What Is Form 1120-W

What Is Form 1120-W - It can also be used to report income for other. Corporation income tax return, including recent updates, related forms and instructions on how to file. A corporation with a tax obligation of $500 or more for. Web corporations use form 1120, u.s. Web form 1120, u.s. Web irs form 1120, the u.s. Tax withheld at source page 1. A corporation is obliged to submit. Corporate income tax return, to report income, gains, losses, deductions, and credits and determine income tax liability. Web irs form 1120, the u.s.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. If your corporation follows a calendar year, your estimated corporate tax payments are due april. Web form 1120, u.s. Corporation income tax return, is the central filing document for incorporated businesses, like corporations and llcs. Is the form supported in our. Corporation income tax return, is used to report corporate income taxes to the irs. A corporation with a tax obligation of $500 or more for. A corporation is obliged to submit. Corporate income tax return, to report income, gains, losses, deductions, and credits and determine income tax liability. Penalties may apply if the corporation does.

Figure the amount of their estimated tax payments. Web the irs form 1120 is provided for american domestic corporations to report their credits, special deductions , gains, losses, and income. Web form 1120, u.s. Corporation income tax return, is used to report corporate income taxes to the irs. Is the form supported in our. Web simplified procedure for claiming a refund of u.s. A corporation is obliged to submit. Corporate income tax return, to report income, gains, losses, deductions, and credits and determine income tax liability. Corporation income tax return, including recent updates, related forms and instructions on how to file. It isn't sent to the irs but is retained by the corporation.

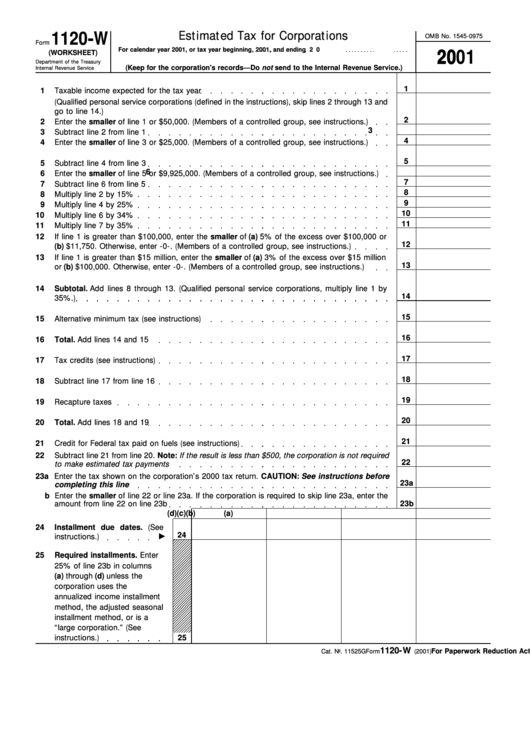

Estimated Tax for Corporations Free Download

The 1120 tax form also helps with tax. A corporation with a tax obligation of $500 or more for. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. If your corporation follows a calendar year, your estimated corporate tax payments are due april. Penalties may apply if the corporation does.

Form 1120PC U.S. Property and Company Tax Return (2015) Free

Web irs form 1120, the u.s. If your corporation follows a calendar year, your estimated corporate tax payments are due april. A corporation with a tax obligation of $500 or more for. Web simplified procedure for claiming a refund of u.s. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn.

Form 1120PC U.S. Property and Company Tax Return (2015) Free

A corporation with a tax obligation of $500 or more for. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web information about form 1120, u.s. Is the form supported in our. Web form 1120, u.s.

Fillable Form 1120W (Worksheet) Estimated Tax For Corporations

If your corporation follows a calendar year, your estimated corporate tax payments are due april. Web form 1120, u.s. A corporation with a tax obligation of $500 or more for. Web information about form 1120, u.s. Web irs form 1120, the u.s.

