What Is Form 4563

What Is Form 4563 - To take advantage of the possession exclusion, eligible individuals must file form 4563,. • form 5695, residential energy credits; Exclusion of income for bona fide residents of american samoa swiftly and with ideval. December 2011) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form. In 2018, the irs and the treasury department redesigned form 1040 with simplification as the goal. Web home forms and instructions about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Divide both the numerator and. Find the gcd (or hcf) of numerator and denominator gcd of 45 and 63 is 9; Web irs form 4562 is used to claim depreciation and amortization deductions. Any amount on line 15 of form 4563, exclusion of income for bona fide residents of american samoa.

National and your adopted child lived with you all year as a member of your household, that child is also considered a u.s. Exclusion of income for bona fide residents of american samoa swiftly and with ideval. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. December 2011) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. One is eligible to file this form if one. Divide both the numerator and. Web taxact has the forms, schedules and worksheets you need. December 2011) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form. Web if you are a u.s. To take advantage of the possession exclusion, eligible individuals must file form 4563,.

Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. Web the simplest form of 45 / 63 is 5 / 7. To take advantage of the possession exclusion, eligible individuals must file form 4563,. Web a form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Find the gcd (or hcf) of numerator and denominator gcd of 45 and 63 is 9; National and your adopted child lived with you all year as a member of your household, that child is also considered a u.s. Web home forms and instructions about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Prepare and print an unlimited number of returns. Form 4562 is also used when you elect to expense certain property under section 179 or. Web irs form 4562 is used to claim depreciation and amortization deductions.

Fill Free fillable Exclusion of for Bona Fide Residents of

December 2011) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form. Exclusion of income for bona fide residents of american samoa swiftly and with ideval. Find the gcd (or hcf) of numerator and denominator gcd of 45 and 63 is 9; Web • you are filing form 2555 (relating.

Form 4563 Exclusion of for Bona Fide Residents of American

Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset,. Web if you are a u.s. Web home forms and instructions about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Web • you are filing form 2555 (relating to foreign earned income).

Form 4563 Exclusion of for Bona Fide Residents of American

Web what is irs form 1040 schedule 3? Exclusion of income for bona fide residents of american samoa swiftly and with ideval. Web a form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. • form 4563, exclusion of income for bona fide. Web irs.

Form 8863 Education Credits (American Opportunity and Lifetime

To take advantage of the possession exclusion, eligible individuals must file form 4563,. Find the gcd (or hcf) of numerator and denominator gcd of 45 and 63 is 9; One is eligible to file this form if one. Form 4562 is also used when you elect to expense certain property under section 179 or. Web if you are a u.s.

Magic Form 4563 Kadın Siyah Yumuşak Ince Süngerli Düz Fiyatı

Form 4562 is also used when you elect to expense certain property under section 179 or. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. Divide both the numerator and. Web a form that one files.

IRS Form 4563 Download Fillable PDF or Fill Online Exclusion of

Web taxact has the forms, schedules and worksheets you need. Web if you are a u.s. Form 4562 is also used when you elect to expense certain property under section 179 or. • form 5695, residential energy credits; Web the simplest form of 45 / 63 is 5 / 7.

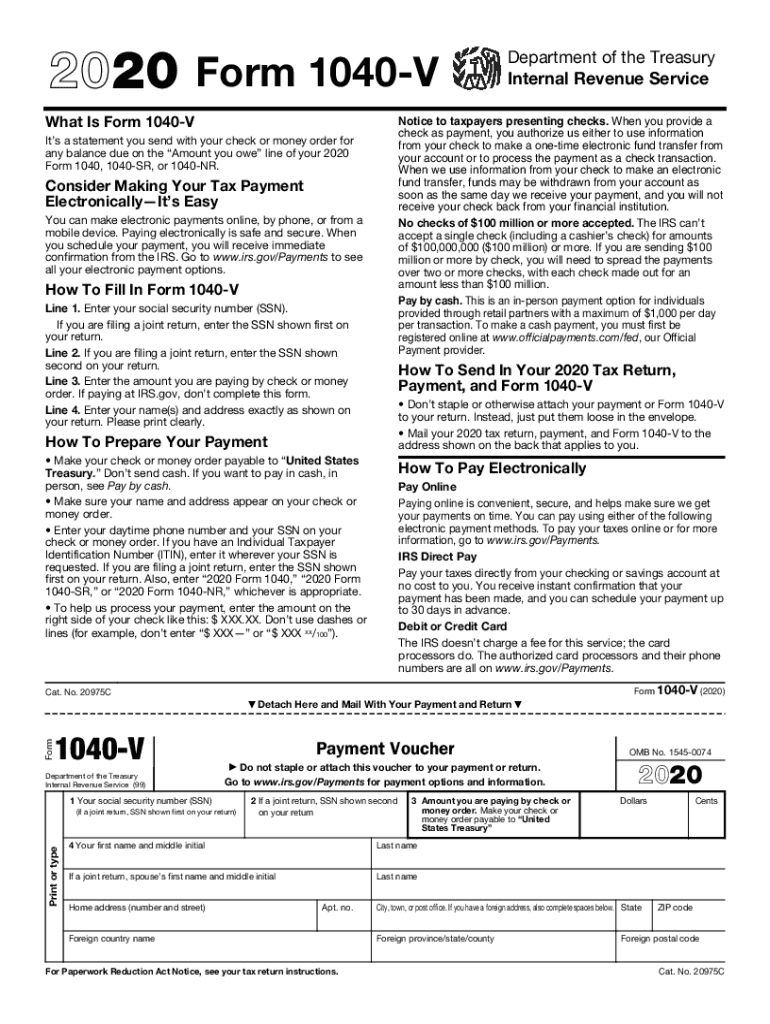

Irs Payment Voucher Fill Out and Sign Printable PDF Template signNow

Form 4562 is also used when you elect to expense certain property under section 179 or. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. Web what is irs form 1040 schedule 3? Web if you.

Form 4563 Exclusion of for Bona Fide Residents of American

Find the gcd (or hcf) of numerator and denominator gcd of 45 and 63 is 9; Web taxact has the forms, schedules and worksheets you need. Web • you are filing form 2555 (relating to foreign earned income) or form 4563 (exclusion of income for residents of american samoa). To take advantage of the possession exclusion, eligible individuals must file.

IRS Form 4563 Exclusion For Residents of American Samoa

Web taxact has the forms, schedules and worksheets you need. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. Web home forms and instructions about form 4562, depreciation and amortization (including information on listed property) use.

Form 4563 Exclusion of for Bona Fide Residents of American

Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset,. Web taxact has the forms, schedules and worksheets you need. December 2011) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. National and your adopted child.

Web Home Forms And Instructions About Form 4562, Depreciation And Amortization (Including Information On Listed Property) Use Form 4562 To:

Web what is irs form 1040 schedule 3? Any amount on line 15 of form 4563, exclusion of income for bona fide residents of american samoa. National and your adopted child lived with you all year as a member of your household, that child is also considered a u.s. Web a form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes.

Web • You Are Filing Form 2555 (Relating To Foreign Earned Income) Or Form 4563 (Exclusion Of Income For Residents Of American Samoa).

Web if you are a u.s. Web any amount on line 45 or line 50 of form 2555, foreign earned income. Divide both the numerator and. Web the simplest form of 45 / 63 is 5 / 7.

Depreciation And Amortization Is An Internal Revenue Service (Irs) Form Used To Claim Deductions For The Depreciation Or Amortization Of An Asset,.

Form 4562 is also used when you elect to expense certain property under section 179 or. To take advantage of the possession exclusion, eligible individuals must file form 4563,. In 2018, the irs and the treasury department redesigned form 1040 with simplification as the goal. Exclusion of income for bona fide residents of american samoa swiftly and with ideval.

December 2011) Department Of The Treasury Internal Revenue Service Exclusion Of Income For Bona Fide Residents Of American Samoa Attach To Form 1040.

One is eligible to file this form if one. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. • form 4563, exclusion of income for bona fide. • form 5695, residential energy credits;

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at11.58.37PM-68ccc0edb6ce4cb8acf163430cfa938b.png)

:max_bytes(150000):strip_icc()/form-4563.asp-final-ac1376da2b4b40fdad50d2c593a18d9c.png)