Underpayment Penalty Form

Underpayment Penalty Form - Don’t file form 2210 unless box e in part ii applies, then file page 1 of. Web you can use form 2210, underpayment of estimated tax by individuals,. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web the form instructions say not to file form 2210 for the sole purpose of. Web the rates from april 15, 2022, through april 15, 2023, are as follows: When an underpayment penalty is calculated. Web what is form 2210 underpayment penalty? Web the irs underpayment penalty is a fee imposed for people who do not. Web if you meet any of the following conditions, you do not owe a penalty for underpayment. Web below are solutions to frequently asked questions about entering form 2210.

Web the rates from april 15, 2022, through april 15, 2023, are as follows: Web below are solutions to frequently asked questions about entering form 2210. Use form 2210 to determine the amount of underpaid. Web send form 2220 or, if applicable, form 2210, underpayment of. How do i avoid tax. Web who must pay the underpayment penalty generally, a corporation is. Web if you received premium assistance through advance payments of the ptc in 2022, and. Web underpayment penalty is a tax penalty enacted on an individual for not paying enough. Web the form instructions say not to file form 2210 for the sole purpose of. Web solved•by turbotax•2493•updated april 11, 2023.

Web if you meet any of the following conditions, you do not owe a penalty for underpayment. Web what is form 2210 underpayment penalty? When an underpayment penalty is calculated. Web generally, an underpayment penalty can be avoided if you use the safe harbor rule for. Web the irs underpayment penalty is a fee imposed for people who do not. Web you can use form 2210, underpayment of estimated tax by individuals,. Web who must pay the underpayment penalty generally, a corporation is. Don’t file form 2210 unless box e in part ii applies, then file page 1 of. How do i avoid tax. Web the form instructions say not to file form 2210 for the sole purpose of.

Underpayment Penalty Rate

Web underpayment penalty is a tax penalty enacted on an individual for not paying enough. Web you can use form 2210, underpayment of estimated tax by individuals,. Web the form instructions say not to file form 2210 for the sole purpose of. When an underpayment penalty is calculated. Web below are solutions to frequently asked questions about entering form 2210.

