What Is Form 8941

What Is Form 8941 - I don't think i have from 8941. It’s filed four times per year, and it’s where you report all federal income taxes, social security. Irs form 941 is the employer’s quarterly federal tax return. Web qualifying as a small employer can lower your tax bill by the quantity of the credit you report on form 8941. Eligible small employers (defined below) use. Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. And then a check box with py 8941 no box is displaying. Irs form 8941 is used by eligible small business owners or employers to calculate the credits they may be eligible for based on their health care. How to complete irs form 8941. Web what is form 8941?

Irs form 8941 is used by eligible small business owners or employers to calculate the credits they may be eligible for based on their health care. Web individuals considered employees. Small business owners who subsidize the cost of employee health insurance premiums may be able to get some of that money back by claiming. It’s filed four times per year, and it’s where you report all federal income taxes, social security. Prior yr 8941 must be entered. Smal business owners who subsidize the expenditure is. How to complete irs form 8941. Web qualifying as a small employer can lower your tax bill by the quantity of the credit you report on form 8941. Web what is form 8941? Web what is form 941?

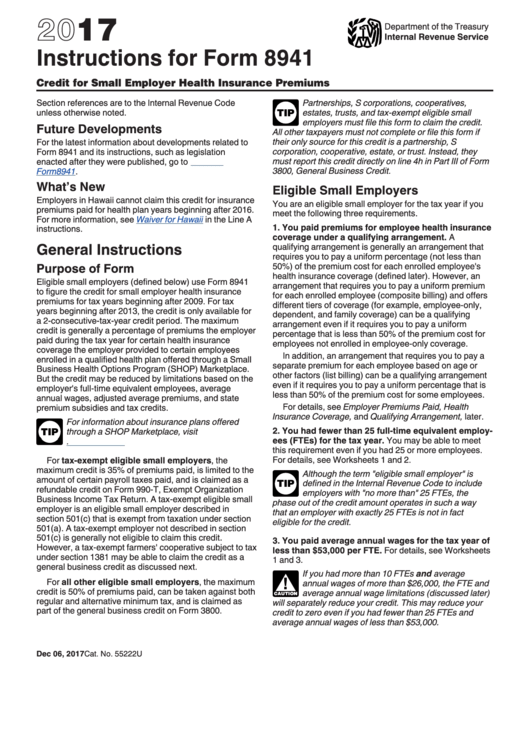

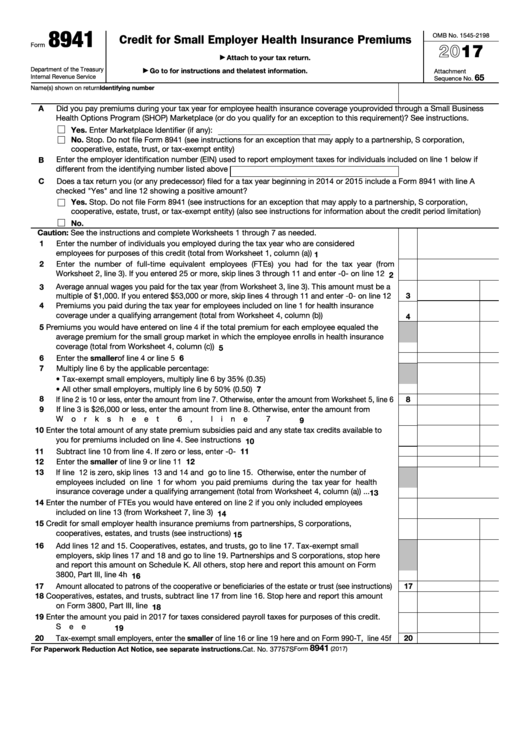

And then a check box with py 8941 no box is displaying. It’s filed four times per year, and it’s where you report all federal income taxes, social security. Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. Irs form 941 is the employer’s quarterly federal tax return. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Web purpose of form eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. The maximum credit is based on. Eligibility requirements for the small employer health insurance premium tax. Web individuals considered employees. Form 8941, officially named the credit for small employer health insurance premiums, provides tax relief to eligible small businesses.

