Uic W2 Form

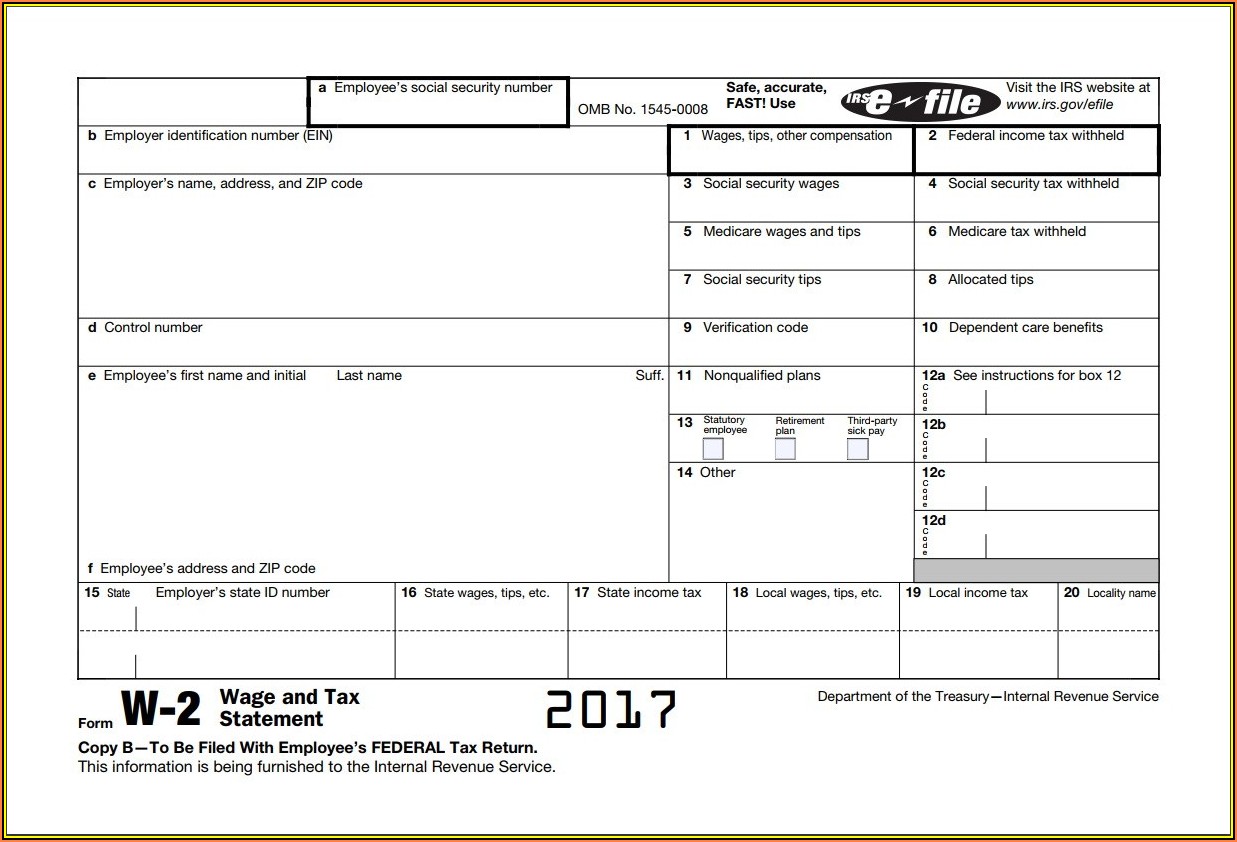

Uic W2 Form - University payroll & benefits (upb) is responsible for issuing the following forms: Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. If you are off campus you will also need to. Taxes that i think i am not required to pay are being taken out of my paychecks, what should i do? Last year more than 50,000 employees chose to receive their. Web employee's wage and tax statement. Web the university payroll & benefits (upb) office facilitates accurate, timely payment and benefits enrollment of employees on each of the three universities. Web illinois department of revenue tax information the tax information section of the payroll & benefits web site provides you with information relevant to tax forms,. This article links to upb page with the details on how to.

If you are off campus you will also need to. Taxes that i think i am not required to pay are being taken out of my paychecks, what should i do? Web illinois department of revenue tax information the tax information section of the payroll & benefits web site provides you with information relevant to tax forms,. This article links to upb page with the details on how to. Web the university payroll & benefits (upb) office facilitates accurate, timely payment and benefits enrollment of employees on each of the three universities. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Last year more than 50,000 employees chose to receive their. Web employee's wage and tax statement. University payroll & benefits (upb) is responsible for issuing the following forms:

Web employee's wage and tax statement. If you are off campus you will also need to. Taxes that i think i am not required to pay are being taken out of my paychecks, what should i do? Web the university payroll & benefits (upb) office facilitates accurate, timely payment and benefits enrollment of employees on each of the three universities. Last year more than 50,000 employees chose to receive their. Web illinois department of revenue tax information the tax information section of the payroll & benefits web site provides you with information relevant to tax forms,. University payroll & benefits (upb) is responsible for issuing the following forms: Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. This article links to upb page with the details on how to.

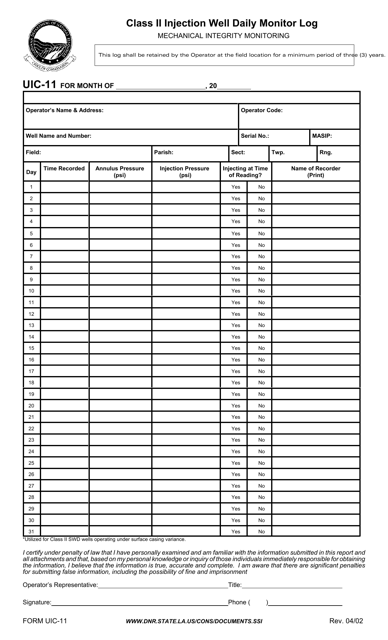

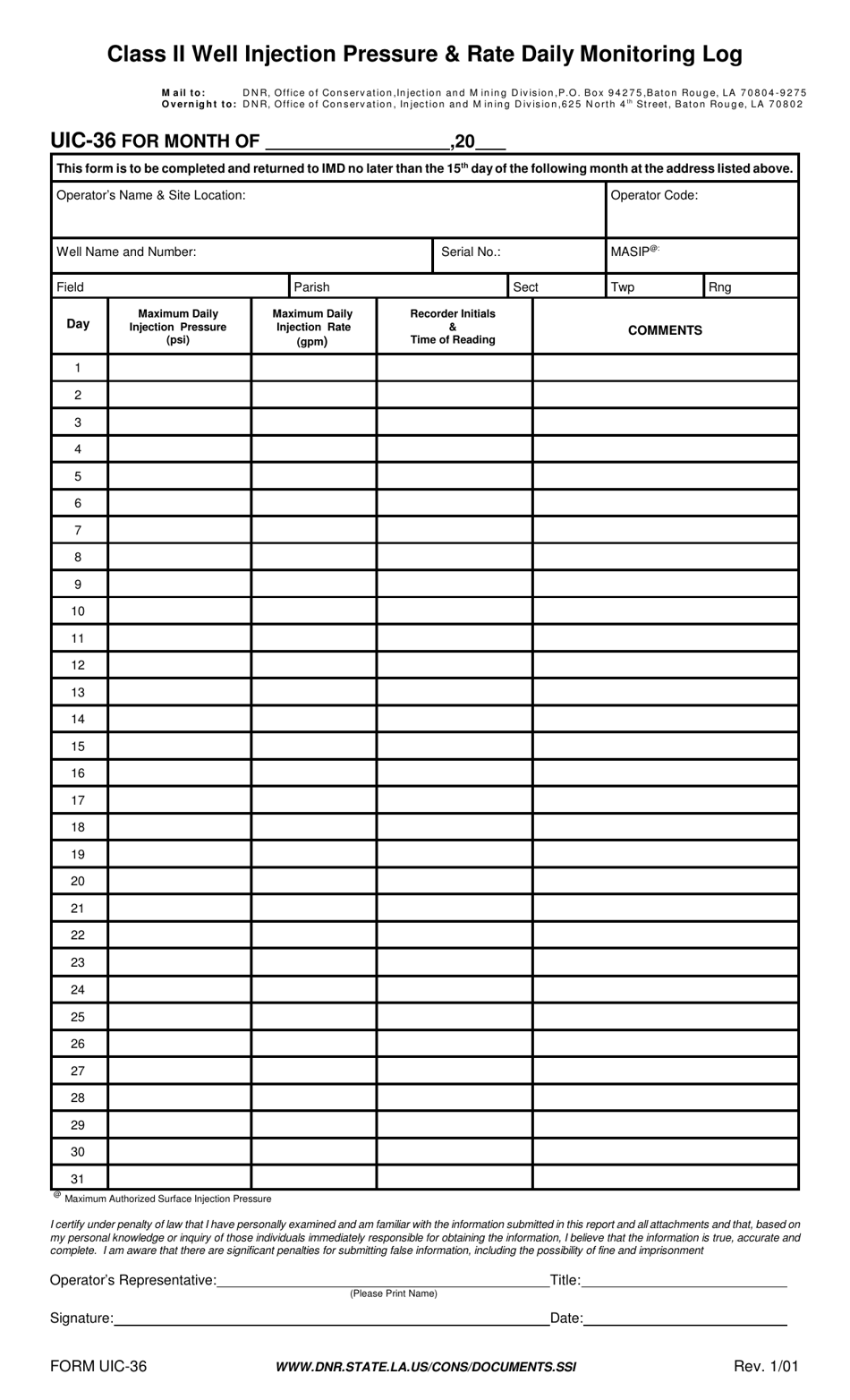

Form UIC11 Download Printable PDF or Fill Online Class Ii Injection

Web employee's wage and tax statement. Web illinois department of revenue tax information the tax information section of the payroll & benefits web site provides you with information relevant to tax forms,. Last year more than 50,000 employees chose to receive their. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or.

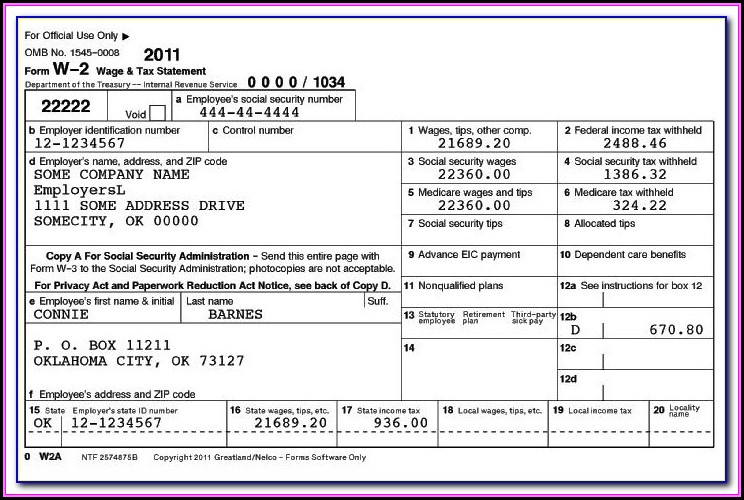

Fake W2 Forms Form Resume Examples o7Y3w1oYBN

If you are off campus you will also need to. This article links to upb page with the details on how to. Taxes that i think i am not required to pay are being taken out of my paychecks, what should i do? Web illinois department of revenue tax information the tax information section of the payroll & benefits web.

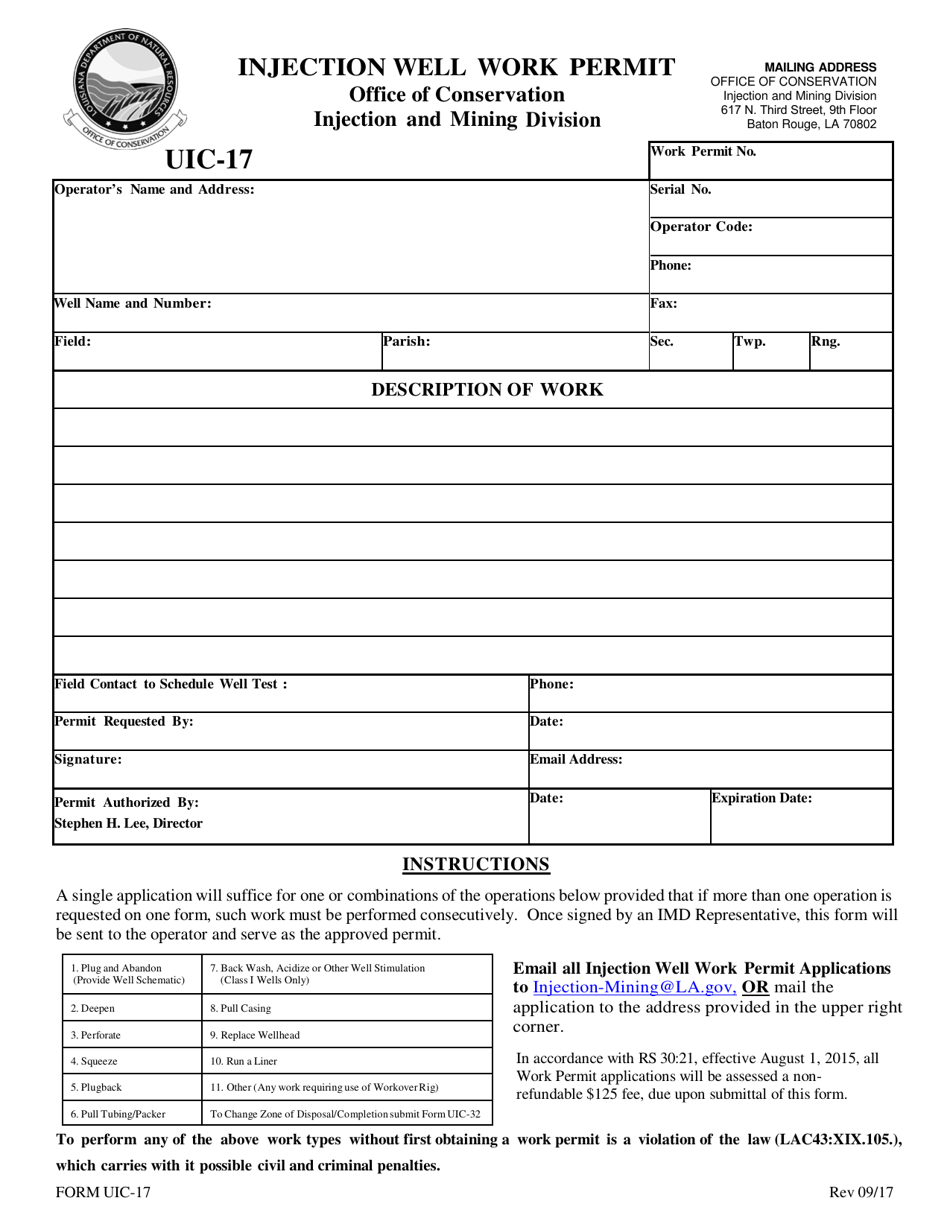

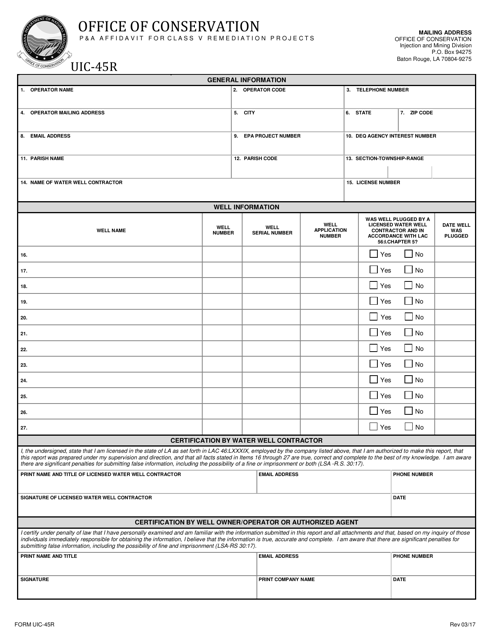

Form UIC17 Fill Out, Sign Online and Download Fillable PDF

Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Web illinois department of revenue tax information the tax information section of the payroll & benefits web site provides you with information relevant to tax forms,. Web the university payroll.

Form UIC25 Download Printable PDF or Fill Online ClassV Well Permit

Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Web employee's wage and tax statement. This article links to upb page with the details on how to. If you are off campus you will also need to. University payroll.

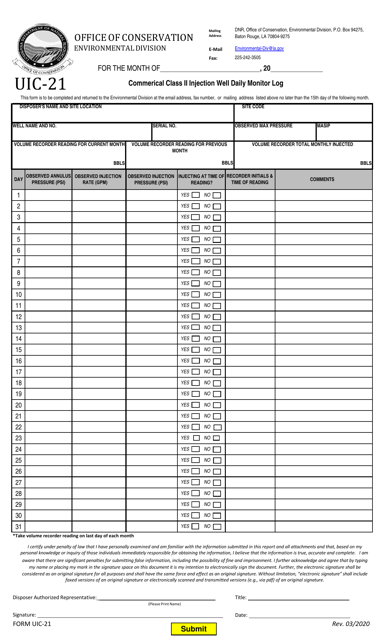

Form UIC21 Download Fillable PDF or Fill Online Commercial Class II

Taxes that i think i am not required to pay are being taken out of my paychecks, what should i do? If you are off campus you will also need to. Web the university payroll & benefits (upb) office facilitates accurate, timely payment and benefits enrollment of employees on each of the three universities. Web every employer engaged in a.

Form UIC1 Download Printable PDF or Fill Online ClassI Waste

Web employee's wage and tax statement. If you are off campus you will also need to. This article links to upb page with the details on how to. Last year more than 50,000 employees chose to receive their. Taxes that i think i am not required to pay are being taken out of my paychecks, what should i do?

Form UIC36 Download Printable PDF or Fill Online Class II Well

University payroll & benefits (upb) is responsible for issuing the following forms: If you are off campus you will also need to. Last year more than 50,000 employees chose to receive their. Web employee's wage and tax statement. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year.