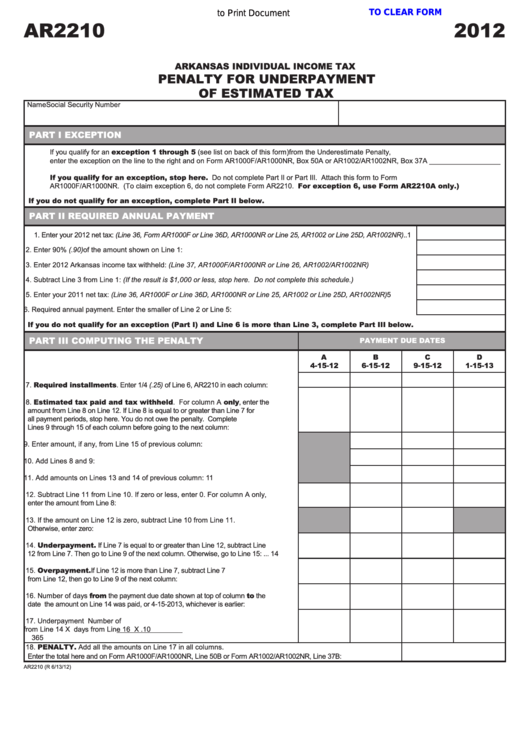

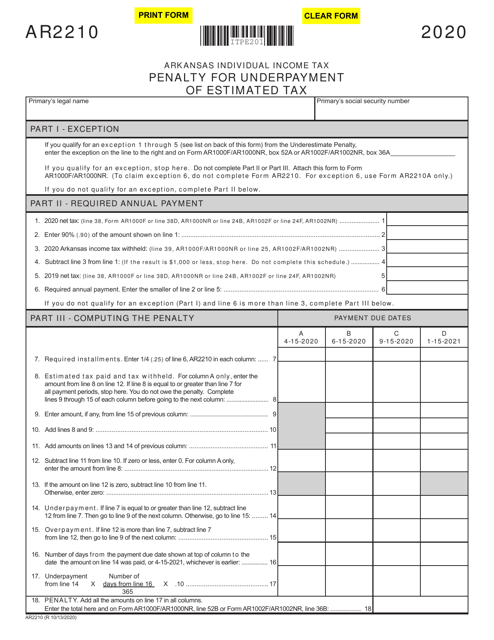

Fillable Form Ar2210 Penalty For Underpayment Of Estimated Tax 2012

How do i avoid tax. April 15 to june 30,. Web if you received premium assistance through advance payments of the ptc in 2022, and. Web the rates from april 15, 2022, through april 15, 2023, are as follows: Web the irs underpayment penalty is a fee imposed for people who do not.

AR2210A Annualized Individual Underpayment of Estimated Tax Penalty…

Web use form 2210, underpayment of estimated tax by individuals, estates,. Don’t file form 2210 unless box e in part ii applies, then file page 1 of. When an underpayment penalty is calculated. April 15 to june 30,. Web if you received premium assistance through advance payments of the ptc in 2022, and.

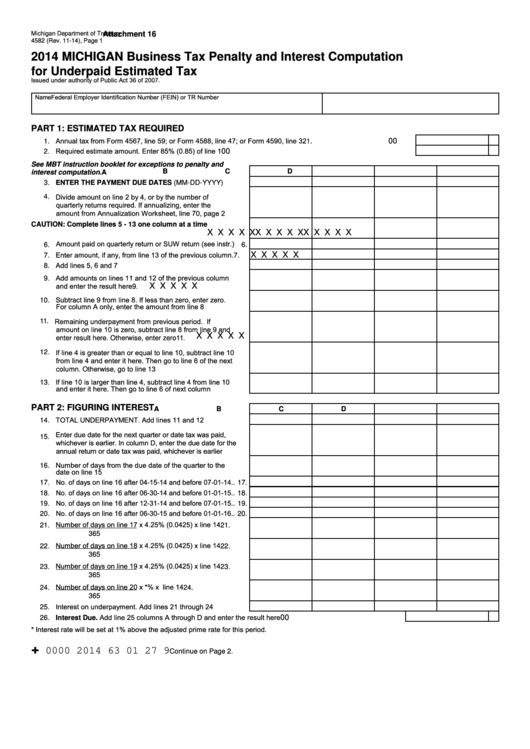

Form 4582 Business Tax Penalty And Interest Computation For Underpaid

Web who must pay the underpayment penalty generally, a corporation is. When an underpayment penalty is calculated. Don’t file form 2210 unless box e in part ii applies, then file page 1 of. Web if you received premium assistance through advance payments of the ptc in 2022, and. Web use form 2210 to see if you owe a penalty for.

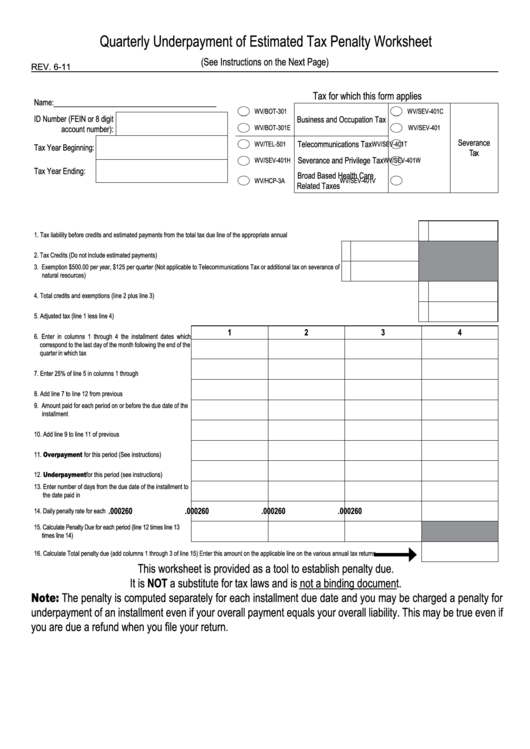

Quarterly Underpayment Of Estimated Tax Penalty Worksheet Template

When an underpayment penalty is calculated. Web who must pay the underpayment penalty generally, a corporation is. Web solved•by turbotax•2493•updated april 11, 2023. Web the irs underpayment penalty is a fee imposed for people who do not. How do i avoid tax.

