What Is Calendar Spread

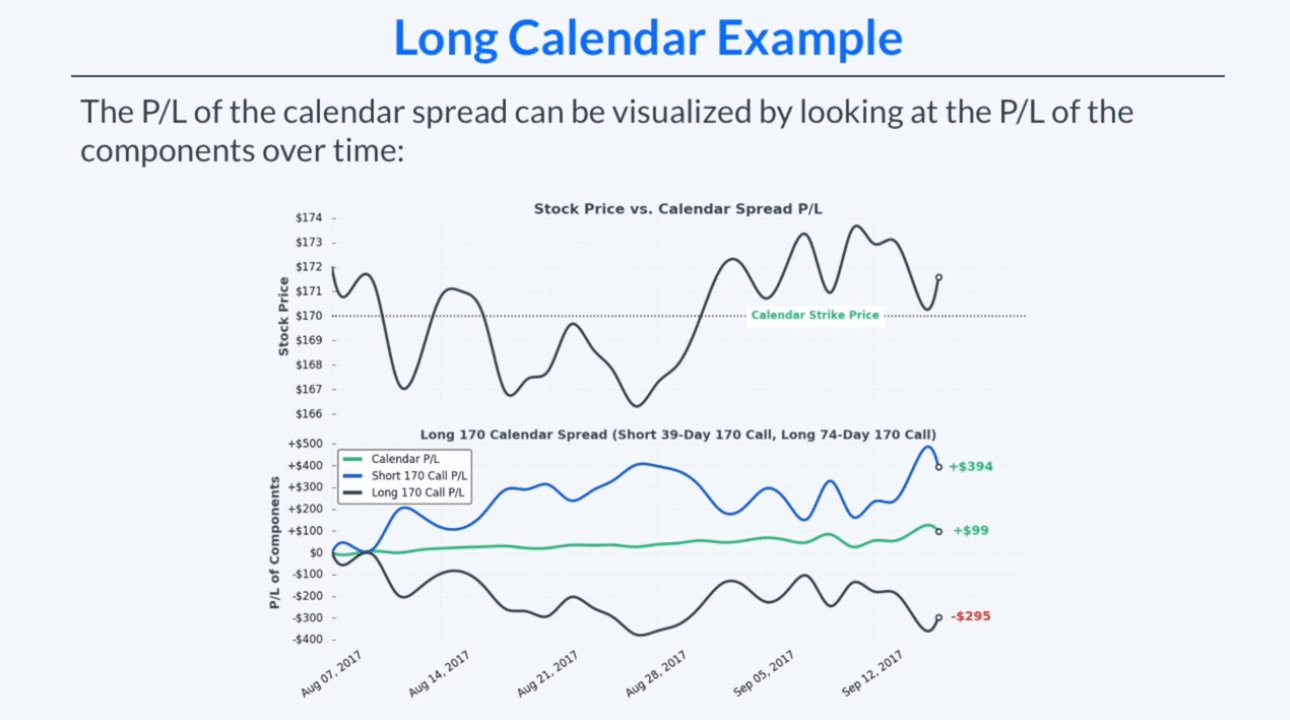

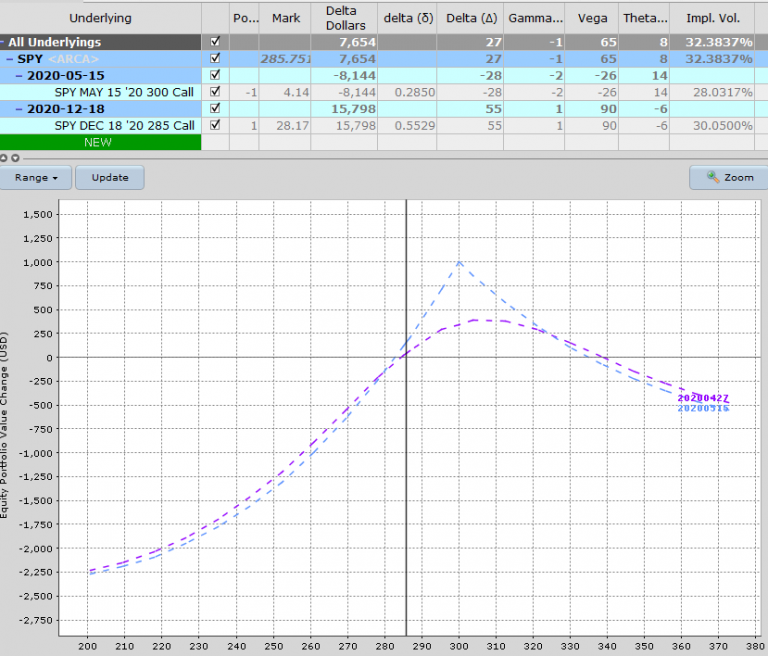

What Is Calendar Spread - Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or. Web a calendar spread is an options strategy that involves simultaneously entering a long and short position on the same underlying asset with different. Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. A calendar spread is initiated for different options with the same. Web one such tool used by seasoned options traders is calendar spread, initiated when market sentiment is neutral. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in. A calendar spread can be constructed with either calls or puts by. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index.

Before you can think about what you want to. A calendar spread can be constructed with either calls or puts by. Web what is a calendar spread? Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. Web a calendar spread is a strategy used in options and futures trading: A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same. Web here are a few techniques to help you reserve more time for what’s most important to you. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. Web one such tool used by seasoned options traders is calendar spread, initiated when market sentiment is neutral.

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in. Web one such tool used by seasoned options traders is calendar spread, initiated when market sentiment is neutral. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. In what could be a postseason matchup in late october, the mets’ bats erupted for four home runs and. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index. Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. Web here are a few techniques to help you reserve more time for what’s most important to you. A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in. Web here are a few techniques to help you reserve more time for what’s most important to you. In what could be a postseason matchup in late october, the mets’ bats.

Long Calendar Spreads Unofficed

