What Is Form 8959 Additional Medicare Tax

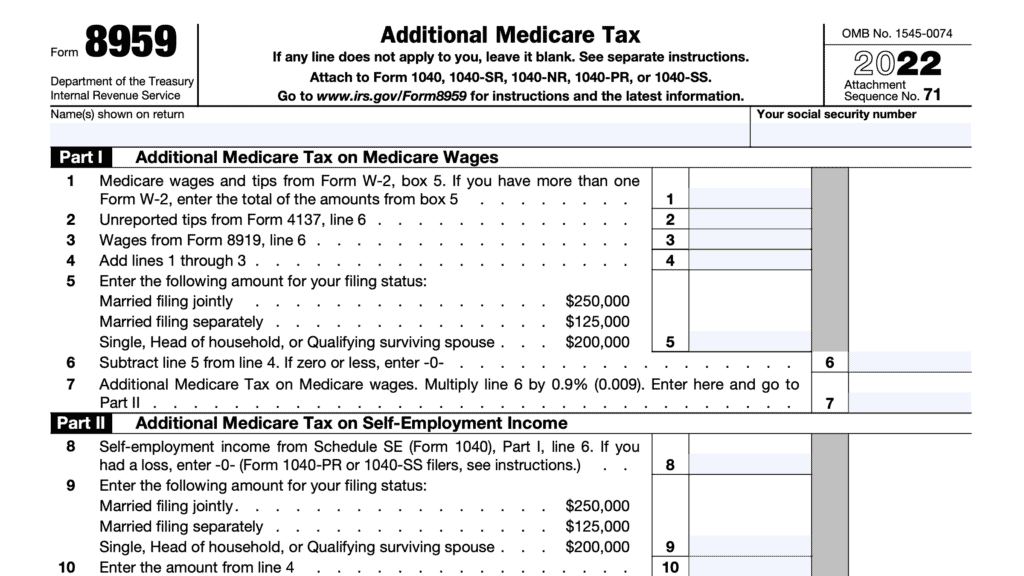

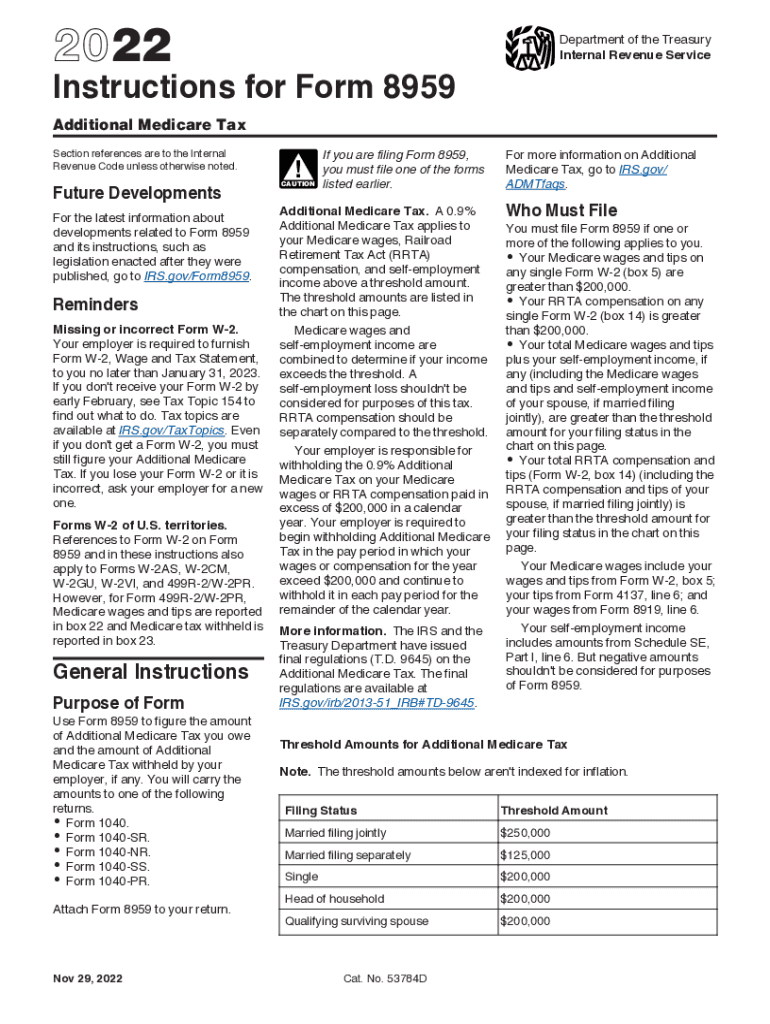

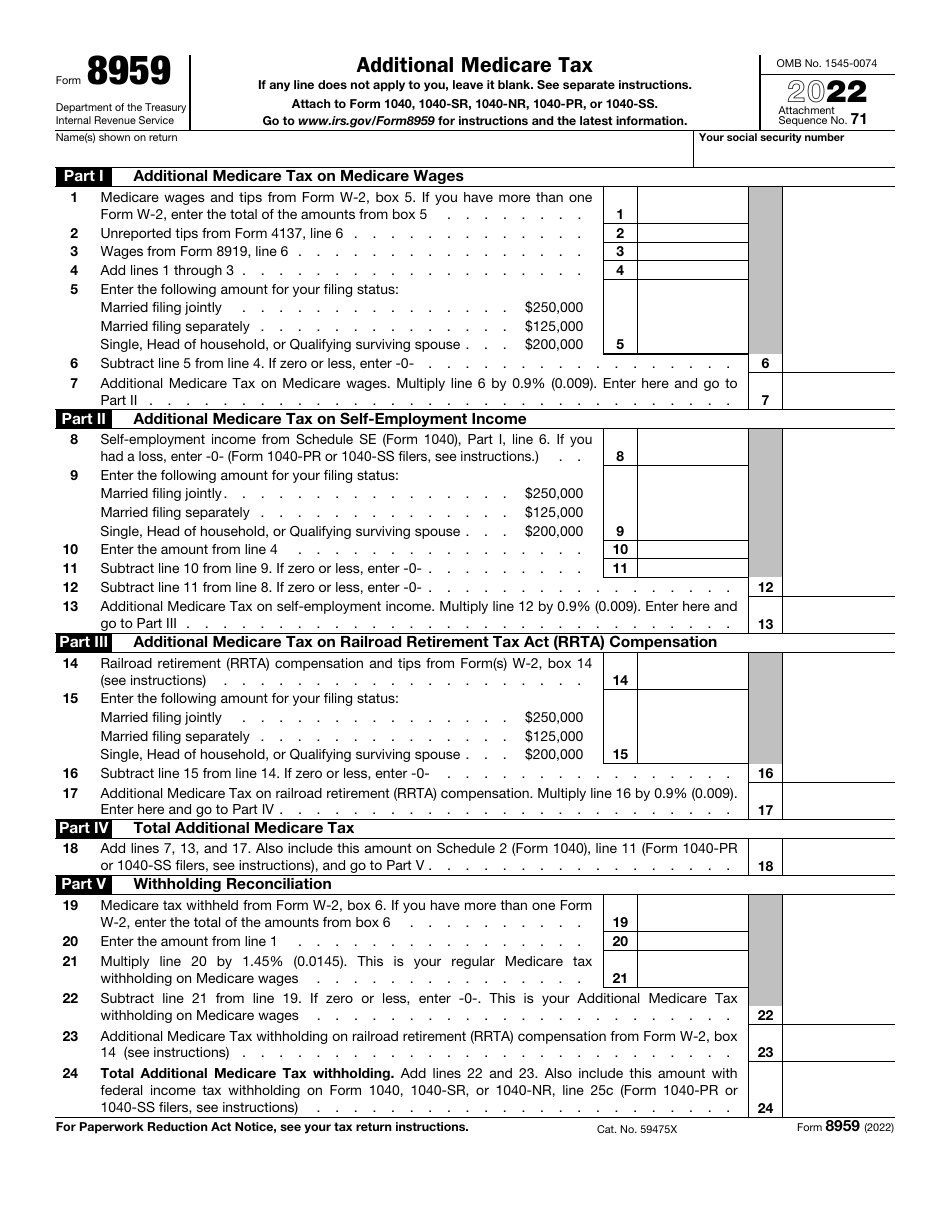

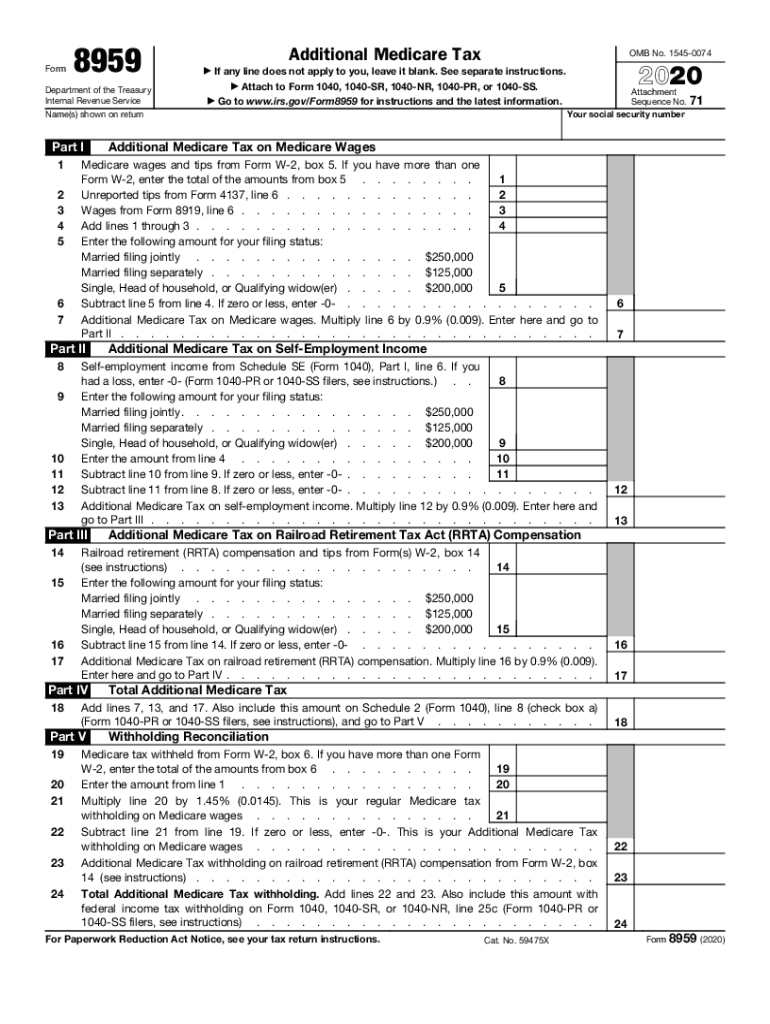

What Is Form 8959 Additional Medicare Tax - Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Complete, edit or print tax forms instantly. Parts i, ii, and iii calculate any additional medicare tax. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Medicare wages and tips are greater than $200,000. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. The 0.9 percent additional medicare tax applies to. Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank.

Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. You will carry the amounts to. Medicare wages and tips are greater than $200,000. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. The 0.9 percent additional medicare tax applies to. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has already withheld. Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following:

Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: The 0.9 percent additional medicare tax applies to. Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Web this additional tax is reported on form 8959. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has already withheld. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. The 0.9 percent additional medicare tax applies to. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web you may need to file form.

What Is the Form 8959 Additional Medicare Tax for Earners

Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. The 0.9 percent additional medicare tax.

IRS Form 8960 Instructions Guide to Net Investment Tax

Complete, edit or print tax forms instantly. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Web what is the additional medicare tax? The 0.9 percent additional medicare tax applies to. Web you may need to file form 8959 and pay more into medicare if one or more of these stipulations apply to you:

How to Complete IRS Form 8959 Additional Medicare Tax YouTube

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Medicare wages and tips are greater than $200,000. The 0.9 percent additional medicare tax applies to..

2022 Form IRS 8959 Instructions Fill Online, Printable, Fillable

Complete, edit or print tax forms instantly. Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: Web you may need to file form 8959 and pay more into medicare if one or more of these stipulations apply to you: Web this tax is calculated.

Form 8959 Additional Medicare Tax (2014) Free Download

Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has already withheld. Web what is the additional medicare tax? Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. This tax became effective in 2013.

Form 8959 additional medicare tax Australian instructions Stepby

Complete, edit or print tax forms instantly. Parts i, ii, and iii calculate any additional medicare tax. Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer,.

IRS Form 8959 Download Fillable PDF or Fill Online Additional Medicare

Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Complete, edit or print tax forms instantly..

Form 8959 Fill Out and Sign Printable PDF Template signNow

Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Medicare wages and tips are greater than $200,000. Web this additional tax is reported on form 8959. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Web what is the additional medicare tax? Complete, edit or print tax forms instantly. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any..

Web This Additional Tax Is Reported On Form 8959.

Complete, edit or print tax forms instantly. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. The 0.9 percent additional medicare tax applies to. Medicare wages and tips are greater than $200,000.

You Will Carry The Amounts To.

Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web what is the additional medicare tax? Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any.

Parts I, Ii, And Iii Calculate Any Additional Medicare Tax.

Web you may need to file form 8959 and pay more into medicare if one or more of these stipulations apply to you: Web the additional medicare tax is calculated on additional medicare tax form 8959, which consists of five parts. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web this tax is calculated on federal form 8959 additional medicare tax and that form also reconciles the amount of tax owed against what an employer has already withheld.

Web Department Of The Treasury Internal Revenue Service Additional Medicare Tax If Any Line Does Not Apply To You, Leave It Blank.

Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: