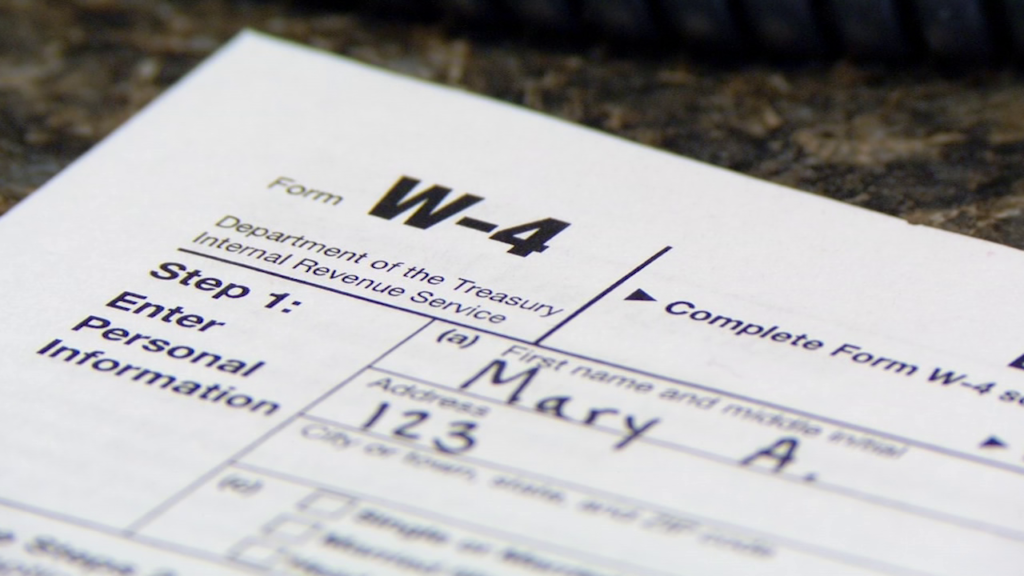

The W-4 Tax Form Is Used To Everfi

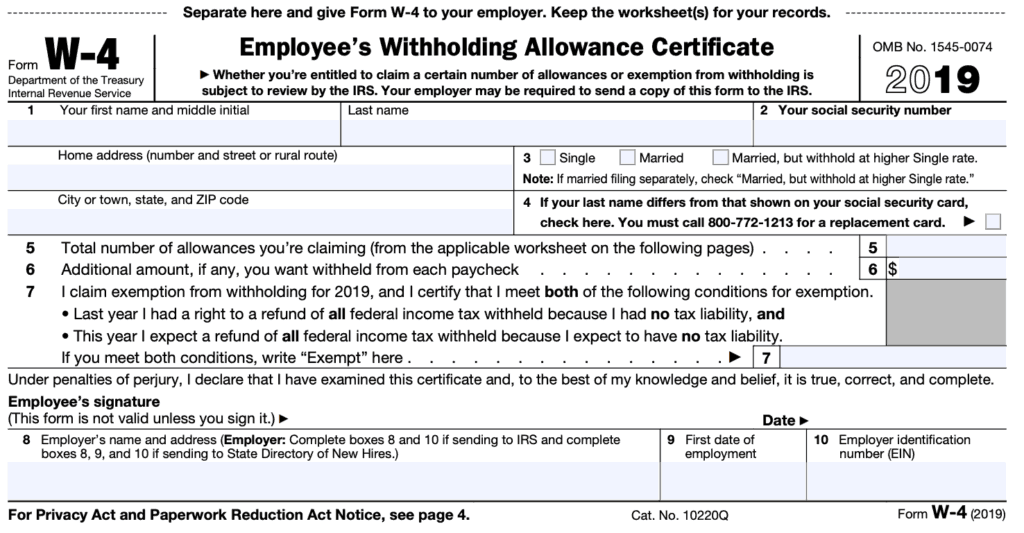

The W-4 Tax Form Is Used To Everfi - Click the card to flip 👆. Let efile.com help you with it. Web sui tax rate notice (sample) move your mouse over the image to see an example missouri sui rate notice, or click here to open in a separate window. This form determines how much money withheld from your wages for tax purposes. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. The irs always posts the next years tax forms before the end of the year. A federal tax form filled out by an employee to indicate the amount that should be. Web june 10, 2020. Payroll taxes and federal income tax withholding. Determine how much your gross.

Your withholding usually will be most accurate when all allowances. Determine how much your gross. The irs always posts the next years tax forms before the end of the year. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. A federal tax form filled out by an employee to indicate the amount that should be. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. To determine how much federal income tax your employer. Web june 10, 2020. However, once you start the enrollment process you. Let efile.com help you with it.

Click the card to flip 👆. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. At the end of the year, your employer. Two earners or multiple jobs. Your withholding usually will be most accurate when all allowances. This form determines how much money withheld from your wages for tax purposes. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Keep more of your paycheck by optimizing your form w4. Let efile.com help you with it.