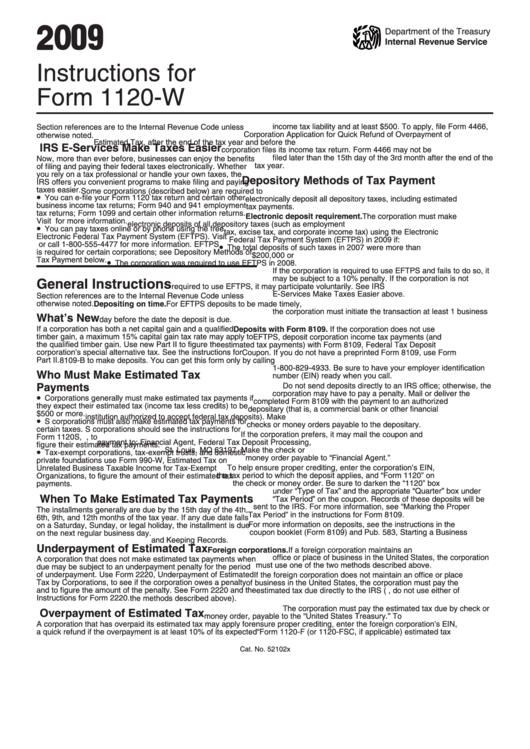

Instructions For Form 1120W 2009 printable pdf download

Corporate income tax return, to report income, gains, losses, deductions, and credits and determine income tax liability. Web the irs form 1120 is provided for american domestic corporations to report their credits, special deductions , gains, losses, and income. Web irs form 1120, the u.s. Web what is the form used for? Tax withheld at source page 1.

IRS Form 1120W 2018 2019 Fillable and Editable PDF Template

It can also be used to report income for other. Is the form supported in our. Web information about form 1120, u.s. Use this form to report the income,. Figure the amount of their estimated tax payments.

Printed Form 1120 W 4 On Paper Close Up Stock Photo Download Image

Web form 1120, u.s. It isn't sent to the irs but is retained by the corporation. Web simplified procedure for claiming a refund of u.s. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Tax withheld at source page 1.

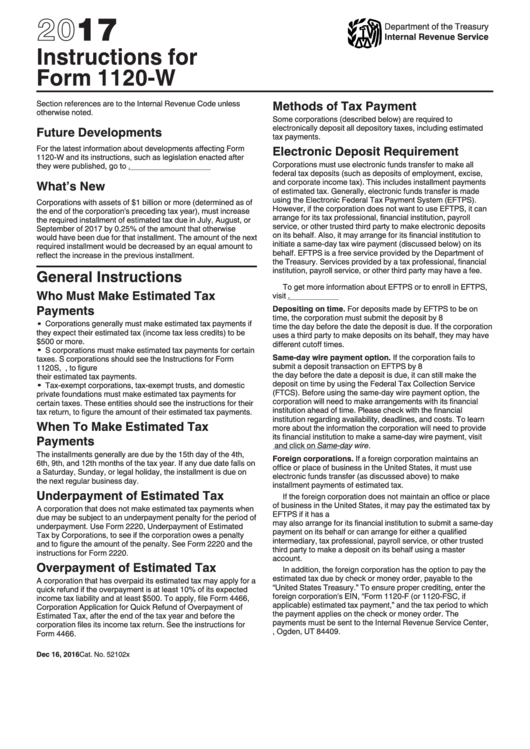

Instructions For Form 1120W Estimated Tax For Corporations 2017

Web the irs form 1120 is provided for american domestic corporations to report their credits, special deductions , gains, losses, and income. Figure the amount of their estimated tax payments. Web information about form 1120, u.s. It isn't sent to the irs but is retained by the corporation. The 1120 tax form also helps with tax.