Web a calendar spread is an options strategy that involves simultaneously entering a long and short position on the same underlying asset with different. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web what is a reverse calendar spread? A calendar spread can be constructed with either calls or.

What is Calendar Spread Options Strategy ? Different types of Calendar

Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is an options strategy that involves simultaneously entering a long and short position on the same underlying asset with different. Web in finance, a.

Everything You Need to Know about Calendar Spreads

A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same. Web one such tool used by seasoned options traders is calendar spread, initiated when market sentiment is neutral. In what could be a postseason matchup in late october, the mets’ bats erupted for.

How Long Calendar Spreads Work (w/ Examples) Options Trading

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied.

How Calendar Spreads Work (Best Explanation) projectoption

In what could be a postseason matchup in late october, the mets’ bats erupted for four home runs and. Web what is a calendar spread? A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same. Web in finance, a calendar spread (also called.

What Is Calendar Spread Option Strategy Manya Ruperta

Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same. Web the calendar.

Everything You Need to Know About Calendar Spreads SoFi

Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. A calendar spread is a.

How to Trade Options Calendar Spreads (Visuals and Examples)

Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web a calendar spread, also known as a time spread, is an options.

Calendar Spreads 101 Everything You Need To Know

A calendar spread can be constructed with either calls or puts by. Web what is a reverse calendar spread? Web one such tool used by seasoned options traders is calendar spread, initiated when market sentiment is neutral. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of.

A Calendar Spread Is A Trading Technique That Involves The Buying Of A Derivative Of An Asset In One Month And Selling A Derivative Of The Same.

