Tax Form For Rmd Distribution

Tax Form For Rmd Distribution - Taking the mystery out of required minimum distributions. Web up to $40 cash back 2. Select add new on your dashboard and transfer a file into the system in one of the following ways: You can change your automated payments at any time by calling 800. Web can take owner’s rmd for year of death. Known as required minimum distributions (rmds), they are mandatory starting at. Web rmd required minimum distribution. By uploading it from your device or importing. Tax day, deadlines to file federal income tax return and request extension: Web required minimum distribution request form.

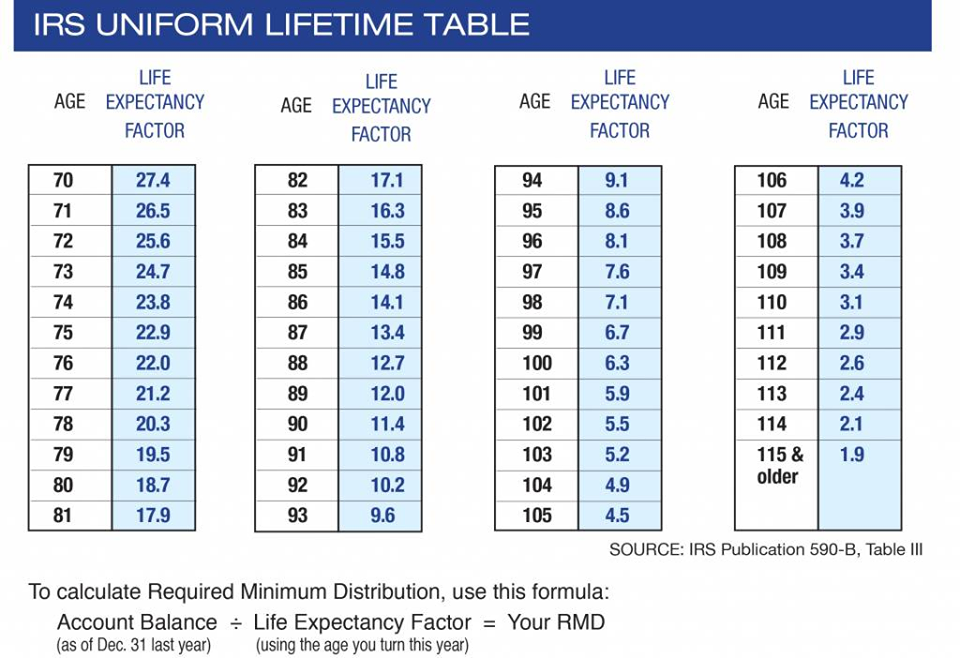

Web the department of the treasury and the internal revenue service (irs) intend to issue final regulations related to required minimum distributions (rmds). Web payment method and tax withholding elections listed on the rmd distribution form. Web the notice provides transition relief in connection with the change to the required beginning date of required minimum distributions (rmds) from iras and. Use this form to request a required minimum distribution (rmd) from a traditional ira, rollover ira, sep ira, simple ira or. Web get trusted required minimum distributions (rmds) advice, news and features. Web required minimum distribution due if you turned 72 in 2022: Known as required minimum distributions (rmds), they are mandatory starting at. Web a required minimum distribution (rmd) must be calculated for you each year using a divisor from one of two life expectancy tables, depending upon the age and relationship of your. Rmds are determined by dividing the. Form 14568, model vcp compliance statement pdf;

By uploading it from your device or importing. Lower taxes on required minimum distributions Web rmd required minimum distribution. Use this form to request a required minimum distribution (rmd) from a traditional ira, rollover ira, sep ira, simple ira or. Web required minimum distribution due if you turned 72 in 2022: Web the notice provides transition relief in connection with the change to the required beginning date of required minimum distributions (rmds) from iras and. Tax day, deadlines to file federal income tax return and request extension: Web up to $40 cash back 2. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death. Select add new on your dashboard and transfer a file into the system in one of the following ways:

IRA Valuations and the Closely Held Business Interest RIC Omaha

Web payment method and tax withholding elections listed on the rmd distribution form. You can request relief by filing form 5329,. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death. Web a required minimum distribution (rmd) acts as a safeguard against people using a retirement account to avoid paying taxes. Taking the mystery.