Form 8941 Credit for Small Employer Health Insurance Premiums (2014

Web purpose of form eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. Irs form 8941 is used by eligible small business owners or employers to calculate the credits they may be eligible for based on their health care. Eligible small employers use form 8941 to.

Fill Free fillable Form 8941 Credit for Small Employer Health

Web in this article, we’ll go over this tax form, including: How to complete irs form 8941. I don't think i have from 8941. Prior yr 8941 must be entered. Web individuals considered employees.

Form 8941 instructions 2016

Irs form 8941 is used by eligible small business owners or employers to calculate the credits they may be eligible for based on their health care. Eligible small employers (defined below) use. Eligibility requirements for the small employer health insurance premium tax. Eligible small employers use form 8941 to figure the credit for small employer health insurance premiums for tax.

What Is Form 8941 Credit for Small Employer Health Insurance Premiums

Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Irs form 941 is the employer’s quarterly federal tax return. And then a check box with py 8941 no box is displaying. Prior yr 8941 must be entered. Eligible small.

Form 8941 Instructions How to Fill out the Small Business Health Care

Eligible small employers use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. And then a check box with py 8941 no box is displaying. I don't think i have from 8941. Web qualifying as a small employer can lower your tax bill by the quantity of the credit you report.

Instructions For Form 8941 Credit For Small Employer Health Insurance

It’s filed four times per year, and it’s where you report all federal income taxes, social security. And then a check box with py 8941 no box is displaying. Web what is form 941? Irs form 941 is the employer’s quarterly federal tax return. This is a federal tax credit offered by the irs that is available to startups with.

Patternbased sourcing (PBS) How to Use Retrospective Information for

Web in this article, we’ll go over this tax form, including: Web what is the form used for? This is a federal tax credit offered by the irs that is available to startups with. Web what is form 8941? Small business owners who subsidize the cost of employee health insurance premiums may be able to get some of that money.

Fillable Form 8941 Credit For Small Employer Health Insurance

Small business owners who subsidize the cost of employee health insurance premiums may be able to get some of that money back by claiming. Smal business owners who subsidize the expenditure is. Web what is form 941? Eligible small employers (defined below) use. Web what is the form used for?

