Virginia Form Va 6

Virginia Form Va 6 - Please note, a $35 fee may be assessed if your payment is declined by your. Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. Complete and mail to p.o. Easily fill out pdf blank, edit, and sign them. Web eforms are a fast and free way to file and pay state taxes online. Total va tax withheld 6c. 1546001745 at present, virginia tax does not support international ach transactions (iat). Complete and deliver to 1300 east main street, tyler building, 1st. Please make check or money order payable to state health department. If you do not agree to withhold additional tax, the employee may need to make estimated tax payments.

Web see the following information: You can print other virginia tax forms here. Who is exempt from virginia withholding? 1546001745 at present, virginia tax does not support international ach transactions (iat). Check if this is an amended return. Easily fill out pdf blank, edit, and sign them. Web eforms are a fast and free way to file and pay state taxes online. Click iat notice to review the details. Total va tax withheld 6c. The department reviews each account annually and makes any necessary changes.

If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. If you do not agree to withhold additional tax, the employee may need to make estimated tax payments. If you haven't filed or paid taxes using eforms and need more information, see: 31 of the following calendar year, or within 30 days after the final payment of wages by your company. Web commonwealth of virginia application for certification of a vital record virginia statutes require a fee of $12.00 be charged for each certification of a vital record or for a search of the files when no certification is made. Returns and payments must be submitted Please make check or money order payable to state health department. The department reviews each account annually and makes any necessary changes. Complete and mail to p.o. Web see the following information:

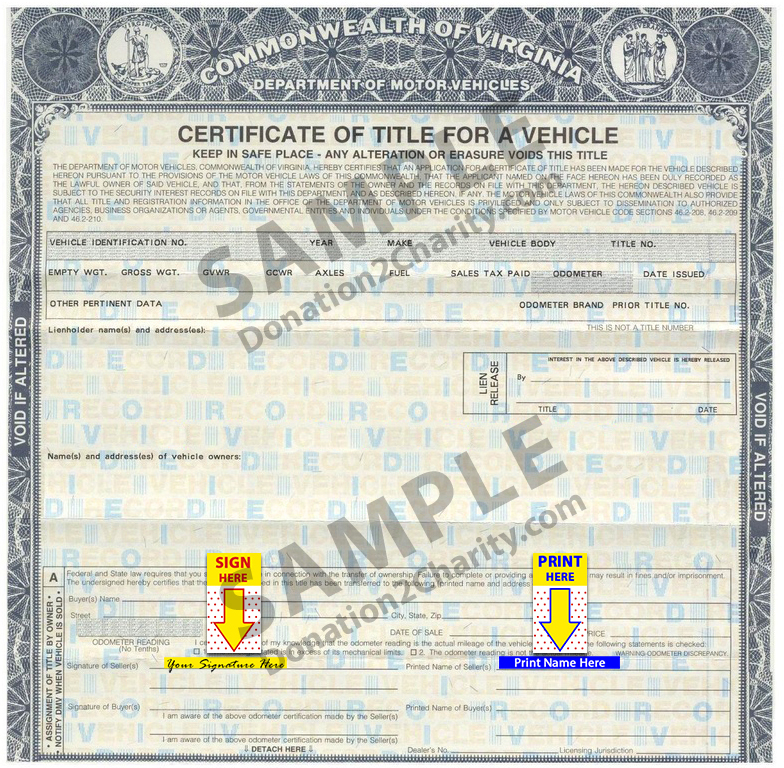

Virginia Donation2Charity

1546001745 at present, virginia tax does not support international ach transactions (iat). Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. A return must be filed even if no tax is due. Please make check or money order payable to state health department. Total va tax withheld.