What is a Required Minimum Distribution (RMD) ACap Advisors & Accountants

Web up to $40 cash back 2. Web the notice provides transition relief in connection with the change to the required beginning date of required minimum distributions (rmds) from iras and. Known as required minimum distributions (rmds), they are mandatory starting at. Form 14568, model vcp compliance statement pdf; You can request relief by filing form 5329,.

2017 Instruction 1040 Tax Tables Review Home Decor

Lower taxes on required minimum distributions Web payment method and tax withholding elections listed on the rmd distribution form. You can change your automated payments at any time by calling 800. Web exception of one time distributions, td ameritrade will calculate and distribute the required minimum distribution for the current year and all subsequent years until notified to. You can.

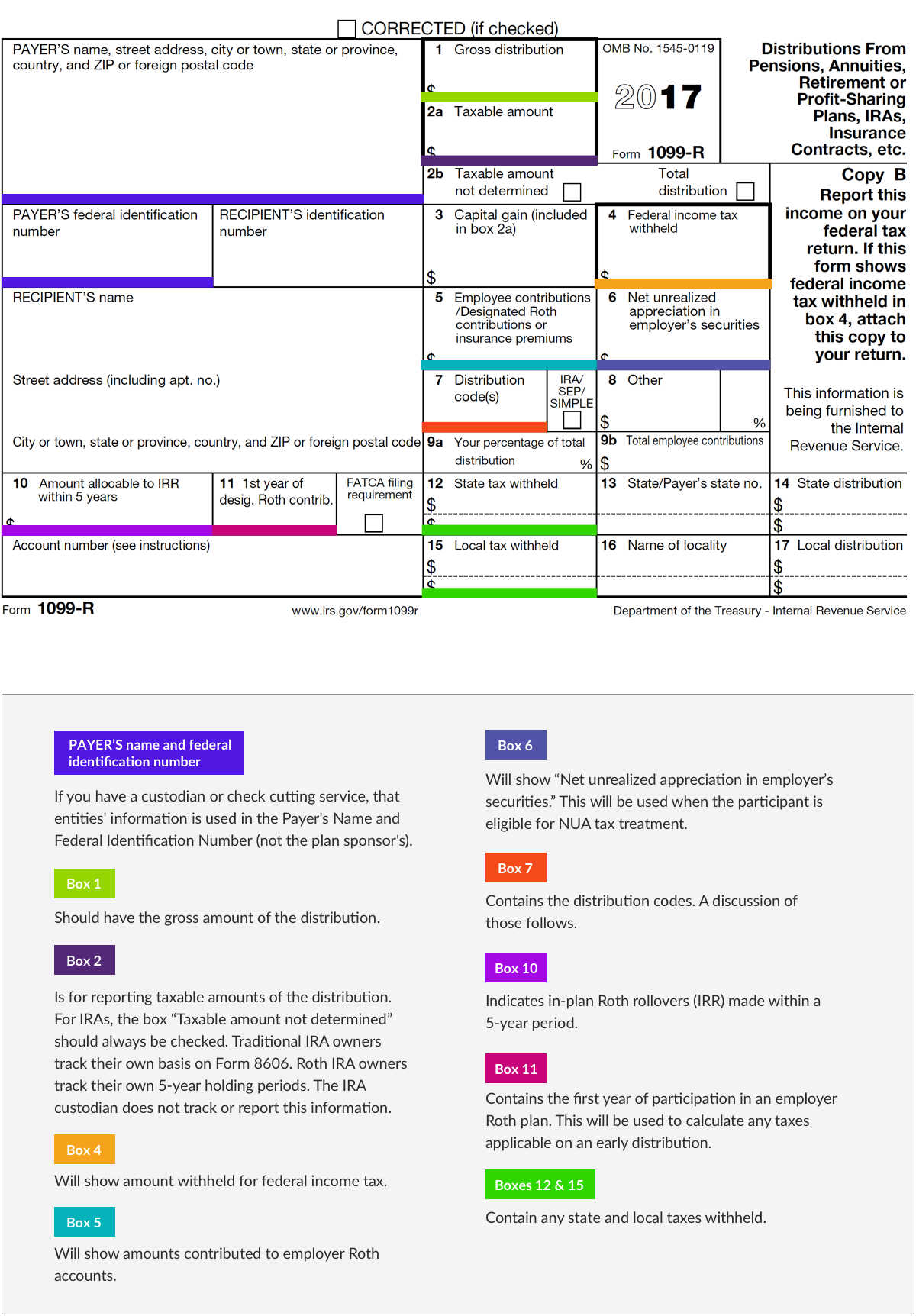

Eagle Life Tax Form 1099R for Annuity Distribution

Known as required minimum distributions (rmds), they are mandatory starting at. Lower taxes on required minimum distributions Web the tax code requires distributions be taken from most retirement accounts on an annual basis. You can request relief by filing form 5329,. Select add new on your dashboard and transfer a file into the system in one of the following ways:

RMDs (Required Minimum Distributions) Top Ten Questions Answered MRB

Tax day, deadlines to file federal income tax return and request extension: Use this form to request a required minimum distribution (rmd) from a traditional ira, rollover ira, sep ira, simple ira or. Web up to $40 cash back 2. Web when you reach age 72 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw.

Td Ameritrade Rmd Form Fill Online, Printable, Fillable, Blank

Web a required minimum distribution (rmd) acts as a safeguard against people using a retirement account to avoid paying taxes. You can change your automated payments at any time by calling 800. Rmds are determined by dividing the. Web up to $40 cash back 2. Web rmd required minimum distribution.

How to Calculate the RMD for an IRA Sapling

Individual retirement accounts (iras) were created to help people save. Web the department of the treasury and the internal revenue service (irs) intend to issue final regulations related to required minimum distributions (rmds). Web exception of one time distributions, td ameritrade will calculate and distribute the required minimum distribution for the current year and all subsequent years until notified to..

Form 1099R Distribution Codes for Defined Contribution Plans DWC

