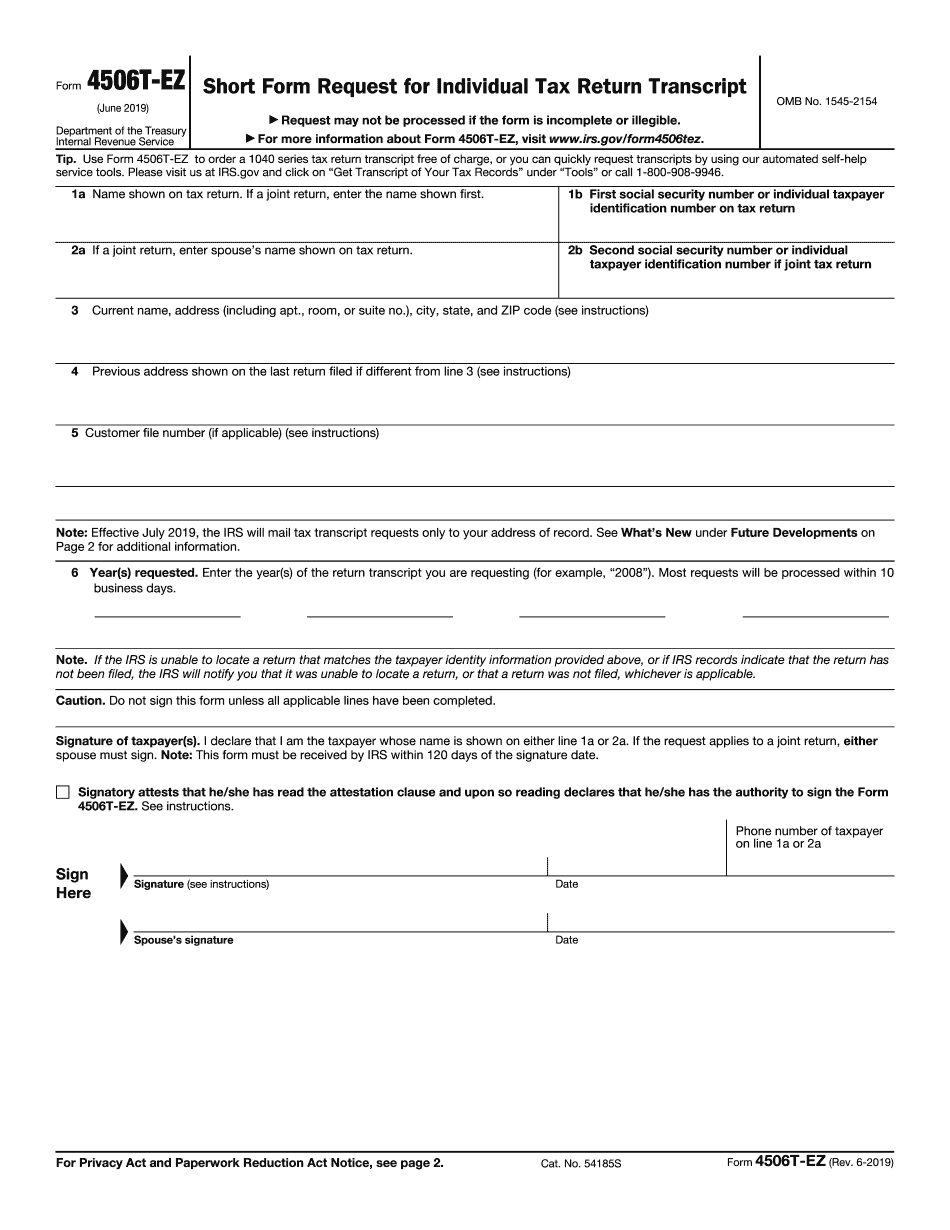

What Is Form 4506-C Used For

What Is Form 4506-C Used For - You can also designate (on line 5) a third party to receive the tax return. The form must include the taxpayer’s signature. Use form 4506 to request a copy of your tax return. Signatory attests that he/she has read the. You will designate an ives participant to receive the information on line 5a. Web the purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated version of irs form. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. But, it also includes paying an expensive. This form must be received by irs within 120 days of the signature date. You will designate (on line 5a) a third party to receive the information.