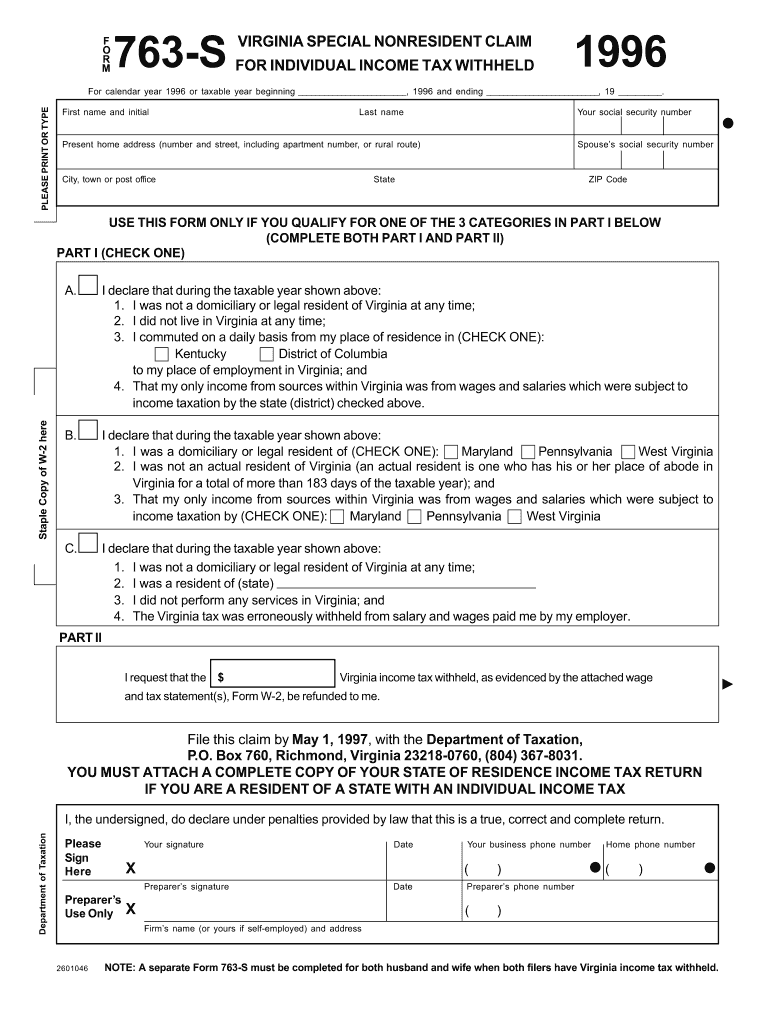

1996 Form VA 763S Fill Online, Printable, Fillable, Blank pdfFiller

Check if this is an amended return. Returns and payments must be submitted Employers are not responsible for monitoring their monthly tax liabilities to see if a status change is needed. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Who is exempt from virginia withholding?

Sr22 Virginia Fill Online, Printable, Fillable, Blank pdfFiller

Employers are not responsible for monitoring their monthly tax liabilities to see if a status change is needed. A return must be filed even if no tax is due. Web eforms are a fast and free way to file and pay state taxes online. Web see the following information: Forms and instructions for declaration of estimated income tax.

Unlawful Detainer Form Virginia Form Resume Examples 9x8ralQw3d

Please make check or money order payable to state health department. Web commonwealth of virginia application for certification of a vital record virginia statutes require a fee of $12.00 be charged for each certification of a vital record or for a search of the files when no certification is made. Please note, a $35 fee may be assessed if your.

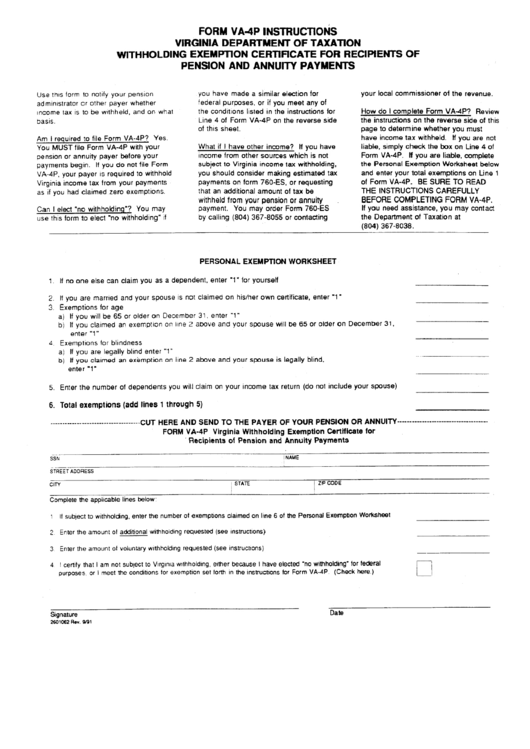

Form Va 4p Instructions Virginia Departnebt Of Taxation Withholding

Who is exempt from virginia withholding? If you haven't filed or paid taxes using eforms and need more information, see: Complete and deliver to 1300 east main street, tyler building, 1st. Web commonwealth of virginia application for certification of a vital record virginia statutes require a fee of $12.00 be charged for each certification of a vital record or for.

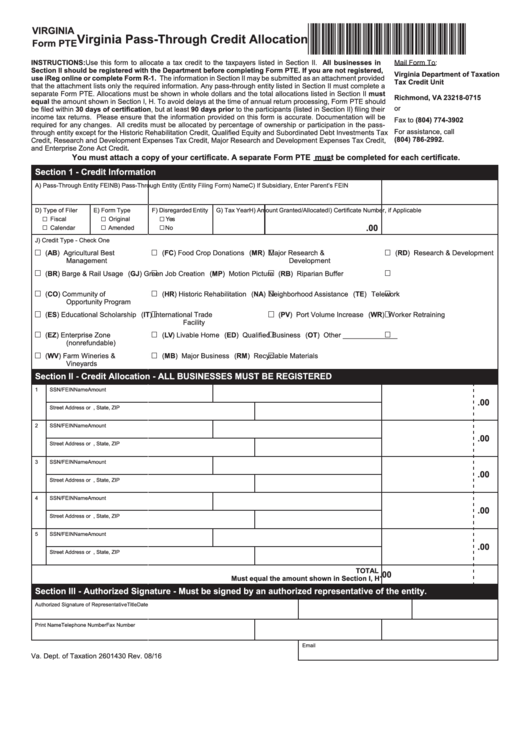

Fillable Virginia Form Pte Virginia PassThrough Credit Allocation

If you haven't filed or paid taxes using eforms and need more information, see: Forms and instructions for declaration of estimated income tax. Save or instantly send your ready documents. Complete and mail to p.o. The department reviews each account annually and makes any necessary changes.

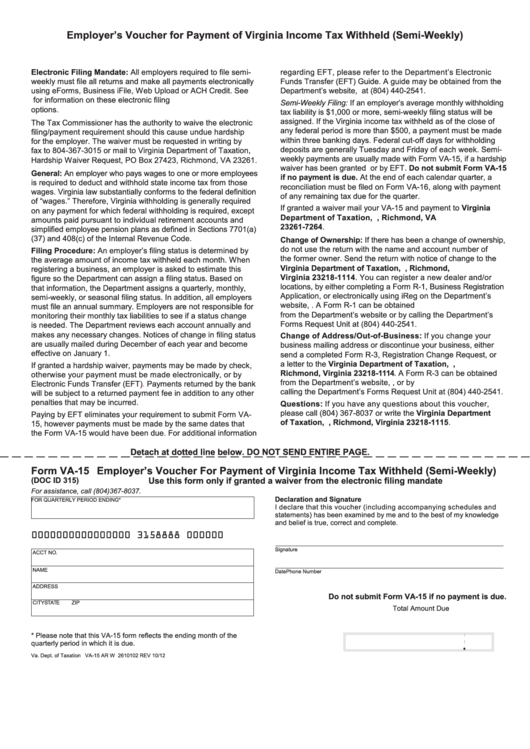

Fillable Form Va15 Employer'S Voucher For Payment Of Virginia

Save or instantly send your ready documents. Select an eform below to start filing. 1546001745 at present, virginia tax does not support international ach transactions (iat). 31 of the following calendar year, or within 30 days after the final payment of wages by your company. Check if this is an amended return.

Va 2022 State Tax Withholding dailybasis

Please note, a $35 fee may be assessed if your payment is declined by your. Easily fill out pdf blank, edit, and sign them. You can print other virginia tax forms here. The department reviews each account annually and makes any necessary changes. Click iat notice to review the details.

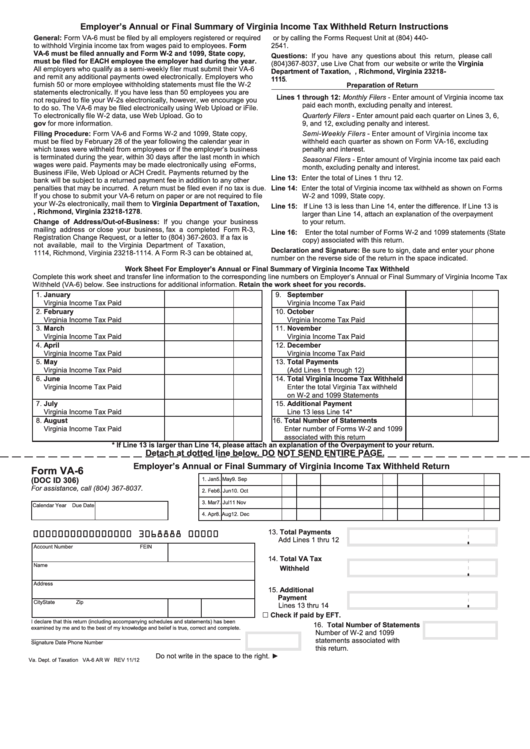

Fillable Form Va6 Employer'S Annual Or Final Summary Of Virginia

Easily fill out pdf blank, edit, and sign them. Check if this is an amended return. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web file online at cis.scc.virginia.gov. If you haven't filed or paid taxes using eforms and need more information, see:

1+ Virginia Offer to Purchase Real Estate Form Free Download

If you do not agree to withhold additional tax, the employee may need to make estimated tax payments. Click iat notice to review the details. Please make check or money order payable to state health department. Please note, a $35 fee may be assessed if your payment is declined by your. Check if this is an amended return.

If You Do Not Agree To Withhold Additional Tax, The Employee May Need To Make Estimated Tax Payments.

Who is exempt from virginia withholding? Web file online at cis.scc.virginia.gov. 1546001745 at present, virginia tax does not support international ach transactions (iat). Save or instantly send your ready documents.

If You Haven't Filed Or Paid Taxes Using Eforms And Need More Information, See:

Please note, a $35 fee may be assessed if your payment is declined by your. You must file this form with your employer when your employment begins. Complete and deliver to 1300 east main street, tyler building, 1st. The department reviews each account annually and makes any necessary changes.

Employers Are Not Responsible For Monitoring Their Monthly Tax Liabilities To See If A Status Change Is Needed.

Check if this is an amended return. Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. Easily fill out pdf blank, edit, and sign them. Please make check or money order payable to state health department.

Total Va Tax Withheld 6C.

Forms and instructions for declaration of estimated income tax. 31 of the following calendar year, or within 30 days after the final payment of wages by your company. Web eforms are a fast and free way to file and pay state taxes online. Select an eform below to start filing.