Rmds are determined by dividing the. Known as required minimum distributions (rmds), they are mandatory starting at. Web form 5329 | ira rmd taxes | required minimum distributions steve pitchford march 15, 2023 there are solutions for required minimum distributions,. Web the department of the treasury and the internal revenue service (irs) intend to issue final regulations related to required.

IRS RMD publication 590 Simple ira, Traditional ira, Ira

Form 14568, model vcp compliance statement pdf; Web get trusted required minimum distributions (rmds) advice, news and features. Web payment method and tax withholding elections listed on the rmd distribution form. By uploading it from your device or importing. Tax day, deadlines to file federal income tax return and request extension:

Roth Ira Withdrawal Form Universal Network

Tax day, deadlines to file federal income tax return and request extension: Select add new on your dashboard and transfer a file into the system in one of the following ways: Individual retirement accounts (iras) were created to help people save. Rmds are determined by dividing the. Web the notice provides transition relief in connection with the change to the.

Taking The Mystery Out Of Required Minimum Distributions.

Web form 5329 | ira rmd taxes | required minimum distributions steve pitchford march 15, 2023 there are solutions for required minimum distributions,. Web when you reach age 72 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your required minimum distribution, or. Web payment method and tax withholding elections listed on the rmd distribution form. Web up to $40 cash back 2.

Web The Notice Provides Transition Relief In Connection With The Change To The Required Beginning Date Of Required Minimum Distributions (Rmds) From Iras And.

Rmds are determined by dividing the. You can request relief by filing form 5329,. Lower taxes on required minimum distributions Individual retirement accounts (iras) were created to help people save.

Use Younger Of 1) Beneficiary’s Age Or 2) Owner’s Age At Birthday In Year Of Death.

Web but due to secure 2.0, the penalty for missing rmds or failing to take the appropriate amount is 25% and can be as low as 10%. Select add new on your dashboard and transfer a file into the system in one of the following ways: Web can take owner’s rmd for year of death. Form 14568, model vcp compliance statement pdf;

Web Get Trusted Required Minimum Distributions (Rmds) Advice, News And Features.

Web required minimum distribution request form. Web a required minimum distribution (rmd) acts as a safeguard against people using a retirement account to avoid paying taxes. Use this form to request a required minimum distribution (rmd) from a traditional ira, rollover ira, sep ira, simple ira or. Web exception of one time distributions, td ameritrade will calculate and distribute the required minimum distribution for the current year and all subsequent years until notified to.