With this file, you can choose which transcripts to. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. The expected result is a significantly faster. How long will it take? Request a copy of your tax return, or designate a third party to. Only list a spouse if their. You can also designate (on line 5) a third party to receive the tax return. It is used by lenders to verify the income of borrowers. You will designate an ives participant to receive the information on line 5a. Web irs form 4506 is the “request for copy of tax return.” you can request a copy of your returns for the past six tax years and the current year, but the form isn’t.

You can also designate (on line 5) a third party to receive the tax return. How long will it take? You will designate an ives participant to receive the information on line 5a. This form must be received by irs within 120 days of the signature date. But, it also includes paying an expensive. Only list a spouse if their. Get ready for tax season deadlines by completing any required tax forms today. You will designate (on line 5a) a third party to receive the information. It is used by lenders to verify the income of borrowers. The form must include the taxpayer’s signature.

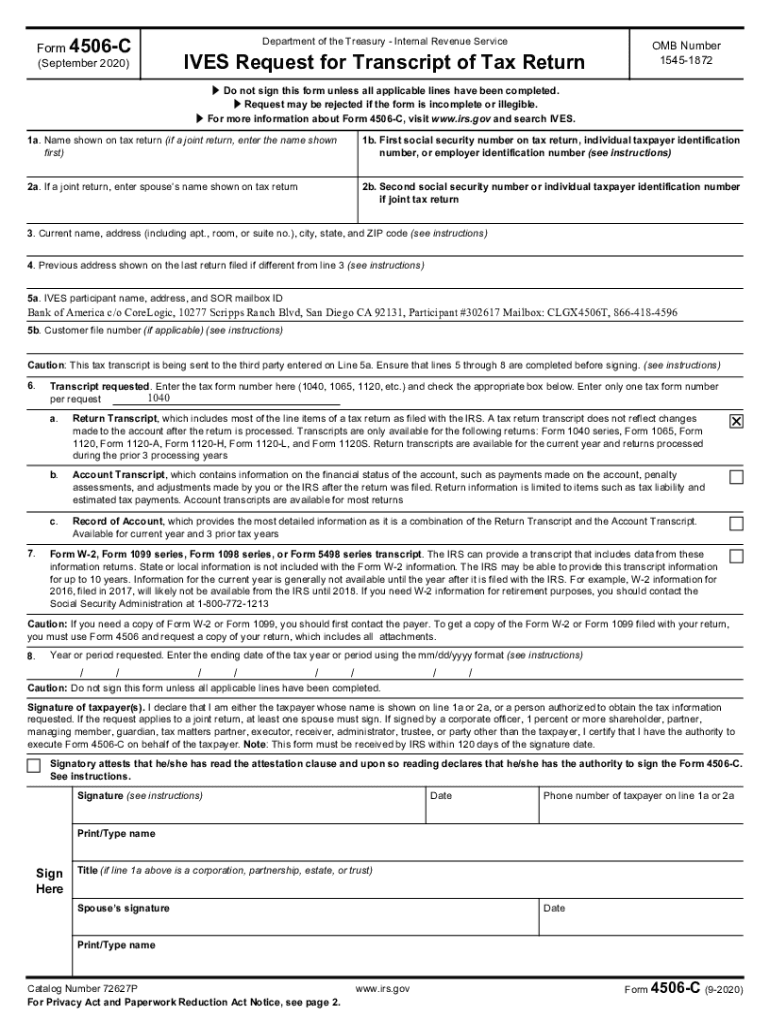

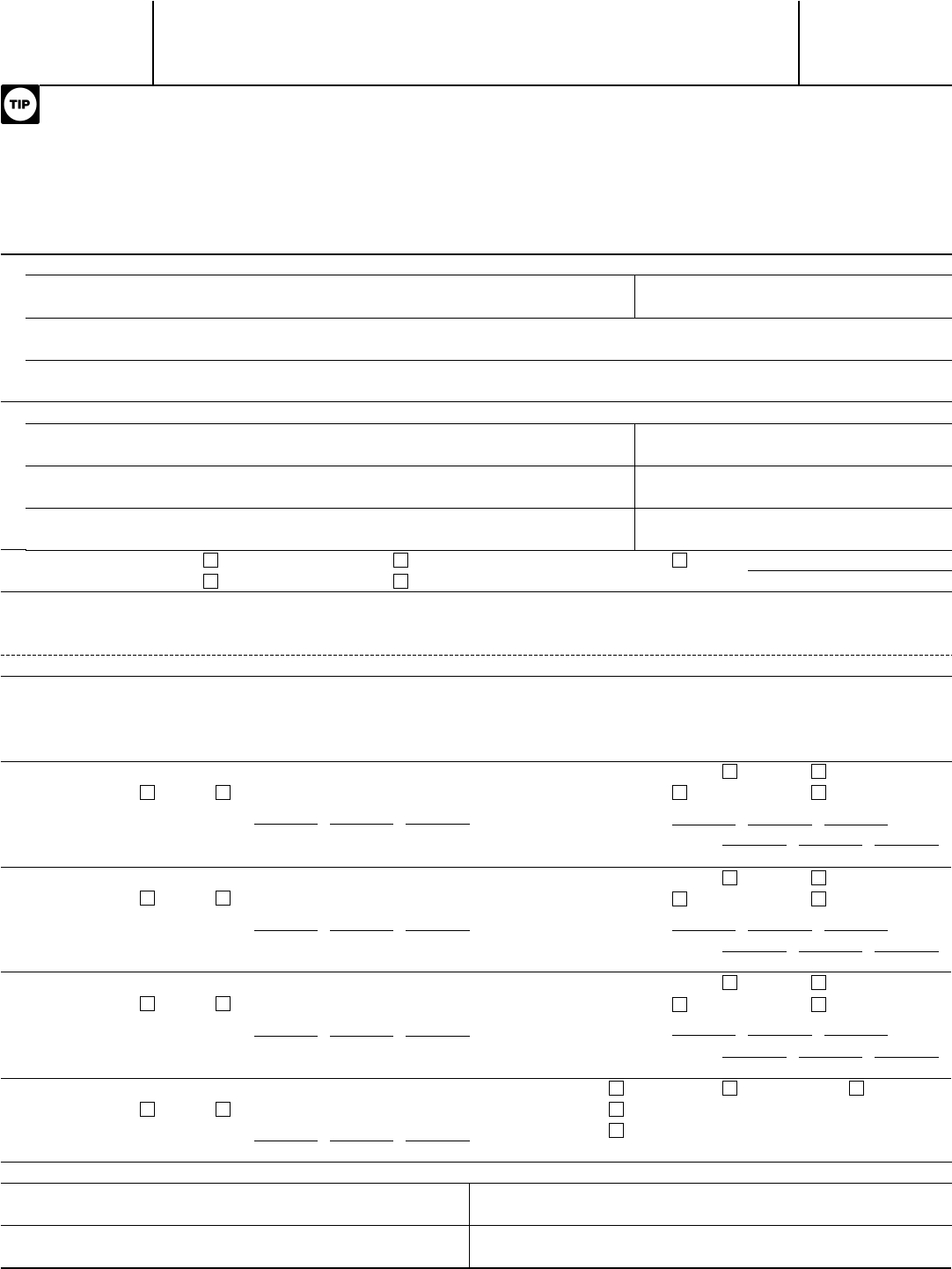

4506 C Fillable Form Fill and Sign Printable Template Online US

How long will it take? Web 18 hours agoto apply for a new passport, you have to fill out forms, get photos taken and go to the post office to mail everything. This form must be received by irs within 120 days of the signature date. Web execute form 4506 on behalf of the taxpayer. The expected result is a.