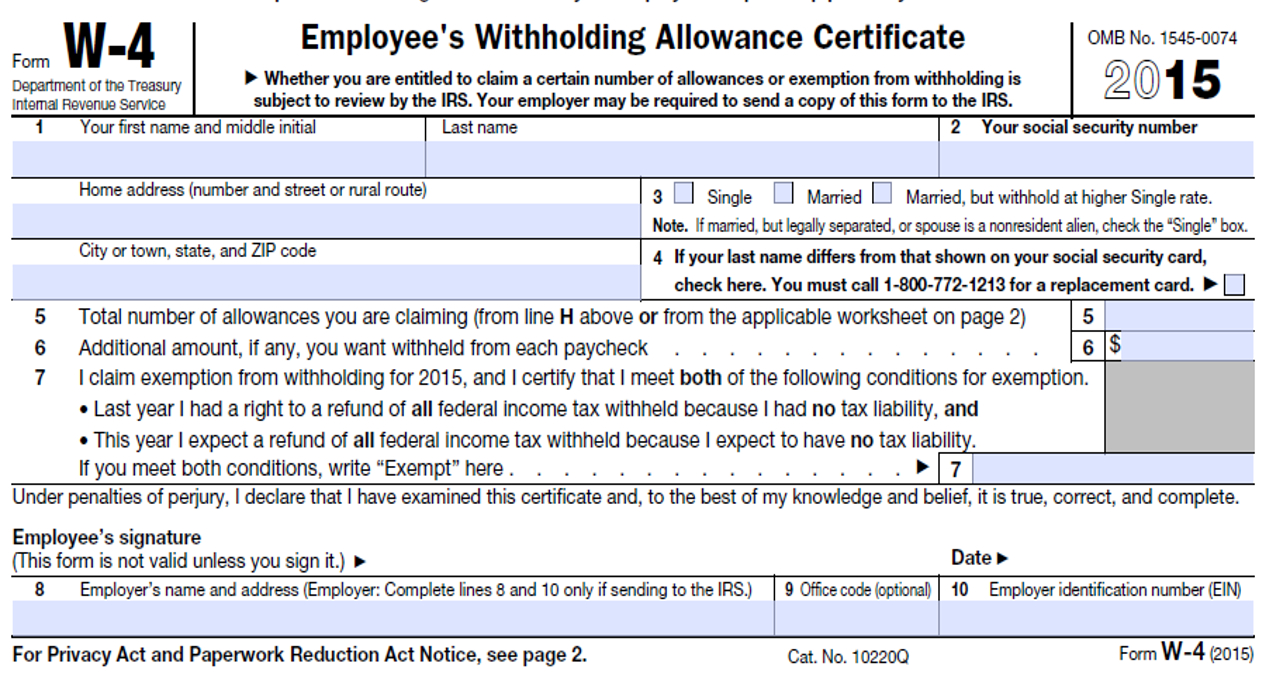

New W4 tax form explained 47abc

This form determines how much money withheld from your wages for tax purposes. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. A federal tax form filled out by an employee to indicate the amount that should be. Web sui tax rate notice (sample) move your mouse over the image to.

Why you should care about new W4 tax form The Columbian

Payroll taxes and federal income tax withholding. Employers will continue to use the information. Two earners or multiple jobs. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. A federal tax form filled out by an employee to indicate the amount that should be.

How To Fill Out Your W4 Tax Form Youtube Free Printable W 4 Form

The irs always posts the next years tax forms before the end of the year. To determine how much federal income tax your employer. Keep more of your paycheck by optimizing your form w4. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Your withholding usually will be most accurate when.

Everything you need to know about the new W4 tax form ABC News

Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. To determine how much federal income tax your employer. Determine how much your gross. Your withholding usually will be most accurate when all allowances. At the end of the year, your employer.

Navigating the New W4 Form Primary Funding

Web june 10, 2020. Payroll taxes and federal income tax withholding. At the end of the year, your employer. This form determines how much money withheld from your wages for tax purposes. Employers will continue to use the information.

Here's how to fill out the new W4 form if you change jobs, get married

Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Payroll taxes and federal income tax withholding. Web sui tax rate notice (sample) move your mouse over the image to see an example missouri sui rate notice, or click here to open in a separate window. Determine how much your gross. In.

Owe too much in taxes? Here's how to tackle the new W4 tax form

Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. A federal tax form filled out by an employee to indicate the amount that should be. Click the card to flip 👆. This form determines how much money withheld from your wages for tax purposes. Determine how much your gross.

The New W4 Tax Withholding Form Is Coming Soon. But Why Is The IRS

Click the card to flip 👆. Let efile.com help you with it. The irs always posts the next years tax forms before the end of the year. A federal tax form filled out by an employee to indicate the amount that should be. Your withholding usually will be most accurate when all allowances.

Form W4 Tax forms, W4 tax form, How to get money

At the end of the year, your employer. Keep more of your paycheck by optimizing your form w4. Let efile.com help you with it. In may you will take. To determine how much federal income tax your employer.

Should I Claim 1 or 0 Allowances On My W4 To Lower My Taxes?

In may you will take. Payroll taxes and federal income tax withholding. This form determines how much tax your employer will withhold. Web sui tax rate notice (sample) move your mouse over the image to see an example missouri sui rate notice, or click here to open in a separate window. Web june 10, 2020.

This Form Determines How Much Money Withheld From Your Wages For Tax Purposes.

Employers will continue to use the information. The irs always posts the next years tax forms before the end of the year. Click the card to flip 👆. Payroll taxes and federal income tax withholding.

Determine How Much Your Gross.

To determine how much federal income tax your employer. Keep more of your paycheck by optimizing your form w4. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. Two earners or multiple jobs.

However, Once You Start The Enrollment Process You.

A federal tax form filled out by an employee to indicate the amount that should be. Your withholding usually will be most accurate when all allowances. In may you will take. At the end of the year, your employer.

This Form Determines How Much Tax Your Employer Will Withhold.

Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Let efile.com help you with it. Web june 10, 2020. Web sui tax rate notice (sample) move your mouse over the image to see an example missouri sui rate notice, or click here to open in a separate window.