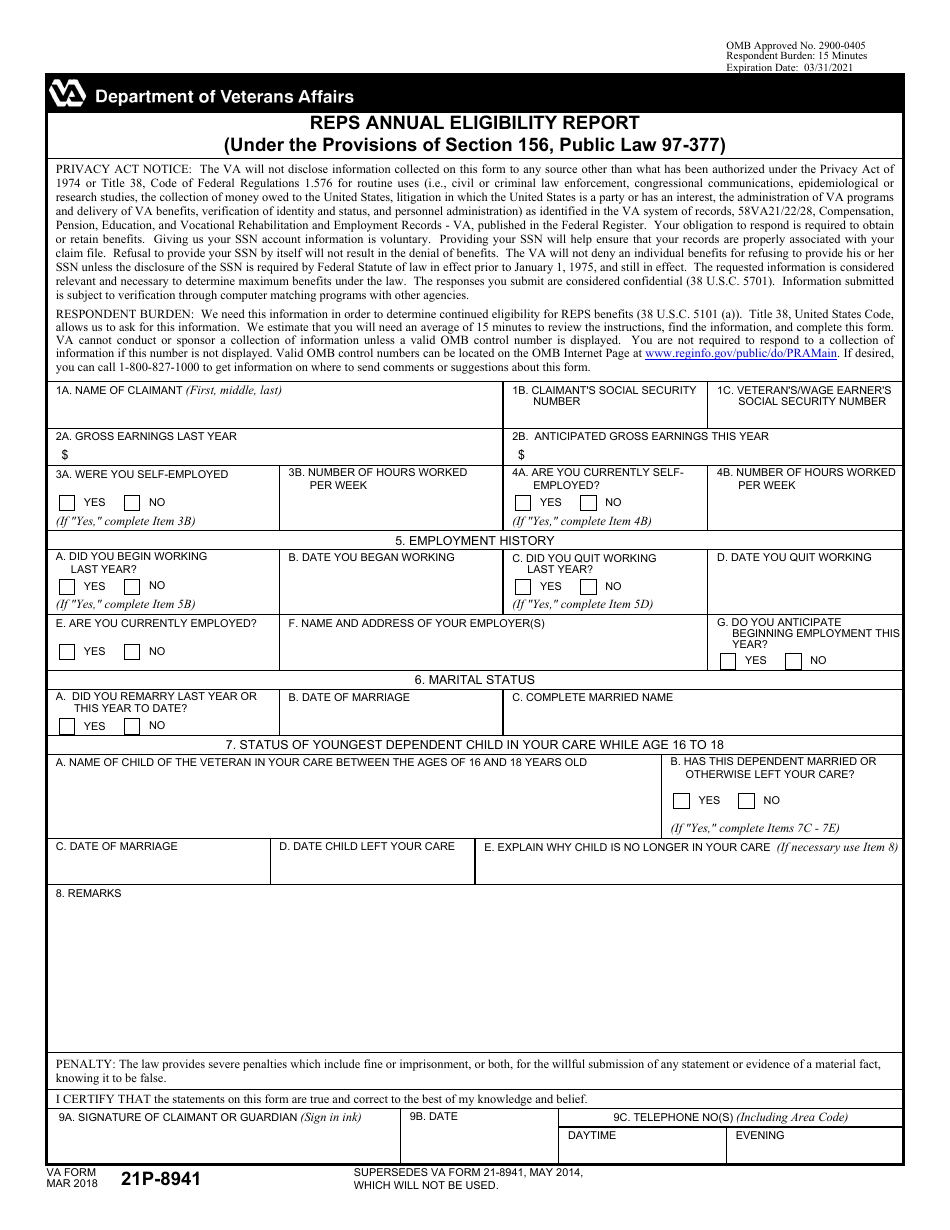

VA Form 21P8941 Download Fillable PDF or Fill Online Reps Annual

Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. Eligible small employers (defined below) use. How to complete irs form 8941. Web what is form 941? The maximum credit is based on.

Cisco Unified IP Phone 8941 (CP8941CK9=) supply & repair Ghekko

Small business owners who subsidize the cost of employee health insurance premiums may be able to get some of that money back by claiming. Eligibility requirements for the small employer health insurance premium tax. Irs form 8941 is used by eligible small business owners or employers to calculate the credits they may be eligible for based on their health care..

Web Purpose Of Form Eligible Small Employers (Defined Below) Use Form 8941 To Figure The Credit For Small Employer Health Insurance Premiums For Tax Years Beginning After 2009.

And then a check box with py 8941 no box is displaying. It’s filed four times per year, and it’s where you report all federal income taxes, social security. Web purpose of form eligible small employers (defined below) use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after. Web what is form 941?

Web What Is The Form Used For?

Small business owners who subsidize the cost of employee health insurance premiums may be able to get some of that money back by claiming. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Smal business owners who subsidize the expenditure is. Web individuals considered employees.

Web Eligible Small Employers Can Use Form 8941 To Figure The Credit For Small Employer Health Insurance Premiums For Tax Years Beginning After 2009.

The maximum credit is based on. How to complete irs form 8941. Prior yr 8941 must be entered. Eligible small employers (defined below) use.

This Is A Federal Tax Credit Offered By The Irs That Is Available To Startups With.

Web what is form 8941? Web what is form 8941? Web qualifying as a small employer can lower your tax bill by the quantity of the credit you report on form 8941. I don't think i have from 8941.