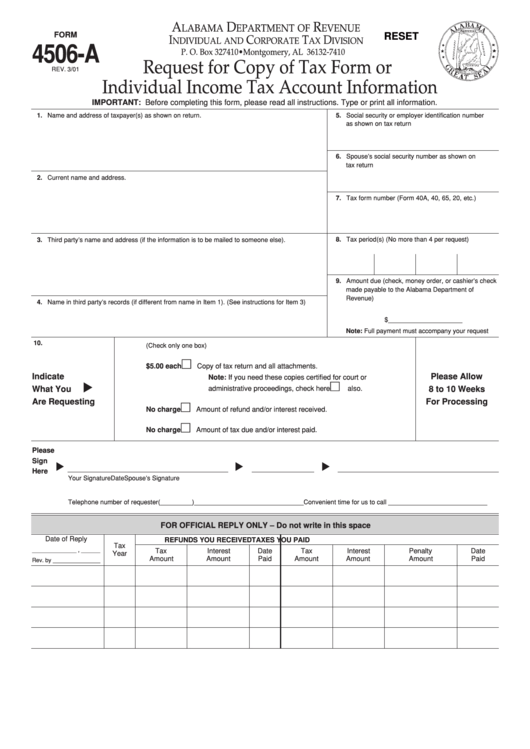

Fillable Form 4506A Request For Copy Of Tax Form Or Individual

1 per the taxpayer first act, a qualified disclosure means a disclosure under. Get ready for tax season deadlines by completing any required tax forms today. Request a copy of your tax return, or designate a third party to. You will designate an ives participant to receive the information on line 5a. Web execute form 4506 on behalf of the.

4506 C Pdf Fill and Sign Printable Template Online US Legal Forms

The form must include the taxpayer’s signature. Use form 4506 to request a copy of your tax return. This form must be received by irs within 120 days of the signature date. Only list a spouse if their. How long will it take?

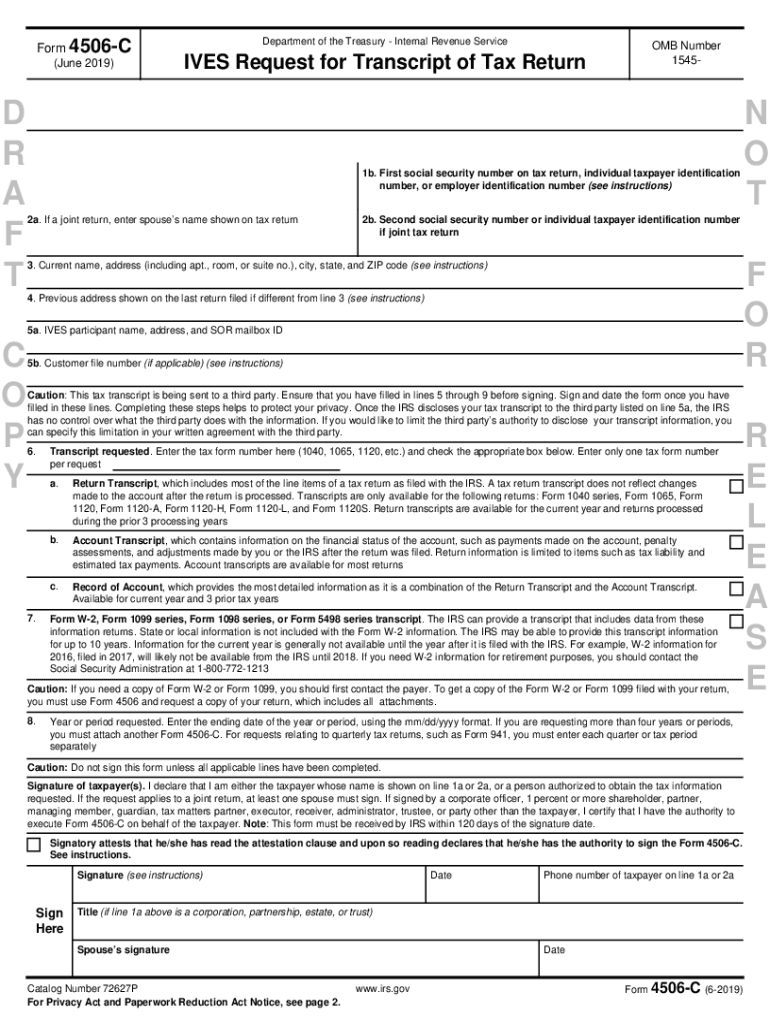

Form 4506T Request for Transcript of Tax Return (2015) Free Download

The form must include the taxpayer’s signature. Signatures are required for any taxpayer listed. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. With this file, you can choose which transcripts to. How long will it take?