W2 Form For Employee Form Resume Examples mx2WDxG96E

University payroll & benefits (upb) is responsible for issuing the following forms: Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. This article links to upb page with the details on how to. Web employee's wage and tax statement..

Form UIC45R Download Fillable PDF or Fill Online P&a Affidavit for

Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Taxes that i think i am not required to pay are being taken out of my paychecks, what should i do? This article links to upb page with the details.

Form UIC26 Download Printable PDF or Fill Online Waste Refusal

Web illinois department of revenue tax information the tax information section of the payroll & benefits web site provides you with information relevant to tax forms,. If you are off campus you will also need to. University payroll & benefits (upb) is responsible for issuing the following forms: Web the university payroll & benefits (upb) office facilitates accurate, timely payment.

This Article Links To Upb Page With The Details On How To.

If you are off campus you will also need to. Web employee's wage and tax statement. University payroll & benefits (upb) is responsible for issuing the following forms: Web the university payroll & benefits (upb) office facilitates accurate, timely payment and benefits enrollment of employees on each of the three universities.

Web Illinois Department Of Revenue Tax Information The Tax Information Section Of The Payroll & Benefits Web Site Provides You With Information Relevant To Tax Forms,.

Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Last year more than 50,000 employees chose to receive their. Taxes that i think i am not required to pay are being taken out of my paychecks, what should i do?