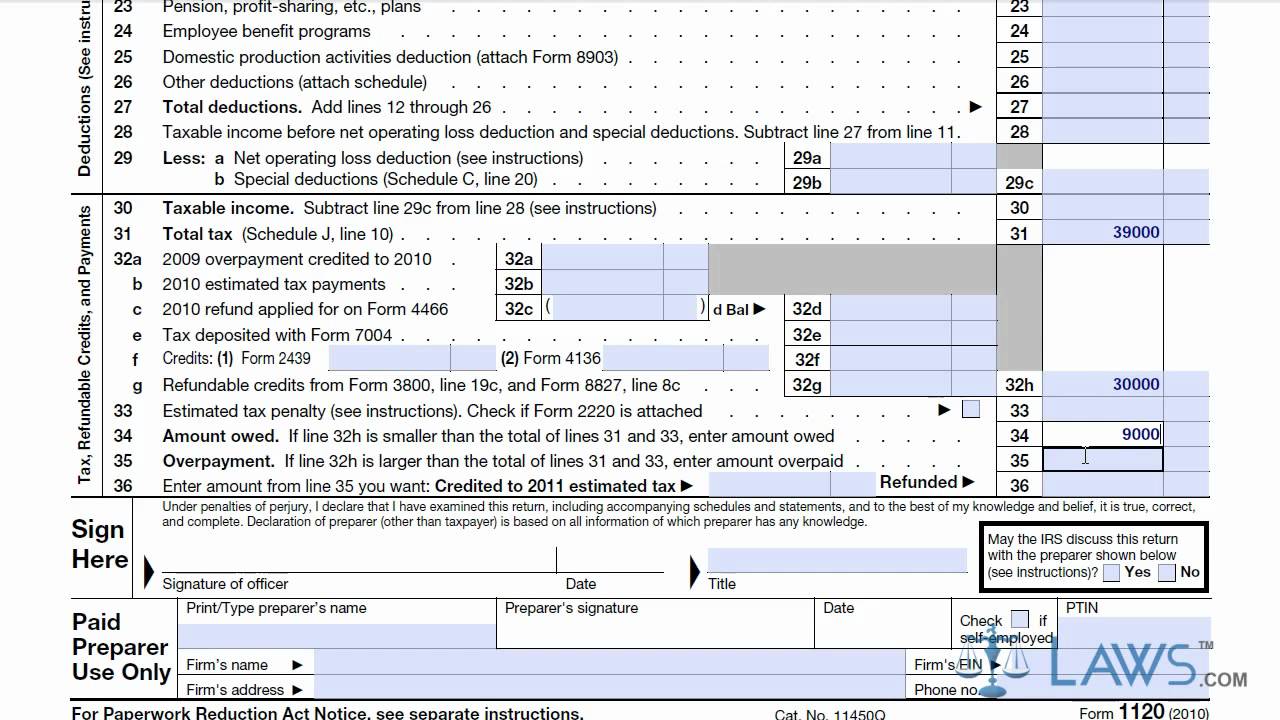

Learn How to Fill the Form 1120 U.S. Corporation Tax Return

Penalties may apply if the corporation does. It can also be used to report income for other. A corporation is obliged to submit. Figure the amount of their estimated tax payments. Web irs form 1120, the u.s.

U.S. TREAS Form treasirs1120w2003

Web information about form 1120, u.s. If your corporation follows a calendar year, your estimated corporate tax payments are due april. Web corporations use form 1120, u.s. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Corporation income tax return, is used to report corporate income taxes to the irs.

Web Form 1120, U.s.

Web irs form 1120, the u.s. Web simplified procedure for claiming a refund of u.s. Penalties may apply if the corporation does. Corporate income tax return, is the form corporations must use to report income, gains, losses, deductions, and credits.

Web The Irs Form 1120 Is Provided For American Domestic Corporations To Report Their Credits, Special Deductions , Gains, Losses, And Income.

Corporation income tax return, is the central filing document for incorporated businesses, like corporations and llcs. A corporation is obliged to submit. Figure the amount of their estimated tax payments. Corporation income tax return, is used to report corporate income taxes to the irs.

Is The Form Supported In Our.

The 1120 tax form also helps with tax. Web irs form 1120, the u.s. Web corporations use form 1120, u.s. If your corporation follows a calendar year, your estimated corporate tax payments are due april.

Tax Withheld At Source Page 1.

It isn't sent to the irs but is retained by the corporation. Use this form to report the income,. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Corporate income tax return, to report income, gains, losses, deductions, and credits and determine income tax liability.