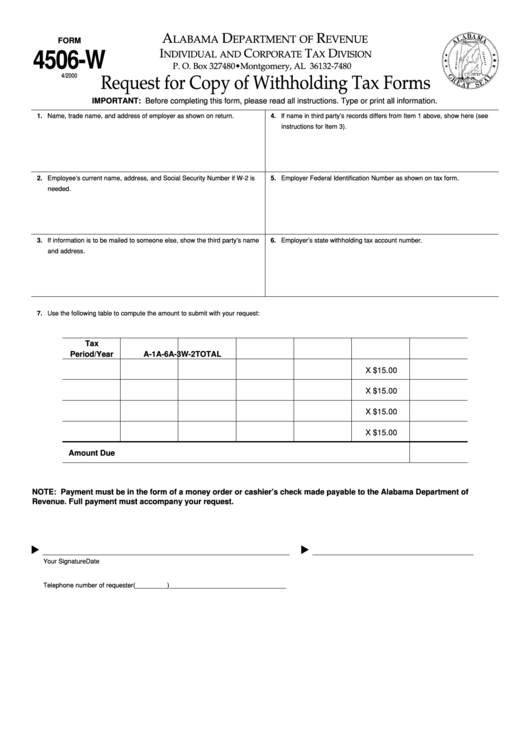

Form 4506W Request For Copy Of Withholding Tax Forms printable pdf

Web irs form 4506 is the “request for copy of tax return.” you can request a copy of your returns for the past six tax years and the current year, but the form isn’t. The form must include the taxpayer’s signature. Signatures are required for any taxpayer listed. Web execute form 4506 on behalf of the taxpayer. You will designate.

Form 4506A Edit, Fill, Sign Online Handypdf

Web 18 hours agoto apply for a new passport, you have to fill out forms, get photos taken and go to the post office to mail everything. 1 per the taxpayer first act, a qualified disclosure means a disclosure under. Web the purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service.

IRS Form 4506A 2018 2019 Fillable and Editable PDF Template

You will designate an ives participant to receive the information on line 5a. It is used by lenders to verify the income of borrowers. Signatures are required for any taxpayer listed. Signatory attests that he/she has read the. With this file, you can choose which transcripts to.

Irs Form 4506a Fillable and Editable PDF Template

Use form 4506 to request a copy of your tax return. Web execute form 4506 on behalf of the taxpayer. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. With this file, you can choose which transcripts to. This form must be received by irs within 120 days of the signature date.

The IRS to replace Form 4506T/TEZ, now extended 60 days.

You will designate an ives participant to receive the information on line 5a. Web execute form 4506 on behalf of the taxpayer. The expected result is a significantly faster. Request a copy of your tax return, or designate a third party to. With this file, you can choose which transcripts to.

How To Fill Out 4506 T Form Create A Digital Sample in PDF

It is used by lenders to verify the income of borrowers. 1 per the taxpayer first act, a qualified disclosure means a disclosure under. Use form 4506 to request a copy of your tax return. The expected result is a significantly faster. You can also designate (on line 5) a third party to receive the tax return.

You Will Designate (On Line 5A) A Third Party To Receive The Information.

Web 18 hours agoto apply for a new passport, you have to fill out forms, get photos taken and go to the post office to mail everything. Signatory attests that he/she has read the. This form must be received by irs within 120 days of the signature date. Get ready for tax season deadlines by completing any required tax forms today.

The Form Must Include The Taxpayer’s Signature.

With this file, you can choose which transcripts to. You will designate an ives participant to receive the information on line 5a. How long will it take? Web irs form 4506 is the “request for copy of tax return.” you can request a copy of your returns for the past six tax years and the current year, but the form isn’t.

Use Form 4506 To Request A Copy Of Your Tax Return.

You can also designate (on line 5) a third party to receive the tax return. Only list a spouse if their. It is used by lenders to verify the income of borrowers. Signatures are required for any taxpayer listed.

Request A Copy Of Your Tax Return, Or Designate A Third Party To.

Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. The expected result is a significantly faster. Web execute form 4506 on behalf of the taxpayer. 1 per the taxpayer first act, a qualified disclosure means a disclosure under.