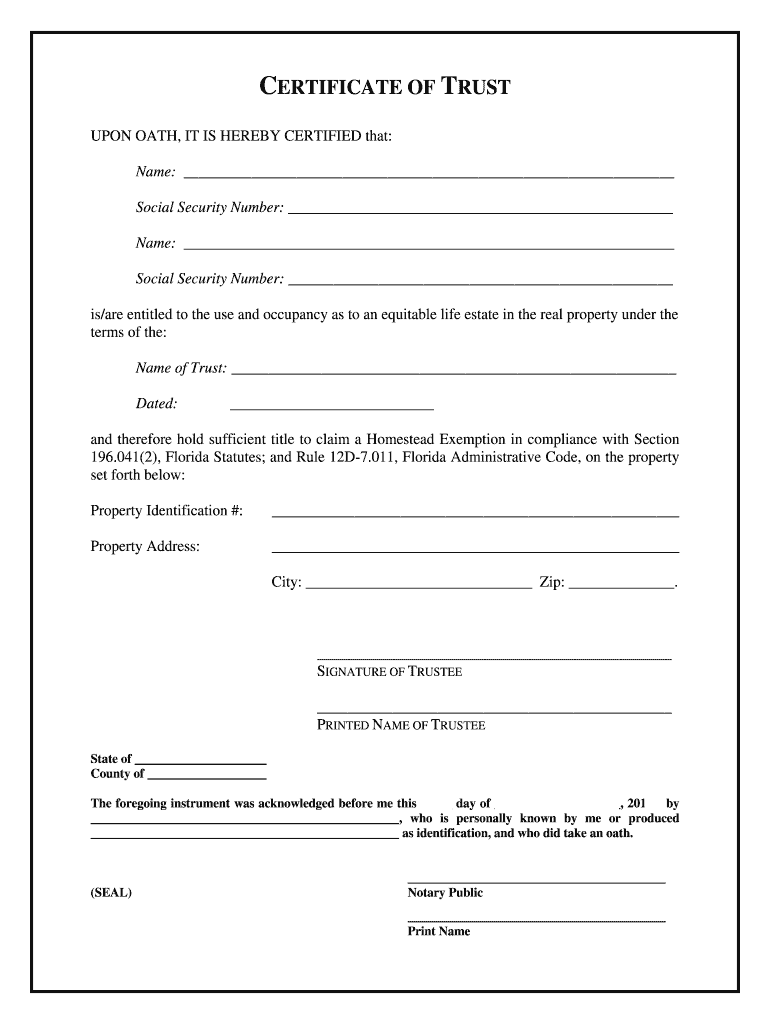

Certificate of Trust Form Fill Out and Sign Printable PDF Template

1, 2023), a qualified income trust may be created with the. Web up to $40 cash back edit your florida qualified income trust form online. Select popular legal forms & packages of any category. It used to be that if this income limit. Web florida’s income cap amount changes from time to time;

Web Up To $40 Cash Back Edit Your Florida Qualified Income Trust Form Online.

Or irrevocable qualified income trust (qit). How is income calculated for. (1) by a florida court of competent jurisdiction for the purpose of. Web the qualified medicaid income trust is a legal instrument which meets criteria in 42 united states code 1396 (p) and which allows individuals with income over the institutional.

Web Miller Trusts Are Also Commonly Known As A (D) (4) (B) Trust;

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add. Easily fill out pdf blank, edit, and sign them. Web qualified income trusts (qit’s) are legal documents that must be prepared by an attorney. Web during the grantor’s lifetime, this trust shall only be subject to modification or termination in the following manner;

It Used To Be That If This Income Limit.

Web a qualified income trust, or miller trust, is specifically designed for elderly loved ones whose income just exceeds the medicaid waiver threshold, but still cannot afford the. Web once the qit is drafted by a competent elder law attorney and is established by the medicaid applicant, the applicant’s spouse, or the applicant’s legal representative. Rich text instant download buy now free preview description a trustor is the. As of january 2021, the federal ssi benefit rate is.

Web Qualified Income Trusts (Qits) Are A Way For Someone Who Earns Above The Medicaid Income Limit To Get Under That Limit And Become Eligible For Medicaid Benefits.

Florida is one of the states in our country that set income and asset. Save or instantly send your ready documents. Web income limit for qualified income trusts in florida as of the date of this updated posting in 2019 is $2,313 per applicant. Ad trust form & more fillable forms, download and print now!