What 1099 Form Do I Use For Rent

What 1099 Form Do I Use For Rent - Publication 527 has more information about these rules. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. If you currently use a property management company to take care of. You will then receive a form 1099 form reporting the. Web in this situation, the taxpayer does not report the rental income and does not deduct rental expenses. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. We’ll outline them by situation: There are three types of 1099 rental income related forms. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Employment authorization document issued by the department of homeland. Web in this situation, the taxpayer does not report the rental income and does not deduct rental expenses. Web 1099 for rental income. Reporting rental income on your tax return. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. If you have not already entered the applicable. You will then receive a form 1099 form reporting the. Web use the form 1099 nec (pdf) to report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors (individuals or.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Publication 527 has more information about these rules. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. If you currently use a property management company to take care of. Employment authorization document issued by the department of homeland. Reporting rental income on your tax return. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. If you have not already entered the applicable. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

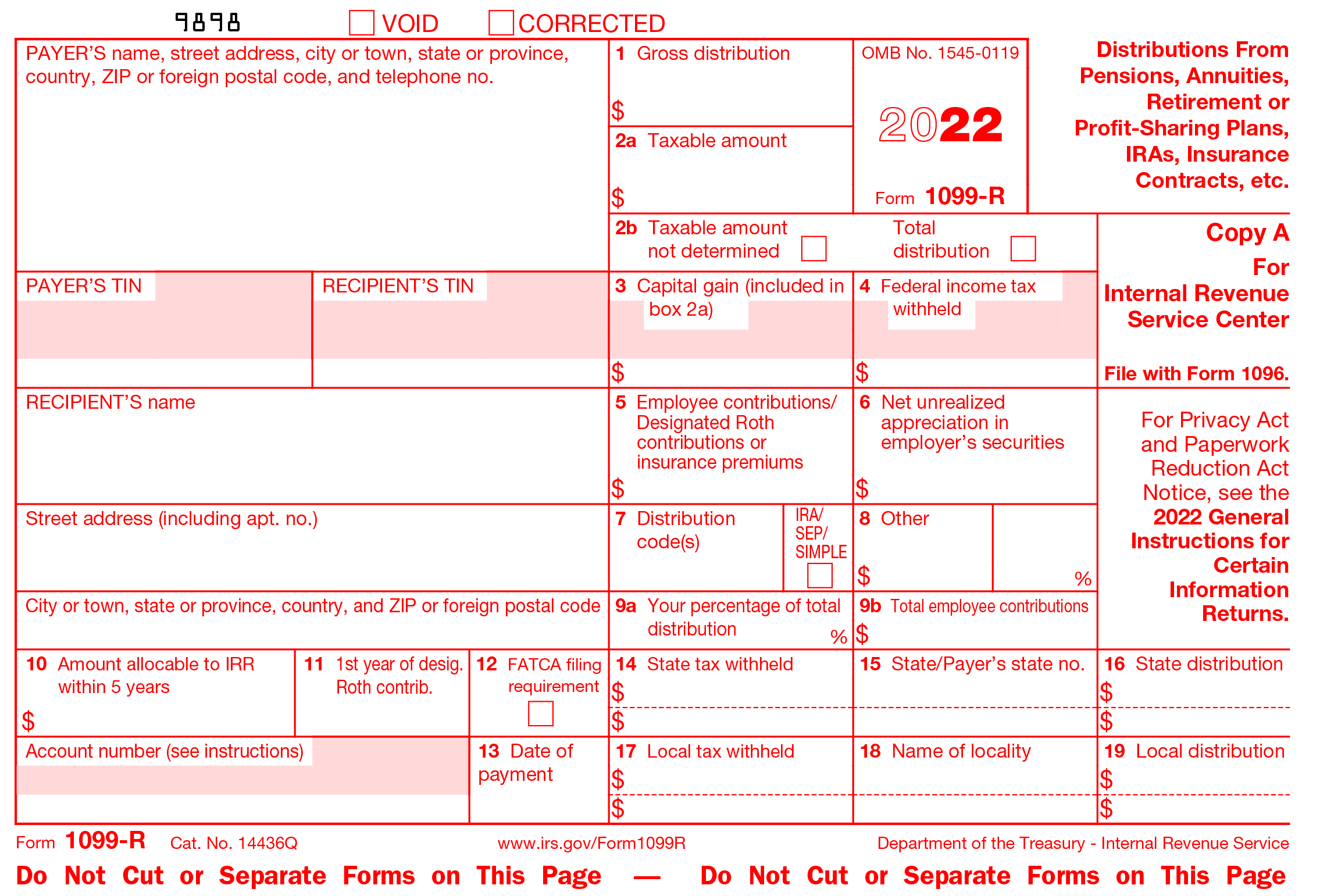

Irs Printable 1099 Form Printable Form 2022

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web 1099 for rental income. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. Web the 1040 form is the official tax return that taxpayers have to file with the.