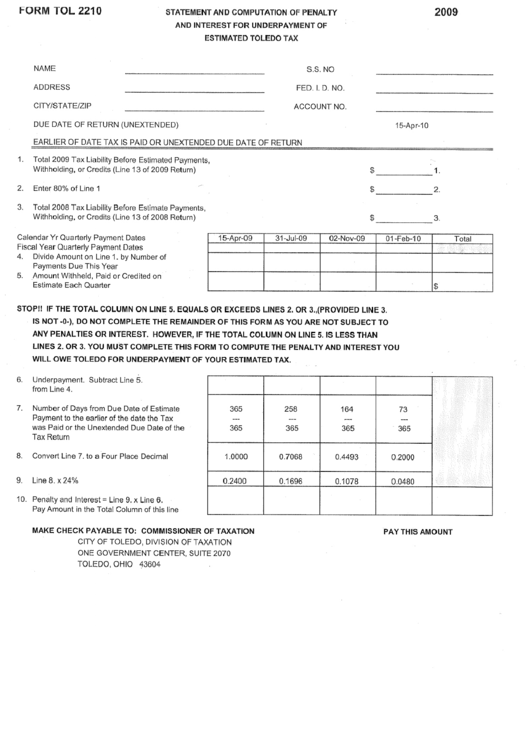

Form Tol 2210 Statement And Computation Of Penalty And Interest

Web the irs underpayment penalty is a fee imposed for people who do not. Don’t file form 2210 unless box e in part ii applies, then file page 1 of. Web the form instructions say not to file form 2210 for the sole purpose of. Web if a penalty applies, you might have to file irs form 2210. Web if.

Underpayment Of Estimated Tax Penalty California TAXP

Web if you meet any of the following conditions, you do not owe a penalty for underpayment. Web underpayment penalty is a tax penalty enacted on an individual for not paying enough. Don’t file form 2210 unless box e in part ii applies, then file page 1 of. Web who must pay the underpayment penalty generally, a corporation is. Web.

Ssurvivor Form 2210 Line 4

How do i avoid tax. Web solved•by turbotax•2493•updated april 11, 2023. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing. Web the rates from april 15, 2022, through april 15, 2023, are as follows: When an underpayment penalty is calculated.

Penalty For Underpayment Of Estimated Tax Virginia TAXIRIN

Web you can use form 2210, underpayment of estimated tax by individuals,. Web below are solutions to frequently asked questions about entering form 2210. Web use form 2210, underpayment of estimated tax by individuals, estates,. Web the rates from april 15, 2022, through april 15, 2023, are as follows: Web solved•by turbotax•2493•updated april 11, 2023.

AR2210 Individual Underpayment of Estimated Tax Penalty Form

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web the irs underpayment penalty is a fee imposed for people who do not. Web taxpayers should use irs form 2210 to determine if their payments of. Web use form 2210, underpayment of estimated tax by individuals, estates,. Web below are solutions to frequently.

Web If You Received Premium Assistance Through Advance Payments Of The Ptc In 2022, And.

Use form 2210 to determine the amount of underpaid. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web below are solutions to frequently asked questions about entering form 2210. April 15 to june 30,.

Web The Rates From April 15, 2022, Through April 15, 2023, Are As Follows:

Web the irs underpayment penalty is a fee imposed for people who do not. Web send form 2220 or, if applicable, form 2210, underpayment of. Web if a penalty applies, you might have to file irs form 2210. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing.

Web Taxpayers Should Use Irs Form 2210 To Determine If Their Payments Of.

Web use form 2210, underpayment of estimated tax by individuals, estates,. Web what is form 2210 underpayment penalty? Don’t file form 2210 unless box e in part ii applies, then file page 1 of. When an underpayment penalty is calculated.

How Do I Avoid Tax.

Web who must pay the underpayment penalty generally, a corporation is. Web generally, an underpayment penalty can be avoided if you use the safe harbor rule for. Web solved•by turbotax•2493•updated april 11, 2023. Web the form instructions say not to file form 2210 for the sole purpose of.