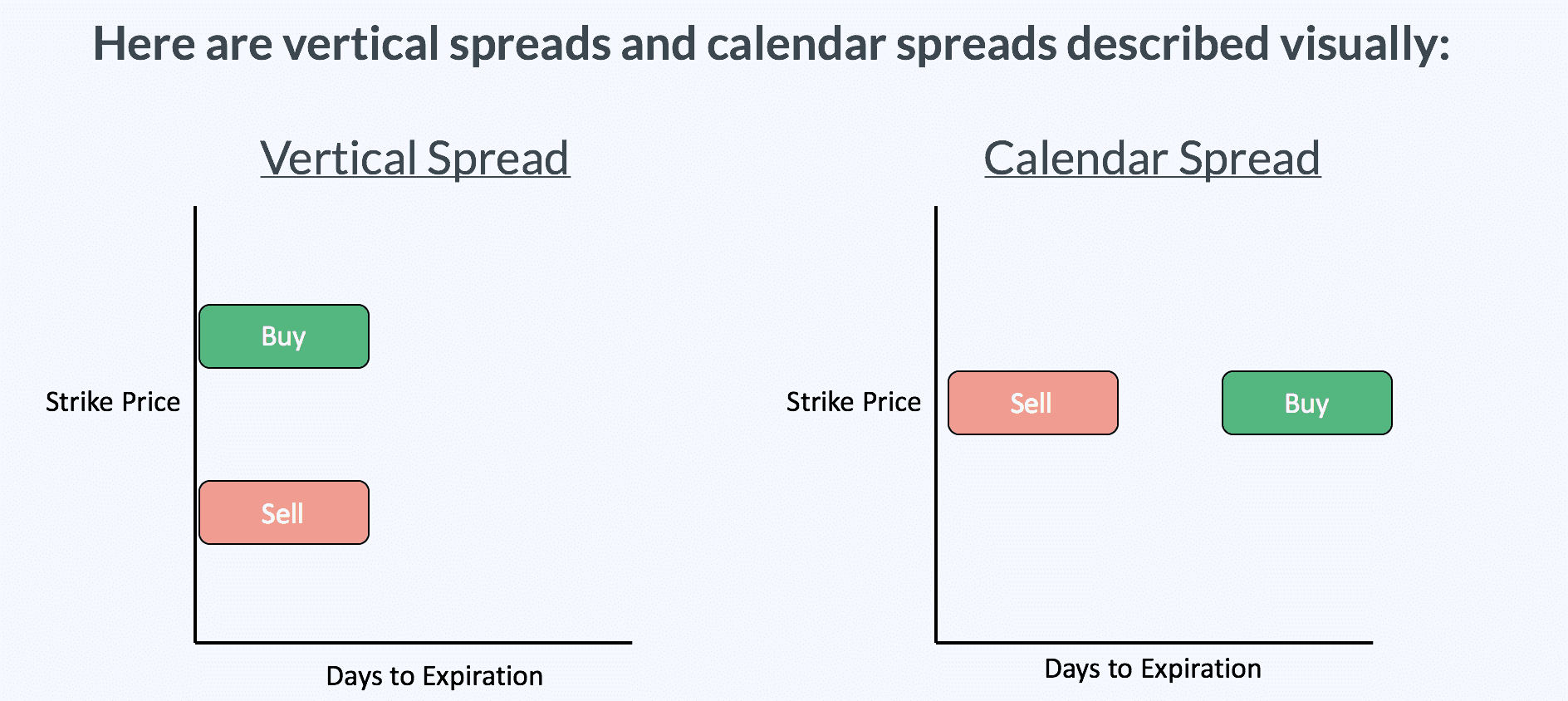

Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. A calendar spread is initiated for different options with the same.

Web A Calendar Spread Is An Options Strategy That Involves Simultaneously Entering A Long And Short Position On The Same Underlying Asset With Different.

Web what is a calendar spread? Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in. Web what is a reverse calendar spread? Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular.

Web A Calendar Spread, Also Known As A Time Spread, Is An Options Trading Strategy That Involves Buying And Selling Two Options Of The Same Type (Either Calls Or.

In what could be a postseason matchup in late october, the mets’ bats erupted for four home runs and. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index. A calendar spread can be constructed with either calls or puts by. Web one such tool used by seasoned options traders is calendar spread, initiated when market sentiment is neutral.

Web When You Invest In A Calendar Spread, You Buy And Sell The Same Type Of Option (Either A Call Or A Put) For The Same Underlying Stock At Identical Strike Prices But.

Web here are a few techniques to help you reserve more time for what’s most important to you. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Before you can think about what you want to.