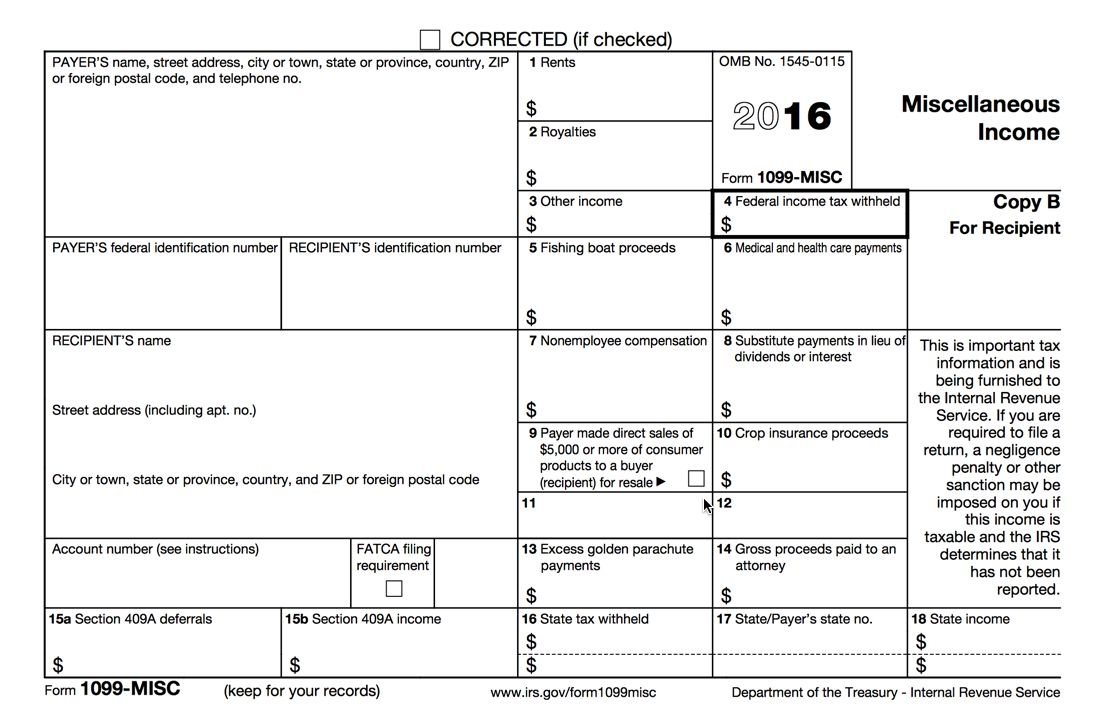

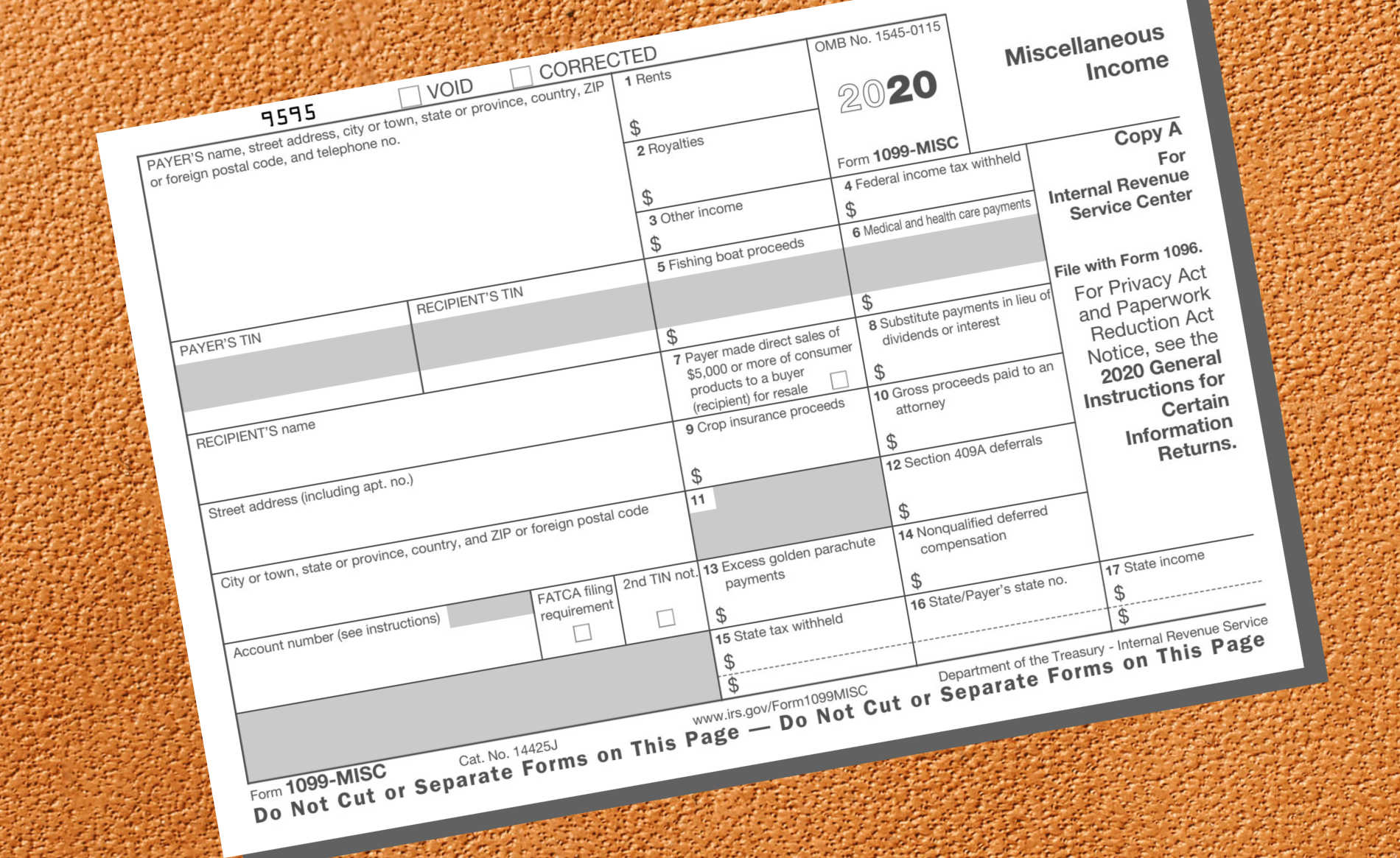

Free Printable 1099 Misc Forms Free Printable

Web use the form 1099 nec (pdf) to report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors (individuals or. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Publication 527 has more information about these rules. Web you can generally use schedule e (form 1040), supplemental.

DoItYourself 1099s, Done Right Moxie Bookkeeping and Coaching Inc.

Takes 5 minutes or less to complete. Publication 527 has more information about these rules. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web in this situation, the taxpayer does not report the rental income and does not deduct rental expenses. Simply answer a few question to instantly download, print & share.

Which 1099 Form Do I Use for Rent

We’ll outline them by situation: Reporting rental income on your tax return. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Simply answer a few question to instantly download, print & share your form. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Free Printable 1099 Misc Forms Free Printable

Takes 5 minutes or less to complete. Web use the form 1099 nec (pdf) to report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors (individuals or. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If you have not already entered the applicable. Web.

What is a 1099Misc Form? Financial Strategy Center

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. We’ll outline them by situation: Web 1099 for rental income. Reporting rental income on your tax.

Form 1099 Misc Fillable Universal Network

Reporting rental income on your tax return. Publication 527 has more information about these rules. If you have not already entered the applicable. Simply answer a few question to instantly download, print & share your form. Web use the form 1099 nec (pdf) to report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. If you currently use a property management company to take care of. Web 1099 for rental income. You will then receive a form 1099 form reporting the. Simply answer a few question to instantly download, print & share your form.

Efile 2022 Form 1099R Report the Distributions from Pensions

Reporting rental income on your tax return. If you currently use a property management company to take care of. Publication 527 has more information about these rules. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

J. Hunter Company Businesses use form 1099NEC to report contractor

Web use the form 1099 nec (pdf) to report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors (individuals or. Reporting rental income on your tax return. If you have not already entered the applicable. There are three types of 1099 rental income related forms. Publication 527 has more information about these rules.

We’ll Outline Them By Situation:

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. There are three types of 1099 rental income related forms. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Web In This Situation, The Taxpayer Does Not Report The Rental Income And Does Not Deduct Rental Expenses.

If you currently use a property management company to take care of. Reporting rental income on your tax return. Simply answer a few question to instantly download, print & share your form. Employment authorization document issued by the department of homeland.

Takes 5 Minutes Or Less To Complete.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web use the form 1099 nec (pdf) to report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors (individuals or. Publication 527 has more information about these rules. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals.

You Will Then Receive A Form 1099 Form Reporting The.

Web 1099 for rental income. If you have not already entered the applicable.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)